What a month it has been. The roles numbers for Might and June had been revised decrease, and the July numbers had been under expectations as a wakeup name to a slowing economic system. Two weeks later, wholesale costs rose 3.3% in comparison with a yr earlier, and the producer worth index rose 0.9% in comparison with the month earlier than as tariffs started to lift the price of inputs. Nationwide debt hit $37 trillion in August. Underlying development for the economic system year-to-date is a weak 1.4%, however it’s distorted by imports. Federal Reserve Chairman Jerome Powell gave his speech following the Jackson Gap Symposium, wherein he expressed rising dangers to employment, persistent inflation pressures, and an openness to rate of interest cuts. The markets reacted enthusiastically to this “bad information is nice information”. Federal Reserve Governor Lisa Cook dinner is suing the Trump administration over the try to fireplace her, elevating questions in regards to the Fed’s independence. What a month it has been, and it’s not over but.

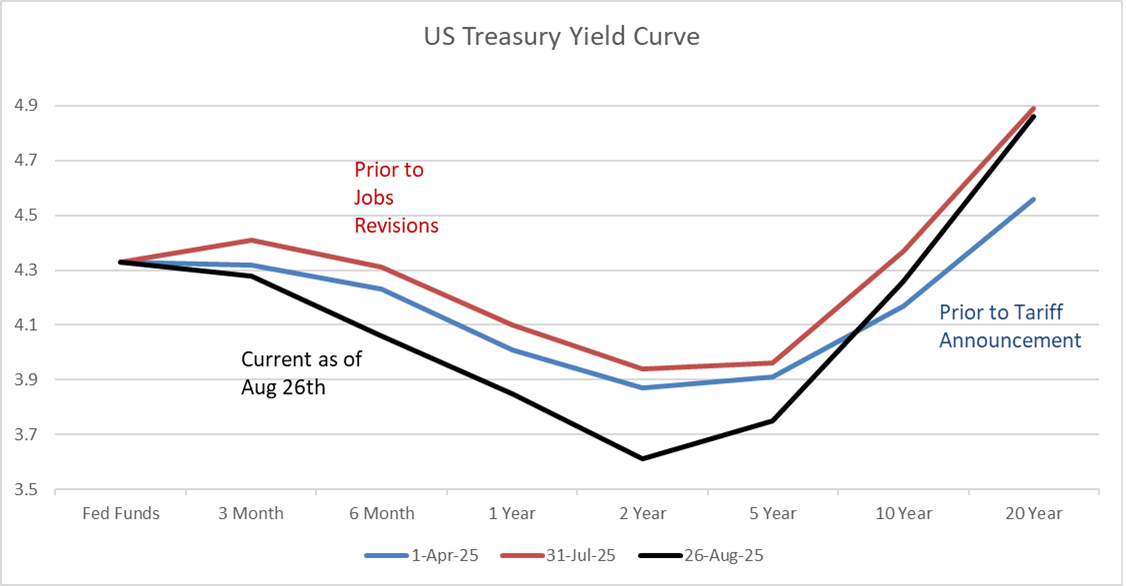

Determine #1 reveals the yield curves for U.S. Treasuries simply earlier than President Trump introduced tariffs, earlier than the employment revisions, and the present yield curve. Traders are searching for increased, longer-term yields due to the upper threat of inflation and rising debt. They anticipate price cuts to start in September. After the employment numbers had been revised decrease, I’ve shifted extra from short-term bond funds to intermediate bond funds in time for charges to drop.

Determine #1: U.S. Treasury Yield Curves

Supply: Writer Utilizing St. Louis Federal Reserve FRED database.

I completed studying “Our Greenback, Your Downside” by Kenneth Rogoff. I strive to remove a minimum of one idea that I can apply from every economics and investing guide that I learn. Dr. Rogoff describes the declining dominance of the greenback and the connection between the greenback, rates of interest, alternate charges, inflation, debt, and deficits. As I’ve written, my long-term view is of slower financial development due partially to demographics, increased long-term rates of interest due to excessive deficits and rising nationwide debt, and below-average future home inventory returns due to excessive valuations. I alter this long-term view to incorporate “a sustained interval of worldwide monetary volatility marked by increased common actual rates of interest and inflation and extra frequent bouts of debt and monetary crises.”

