Pricey pals,

Welcome to the March situation of Mutual Fund Observer.

I’m shocked, generally, at how a lot I now respect a few of the stuff that I discovered most senseless and annoying in highschool. (I’m nonetheless not there with Moby Dick; the entire thought of a monomaniacally obsessed outdated man main his ship to destruction as a result of he can’t be reasoned with and received’t again down, simply strikes me as implausible, however I’m prepared to hear.)  My secret hope as a professor is that I’m just like the gardener scattering seeds too early, in patches that appear disconsolate, for these seeds nonetheless sprout whither they’d. And so, I train my college students about Thorstein Veblen, certainly one of his age’s most impenetrable geniuses (he coined “conspicuous consumption”), and Sherry Turkle, certainly one of our age’s most considerate, who asks “What can we grow to be once we speak to machines?” We examine Hitler, and in regards to the disastrous misjudgments – by mainstream politicians who had religion that they may management him and German industrialists who had religion that they may harness him to their eternal revenue – that led to the rise of Hitler. We learn the reflections of the first rate, hardworking Germans who satisfied themselves that it was higher to maintain their heads down and pray.

My secret hope as a professor is that I’m just like the gardener scattering seeds too early, in patches that appear disconsolate, for these seeds nonetheless sprout whither they’d. And so, I train my college students about Thorstein Veblen, certainly one of his age’s most impenetrable geniuses (he coined “conspicuous consumption”), and Sherry Turkle, certainly one of our age’s most considerate, who asks “What can we grow to be once we speak to machines?” We examine Hitler, and in regards to the disastrous misjudgments – by mainstream politicians who had religion that they may management him and German industrialists who had religion that they may harness him to their eternal revenue – that led to the rise of Hitler. We learn the reflections of the first rate, hardworking Germans who satisfied themselves that it was higher to maintain their heads down and pray.

This separation of presidency from individuals, this widening of the hole, passed off so step by step and so insensibly, every step disguised (maybe not even deliberately) as a short lived emergency measure or related to true patriotic allegiance or with actual social functions. And all of the crises and reforms (actual reforms, too) so occupied the people who they didn’t see the slow-motion beneath, of the entire course of of presidency rising remoter and remoter. . . (A German professor talking with Milton Mayer, They Thought They Had been Free: The Germans, 1933-45. College of Chicago Press, 1955)

We learn the ultimate report of Herbert Hoover’s 1929 Committee on Latest Financial Adjustments that hailed an “virtually insatiable urge for food for items and providers,” and envisaged “a boundless subject earlier than us … new desires that make method endlessly for newer desires, as quick as they’re happy.”

The youngsters from Nepal and Mongolia learn it alongside the children from Naperville and Milwaukee, learn it very in a different way from each other, and communicate to one another with growing confidence about how they hook up with the readings … and join to one another.

And so, within the spring of my 41st 12 months on the faculty, I’ll proceed scattering seeds and nurturing hope.

Heck, maybe at some point they’ll mirror on my courses as I’ve mirrored on Dickens.

“It was the most effective of instances, it was the worst of instances, it was the age of knowledge, it was the age of foolishness, it was the epoch of perception, it was the epoch of incredulity, it was the season of sunshine, it was the season of darkness, it was the spring of hope, it was the winter of despair.”

― Charles Dickens, A Story of Two Cities (1859)

On this month’s Observer

Our colleague Lynn Bolin continues taking a look at bonds as a beautiful various, on a risk-adjusted and valuation foundation, to shares simply now. “Spicy Bond Funds” explores “spicier” (higher-yielding) bond investments within the present market surroundings. Lynn analyzes varied danger elements together with inflation, length danger, and coverage uncertainty, and supplies a complete rating system for bond funds. Spoiler: you may wish to test Janus Henderson AAA CLO ETF (JAAA) as a comparatively secure solution to obtain greater yields within the present market,

Lynn enhances that with a brand new tackle an outdated technique, bond laddering. In “ETF Bond Ladders,” he examines ETFs designed for bond laddering, specializing in merchandise from Invesco (BulletShares) and BlackRock (iShares iBonds). The essay concludes with the be aware that company BBB-rated bond ladders can be Lynn’s mainstay funding, with potential additions of high-yield bonds for near-term investments and municipal bonds for tax-efficient accounts.

