A reader asks:

What are we speculated to do over the subsequent 4 years with the Administration’s steady change in insurance policies? I went heavy into money earlier than Trump took workplace. I trusted that he was going to maintain his phrase, and break issues. I simply didn’t anticipate him to interrupt the market. However now I’m caught, frightened of this fixed uncertainty that appears to by no means go away. It’s already been an extended 3 months. I used to be planning to retire this 12 months, however unlikely now. My Cash Market is getting that respectable 4% yield proper now, and a minimum of this helps me sleep at night time.

One other reader asks:

I’m a 40 12 months outdated in good monetary place in the mean time. That mentioned, I’m not bullish on the financial future. I’m not focused on hoarding gold bars, however wish to put a portion of my portfolio in investments that will do effectively, or a minimum of higher, in a world the place revenue inequality, protectionism, AI advance, and America’s social cloth continues to fray. What would you suggest?

Every week I get a Google Doc stuffed with questions from our viewers at Ask the Compound.1

This was the collective sentiment from the questions this week:

There have been quite a few questions alongside the identical strains. Persons are anxious.

It’s loopy how rapidly the narrative has shifted.

Just some brief months in the past there was discuss of Trump being the largest pro-business, pro-stock market president ever:

Now persons are questioning if that is the top of American exceptionalism:

Life comes at you quick.

If Trump retains up the present commerce insurance policies it’s going to be unhealthy for the worldwide financial system, provide chains, revenue margins, client costs and company earnings. There isn’t a sugar coating it. These will not be pro-business or pro-stock market insurance policies. They’re the alternative.

However you possibly can’t simply go into the fetal place as a result of this makes you nervous. You continue to must put money into one thing.

These questions come from folks at totally different life levels, so I’ll sort out them individually.

Let’s say the worst does come to go and the subsequent few years are unhealthy for the financial system and the markets. Take away the rationale. The rationale doesn’t matter.

While you’re in retirement, it’s important to anticipate financial slowdowns, bear markets and corrections.

A pair retiring at present of their mid-60s has a 50-60% chance of a minimum of one among them dwelling till age 92. There might be a presidential election in 2028. That’s lower than 4 years away. Your retirement may final 20-30 years.

Except you’ve gotten an enormous pile of money, that cash market fund isn’t going that can assist you sustain with inflation over the approaching many years. It’s important to take some danger in retirement when you want to beat the rise in lifestyle.

One of many huge dangers for retirement traders is sequence of return danger. You don’t need unhealthy returns early in retirement to derail your funding plan. Subsequently, it’s good to think about what number of years’ value of spending you’ve gotten stashed away in secure, liquid property to see you thru the inevitable intervals of disruption. That’s true no matter who the president is.

Retirement planning nonetheless comes right down to your time horizon, monetary circumstances, and private spending habits. Uncertainty in retirement by no means goes away however it’s important to deal with what you management and make course corrections to your plan alongside the best way.

