The standard response from somebody once they discover out that I’ve retired is, “Congratulations! What do you do in your spare time?” To which I reply, “I volunteer at Habitat For Humanity and Neighbor To Neighbor, go to the health club, go to household, take day journeys, and write monetary articles.” I’d get a extra excited response if I replied that I am going paragliding in Costa Rica. I do often get a response from folks desirous to know extra about investing.

This text summarizes how I charge fairness funds. I observe the bucket technique. I make investments for earnings in Bucket #2 and focus danger in Bucket #3, the place I’m extra involved about tax effectivity. I exploit a easy method of investing in funds and never particular person shares. Constancy and Vanguard handle most of my extra aggressive accounts.

I’ve refined my ranking system to judge how my retirement nest egg is performing and if I ought to make any changes. It’s based mostly on Threat, Valuations, Three Yr Threat Adjusted Efficiency, and Momentum utilizing the MFO Premium fund screener and Lipper international dataset. I’m reasonably danger off now, however sooner or later, I’ll need to spend money on fairness funds for yield.

Shares are riskier than most bond funds however have larger returns over the long run. On this article, danger is relative to different fairness funds. I classify Lipper Classes and funds into 4 classes as follows.

- Part 1, TIER ONE (Decrease Valuations, Decrease Threat, Larger Yield)

- Part 2, TIER TWO (Low to Average Valuations, Decrease Threat)

- Part 3, TIER THREE (Average Threat)

- Part 4, TIER FOUR (Larger Threat)

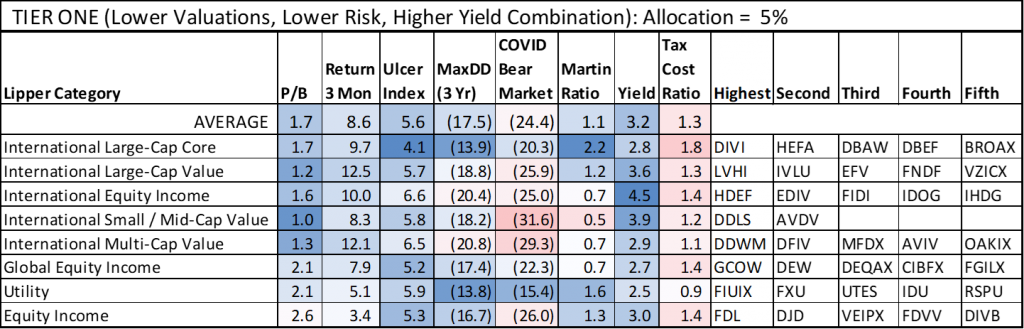

TIER ONE (Decrease Valuations, Decrease Threat, Larger Yield Mixture)

Desk #1 incorporates the Lipper Classes which have decrease relative danger and valuations and better yields. I’ve 5% of my allocation to equities in these Lipper Classes. The upper yield helps dampen volatility. Most are worldwide funds which will even be uncovered to forex danger. The 5 highest-rated funds are listed.

Desk #1: Tier One Fairness Funds for Security and Yield

Supply: Creator Utilizing MFO Premium fund screener and Lipper international dataset; Morningstar for three-month return as of March twenty first.

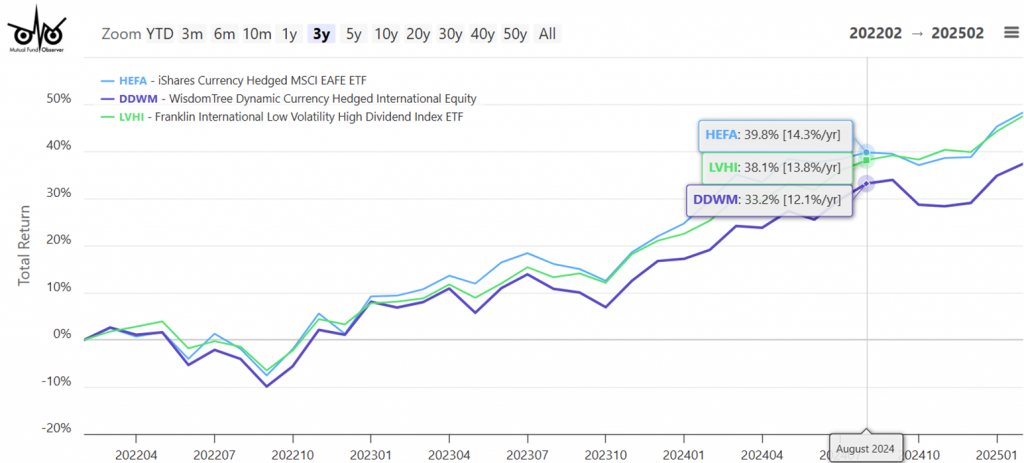

Determine #1 incorporates a number of Tier One funds that I discover enticing.