In “The Nice Rotation” (beneath), I spotlight the shocking extent of the change in inventory traders’ preferences – small, worth, worldwide, and rising are being rediscovered – and provide up the funds that needs to be on an investor’s shortlist.

To not put too high quality some extent on it, however the Trump administration has gutted efforts to reduce world warming, coordinate worldwide responses to it, or keep a reputable data infrastructure for it. In January we famous that the mandatory response to permitting such a collapse was a shift to infrastructure investing to handle the consequences. In February, we prolonged the evaluation to water infrastructure. In “The Local weather Denial Revenue Paradox,” we replace the state of presidency efforts and lay out extra investing alternatives. (I’ll return to being optimistic in regards to the future subsequent month.)

After markets get pricier and shakier, asset managers are doing what asset managers do: they’re rolling out new merchandise in new asset courses utilizing new algorithms that assure that completely satisfied days can be right here once more. After strolling by the unhappy wreckage of different “can’t miss” improvements, we spotlight the dangers surrounding three new funds and ETFs in “Liquid Guarantees, Illiquid Actuality.”

All of which delivered to thoughts the gorgeous collapse of Firsthand Know-how Worth Fund, a story that continues to this present day. Launched in 1994, the fund returned 60% a 12 months within the Nineteen Nineties and gave rise to a half dozen siblings. Twenty years after launch it grew to become a enterprise improvement firm doing personal fairness investing in the identical types of tech firms. And ten years later, the fund is buying and selling for $0.06/share and isn’t even in a position to liquidate. The cautionary story is in “The Rise and Fall of Firsthand Know-how Worth Fund.”

Talking of rising and falling, The Shadow paperwork the demise of Matthews Asian Development & Revenue, a fund made well-known by Paul Matthews and Andrew Foster because the least unstable, most constantly wonderful solution to put money into Asia equities from 1994 to about 2011. However thereafter …

The Nice Rotation

We will set up two issues in regards to the inventory market with nice confidence:

-

The US inventory market has an enormous downside. “Large” within the sense that traders have poured cash so steadily and so lengthy right into a handful of leaders that their valuations are starting to redefine “irrational.” Jason Zweig notes, “Even after the stumble in tech shares late final month, the Magnificent Seven traded this week at a mean of 43.3 instances what analysts count on them to earn over the subsequent 12 months” (“What You Ought to Do In regards to the Inventory Market’s Large Downside,” com, 2/7/25).

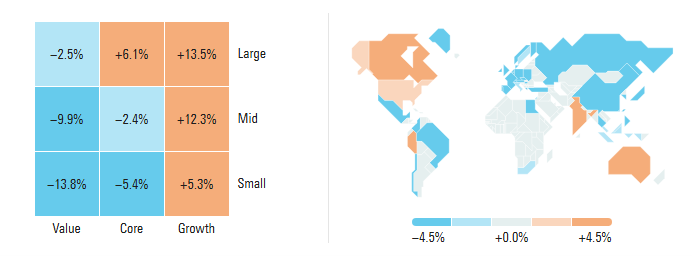

That leaves many of the US market and just about the entire remainder of the world with tolerable valuations. Spencer Jakab stories that “developed-market massive progress shares have been buying and selling final week at 98th-percentile valuations… [meaning] they’ve been dearer solely 2% of the time.” (Ever.) Concurrently, “developed-market massive worth is on the 2nd percentile, so it has been cheaper solely 2% of the time” (“Shares have a giant, costly downside,” WSJ, 2/25/25, B10). Morningstar photos it this fashion:

Leuthold Group stories that small caps are promoting at a 26% low cost to massive caps, adjusted for earnings, and worth is promoting at a near-historic low cost to progress.

-

Buyers have seen. As of March 3, 2025, Vanguard Worth ETF is up 4.5% on the 12 months, Vanguard Development ETF is down 1.2%. Equally, the Vanguard FTSE EM ETF is up 1.6%, Vanguard Complete Worldwide Inventory ETF is up 5.7% and the value-oriented Vanguard Worldwide Excessive Dividend Yield ETF is up 6.6%.

