With the excessive volatility over tariffs, uncertainty, and considerations over the independence of the Federal Reserve, components of this text could also be outdated inside hours of finishing it. How does one make investments on this atmosphere? I’ve up to date my Funding System to replicate my present technique. Briefly, it’s arrange as a standard 60% inventory/40% bond portfolio inside a variety of 55% to 65% shares based mostly on my funding mannequin. I set the mannequin as much as make small quarterly changes based mostly on volatility-adjusted momentum and a shift between worldwide and home development based mostly on valuations and momentum.

In April, I looked for and located that I can obtain the month-to-month returns for the lifetime of a fund within the MFO Premium fund screener and the Lipper world dataset. I started creating funding fashions over a decade in the past utilizing knowledge principally out there on the St. Louis Federal Reserve Database (FRED). Utilizing precise fund knowledge from MFO is a big enchancment. The target of the mannequin is to maximise the returns on investments since 1995, given my constraints. There’s a whole lot of knowledge at FRED that covers this time interval, and I need an “all-weather” strategy with low turnover. I modified the Funding Mannequin in April to make use of historic knowledge on 4 fairness funds and 7 mounted earnings funds.

The Funds

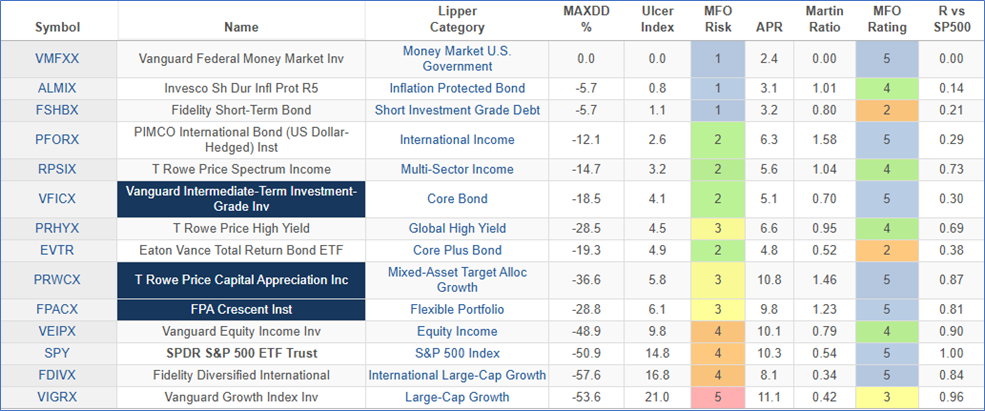

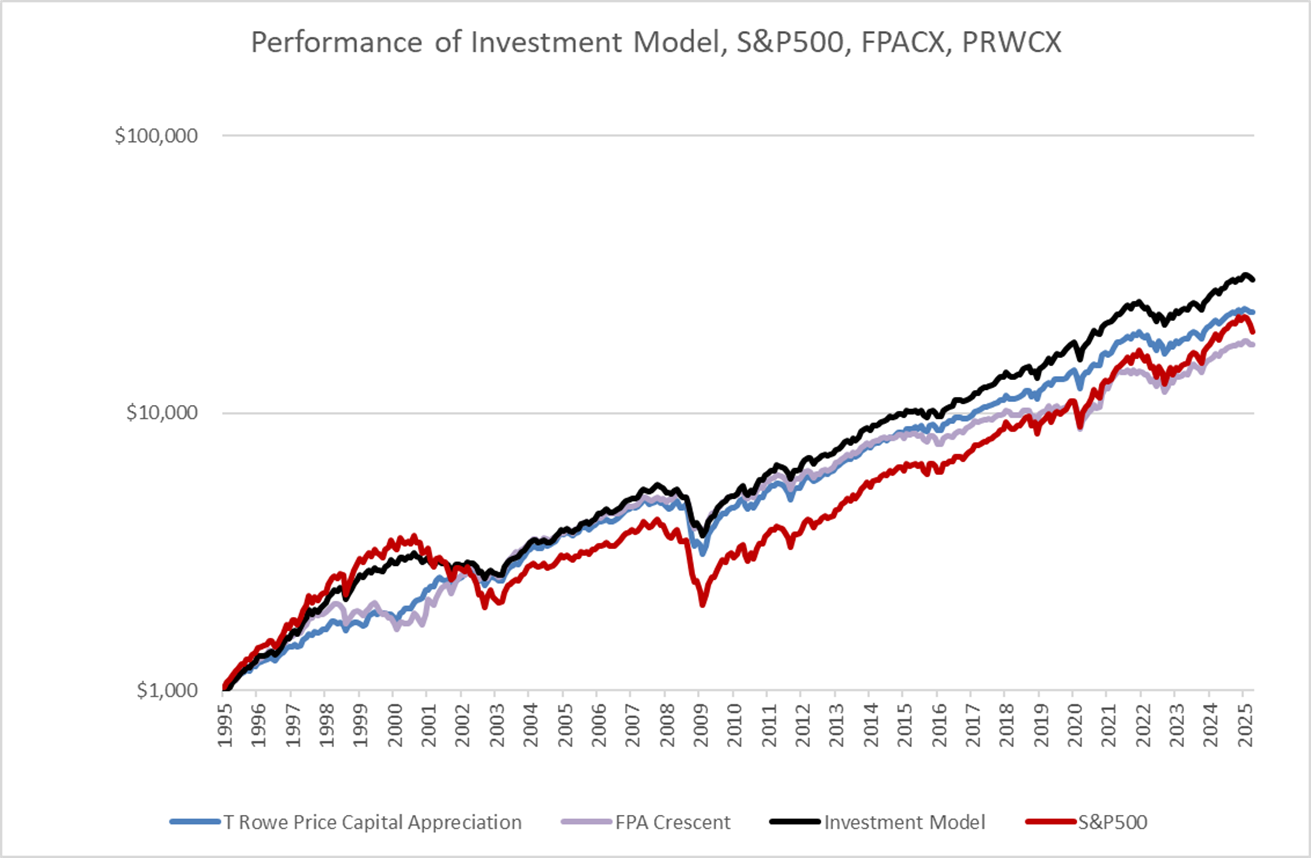

The twelve funds that I included within the Funding Mannequin are proven in Desk #1 together with two glorious mixed-asset funds for a baseline: T Rowe Worth Capital Appreciation Revenue (PRWCX) and FPA Crescent (FPACX). Discover that the SPDR S&P 500 ETF (SPY) returned 10.3% over the previous thirty years whereas PRWCX and FPACX have aggressive returns of 10.8% and 9.8%, respectively. The funds had been chosen that may neatly match right into a Bucket Strategy. The bond choice consists of riskier bond funds which have a low correlation to shares and are much less dangerous than shares. The funds had been chosen to maximise the return within the Mannequin whereas sustaining a low turnover philosophy.

