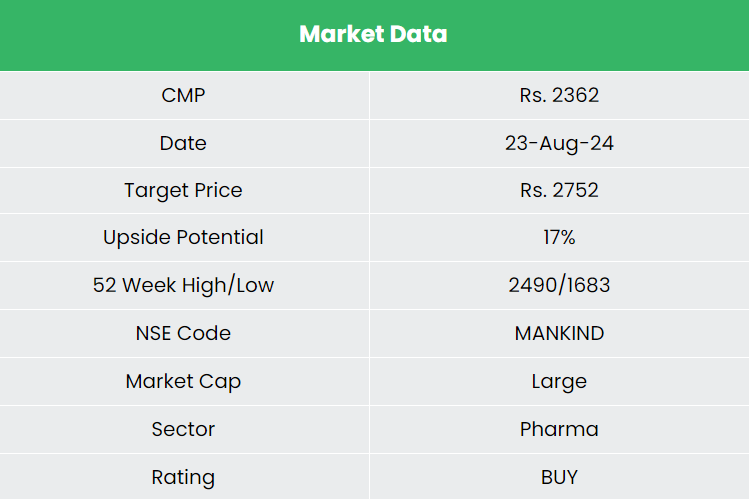

Mankind Pharma Ltd – Constructing a More healthy Bharat

Included in 1995 and headquartered in New Delhi, Mankind Pharma Ltd. develops, manufactures, and markets a variety of pharmaceutical formulations throughout acute and power therapeutic areas, in addition to shopper healthcare merchandise. For the previous seven years, it has been India’s main pharmaceutical firm by prescription quantity. The corporate affords varied dosage kinds, together with tablets, capsules, syrups, and over-the-counter merchandise. Initially centered on rural areas, Mankind Pharma expanded into peri-urban, metropolitan, and Tier-1 cities. It operates 30 manufacturing services, with 75% of manufacturing in-house, and 6 R&D facilities which have developed 23 model households.

Merchandise and Companies

Mankind Pharma’s choices fall into two foremost segments:

- Home Pharmaceutical: A broad vary of formulations for acute and power situations, together with anti-infectives, cardiovascular, gastrointestinal, anti-diabetic, neuro/CNS, nutritional vitamins/minerals/vitamins, and respiratory therapies.

- Shopper Healthcare: Established manufacturers in being pregnant detection, oral contraceptives, condoms, antacids, nutritional vitamins, and anti-acne merchandise. Standard manufacturers embody Prega Information, Manforce, Undesirable Equipment, and Fuel-O-Quick.

Subsidiaries: As of FY24, the corporate has 34 subsidiaries, 3 joint ventures and 5 associates.

Development Methods

- BSV Acquisition: Buying Bharat Serums and Vaccines for Rs.13,630 crore to increase in girls’s well being and significant care.

- Power Development: Power section grew by 14%, pushed by 21% progress in anti-diabetic and 15% in cardiac therapies.

- Market Share Acquire: Elevated market share to five.1% in cardiac and 4.4% in anti-diabetes therapies.

- OTC Management: Main OTC manufacturers like Prega Information and Manforce proceed to dominate their markets.

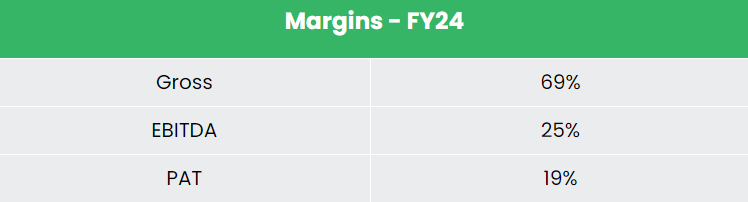

Monetary Efficiency

Q1FY25

- Income: Rs.2,893 crore in Q1FY25, up 12% from Rs.2,579 crore in Q1FY24.

- Working Revenue: Rs.686 crore, a 5% YoY progress from Rs.655 crore.

- Internet Revenue: Rs.543 crore, growing 10% YoY from Rs.494 crore.

- Export Income: Grew by 62% YoY.

- Money Move from Operations: Rs.546 crore.