Contrarily, the Roundhill Magnificent Seven ETF is down 6% YTD. Vanguard Mega Cap Development ETF is down 2%. Tesla is down 27% YTD. Google is down 10%. Trump Media & Tech is down 32%.

All of that is separate from broader issues about chaos, tariffs, reciprocal tariffs, escalating tariffs, authorities shutdowns, and burgeoning deficits.

What may an investor think about?

If you happen to’re a younger investor with a diversified portfolio (suppose greater than 50 shares representing many alternative industries, ideally unfold over a number of international locations), do nothing to your portfolio. You’re high quality. This is likely to be disagreeable, however that’s a part of the worth of taking part in the sport.

If you happen to’re an investor with all your eggs in a single small basket (you could have a tech ETF and shares of Nvidia, Google, and Amazon), broaden your publicity. That doesn’t imply promoting what you personal. It would imply including one thing like Invesco S&P 500 Equal Weight ETF (RSP). At base, the equal weight 500 counteracts the big/progress/momentum biases embedded in lots of portfolios. It offers equal publicity to the biggest and smallest firms within the S&P 500 which creates a right away contrarian stability. It’s extra oriented towards cheaper shares, smaller shares, old-economy shares, and dividends than the S&P or the standard portfolio. In Morningstar phrases, it’s a one-star fund which is exactly its enchantment: it invests within the firms left for lifeless by the FAANG/MAG7 mania.

If you wish to enhance your publicity to value-oriented shares, think about Knowledge Tree US Worth ETF (WTV) or Goodhaven Fund (GOODX). Why these two? We turned to the MFO Premium screener which permits us to evaluate open-end funds, closed-end funds, and exchange-traded funds side-by-side. We screeners for funds with three important traits:

- Excessive three-year data ratio: The data ratio measures a fund supervisor’s ability by evaluating the surplus returns generated (above a benchmark) to the volatility of these extra returns, indicating how constantly the supervisor outperforms their benchmark. It’s a type of refinement of the Sharpe Ratio. A excessive data ratio is sweet; it alerts a better contribution by the supervisor or the mannequin.

- Beneath-average Ulcer Index: The Ulcer Index measures draw back danger by quantifying the depth and length of drawdowns in an funding’s worth, giving traders a clearer image of potential “abdomen ache” than conventional volatility metrics. It’s a key metric in MFO’s fund rankings. Low Ulcer indexes are good; they sign fewer ulcers.

- Obtainable to common traders: which is to say, affordable minimal and never restricted to a restricted class of patrons.

We utilized that screener to massive worth, mid-cap worth, and multi-cap worth funds for the previous three years. Thirty-four worth funds and ETFs confirmed each wonderful supervisor efficiency and wonderful resilience over the previous three years. Knowledge Tree US Worth had the best data ratio of all, and Goodhaven had the best ratio for all mutual funds.

| Annual return | Information Ratio | Ulcer Index | ||

| Knowledge Tree US Worth | Multi-cap worth | 14.1 | 2.02 | 5.3 |

| Goodhaven | Multi-cap worth | 14.6 | 1.44 | 5.3 |

| MCV common | 8.4 | -0.02 | 5.6 |

If you wish to enhance your publicity to small cap shares, think about Vanguard Strategic Small Cap Fairness, North Sq. Dynamic Small Cap, or Adirondack Small Cap.

Vanguard Strategic Small Cap Fairness is an actively managed, low-cost small-cap mix fund that holds about 500 names (yikes! Nevertheless it works) with a growth-at-a-reasonable-price self-discipline. It prices one-third of the class common and is about as diversified as could be.

North Sq. Dynamic Small Cap employs a scientific, quantitative strategy to establish behavioral inefficiencies in small-cap fairness markets, leveraging subtle knowledge science to use pricing dislocations attributable to investor biases. That “behavioral finance” angle is pretty distinctive.