Desk #1: Funds In Funding Mannequin – Thirty 12 months Metrics

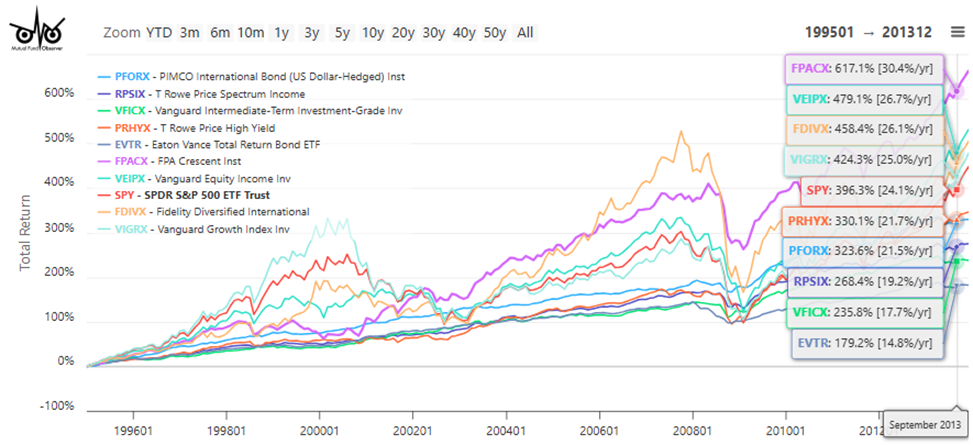

Through the time interval from 1995 to 2013, many mixed-asset funds outperformed the S&P 500 for a number of causes. First, bonds outperformed shares in the course of the two main bear markets, and worldwide shares outperformed home shares over lengthy durations of time, particularly as home equities grew to become overvalued in the course of the Housing Bubble.

Determine #1: Funds In Funding Mannequin – Complete Return 1995 – 2013

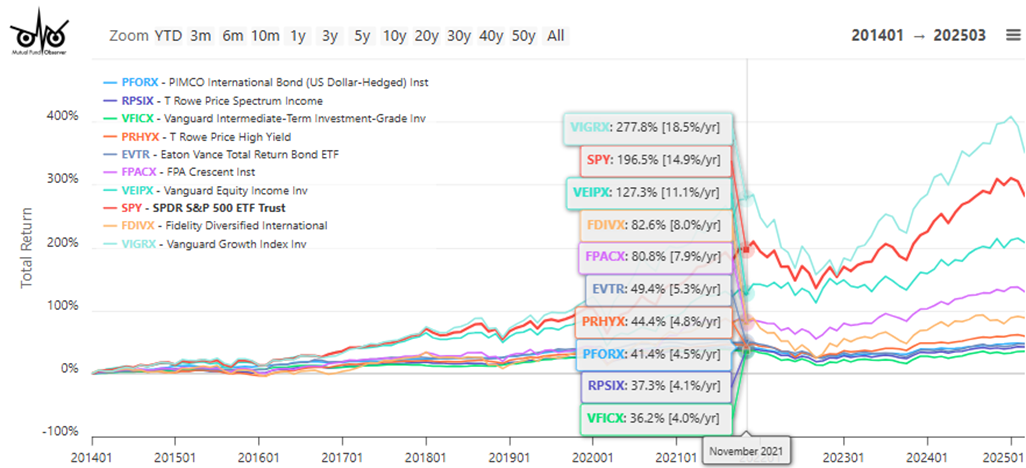

Through the time interval from 2014 to 2025, Quantitative Easing and straightforward financial coverage suppressed bond yields, and valuations of home equities grew to become overvalued. Worldwide equities have underperformed. Because of this, mixed-asset funds have carried out worse than the S&P 500.

Determine #2: Funds In Funding Mannequin – Complete Return 2014 – 2025

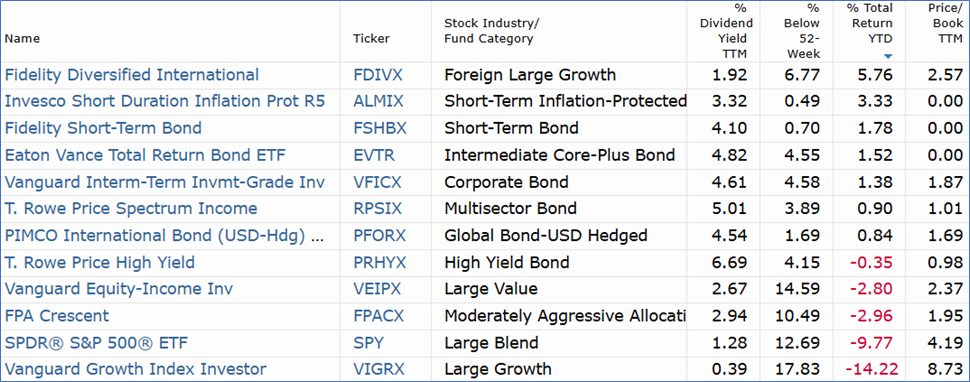

At first of the 12 months, home shares had been extremely valued. The S&P 500 was down nearly ten p.c year-to-date (as of April 22nd) in comparison with international massive development, which rose practically 6% this 12 months. The value-to-book worth of the S&P 500 continues to be excessive in comparison with worldwide shares.

