Capital asset usually refers to something that you just personal for private or funding functions. It consists of every kind of property; movable or immovable, tangible or intangible, fastened or circulating.

Capital belongings are additional categorized as Monetary Belongings and Non-Monetary Belongings. Monetary belongings are intangible and characterize the financial worth of a bodily merchandise.

Shares (Shares) and mutual funds are the very best examples of Monetary Belongings.

The revenue (if any) that you just make in your mutual fund investments once you redeem or promote the MF items is known as Capital Positive factors. It may be a Brief Time period Capital Achieve (STCG) or a Lengthy Time period Capital Achieve (LTCG) relying upon the ‘Interval of Holding’. The tax that’s relevant on these income is named ‘Capital Positive factors Tax’.

On this submit allow us to perceive: What are the elements that decide the tax standing of mutual funds? What are the tax implications on mutual fund investments? What are the Price range 2018-19 proposals associated to Mutual Funds Taxation? – Mutual funds taxation & capital beneficial properties tax charges on mutual funds for Monetary 12 months 2018-2019 (Evaluation 12 months 2019-2020).

Components figuring out the tax standing of mutual funds

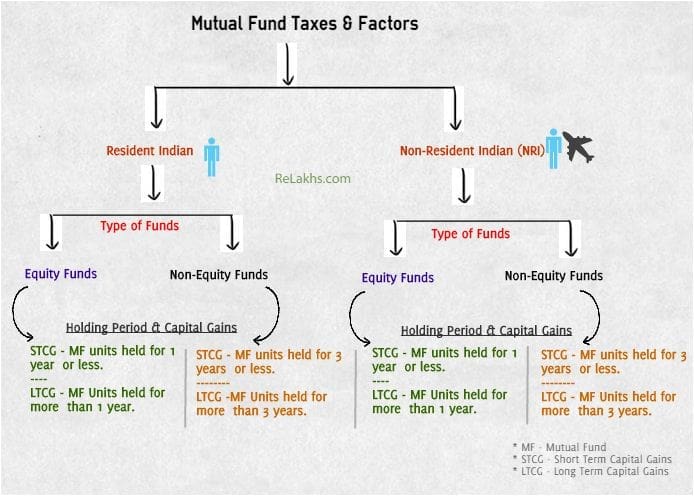

The capital beneficial properties tax on mutual fund withdrawals relies on the elements as under;

- Residential Standing

- Fund Kind (whether or not the fund is an Fairness-oriented fund (or) a Non-Fairness Oriented Fund)

- Holding Interval (Period of your funding)

1. Residential Standing & Mutual Funds Taxation

The capital beneficial properties tax charges are decided primarily based on the residential standing of a person / investor. Residential standing will be both ‘Resident Indian’ or ‘Non-Resident India” (NRI). (Associated article : ‘Residential Standing on-line calculator.’)

2. Kind of Funds & Mutual Funds Taxation

What are Fairness-oriented Mutual Funds? – MF schemes that make investments at the very least 65% of its fund corpus into fairness and fairness associated devices are generally known as fairness mutual funds. Examples are : Massive cap, ELSS tax saving funds, Mid-cap, Balanced funds (fairness oriented), Sector funds and so on.,

What are Non-Fairness Mutual Funds? – MF schemes that maintain lower than 65% of their portfolio in equities and fairness associated devices are generally known as Non-Fairness Funds / Debt funds. Examples are : Liquid Mutual funds, Cash Market funds, Gold funds, Infrastructure debt funds, MIPs, FMPs, Hybrid funds (Debt oriented) and so on.,

3. Interval of Holding & Capital Positive factors on Mutual Funds

Capital beneficial properties on Mutual funds might be both long run capital beneficial properties or brief time period capital beneficial properties, relying in your funding horizon.

- Lengthy Time period Capital Positive factors

- In case you make a acquire / revenue in your funding in a Fairness Mutual Fund scheme that you’ve got held for over 1 12 months, it is going to be categorized as Lengthy Time period Capital Achieve.

- In case you make a acquire / revenue in your funding in a Non-Fairness Mutual Fund scheme (or in a Debt Fund) that you’ve got held for over 3 years, it is going to be categorized as Lengthy Time period Capital Achieve.

- Brief Time period Capital Positive factors

- In case your holding in a Fairness mutual fund scheme is lower than 1 12 months i.e. for those who withdraw your mutual fund items earlier than 1 12 months, after making a revenue, then the revenue will likely be thought of as Brief Time period Capital Achieve.

- In case you make a acquire / revenue in your Debt fund (or apart from fairness oriented schemes) that you’ve got held for lower than 36 months (3 years), it is going to be handled as Brief Time period Capital Achieve.

Price range 2018-19 & Mutual Fund Taxation

Mutual Funds Capital Positive factors Taxation Guidelines FY 2018-19 | Newest Mutual Funds Capital Positive factors Tax Charges AY 2019-20

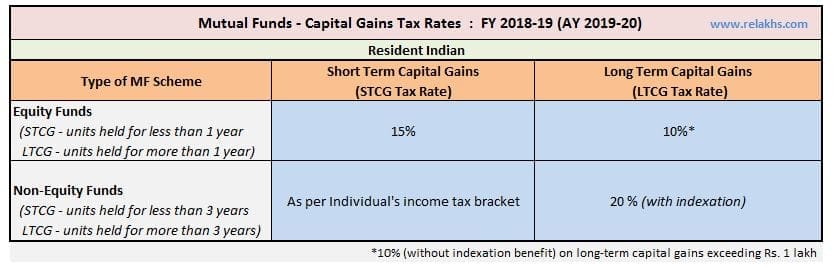

Capital Positive factors Tax Charges on Mutual Fund Investments of a Resident Indian are as under;

- The STCG (Brief Time period Capital Positive factors) tax fee on fairness funds is 15%.