Determine #1: Chosen Tier One Fairness Funds for Security and Yield

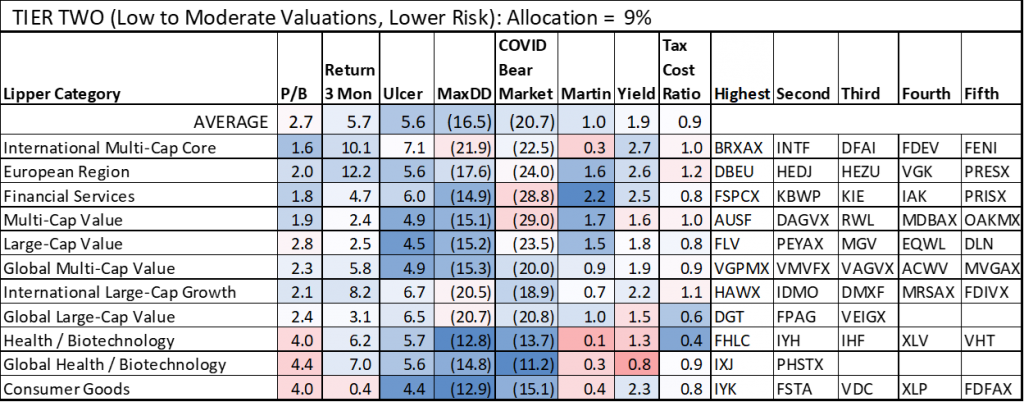

TIER TWO (Low to Average Valuations, Decrease Threat)

Tier Two funds have low to reasonable danger and valuations, however yields are decrease than in Tier One. I’ve 9% of my allocation to equities in these Lipper Classes. They’re sorted by my ranking system from highest to lowest. Worldwide, Monetary Companies, and Worth funds charge extremely. Throughout the COVID Bear Market, most of those funds had a most drawdown of lower than 25%.

Desk #2: Tier Two Fairness with Low to Average Valuations and Decrease Threat

Supply: Creator Utilizing MFO Premium fund screener and Lipper international dataset; Morningstar for three-month return as of March twenty first.

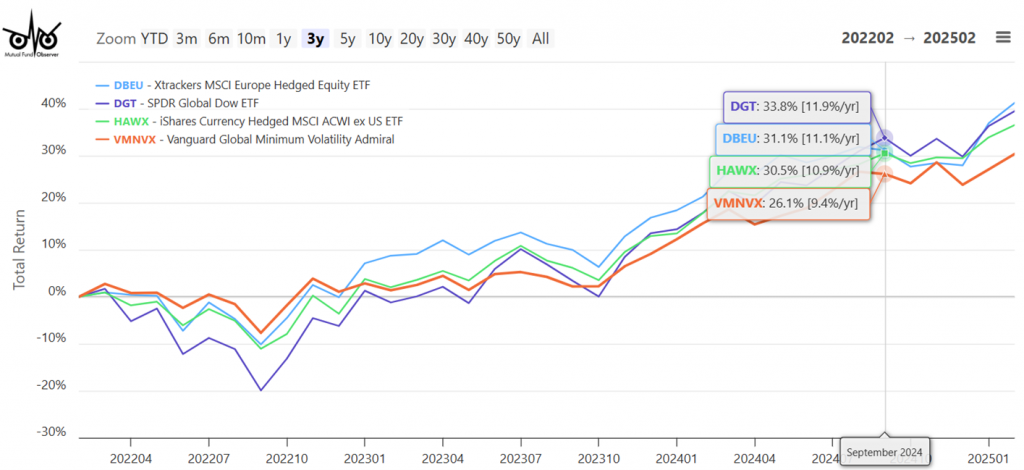

Determine #2 incorporates a number of Tier Two funds that I discover enticing.