Desk #2: Funds In Funding Mannequin – 12 months-To-Date Efficiency

Portfolio Allocation and Efficiency

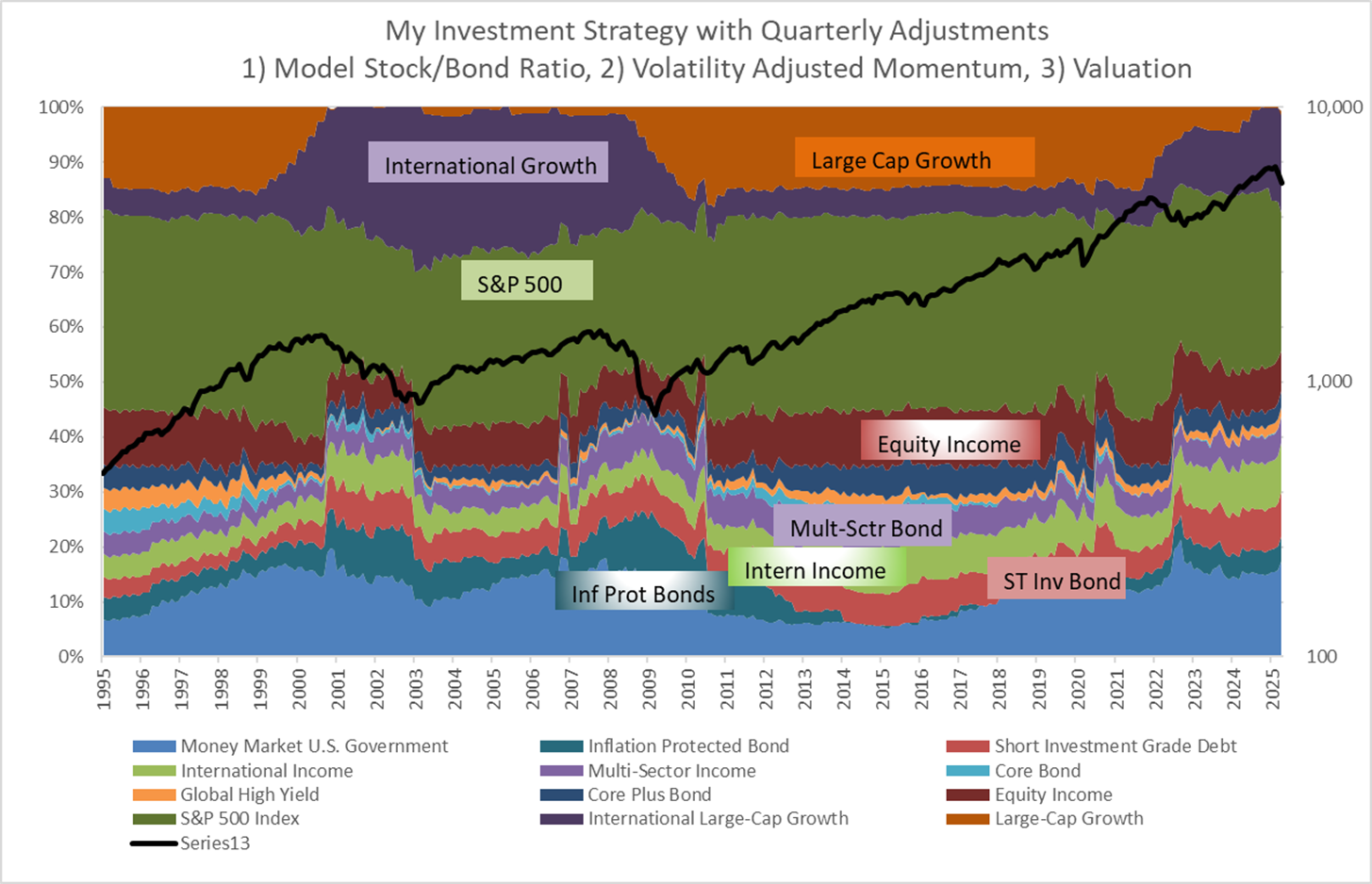

The funding mannequin makes use of financial and monetary indicators for the previous thirty years to “nowcast” present market situations. My funding technique is to observe a standard portfolio of funds with 60% allotted to shares inside a variety of 55% to 65%, and 1) make changes quarterly for two% of the portfolio based mostly on quarterly returns adjusted for volatility, 2) shifting as much as 5% of fairness between home and worldwide development funds based mostly on valuations and momentum, and three) utilizing the Funding Mannequin calculated inventory to bond ratio for “danger on – danger off”. The allocations over the previous thirty years are proven in Determine #3.

The Funding Mannequin likes money, which I’ve capped at 15%. Cash markets carried out “much less badly” than many bond funds throughout Quantitative Easing, and bond efficiency worsened beginning in 2022. Money just isn’t trash. Lately, inflation-protected bonds have been performing nicely, as have short-term investment-grade and worldwide bond funds. On the fairness aspect, I restrict the allocation to home development shares to fifteen% of the portfolio. The mannequin started shifting allocations to worldwide shares as valuations elevated, regardless that home development was outperforming, however worldwide shares have carried out exceptionally nicely in 2025.