- The STCG tax fee on Non-Fairness funds (or) Debt funds is as per the investor’s earnings tax slab fee.

- The LTCG (Lengthy Time period Capital Positive factors) tax fee on fairness funds is 10% on LTCG exceeding Rs 1 Lakh.

- The LTCG tax fee on non-equity funds is 20% (with Indexation profit)

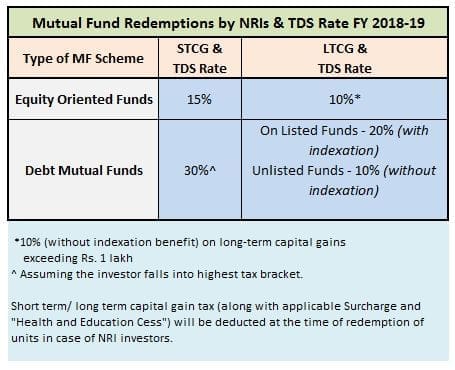

Capital Positive factors Tax Charges on NRI Mutual Fund Investments for the Monetary 12 months 2018-19 (Evaluation 12 months 2019-20) are as under;

- The STCG tax fee on fairness funds is 15%.

- In case the short-term capital beneficial properties had been on account of listed fairness shares which had been offered on a inventory change or equity-oriented mutual fund, then the provisions for tax calculations as per part 111A of the Revenue Tax Act present that 15% tax is payable by non-residents on a flat foundation with out getting any good thing about the preliminary exemption restrict of Rs 2,50,000. Sadly, the essential exemption restrict is obtainable just for resident people and HUFs, and never for every other entities. If the short-term capital beneficial properties isn’t on account of both of the 2 varieties of sale talked about above, then the advantage of preliminary exemption will likely be out there even to non residents.

- The STCG tax fee on Non-Fairness funds (or) Debt funds is as per the investor’s earnings tax slab fee. (Tax Deducted at Supply – TDS @ 30% is relevant)

- The LTCG tax fee on fairness funds is 10%, on LTCG exceeding Rs 1 Lakh.

- The LTCG tax fee on non-equity funds is 20% (with Indexation) on listed mutual fund items and 10% on unlisted funds.

Base 12 months & Indexation : As per Price range (2017-18), the bottom 12 months for calculation of Indexation has been modified to 2001. It has an have an effect on (largely constructive) on investments the place indexation profit is obtainable when calculating Capital acquire taxes.

- For instance: Suppose you’re holding on to your investments made in debt funds (or) Property earlier than 2001, the Honest Market Worth (NAV) as on 1 st April, 2001 will likely be thought of as value of acquisition for calculating capital beneficial properties. This can assist the investor to cut back the capital beneficial properties taxes.

- As of now, the bottom 12 months is 1981. To calculate the capital beneficial properties on the time of promoting any Deb fund items / property bought earlier than 1981, its buy worth is now calculated on the idea of the truthful market worth of 1981. Calculation on the truthful market worth of 2001 will improve the price of acquisition and decrease the capital acquire.

(How do you calculate the listed value of buy? The listed value is calculated with the assistance of above desk of value inflation index.

Divide the fee at which you bought the Mutual Fund items by the index as on the date of the acquisition. Multiply this by the index as on the date of sale.

For Instance : If buy 12 months is 2011 and 12 months of sale is in Monetary 12 months 2015. Then listed value of buy can be –

Listed value of buy = (Buy worth / 184) * 254.)

Taxation of Mutual Fund Dividends

- Dividends on Fairness Mutual Funds : The dividend acquired within the fingers of an unit holder for an fairness mutual fund is totally tax free. Nevertheless, w.e.f. FY 2018-19, the fund homes should pay 10% Dividend Distribution Tax (DDT) on fairness oriented mutual fund schemes. (Efficient DDT fee is 11.648% inclusive of 12% surcharge & 4% cess.)

- Dividends on Debt Funds : The dividend earnings acquired by a debt fund unit holder can be tax free. However, the mutual fund firm has to pay a dividend distribution tax (DDT) earlier than distributing this dividend earnings to its Unit-holders. DDT on Debt Mutual Funds is 29.12% (inclusive of surcharge & cess).

NRI Mutual Fund Investments & TDS Price

Beneath are the TDS fee relevant on MF redemptions by NRIs for AY 2019-20.

Hope this submit is informative. Do you verify your capital beneficial properties assertion(s) yearly? Do you embody your capital beneficial properties taxes (if any) in Revenue Tax Returns (ITR). Share your feedback.

Proceed studying :

(Assumption – STT (Securities Transaction Tax) is payable) (Featured Picture courtesy of Stuart Miles at FreeDigitalPhotos.internet) (Publish revealed on 01-March-2018)