Many and lots of a yr in the past, within the kingdom of ABC, Woody Allen was certainly one of my very first company. And we consented to take questions from an keen viewers of largely younger individuals. Like ourselves.

The questioner regarded like a highschool woman and shouted to Woody from the balcony, “Do you assume intercourse is soiled?”

Allen: “It’s in the event you do it proper.” (Dick Cavett, “Because the comics say, These children as we speak! I inform ya.” New York Instances, 9/13/2013)

I’d moderately hoped that the commentary originated with somebody moderately extra healthful, Groucho Marx or Mae West, for instance, however we’re caught with what the historic report offers us.

Three years in the past, within the midst of a considerable market correction (fairness portfolios had been down 20%, 60/40 portfolios down 16% – in simply six months), we wrote “Soiled intercourse, your spanked portfolio and planning for the subsequent market” (07/2022). For causes unclear to Midwesterners like me, we had a short-lived spike in our Google search rankings that month. Odd, for the reason that level of the article was modest:

- First, we needed to remind readers that corrections occur and should not a trigger for portfolio upheaval

- Second, we needed to commend high-quality small caps as a possible supply of acquire in the subsequent market.

The query is, how good was the recommendation? We’ll take a look at it in flip.

Corrections don’t warrant panic.

How may you reply, we requested, to the present bout of painful bruising?

- When you have a well-designed strategic funding plan, do nothing.

- In case your portfolio is an unplanned collage of issues greatest described as “it appeared like a good suggestion on the time,” construct a plan earlier than executing the plan.

- In case your portfolio is taxable, begin figuring out the price foundation of your shares.

From that date to this, “calm” was a worthwhile technique. Listed below are the three-year returns from 10 Vanguard index funds representing main asset lessons:

| Vanguard 500 | US massive core | 18.5% |

| Complete Inventory Market | US massive core | 17.8% |

| Prolonged Market Index | Mid- to small cap | 13.6% |

| Small Cap Index | US small core | 10.6% |

| Vanguard Worldwide Core Inventory | Int’l massive core | 14.8% |

| Vanguard EM Inventory Index | Diversified EM | 8.6% |

| Balanced Index | Average 60/40 allocation | 11.8% |

| Complete Worldwide Bond Index | World bond – USD Hedged | 3.9% |

| Complete Bond Market Index | Intermediate core bond | 2.7% |

| Brief-Time period Bond Index | Brief-term bonds (duh) | 3.7% |

Supply: Morningstar.com, 6/14/2025

The quick model: an indolent investor with typical fairness publicity, 60% appears the default, simply booked double-digit returns regardless of two crises (2022 and spring 2025) and, as a bonus, had time to learn a great e-book or three (or to prepare a pro-democracy protest, however that’s a separate story).

Small and high quality are worthy focuses

We wrote: “Cheap commentators – from T Rowe Worth and Leuthold to GMO and Warren Buffett – have argued that your biggest returns now may come from specializing in undervalued, high-quality firms which might be rising dividends and are grounded in actual belongings. At a time when there are historic reductions for small vs massive, worth vs development, and high quality vs momentum, we requested the parents at Morningstar to have a look at which small-cap worth funds had the best high quality portfolios.”

Small, high quality, and worth appeared to align with the suggestions of significant adults. Surprisingly, it additionally aligns with whole returns over the previous 5 years.

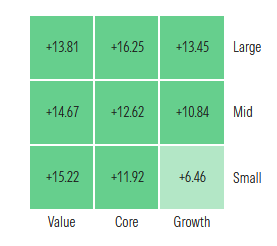

5-year efficiency by fashion field, as of 6/13/2025

Small-value received? Wager you didn’t see that coming! The previous 5 years noticed three main market dislocations (Covid, 2022’s inflation panic, and the spring 2025 tariff panic) and fairly uniformly double-digit returns. (The estimable Invoice Bernstein, a self-described asset class junkie, as soon as described small-growth as “a failed asset class” as a result of they’re unstable, structurally overpriced and don’t pay a danger premium for it.)