This text describes the adjustments that I’ve been making to my portfolio, as it seems that we’re reaching an inflection level in rates of interest with a slowing economic system and rising inflation. First, I’ve lowered my inventory to bond allocation from 65% to 50% together with reducing my threat profile of what Constancy manages, which permits extra flexibility in what I handle. Second, I’ve adopted a barbell strategy, shifting cash from short-term bond funds to intermediate bond funds. Third, I’ve shifted investments from funds with decrease high quality bonds to increased high quality. Final however not least, I’ve added bond and versatile portfolio funds to guard in opposition to inflation.

iShares iBonds with Goal Maturities

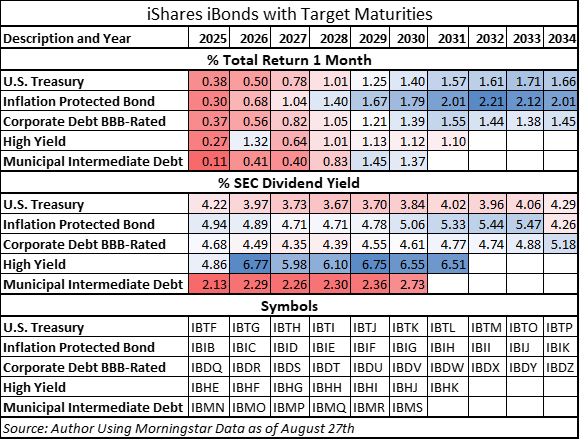

This yr, I switched from including particular person bonds to iShares iBonds with goal maturities to my bond ladder. I like them for diversification, simplicity, and liquidity. They maintain bonds that mature close to the goal date, and the fund is liquidated on its maturity date, and pays curiosity month-to-month.

Desk #1 reveals the one-month return, the yield, and symbols for these funds via 2034, to mirror efficiency. Whereas job numbers had been revised decrease, inflation reveals indicators of rising, and after Fed Chair Powell’s speech, short-term Company bond ETFs had about 0.37% one-month returns, whereas these maturing in 2033 and 2034 had 1.4% one-month returns. Inflation-protected bonds with longer durations have executed even higher.

Desk #1: iShare iBonds One Month Returns and Yields

Writer’s Latest Bond Fund Purchases

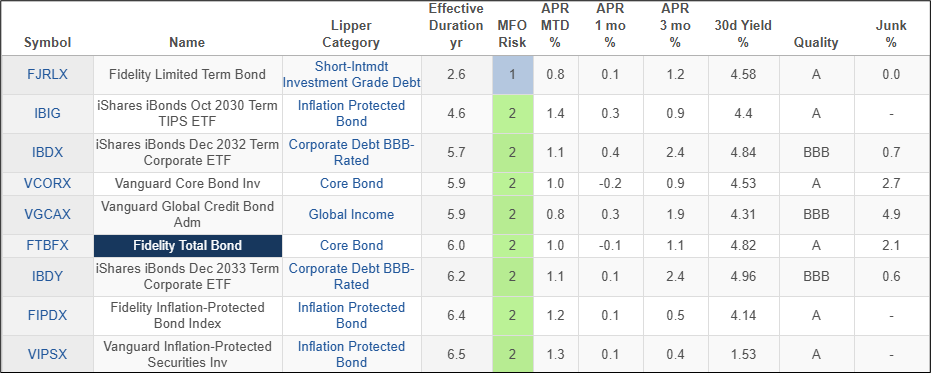

The economic system is slowing, and bankruptcies are rising. Over the previous a number of months, I bought all of my high-yield bond funds and lots of of my mortgage participation funds with a view to focus extra on high quality. I shifted from shorter-duration bond funds to these with longer durations in a barbell strategy. I diversified into extra investment-grade company bond funds via core and whole bond funds. Desk #2 comprises my newest adjustments over the previous few months.

Desk #2: Writer’s Latest Bond Purchases – Metrics as of August twenty third

Closing

Quantitative Easing suppressed long-term yields till inflation elevated following the COVID pandemic. I agree with Dr. Rogoff’s remark in Chapter 26, “The Siren Name of ‘Decrease Endlessly’ Curiosity Charges”, “My long-standing guess is that the typical actual rate of interest on ten-year inflation-indexed U.S. Treasury bonds shall be a lot increased within the 2020s and 2020s than the near-zero common stage in 2012-2021.”

Federal Reserve Chairman has signaled a receptiveness to reducing charges in September due to a softening labor market. I exploit the barbell strategy with short-term bonds and inflation-protected bonds to guard in opposition to rising inflation. I’ve locked in increased yields with intermediate bond funds to make the most of a steepening yield curve and diversified into investment-grade bonds. I count on that longer-term charges should keep longer to finance the rising nationwide debt and threats of upper inflation. Financing long-term debt with short-term debt is a significant threat.

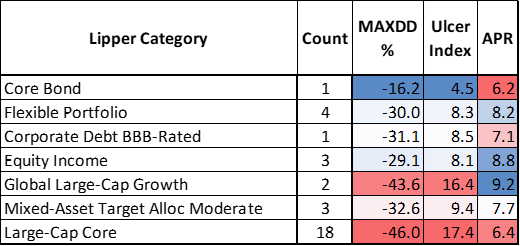

Out of curiosity, I calculated the typical return of Lipper Classes in the course of the Nineteen Seventies when inflation averaged 6.6%. Most shares and bonds didn’t beat inflation. World fairness funds and company bonds carried out a bit higher. I don’t count on inflation to be as extreme within the coming decade; nevertheless, I consider that it’s prudent to have a diversified portfolio.

Desk #3: Lipper Class Efficiency Throughout the Nineteen Seventies.