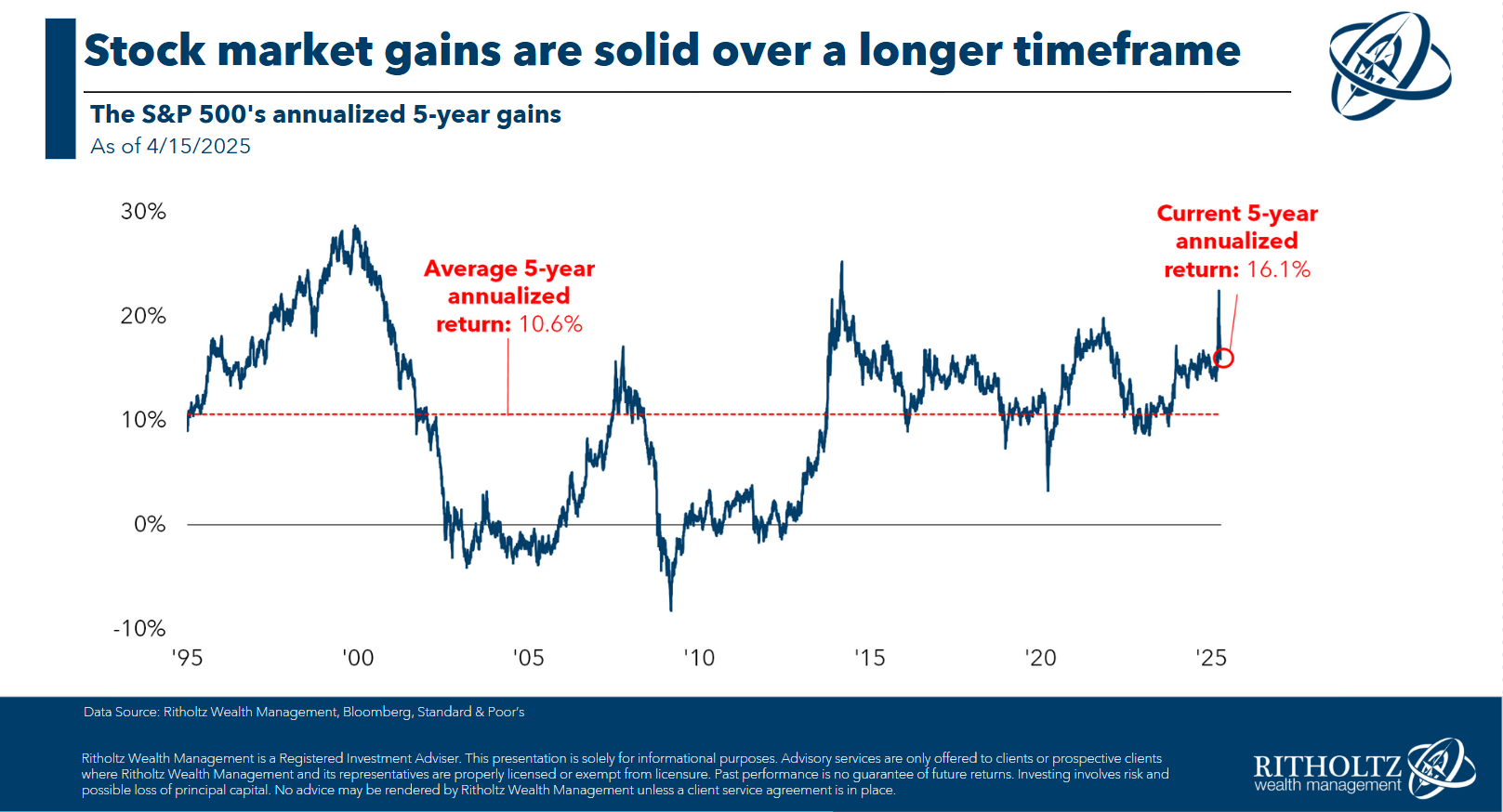

It’s additionally essential to acknowledge that inventory market returns have been unbelievable even once you embody the present correction:

Over the previous 5 years, the S&P 500 remains to be up 16% per 12 months.

The mistaken query: Ought to I promote all of my shares?

The best query: Ought to I alter my allocation?

If you happen to’re 100% shares and this makes you that nervous possibly try to be extra like 80/20, 70/30 or 60/40. I’m by no means a fan of going all out with no plan on the opposite aspect of that call.

Asset allocation is extra essential than market timing.

Investing in center age is commonly neglected since private finance consultants are likely to deal with younger traders (keep the course) or retired traders. At 40, you must have some monetary property however you even have loads of time left to save lots of and make investments.

It’s a balancing act.

I don’t know if try to be pessimistic about the way forward for our financial system however unhealthy instances must be anticipated when you’ve gotten a multi-decade time horizon.

I broke down numerous asset class returns by decade to get a way of efficiency throughout the tough stretches:

The unhealthy financial many years have been the Thirties, Seventies and 2000s. Shares carried out poorly in all three of these many years.2

Gold did fairly effectively in all of these intervals. Bonds held up effectively within the Thirties and 2000s however acquired crushed by inflation within the Seventies. Housing crashed throughout the Nice Melancholy however carried out phenomenally within the Seventies and 2000s.

Pay attention, I may provide you with a portfolio to guard your property with a bunch of various methods. Possibly it really works, possibly it doesn’t. The proper portfolio is barely recognized in hindsight.

These are the instances when diversification issues greater than ever. It’s not solely a danger administration technique however a approach to make sure you put money into the eventual winners (which we received’t know till after the very fact).

Your means to stay with a method might be extra essential than the technique itself.

If you happen to’re actually that nervous in regards to the financial system, save extra money. Do your greatest to enhance your profession prospects and improve your revenue.

It’s additionally value declaring that predicting the longer term is difficult. Nobody would have anticipated issues to prove so effectively after Covid hit. Simply take a breath and see how this all performs out.

I’m not going to lie — I don’t have plenty of religion in our political leaders in both get together lately.

However I nonetheless place confidence in the American spirit of ingenuity and entrepreneurship. I nonetheless have religion firms will do something they will to show a revenue and develop.

That hasn’t modified.

No matter you do along with your cash, simply have a plan in place and don’t let your feelings drive your funding selections.

Callie Cox joined me on Ask the Compound this week to debate these questions and way more:

Additional Studying:

Misbehaving in a Unstable Market

1E mail us at [email protected] when you’ve got a query.

2Subtract inflation from the Seventies quantity and also you get damaging actual returns.