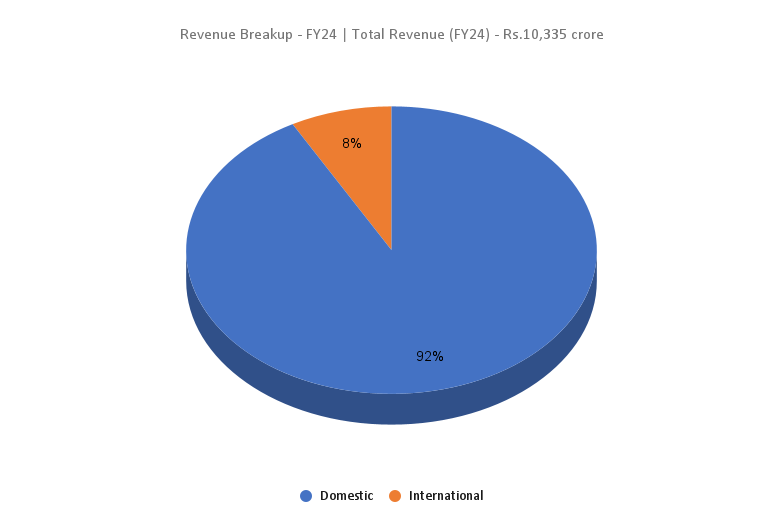

FY24

- Income: Rs.10,335 crore in FY24, up 18% from FY23.

- Working Revenue: Rs.2,550 crore, a 34% YoY enhance.

- Internet Revenue: Rs.1,942 crore, up 48% YoY.

- New Facility: Inaugurated India’s first totally built-in Dydrogesterone facility in Udaipur.

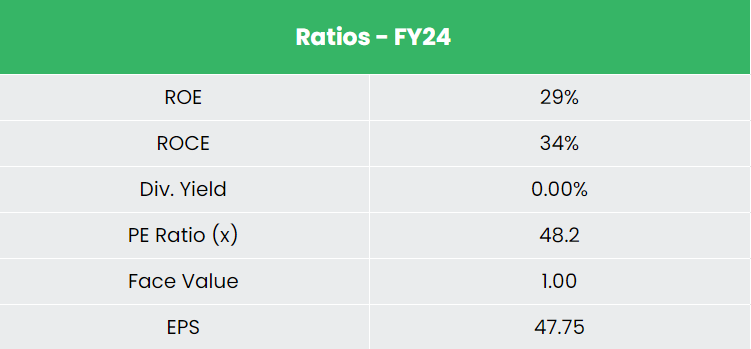

Monetary Efficiency (FY21-24)

- Income and PAT CAGR: 18% and 14% respectively over the previous 3 years (FY21-FY24).

- ROE and ROCE: Common of twenty-two% and 27% over the previous 3 years.

- Capital Construction: Robust, with a debt-to-equity ratio of 0.02.

Business outlook

- Business Dimension: The Indian pharmaceutical trade is the third largest globally by quantity and is predicted to succeed in US$130 billion by 2030, rising at a CAGR of over 10%.

- Development Drivers: Elevated healthcare spending, ageing inhabitants, inhabitants progress, rise in life-style ailments, and larger consciousness of high quality healthcare.

- World Choice: Indian medicines are favored worldwide for his or her low value and prime quality, incomes India the title of ‘Pharmacy of the World.’

- Regulatory Presence: India has the very best variety of FDA-approved crops outdoors the US.

- Mergers and Acquisitions: Anticipated to drive trade progress and create alternatives for increasing product choices and assembly various affected person wants.

Development Drivers

- FDI Insurance policies: As much as 100% FDI allowed by means of the automated route for Greenfield pharmaceutical initiatives; as much as 74% for Brownfield initiatives, with larger stakes requiring authorities approval.

- Authorities Initiatives: Packages like Pradhan Mantri Bhartiya Jan Aushadhi Pariyojana and Ayushman Bharat improve the accessibility of reasonably priced medicines.

- ‘Make in India’ Initiative: Supported by the Manufacturing Linked Incentives (PLI) scheme to spice up home manufacturing and promote indigenous merchandise.

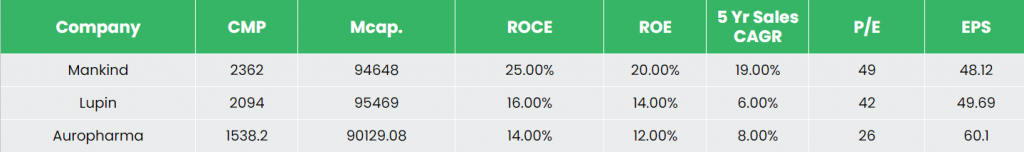

Aggressive Benefit

Mankind Pharma is producing larger returns from invested capital in comparison with rivals like Lupin Ltd and Aurobindo Pharma Ltd. The corporate’s constant income progress displays its efficient monetary allocation methods and prudent administration.