Determine #3: Funding Mannequin Allocations

My goal is to study from how totally different methods work and never unrealistically optimize a back-tested technique. I’ve the benefit of thirty years of financial knowledge out there on the St Louis Federal Reserve (FRED) database, hindsight on valuations, and precise fund efficiency. The Funding Mannequin returned 11.6% APR over the thirty years in comparison with 10.3% for SPDR S&P 500 ETF (SPY), 10.8% for T Rowe Worth Capital Appreciation Revenue (PRWCX), and 9.8% for FPA Crescent (FPACX).

Determine #4: Funding Mannequin Complete Return vs S&P500, FPACX, PRCWX

There are 13 combined asset funds which have returned 9% or extra over the previous thirty years in the course of the time when the S&P 500 returned 10.3%. All of them have a better risk-adjusted return as measured by the Martin Ratio than the S&P 500. A lot of the combined asset funds outperformed the S&P 500 in the course of the 1995 to 2013 time interval, whereas the S&P 500 outperformed since 2014.

My Evaluation

The Funding Mannequin has beneficial a risk-off allocation of 55% for the reason that center of 2022. I let the winners run, and the allocation rose to 65% by the tip of final 12 months. As I described beforehand, I made withdrawals to refill short-term Funding Buckets and diminished ris,okay decreasing allocations beneath 60% previous to inauguration day. What drove this weak point when the market rose by twenty p.c over the previous two years?

