Whereas President Trump and FHFA Director Pulte proceed to name for decrease charges, mortgage charges have quietly marched all the way down to their 2025 lows.

It’s form of humorous to see it play out as a result of they’ve been barking up the unsuitable tree, but nonetheless seeing desired outcomes.

That unsuitable tree is Fed Chair Powell, who together with the opposite Fed members doesn’t set shopper mortgage charges.

Regardless of that, it appears that evidently nearly every day he’s lambasted for ready to chop charges, which makes you marvel if it’s a extra elaborate transfer to forged blame if issues go sideways.

In any occasion, the 30-year mounted is now close to its finest ranges of 2025, and will get even higher.

The 30-Yr Fastened Mortgage Is Inching Again Towards 6.50%

Positive, 6.50% didn’t sound too scorching again in 2022 when the 30-year mounted was nonetheless within the 3-4% vary, however what a distinction just a few years make.

That is the fantastic thing about the human thoughts, which makes changes after being uncovered to altering situations.

With regard to mortgage charges, when you see 8%, 6-something doesn’t sound half dangerous anymore.

You would possibly neglect (to be honest, not utterly) the place mortgage charges was once, and simply be completely satisfied they aren’t as dangerous as they have been.

For reference, the 30-year mounted ascended previous 8% in October 2023, earlier than starting to enter a falling fee trajectory. Albeit one with ups and downs alongside the way in which.

Now mortgage charges are nearly at their lows for the yr, 6.67% ultimately look, the one exception being a pair days in early April when the commerce battle had charges dipping to six.60%.

However that was very short-lived, and likely missed it anyway. So for all intents and functions, that is just about the underside for charges in 2025 to date, a minimum of per MND’s every day fee.

In truth, we’re form of again to October 2024, and if we maintain transferring in the appropriate course, we may get again to September 2024 when charges neared 6%.

That appeared to get issues cooking once more, so it’s important to marvel if it’ll recharge the flagging housing market if we get there as soon as extra.

Watch Out for the Jobs Report on Thursday!

Whereas there’s hope mortgage charges may proceed to inch decrease this week, we’ll want a cool jobs report on Thursday to maintain the momentum going.

The jobs report tends to be a very powerful knowledge level in terms of mortgage charges, particularly at the moment with all eyes now on labor as a substitute of inflation.

Positive, inflation continues to be a priority, particularly with all of the unknowns associated to tariffs, however jobs have taken heart stage as bond merchants fret in regards to the well being of the economic system.

Forecasts are calling for a fairly weak jobs report as is, with simply 110,000 new jobs created in June, down from 139,000 a month earlier.

The unemployment fee can be anticipated to climb to 4.3% from 4.2%, whereas wage progress is anticipated to sluggish.

Assuming that every one occurs, mortgage charges may break even decrease, although if jobs knowledge is unexpectedly scorching, the alternative may occur. So be careful!

Both manner, I count on loads of rhetoric from Trump and maybe Pulte on mortgage charges being too excessive, and for the Fed to maintain chopping.

Three Fed Fee Cuts in 2025 Again on the Desk?

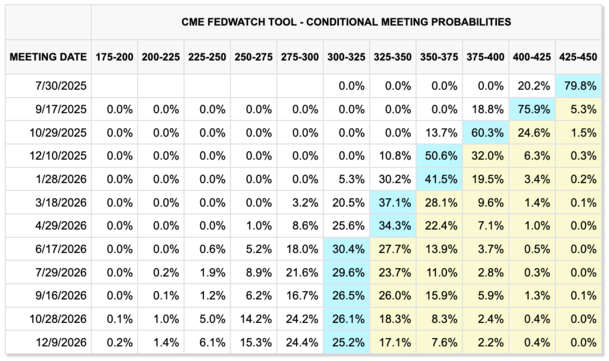

Curiously, the percentages of the Fed chopping are rising by the day, and we one way or the other may be again to a few cuts for 2025, assuming the CME forecast pans out.

Simply keep in mind that the Fed cuts don’t translate to mortgage fee cuts. The 2 are loosely correlated.

But when the Fed is chopping, likelihood is the 10-year bond yield can even be dropping beforehand and so too will mortgage charges.

And we’d even see a few of these extra aggressive 2025 mortgage fee forecasts (together with my very own) come to fruition.

I’ve been saying for some time that there was nonetheless loads of yr left, regardless of many others falling by the wayside on mortgage charges for 2025.

So cling in there and maybe issues will prove higher than anticipated.

Learn on: Is the Magic Quantity for Mortgage Charges Now Something Shut to six%?