Outlook

- Girls’s Well being and Fertility: With life-style modifications and rising power situations, this section affords vital potential. Mankind goals to guide the gynaecology-fertility market by means of its acquisition of BSV, a high-entry-barrier enterprise with minimal competitors.

- Enterprise Technique: Mankind’s method—beginning with rural markets and increasing to metro cities whereas diversifying from power to shopper well being care merchandise—seems to be promising.

- New Launches: The corporate launched Inclisiran, a premium injection in-licensed from Novartis costing Rs. 1 lakh, and Ova Information, anticipated to develop equally to Prega Information.

- Improvement Pipeline: As of FY24, Mankind has 109 new molecules in improvement.

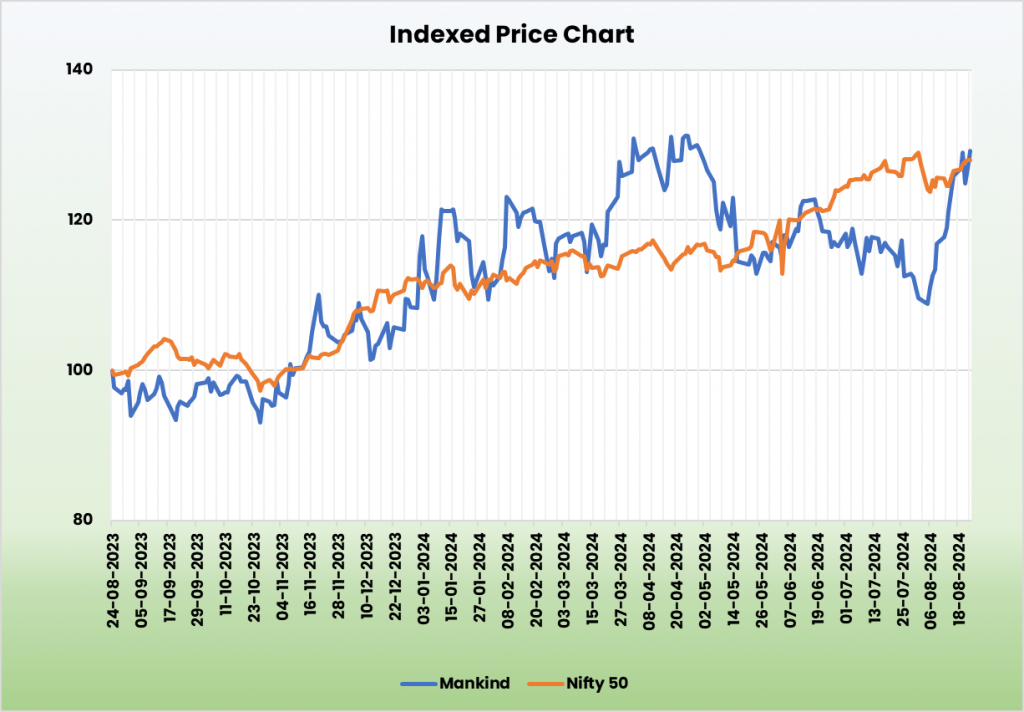

Valuation

Mankind’s technique of increasing into high-entry-barrier segments with sturdy pricing energy and market share is predicted to drive strong progress. We suggest a BUY score with a goal value (TP) of Rs.2,752, representing 43x FY26E EPS.

Dangers

- Regulatory Threat: The trade faces vital regulatory scrutiny, together with potential limitations or bans on merchandise by businesses just like the USFDA, which might affect income and operations.

- Patent Threat: The corporate might face challenges in defending patents or managing third-party agreements, doubtlessly affecting its enterprise operations.

Word: Please word that this isn’t a suggestion and is meant just for academic functions. So, kindly seek the advice of your monetary advisor earlier than investing.

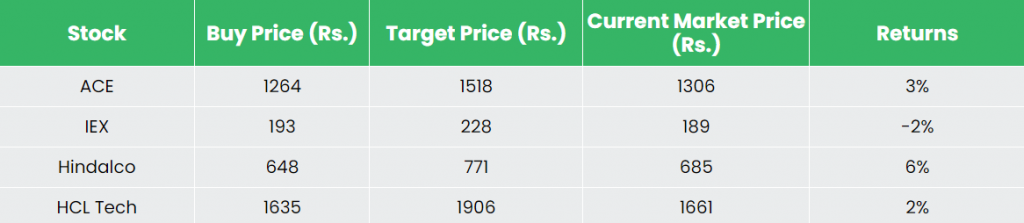

Recap of our earlier suggestions (As on 23 August 2024)

Different articles it’s possible you’ll like

Submit Views:

1,144