Adirondack Small Cap is the top-performing small worth fund, incomes a exceptional 11% annual return in one of many market’s left-for-dead classes. The fund makes a speciality of figuring out undervalued small-cap firms which have fallen out of favor with traders, in search of to capitalize on these “turnaround conditions” earlier than mainstream traders take discover. They aim firms which may rebound inside three years. The workforce has been round ceaselessly and is closely invested within the fund.

| Annual return | Information Ratio | Ulcer Index | ||

| Vanguard Strategic SC | Small cap core | 7.9 | 1.68 | 7.0 |

| North Sq. Dynamic SC | Small cap core | 9.5 | 1.64 | 7.2 |

| SCC Common | -3.9 | 7.9 | ||

| Adirondack SC | Small cap worth | 11.1 | 1.14 | 5.8 |

| SCV Common | 4.9 | -0.02 | 7.4 |

If you wish to enhance your publicity to worldwide shares, think about the Janus Henderson World Analysis or Moerus Worldwide Worth. The Janus Henderson World Analysis is a world large-cap progress fund that employs a particular sector-driven strategy the place specialised groups of devoted sector analysts construct high-conviction portfolios of their greatest concepts worldwide. In addition they work to hedge away most macroeconomic dangers leaving the portfolio efficiency largely pushed by inventory choice.

Moerus Worldwide Worth is a globally unconstrained deep worth fund managed by Amit Wadhwaney, who employs a disciplined strategy to figuring out firms buying and selling at vital reductions to intrinsic worth throughout developed and rising markets, with a specific emphasis on sturdy stability sheets over earnings statements. Amit has three a long time of worth investing expertise and willingness to embrace market turmoil as a possibility, in search of out underfollowed companies, complicated conditions, and quickly distressed sectors that the majority traders keep away from, creating a particular portfolio of 30-40 high-conviction holdings with minimal index overlap.

| Annual return | Information Ratio | Ulcer Index | ||

| Janus Henderson World Analysis | World massive cap progress | 12.64 | 0.89 | 7.41 |

| World LCG ave | 8.8 | -0.33 | 8.98 | |

| Moerus Worldwide Worth | World small-mid cap | 15.65 | 1.71 | 6.09 |

| World small ave | 2.6 | -0.60 | 6.22 |

And should you’re merely freaked out, (a) welcome to the membership and (b) enhance the strategic money allocation in your portfolio. Money and money alternate options are paying 4-5% a 12 months with minimal draw back. If you happen to don’t have any nice conviction in danger property, take a deep breath and put money into some variation of an ultra-short bond fund or cash market.

| Annual return | Most drawdown | Information Ratio | Ulcer Index | ||

| CrossingBridge Extremely-Quick | Bond | 4.89 | -0.12% | 1.37 | 0.03 |

| Constancy Conservative Revenue | Extremely-short bond | 4.43 | -0.21 | 0.8 | 0.06 |

| Random cash market fund | The group common | 4.24 | 0.0 | -0.95 | 0.0 |

CrossingBridge is run by David Sherman & co., and so they have an excellent report of low-risk earnings investing. Constancy Conservative Revenue is an inexpensive, energetic, middle-of-the-road ultra-short bond fund. The “low-cost” is de facto helpful right here. We’ve additionally included the profile of the cash market peer group. In actuality, there’s no draw back to any of them and valuable little upside deviation. So, the entire group sits at 4.2% give-or-take 0.2%. Choose whichever one is handy to you should you don’t need the prospect of including only a little bit of upside with CrossingBridge or Fido.

The underside line: operating round in panic shouldn’t be your good friend. Hiding shouldn’t be your good friend. Taking a deep breath and making rational changes is. We’ll assist.

Celebrating Moral Enterprise: B Corp Month

March has been designated as “B Corp Month.” Hallmark has not but taken discover.

March has been designated as “B Corp Month.” Hallmark has not but taken discover.

In an period of rising disillusionment with conventional company buildings, B Corps stand as beacons of a extra conscientious strategy to enterprise. Whereas many firms prioritize earnings at any value, Profit Companies (B Corps) signify a revolutionary paradigm that balances monetary success with constructive social and environmental impression.

