Expensive mates,

Welcome to the “Midsommar in Scandinavia” situation of the Mutual Fund Observer. Chip and I are having fun with a long-planned vacation in Sweden and Norway. We’re equally delighted that you simply’re right here … and we’re there!

On this month’s Observer…

Amongst different issues (how would I do know for positive? I’m in Gamla Stan), Lynn Bolin addresses the rising risk of tariff-induced inflation with “Defending In opposition to Tariff Induced Inflation,” analyzing how widespread tariffs will seemingly be handed by way of to shoppers and drive inflation to an estimated 3.4% peak subsequent quarter. Drawing on 5 years of post-pandemic bond efficiency information, he demonstrates that shorter-duration and inflation-protected securities have considerably outperformed conventional intermediate-term bonds, main him to rotate into funds like Vanguard Brief-Time period Inflation-Protected Securities Index (VTAPX), Constancy Inflation-Protected Bond Index Fund (FIPDX), and PIMCO Inflation Response Multi-Asset Fund (PZRMX). Bolin has lowered his inventory allocation from 65% to 50% and now maintains roughly 7% of his bond allocation in inflation-protected securities, with one other 40% in shorter-duration bonds, whereas additionally incorporating target-maturity TIPS ETFs like iShares iBonds Oct 2030 Time period Suggestions ETF (IBIG) into his bond ladders.

America’s premier Asian funding boutique, Matthews Asia, has fallen on onerous instances. Former CEO and portfolio supervisor Mark Headley has returned from retirement, intent on fixing that. Our hour-long interview is summarized in “Good Bones There.”

With none doubt, probably the most profitable small-cap worth fund in existence is Scott Barbee’s Aegis Worth Fund. We final shared a full profile of the fund in 2013, but it surely has appeared in eight data-driven articles since then. We determined it was excessive time to meet up with Mr. Barbee and proper our oversight in a profile of Aegis Worth Fund (AVALX).

Three years in the past, within the midst of a market meltdown (do you even recall the ’22 crash now), we provided recommendation on how to deal with a … ummm “spanked portfolio.” The whimsical accompanying graphic generated a stunning quantity of web site visitors. This month, we provide a three-year retrospective on our 2022 recommendation: maintain calm and take into account small-value funds with high-quality portfolios. The efficiency numbers appear promising.

We additionally share a Launch Alert for Stewart Traders Worldwide Leaders Fund, the US launch of a profitable non-US technique specializing in a concentrated portfolio of high-quality, sustainable companies. The launch was seeded by a US basis, so the preliminary share class is establishment with retail within the pipeline!

Effervescent just under the floor

Hedge funds are shifting to Asia. Goldman Sachs studies that hedge fund buying and selling in Asian markets have a five-year excessive in June. “Hedge funds purchased equities in Japan, Hong Kong, Taiwan and India final week, however had been brief promoting onshore Chinese language shares,” Goldman mentioned.

Household workplaces are shifting to infrastructure and personal debt. A BlackRock survey of 175 household workplaces, the funding supervisor for ultra-wealthy households, studies that one-third had been planning to extend publicity to personal debt this yr and 30% had been planning to commit extra sources to infrastructure investments.

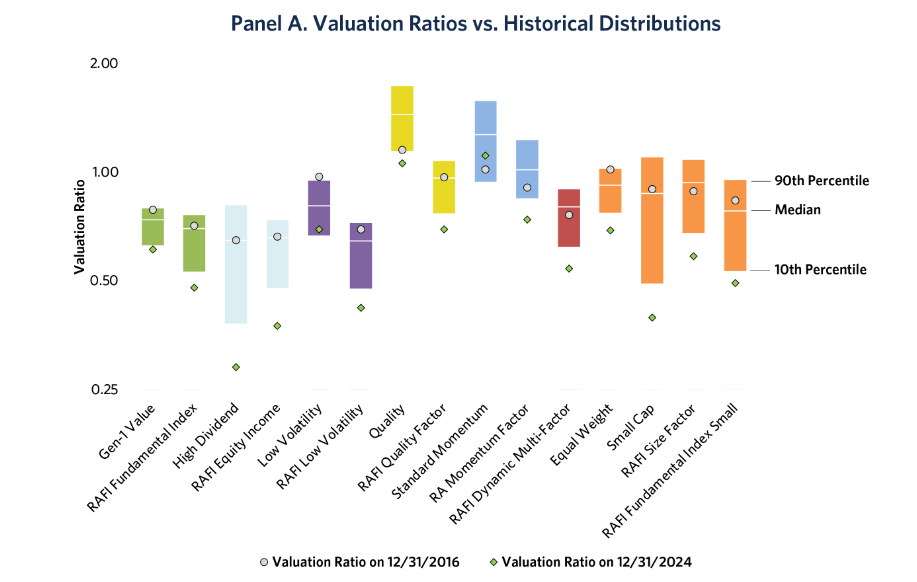

Virtually each sensible beta (e.g., low volatility or basic valuation) technique has failed to provide, in keeping with new analysis from Analysis Associates (free registration required). The brief model: RA has been monitoring the efficiency of a sequence of factor-based portfolios since 2018, seeking to see whether or not any offered the promised extra return.