Morningstar ranked 160 portfolios from highest high quality to lowest. Morningstar measures “high quality” by assessing “the profitability and monetary leverage of an organization, primarily based on an equally weighted mixture of trailing 12-month return on fairness and debt/capital ratios.” The desk under contains the 11 funds thought-about small-cap worth by Morningstar with the best high quality portfolios. (Why 11 and never 10? There was a tie.) This desk is sorted by their 2022 portfolio high quality, with Royce Particular having the best high quality portfolio of the 160 Morningstar assessed, Auer second, and so forth.

Right here’s how they’ve carried out since then, relative to their class averages.

High quality small caps, three-year efficiency, type by portfolio high quality

| Class | APR |

APR |

APR Ranking | Ulcer Ranking | DSDEV Ranking | Bear Market Ranking | MFO Ranking | Sharpe Ranking | ||

| Royce Small-Cap Particular Fairness | RYSEX | SCV | 2.5 | -1.6 | 2 | 1 | 1 | 2 | 2 | 2 |

| Auer Progress | AUERX | SCC | 9.4 | 4.3 | 5 | 1 | 4 | 7 | 5 | 5 |

| Pacer US Small Cap Money ETF | CALF | SCC | 1.3 | -3.9 | 1 | 5 | 5 | 8 | 1 | 1 |

| Acquirers Small and Micro Deep Worth ETF | DEEP | SCV | 1.0 | -3.1 | 1 | 4 | 3 | 7 | 2 | 2 |

| Aegis Worth | AVALX | SCV | 13.2 | 9.2 | 5 | 1 | 3 | 8 | 5 | 5 |

| Hartford Multifactor Small Cap ETF | ROSC | SCC | 5.6 | 0.4 | 3 | 2 | 2 | 5 | 3 | 3 |

| Royce SCV | RYVFX | SCC | 6.1 | 0.9 | 4 | 3 | 3 | 6 | 3 | 4 |

| James Small Cap | JASCX | SCC | 11.6 | 6.4 | 5 | 1 | 1 | 5 | 5 | 5 |

| James Micro Cap | JMCRX | SCC | 6.6 | 1.4 | 4 | 3 | 4 | 6 | 4 | 4 |

| Ancora MicroCap | ANCIX | SCV | 3.0 | -1.1 | 2 | 1 | 1 | 5 | 3 | 3 |

| WCM SMID High quality Worth | WCMFX | SCC | 7.7 | 2.5 | 5 | 2 | 1 | 4 | 5 | 5 |

| Small core common | 5.2 | 3 | 3 | 3 | 6 | 3 | 3 | |||

| Small worth common | 4.0 | 3 | 3 | 3 | 6 | 3 | 3 |

Right here’s learn that desk. The primary three columns determine the fund: title, ticker, and Lipper class. The subsequent two deal with whole returns: annualized proportion and the quantity by which they led or trailed their friends. The remaining columns supply simplified risk-return rankings. For every measure of danger versus return (Ulcer Index, draw back deviation, bear market efficiency, MFO’s total evaluation, Sharpe ratio), MFO divides peer teams into 5 bands – greatest, above common, common, under common, worst – and shade codes them. To your functions, examine for blue (greatest) and inexperienced (above common). Yellow is respectably common. Keep away from pink.

Conclusions:

- Lively labored. 75% of the energetic funds on the record outpaced their peer group and benchmark.

-

Passive didn’t, a lot. Two of the three passive funds lagged their friends by, on common, 350 foundation factors, which is a giant honkin’ deal when your whole return is round 1%. The 2 funds that the majority dramatically trailed their friends had been passive, good beta EFTs. Pacer US Small Cap Money Cows invests in small caps with exceedingly excessive free-cash flows. That led to huge overweights in tech and power, and huge underweights in client items and monetary providers. It’s a excessive turnover technique (108%) with 200+ names within the portfolio. Acquirers Small and Micro Deep Worth ETF tracks an index of 100 deeply undervalued small and micro-cap shares. Their technique is distinctive and never … umm, index-like:

The preliminary universe of shares is then valued holistically—belongings, earnings, and money flows are examined—in accordance with the Index methodology to know the financial actuality of every inventory. Every inventory is then ranked on the idea of such valuation. Potential parts are additional evaluated utilizing statistical measures of fraud, earnings manipulation, and monetary misery. Every potential part is then examined for a margin of security in 3 ways: (a) a large low cost to a conservative valuation, (b) a robust, liquid stability sheet, and (c) a sturdy enterprise able to producing free money flows. Lastly, a forensic-accounting due diligence evaluate is carried out …

As marketed, it invests in shares a lot smaller and far more undervalued that nearly any of its SCV friends. Like CALF, its annual portfolio turnover exceeds 100%. In the long run, the technique tends to underperform its friends by 100-300 bps.

