I obtained to considering that a method mortgage charges might come down is because of housing market weak point.

The thought is layered in all forms of irony as a result of the Fed arguably raised charges again in 2022 due principally to an overheated housing market.

Again then, they knew the one approach to push again demand was to finish QE, elevate their very own fed funds price, and hope mortgage charges adopted.

Mortgage charges did certainly observe, rising from round 3% to over 7% in lower than a 12 months.

And now the longer-term results of that price climbing marketing campaign might lastly result in extra easing.

The Housing Market Is Teetering, Lastly

It took so much longer than anticipated, however the housing market is lastly displaying actual indicators of stress.

Affordability has been an issue for a pair years now, due largely (once more) to mortgage charges.

However now we’re lastly seeing for-sale stock develop and residential costs start to fall or transfer sideways in lots of markets.

The newest weak knowledge was housing begins, which got here in under expectations.

Housing begins, which characterize the breaking floor of latest builds, fell nearly 10% in Might and had been off almost 5% from a 12 months in the past.

In the meantime, constructing permits, the step continuing begins, slid to a seasonally adjusted annual price of 1.393 million in Might, per the Census Bureau, the bottom degree in nearly 5 years.

Then there was residence builder sentiment, which dropped to its third lowest level since 2012, which was across the time the housing market bottomed from the prior cycle.

Recently, builders have been underneath immense stress to unload properties, throwing the kitchen sink at potential residence patrons to get offers accomplished.

However extra have lastly begun to see the writing on the wall and are literally decreasing costs as an alternative of merely providing upgrades and mortgage price buydowns.

Regardless of all that, residence costs are nonetheless anticipated to eke out small positive aspects over the subsequent few years.

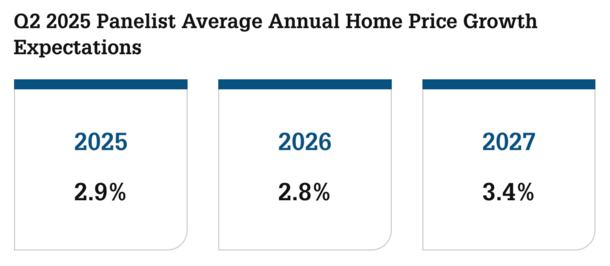

A panel of greater than 100 housing consultants anticipate residence worth progress to common simply 2.9% in 2025 and a pair of.8% in 2026, per the most recent Fannie Mae Residence Worth Expectations Survey (HPES).

That’s down from 3.4% in 2025 and three.3% in 2026 within the prior forecast, and properly under the 5.3% in nationwide residence worth progress for 2024.

To sum issues up, the housing market is lastly cracking underneath the stress of excessive mortgage charges and the poor affordability that goes with them.

Decrease Mortgage Charges Might Arguably Proper the Ship Right here

Ever since mortgage charges surged larger in 2022, people nervous that any fast reversal would merely result in the identical issues that required the upper charges to start with.

It was a catch-22. An excessive amount of residence purchaser demand and never sufficient housing provide, thereby fanning the flames and inflicting residence worth appreciation to proceed operating too sizzling.

However two issues are completely different right now. One is time. It’s been a number of years now for the reason that 30-year mounted climbed above 6% and stayed there.

That has allowed for-sale stock to lastly play catch up and start to outpace demand in lots of (not all) markets nationwide.

The opposite factor is that there’s a brand new notion of mortgage charges right now in that we’ve gotten used to higher-for-longer.

That’s to say that if mortgage charges come down from present ranges, however keep properly above these file low ranges, they received’t essentially trigger a frenzy.

After seeing 8% mortgage charges in late 2023, and seven% for a lot of the previous 12 months and alter, we might normalize with one thing nearer to six% or maybe the excessive 5s.

In different phrases, a candy spot of kinds the place charges aren’t so low that they trigger overspeculation, however not too excessive the place they proceed to crush the housing market.

When it boils all the way down to it, the builders are struggling primarily attributable to excessive mortgage charges.

It’s inflicting them to create workarounds, specifically huge mortgage price buydowns, to get offers to the end line.

If charges had been that little bit decrease, they wouldn’t want to do this almost as a lot, nor would it not value them as a lot cash.

However Housing Market Ache May Be the Solely Strategy to Decrease Mortgage Charges

The scenario is hard although. You form of want some degree of housing market ache for the Fed to behave, and for bond yields to return down.

And also you want this to be convincing sufficient to offset any fears associated to tariffs reigniting inflation, or the federal government spending invoice making a Treasury bond glut.

So the housing market would possibly have to ship some unhealthy knowledge for consecutive months to get the Fed’s consideration (and that of bond merchants).

Solely then will yields be capable of come down, and mortgage charges with them. And solely decrease mortgage charges will present true reduction to the housing market.

Keep in mind, a 1% decline in mortgage price is akin to an 11% worth drop.

Possibilities of residence costs dropping by double-digits isn’t the likeliest end result, even with stock rising and residential purchaser demand weak.

Decrease mortgage charges are the trail of least resistance, and cuts would possibly lastly be acceptable with the housing market and wider financial system not displaying numerous power.

Learn on: 2025 mortgage price predictions (how do they take a look at mid-year?)