B Corps are companies that meet rigorous requirements of social and environmental efficiency, accountability, and transparency. Not like typical firms that reply primarily to shareholders, B Corps legally decide to contemplating all stakeholders: employees, clients, suppliers, group, and the surroundings. Within the US, 2,400 firms are organized as B Corps. Worldwide, that swells to 9,500.

What makes B Corps value celebrating? They’re proving that enterprise is usually a pressure for good. From truthful wages and various workforces to sustainable sourcing and moral manufacturing, these firms show that revenue and goal aren’t mutually unique, they’re mutually reinforcing.

What makes B Corps value celebrating? They’re proving that enterprise is usually a pressure for good. From truthful wages and various workforces to sustainable sourcing and moral manufacturing, these firms show that revenue and goal aren’t mutually unique, they’re mutually reinforcing.

The B Corp motion isn’t simply idealism; it’s pragmatism for our instances. As shoppers more and more vote with their {dollars} for firms that mirror their values, B Corps are displaying that moral enterprise practices create resilience, innovation, and long-term success. The Annual Report of B Lab paperwork quite a lot of methods by which these firms actually are totally different.

I’m not shocked, although I’m barely appalled, by the velocity with which Company America as an entire has thrown all ideas besides shareholder (and govt) features beneath the bus. By supporting the nice guys, you aren’t underwriting the swift abandonment of workers, communities, and the surroundings by the billionaire-dollar firms that have been cheerleading for it, flying rainbow flags, and signing on to world initiatives … for exactly so long as it was handy.

Assist how?? Observe B Lab World, the certifying physique, on social media (LinkedIn, Instagram, Fb, X) and observe the #GenB or #BCorpMonth hashtag to see the totally different stuff taking place all through March. You can even use the ‘Discover a B Corp’ listing to find companies which can be a part of the group and use your buying energy to help B Corp firms, and the motion of enterprise as a pressure for good.

And different good guys

![]() You may also think about Bookshop.org as an moral various to Amazon, no less than as a bookseller. They’ve donated $36+ million in earnings to native bookshops since their launch throughout Covid. Good individuals, large choice. Amazon has lately modified coverage, they now forbid Kindle customers from downloading their books, giving them everlasting management of your purchases. (You may recall their freakish choice to take away the e book 1984 from all Kindle readers just a few years in the past.) Bookshop has e-books and is working with people like Kobo to make them out there on readers.

You may also think about Bookshop.org as an moral various to Amazon, no less than as a bookseller. They’ve donated $36+ million in earnings to native bookshops since their launch throughout Covid. Good individuals, large choice. Amazon has lately modified coverage, they now forbid Kindle customers from downloading their books, giving them everlasting management of your purchases. (You may recall their freakish choice to take away the e book 1984 from all Kindle readers just a few years in the past.) Bookshop has e-books and is working with people like Kobo to make them out there on readers.

Equally, a handful of main retailers have acknowledged the enterprise case of sustaining a various and vibrant workforce and have, thus far, refused to roll again company efforts to help their workers. These embody Costco, Crate & Barrel, Dwelling Depot, Ikea, Kroger, Sprouts Wayfair, West Elm … and Complete Meals (?).

Thanks, as ever …

To our devoted “subscribers,” Wilson, S&F Funding Advisors, Greg, William, William, Stephen, Brian, David, and Doug, thanks!

To our devoted “subscribers,” Wilson, S&F Funding Advisors, Greg, William, William, Stephen, Brian, David, and Doug, thanks!

To, Sara from Brooklyn, Charles of Michigan, Ronald from Alexandria, Marjorie (thanks, ma’am, I additionally get such a headache some days) of Chicago, The Grinch Redux, and expensive Binod from Houston, thanks! And for extra than simply monetary help. You make a distinction.

It’s planting time. Chip is busily looking seed catalogs for spring-planted garlic (stiff neck largely, as a result of they generate scrumptious garlic scapes) and gentle onions. I’ll proceed trying to find the proper potato. And someplace in there, extra native wildflowers and grass (sheep fescue appears cool) will proceed their relentless incursion on our garden.

Planting is an act of hope. Gardening is a gesture of resilience. Pursue each, expensive pals.

As ever,