by Hope

I’m very pleased with myself. Right here’s why…

Debt

| Debt Description | October, 2023 Whole | Curiosity Charge | Minimal Cost | Present Whole | Payoff Date (Est) |

|---|---|---|---|---|---|

| Scholar Loans | $22,121 | 2.875% | $307 | $19,036 | |

| CC – Apple** | $500 | $0 | Might, 2025 | ||

| CC – Frontier | $3,857 | 29.99% | $0 | $0 | Might, 2025 – Closed |

| Dad – New Furnace | $2,600 | 0% | $0 | $0 | Might, 2025 |

| CC – USAA | $5,000 | 19.15% | $0 | $0 | Might, 2025 |

| CC – Sam’s Membership | $0 | Might, 2025 (once more) | |||

| CC – Amazon | $0 | Might, 2025 (once more) – Closed | |||

| CC – Southwest | $0 | Might, 2025 | |||

| Painter | $0 | Might, 2025 | |||

| CC – AMEX | $894 | 29.24% | $0 | $0 | Mar, 2024 – Closed |

| CC – Sams | $1,106 | 29.99% | $0 | $0 | April, 2024 |

| Private Mortgage #1 | $2,500 | 0% | $0 | $0 | July, 2024 |

| Private Mortgage #2 | $2,500 | 0% | $0 | $0 | August, 2024 |

| CC – Wander | $1,630 | 29.24% | $0 | $0 | August, 2024 – Closed |

| CC – Amazon | $1,497 | 29.99% | $0 | $0 | September, 2024 |

| Whole | $44,206 | $307 | $19,036 |

I paid $1,925 to debt in July. (June’s debt replace.) For the primary time in 3 a long time, I’ve below $20K in debt, no bank card debt, quite no different debt. My automotive is paid off and in fine condition and I’m in an amazing place mentally.

There’s a mild on the finish of this very lengthy tunnel. On high of that, I’ve cash within the financial institution!

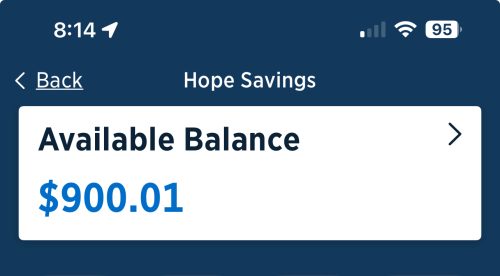

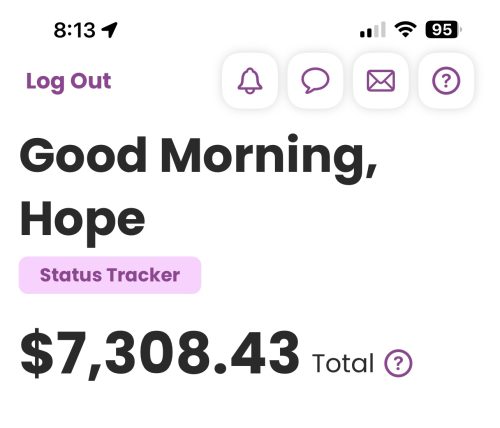

Financial savings

I’ve more cash in financial savings than I’ve had in DECADES. And never solely that, however I’m not touching it. I’ve no rapid plans for it (you’ve seen my Price range and the Buckets I’m utilizing in Ally). I’ve actually not touched my Ally account since I initially opened it with $5,000 from the home promote.

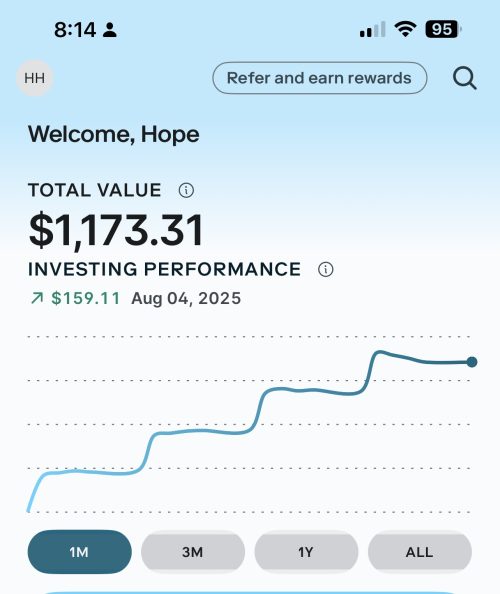

I’ve WEEKLY automated deposits going to each my Ally account and my investments account. (For the file, these screenshots are from the top of July.)

Abstract

Pay attention, I do know it’s not the place I should be at my age. I get that. Really.

However I can’t return. I can go ahead although, and I’m. And I’m pleased with myself.

My consideration is break up…debt and financial savings. Possibly not essentially the most environment friendly option to do it. However I’m doing it. Debt is dropping steadily, financial savings is rising quickly.

I actually went from $0 in financial savings, dwelling on a shoestring to having near $10K in financial savings accounts in simply over 2 months. And as my earnings grows, my financial savings and debt payoff goes extra shortly.

This Month

Now this month, I’ll spend some cash. Princess and I are throwing Magnificence a bridal bathe. I budgeted $1,500 – most coming from my month-to-month “allowance” that I haven’t actually touched. I’ll share the small print on how that goes later as I’m nonetheless making an attempt to determine every little thing out. As of in the present day, I’ve spent the next:

- $33 for invites. I designed them on Canva after which had them printed there. I used stamps I had so not counting that expense.

- $50 to carry the occasion area. I’ll pay one other $200 earlier than the occasion. The occasion area consists of tables, chairs, desk cloths, and serving ware.

- $11 for my flight to and from ATL – sure, extra factors.

- $196 for desk decorations (flowers) and provides for an exercise.

I do know I’m going to provide some meals. And one other recreation or too – pondering of the bathroom paper to make wedding ceremony attire. I’m truthfully simply feeling my manner as I’ve by no means had a bridal bathe or attended one. However it is going to be enjoyable to expertise this with my women and have a good time Magnificence!

Hope is a resourceful and solutions-driven enterprise supervisor who has spent practically 20 years serving to purchasers streamline their operations and develop their companies by means of mission administration, digital advertising and marketing, and tech experience. Just lately transitioning from her position as a single mother of 5 foster/adoptive youngsters to an empty nester, Hope is navigating the emotional and sensible challenges of redefining her life whereas sustaining her willpower to regain monetary management and remove debt.

Residing in a comfy small city in northeast Georgia along with her three canine, Hope cherishes the serenity of the mountains over the bustle of the seashore. Although her children at the moment are discovering their footing on the earth—pursuing training, careers, and independence—she stays deeply dedicated to supporting them on this subsequent chapter, whilst she faces the bittersweet tug of letting go.

Since becoming a member of the Running a blog Away Debt group in 2015, Hope has candidly shared her journey of economic ups and downs. Now, with a renewed focus and a transparent path forward, she’s able to deal with her funds with the identical ardour and perseverance that she’s delivered to her life and profession. By her writing, she continues to encourage others to confront their very own monetary challenges and attempt for a brighter future.