They didn’t. In each case, simply investing in “the market” was a greater guess.

The excellent news: “the market” – outlined by its giant / progress / momentum subset, is now so egregiously overpriced that just about all the things outdoors of that area of interest is dramatically underpriced.

The best way to learn that chart is to begin by discovering the little inexperienced diamonds. These are the more-or-less present valuations of every technique relative to its historic valuations. Inexperienced diamonds beneath the coloured bar, which illustrates the historic vary from 10th percentile to 90th, indicators that the technique is now cheaper than it has been 90% or 95% of the time.

RA concludes that’s excellent news since valuation issues:

… we imagine there could also be hope for all sensible beta methods. If markets obtain a wake-up name and valuations revert, a mess of systematic factor-based fairness methods might all have a subject day. After eight years of going horribly mistaken, sensible beta investing might now go horribly proper.

AI is rather a lot dumber than we thought. A sequence of analysis studies, most not too long ago from Apple, argue that whereas AI can execute sure duties exceptionally effectively, reasoning is just not amongst them. The researchers discovered that in easy reasoning duties, together with the Towers of Hanoi problem, AIs underperform 7-year-olds. Their central argument is that even probably the most superior LLMs don’t assume in any method that resembles us. Their conclusion is that AI “pondering” is not only completely different, it’s horrible. (Gary Marcus, “A Knockout Blow for LLMs? LLM ‘reasoning’ is so cooked, they turned my title right into a verb,” Communications of the ACM, 6/16/2025).

Because the complexity of calls for rises, shifting AI past its consolation zone, so does the frequency of hallucinations. One estimate is that 79% of responses from a few of the newer AI comprise hallucinated content material (“A.I. Is Getting Extra Highly effective, however Its Hallucinations Are Getting Worse,” New York Instances, 5/6/2025, subscription required).

A coda to that argument: ChatGPT simply misplaced a chess match to an Atari 2600. For those who’re, oh, beneath 50, you may be forgiven for the query “WTF is an Atari?” as a result of the 2600 is a house online game console launched in 1977. ChatGPT truly volunteered to play the outdated sport system. Oops. One report of the match contained this abstract:

In reality, the Atari wiped the ground with ChatGPT when it got here to chess. I don’t imply the near-half-century-old sport console received. I imply that ChatGPT made blunders that may embarrass the greenest of learners.

On the upside, maybe it thinks it received? “So I mentioned ‘right here, maintain ma beer an’ gimme a knight an’ I kicked its little Atari keester all the best way to …’”.

AI is dirtier than we thought. Not “smutty filth” (although that’s good, too) however “energy- and water-gulping soiled.” MIT researchers discovered two troubling traits: AI information facilities use extra energy and extra energy derived from fossil fuels than “regular” information facilities:

… greater than half of the electrical energy going to information facilities will probably be used for AI. At that time, AI alone might devour as a lot electrical energy yearly as 22% of all US households. In the meantime, information facilities are anticipated to proceed trending towards utilizing dirtier, extra carbon-intensive types of vitality (like fuel) to fill fast wants, leaving clouds of emissions of their wake. (“We did the maths on AI’s vitality footprint. Right here’s the story you haven’t heard,” MIT Expertise Evaluate, 6/2025)

A part of the problem is that AI firms appear desperately involved with obscuring the magnitude of their vitality and water use, which some suspect appears like a responsible conscience at work.

AI customers are stupider than we thought. People have casually and continually noticed the tendency of individuals to be lazy, turning to AI to do their work and thoughtlessly passing it alongside as their very own. The underlying phenomenon is known as “cognitive offloading.” It’s pushed by two organic imperatives: people have a restricted provide of vitality every day and pondering requires a variety of vitality. Our survival response is to assume as little as essential to get by way of the day. The well mannered time period for us is “cognitive misers.” We depend on methods, shortcuts, and habits – none of which require a lot vitality – to muddle by way of. However we additionally offload duties – we delegate – every time doable. As a fast take a look at, what number of phone numbers are you able to recite off the highest of your head? (No, 9-1-1 doesn’t rely.) After I was younger, the reply was most likely “dozens.” In the present day, it’s most likely two or three (my very own, Chip’s, and my son’s). I rely on my cellphone to maintain monitor of the remaining. That’s cognitive offloading.