Determine #2: Chosen Tier Two Funds with Low to Average Valuations and Decrease Threat

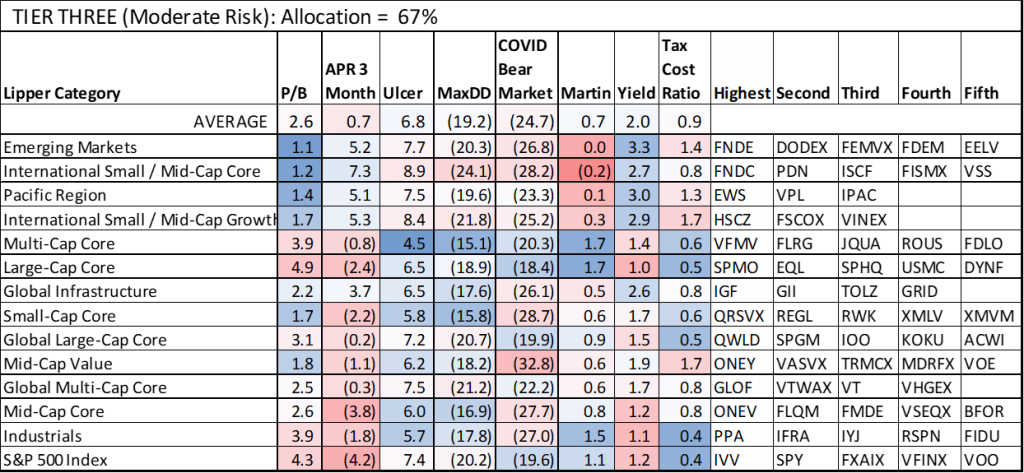

TIER THREE (Average Threat)

Desk #3 incorporates Lipper Classes with reasonable fairness danger. It’s the place the majority of my fairness investments lie. It incorporates diversified core and complete market funds. Throughout the COVID Bear Market, many of those funds had a most drawdown of 25% or extra.

Desk #3: Tier Three Fairness Funds with Average Threat

Supply: Creator Utilizing MFO Premium fund screener and Lipper international dataset; Morningstar for three-month return as of March twenty first.

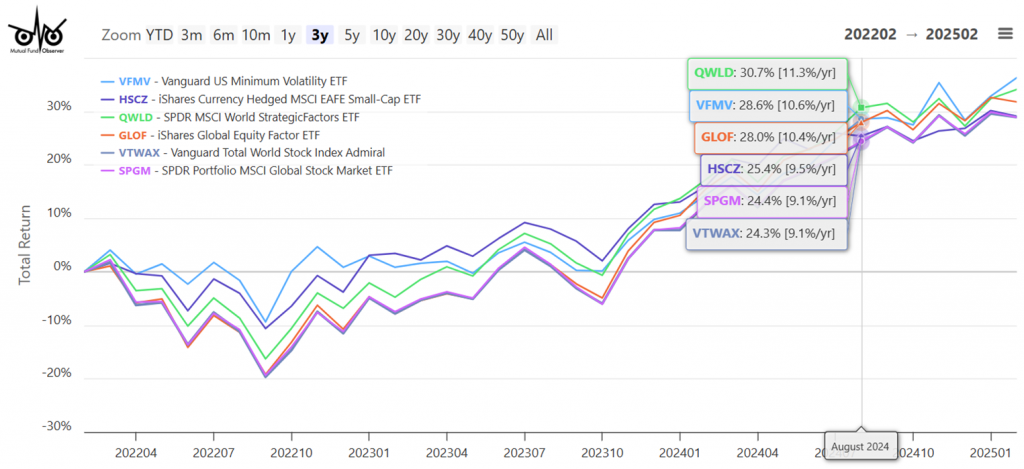

Turning over your retirement nest egg to Monetary Advisors requires a leap of religion. Constancy makes use of Constancy Strategic Advisers US Complete Inventory (FCTDX), and Vanguard makes use of Vanguard Complete Inventory Market Index ETF (VTI) for Multi-Cap Core funds, which I wrote about in Prime Performing Multi-Cap Core Funds (FCTDX, VTI, VTCLX). They’re good funds. The 2 highest-rated Multi-Cap Core funds that I observe are Vanguard US Minimal Volatility ETF (VFMV) and Constancy US Multifactor ETF (FLRG). My rating system relies on my opinion that worth and decrease danger will outperform within the intermediate-term. Each Constancy and Vanguard tilt their portfolios utilizing different funds.

Determine #3 reveals chosen Tier Three funds that I discover enticing.