-

Aegis Worth and James Small Cap labored greatest. Aegis, a purely excellent and distinctive fund, beat its friends by 920 foundation factors, whereas James Small led by 640.

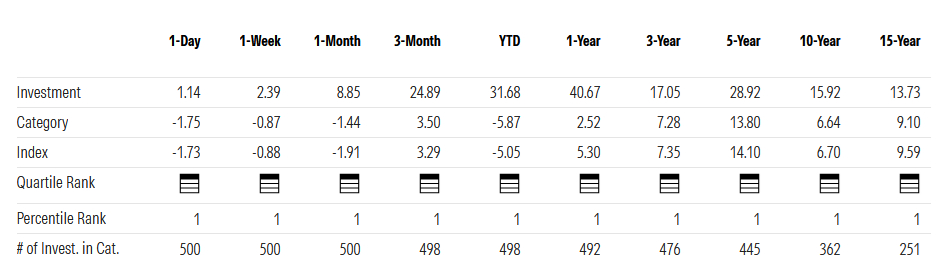

Aegis Worth Fund (AVALX) pursues long-term capital appreciation by investing in a concentrated portfolio of deeply undervalued, small-cap shares—typically within the lowest quintile of the market by price-to-book worth. Managed by Scott Barbee since its 1998 inception, the fund targets ignored out-of-favor firms, exploiting market inefficiencies and volatility the place analyst protection is sparse and liquidity is low. With a disciplined, research-intensive strategy, AVALX has achieved superb outcomes. How superb? Right here’s Morningstar’s abstract of its whole returns – the highest row – and what number it occupies amongst all small-value funds.

Translation for the data-hesitant: the fund carried out within the prime 1% of all small cap funds for the previous day, week, month, quarter, yr after which 3-, 5, 10- and 15-year durations. We’ve profiled Aegis Worth Fund on this month’s challenge.

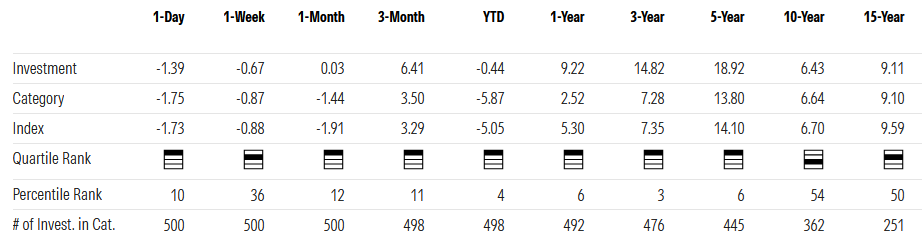

The James Small Cap Fund (JASCX) seeks long-term capital appreciation by investing primarily in undervalued home and worldwide small cap shares. The goal are firms with robust profitability and optimistic momentum, emphasizing high quality “core” names with a slight worth tilt. The fund sometimes holds a diversified portfolio (86 shares as of March 2025), with about 28% of belongings in its prime 10 holdings, and maintains a tremendous low turnover price of 18%. Most small caps are far greater and Vanguard’s three small cap index funds have turnovers (13 – 21%) on this identical vary.

The fund’s long-term efficiency, relying on the precise time-frame, ranges from completely respectable to rock star.

The fund’s three present managers have been 10 – 25 years of expertise managing the fund. The crew was as soon as a lot bigger (as a lot as 9 managers in 2015-2018) however this tighter crew appears to be working.

Backside line

It’s the endless story: planning works, persistence works, calm works. Grabbing for bangles and baubles? Not a lot.