A second set of MIT researchers, the Mind on Massive Language Fashions workforce, has been doing pretty rigorous analysis on how our brains reply to the provision of AI/LLMs as an offloading choice. (Spoiler alert: not effectively.) Most not too long ago, they gave three teams of scholars the identical job. One group had entry to ChatGPT, one had entry to Google, and the opposite needed to assume for themselves. (Yikes.) The examine ran over 4 months and included each mind exercise displays and direct commentary. Their findings:

Mind connectivity systematically scaled down with the quantity of exterior assist: the Mind‑solely group exhibited the strongest, widest‑ranging networks, Search Engine group confirmed intermediate engagement, and LLM help elicited the weakest total coupling … The reported possession of LLM group’s essays within the interviews was low. The Search Engine group had robust possession, however lesser than the Mind-only group. The LLM group additionally fell behind of their skill to cite from the essays they wrote simply minutes prior. (Your Mind on ChatGPT, 6/2025)

The brief model: the brains of Chat-dependent college students actually powered down and whereas the scholars nominally accomplished the work themselves, they’d little perception in their very own written conclusions and couldn’t fairly keep in mind what they’d simply mentioned.

Somewhat as we will’t fairly keep in mind our sibling’s cellphone quantity 5 minutes after we referred to as them.

Job opening: Greatest billionaire pal

The White Home apparently has a gap for a brand new Greatest Billionaire Buddy (BBF) after a spectacular fallout between Mr. Trump and the earlier holder of the place, Mr. Musk. Mr. Musk, who invested closely in Mr. Trump’s election marketing campaign, left authorities service, such because it was, denounced Mr. Trump’s signature legislative bundle as “a disgusting abomination” and endorsed a name for Mr. Trump’s impeachment. He nonetheless affirmed his “love for the man.”

Two of Mr. Musk’s associates attribute the fallout to Mr. Trump’s failure to offer Musk and Tesla favorable remedy beneath the invoice. “Elon was butthurt,” in keeping with one supply. Musk threatened to decommission his fleet of Dragon spacecraft. Trump threatened to “terminate Elon’s Authorities Subsidies and Contracts” and to analyze his enterprise practices. Musk caved.

We’ve written a good quantity in regards to the historical past and enduring psychology of those alliances (“For those who’re so wealthy, why aren’t you sensible?” LinkedIn, 4/2025).

Two issues to recollect:

- This isn’t aberrant habits; it’s a superbly predictable sequence of occasions pushed by well-documented psychological analysis (it’s exceedingly tough to amass huge wealth with the presence of excessive danger tolerance and indifference to adverse externalities) and repeated endlessly over the course of the previous 125 years. The ultra-rich cozy as much as authoritarian guidelines, hoping to commerce assist for future wealth. It goes poorly.

- This must be an essential filter for traders, on a regular basis {and professional} alike. Current headlines start with “Invoice Ackman says …” or “5 locations billionaires are placing their cash” ought to elevate your shields, not your hopes. With huge respect for Mr. Ackman’s acumen at making himself very, very wealthy, neither his political preferences nor his funding actions should information your pondering. They’re manifestations of his world and pursuits, not yours.

Thankfully, the BBF place is more likely to be swiftly stuffed. UBS studies (6/2025) that there at the moment are 31 individuals with wealth in extra of $50 billion {dollars}.

Queue kinds to the fitting!

Thanks …

To the entire of us serving to to make our Scandinavian sojourn superb!

We requested, you answered!

Thanks a lot to all the oldsters who shared good needs and journey recommendation for our upcoming Scandinavian journey: Stuart, Leah, Marjorie, DGH, and Roger. Thanks, thanks!

Stuart: the Vasa Museum is one in every of our must-see websites! Gotland and Stumholmen are saved for our subsequent journey.

Leah: thanks for the sweater recommendation – we’re setting apart a funds for Bergen. And Chip may be reserving a desk at Bryggen Tracteursted as I write.

DGH: Pending good climate, the Norse Folkemuseum and time to wander round Bygdøy are on the itinerary. Additionally, will we like cinnamon rolls? “Like” is such an understatement. WB Samson, obtained it!

Roger: We’re doing the Norway in a Nutshell with an in a single day in Flåm. Because you and Leah each made be aware of the climbing/strolling alternatives, we’ll see what we will slot in. We even have Frogner Park on the checklist!

And, many thanks, all the time, to the regular contributors who assist us maintain the lights on and our spirits up: the great of us at S&F Funding Advisors, Wilson, Greg, William, William, Stephen, Brian, David, Doug, and Altaf. We’ll completely Fika with you ASAP!

We’ll see you in August and share the journey!