Determine #3: Chosen Tier Three Fairness Funds with Average Threat

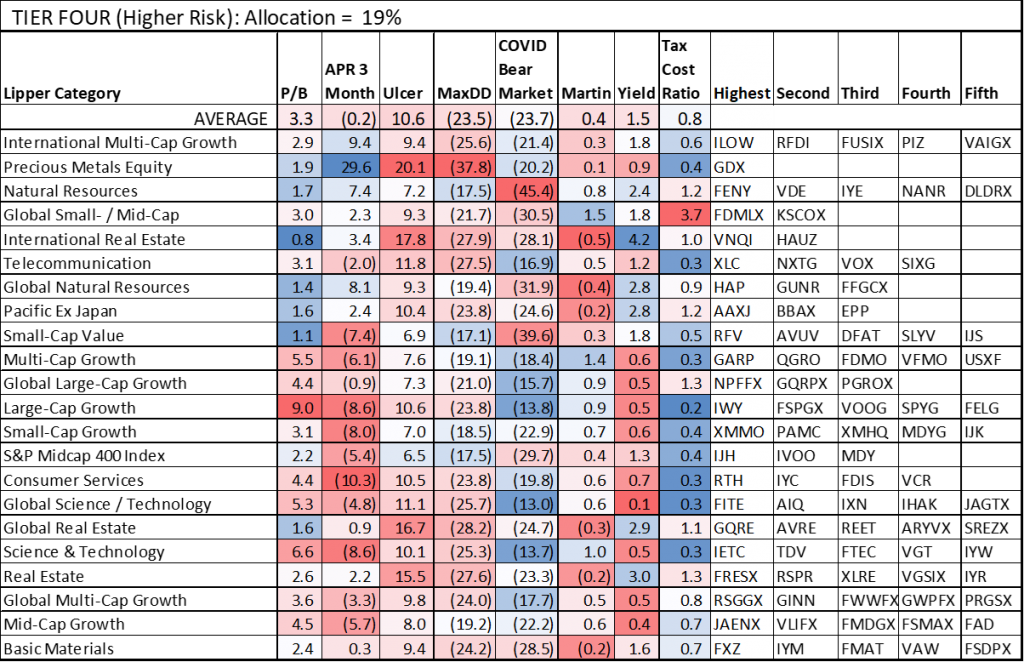

TIER FOUR (Larger Threat)

Tier 4 fairness funds are likely to have a excessive Ulcer Index worth. Valuations and drawdowns differ extensively. Many are funds that one might need to use to tactically make investments by way of the enterprise cycle. I’ve 19% of my allocation to equities within the Tier 4 classes, principally in Worldwide Multi-Cap Progress, that are performing properly now.

Desk #4: Tier 4 Fairness Funds with Larger Threat

Supply: Creator Utilizing MFO Premium fund screener and Lipper international dataset; Morningstar for three-month return as of March twenty first.

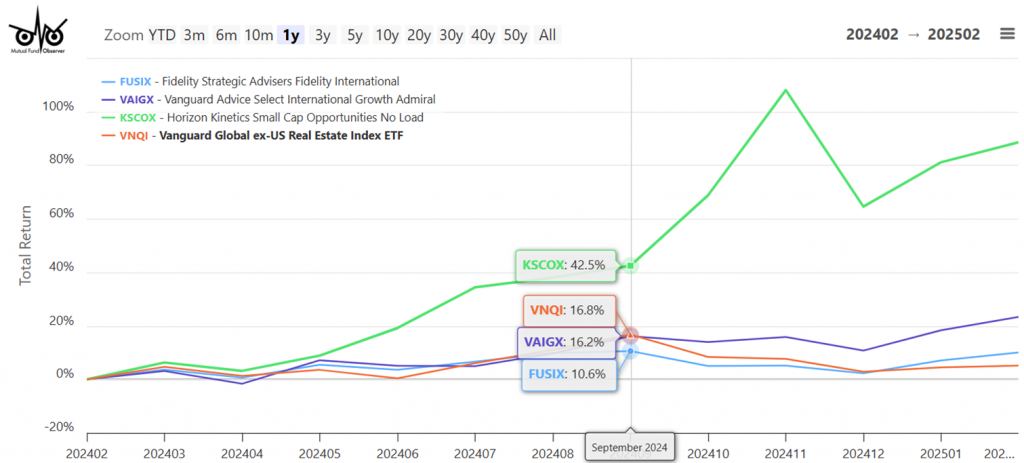

Determine #4 incorporates Tier 4 Fairness funds which are trending. Constancy Strategic Advisers Constancy Worldwide (FUSIX) and Vanguard Recommendation Choose Worldwide Progress (VAIGX) are solely out there to shoppers utilizing monetary planning companies.

Determine #4: Chosen Tier 4 Fairness Funds with Larger Threat

Closing

Uncertainty is excessive now for a lot of causes, and the markets are unstable. I anticipate issues to settle down within the subsequent few months. The economic system is robust however slowing. I made most of my bucket technique changes on the finish of final yr and am driving out the volatility.

One youthful one that requested about investing made the remark that his portfolio was not doing properly. I bought the impression that he was investing in particular person expertise shares, which have fallen arduous. I advised contemplating a robo-advisor to get publicity to worldwide shares which are doing properly. Blended-asset funds could be one other good choice.