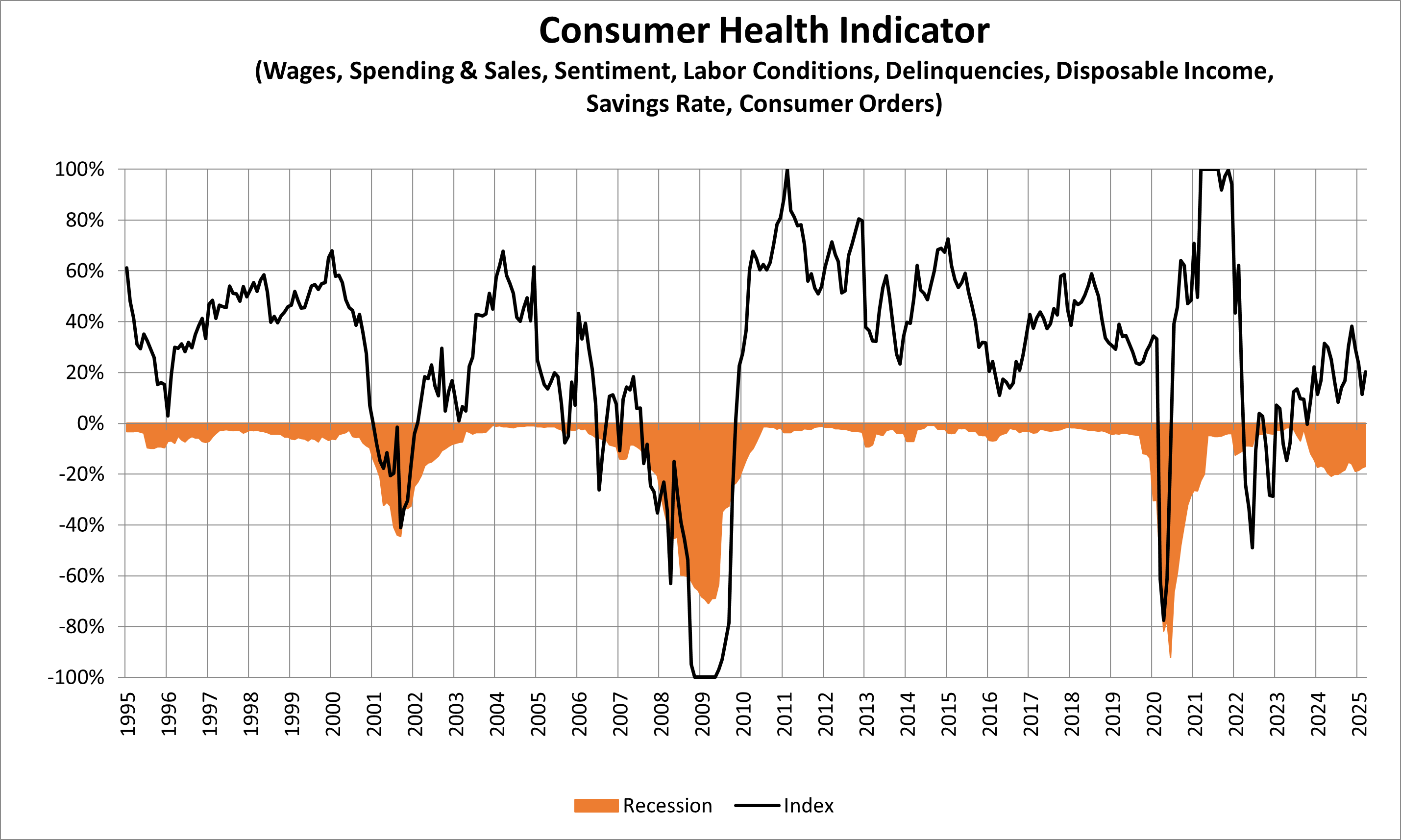

The Funding Mannequin consists of over thirty important indicators which can be composed of over 100 sub-indicators. Let’s check out just a few of those. Almost 70% of the gross home product is client spending. My Client Well being Indicator, proven in Determine #5, estimates the patron’s potential to spend sooner or later. It’s based mostly on Wages, Spending, Client Sentiment, Labor Circumstances, Credit score Delinquencies, Disposable Revenue, Financial savings Charges, and Consumable Orders. The place acceptable, these are adjusted for inflation. The Client is operating out of breath. About two-thirds of households live paycheck to paycheck, and about half of those don’t have sufficient financial savings to cowl three months of dwelling bills. Social developments like “Below-Consumption Core” and “Don’t Purchase 2025” replicate the will to chop again on spending and save extra.