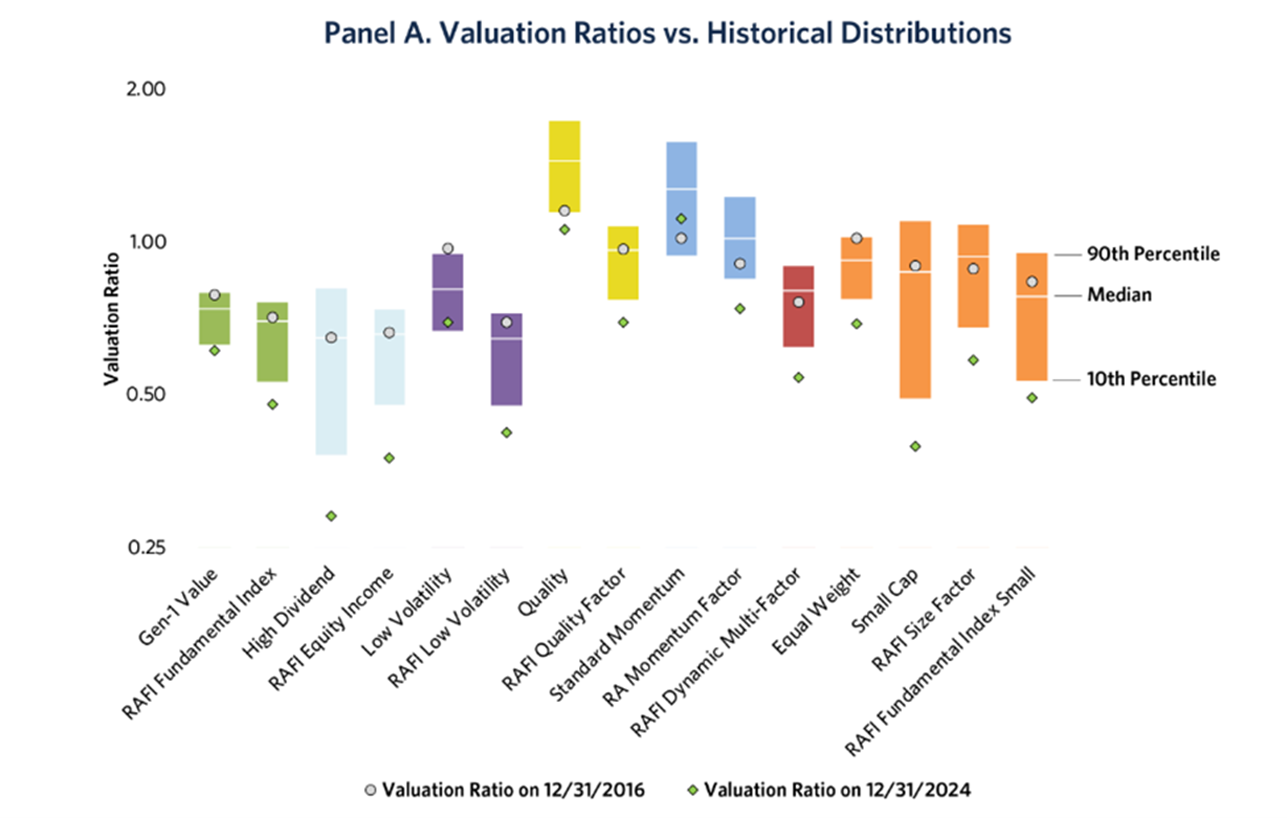

The important thing query is: what’s the potential that small and q1uality will proceed to work within the years simply forward? Due to the incessant deal with one area of interest, the Favored Few throughout the massive development enviornment – the FANGs, then the MAG-7 and now All Issues AI – and the continued development of company earnings throughout the board, small and high quality are each cheaper now than they had been eight years in the past. When you assume that buy worth issues in future returns, meaning they’re extra enticing now than they had been eight years in the past.

The chart under additionally seems within the July 2025 Writer’s Letter.

The best way to learn that chart is to begin by discovering the little inexperienced diamonds. These are the more-or-less present valuations of every technique relative to its historic valuations. Inexperienced diamonds under the coloured bar which illustrates the historic vary from 10th percentile to 90th, indicators that the technique is now cheaper than it has been 90 or 95% of the time.

Lastly, we’ve addressed the worth of “calm” in an age of chaos in a sequence of articles by 4 completely different authors on The Chaos-Resistant Portfolio. (All are simple to search out. Use the “Search MFO” field and enter simply the phrase “chaos.”) The quick model of these articles is that the worth of calm within the years forward is a considerate reevaluation of your portfolio allocation as we speak.