Determine #5: Client Well being

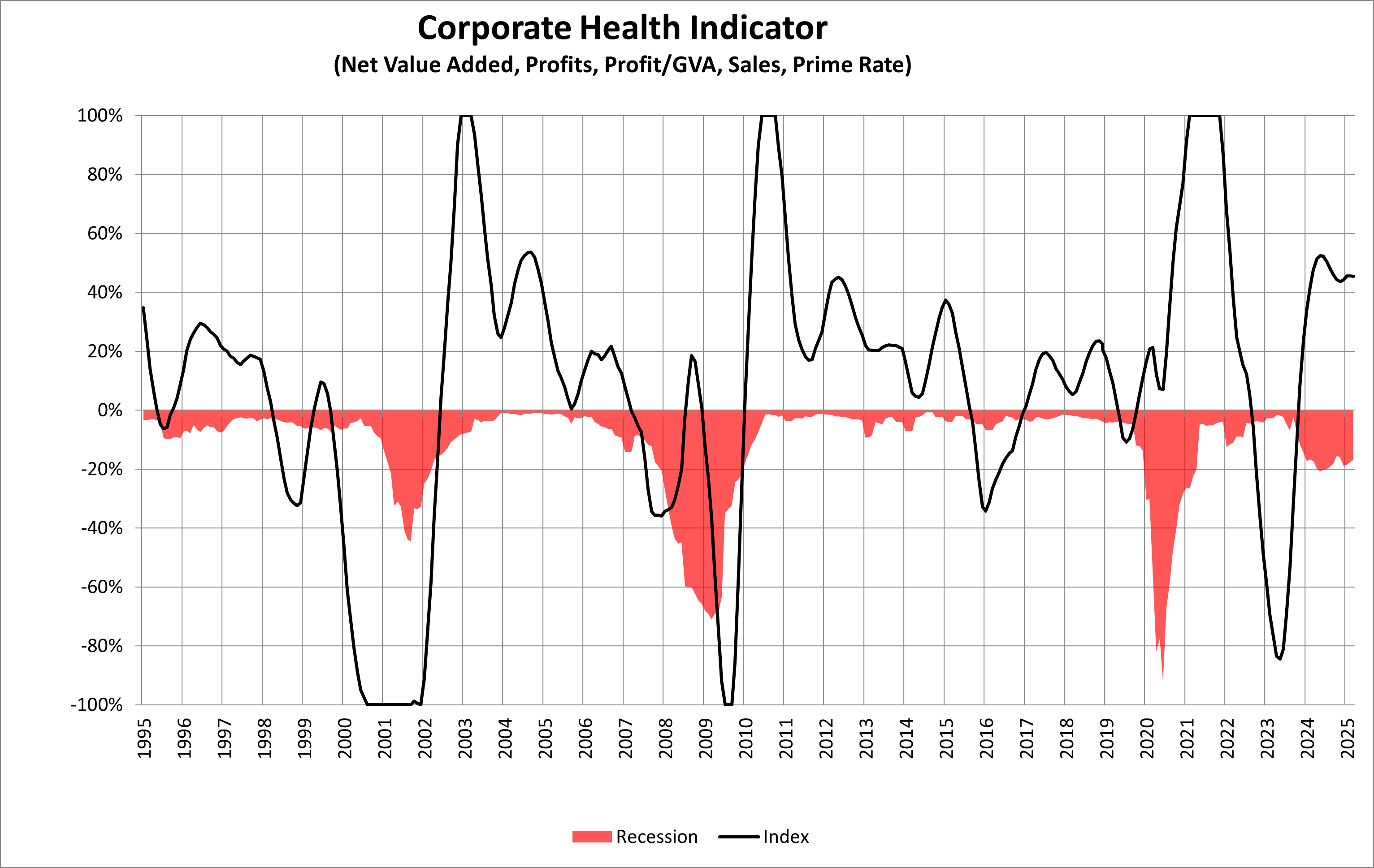

Determine #6 is my Company Well being Indicator, which is a composite of Internet Worth Added (a measure of contribution to the economic system after depreciation), Earnings, Gross sales, and the Prime Fee. The place acceptable, these are adjusted for inflation. Growing tariffs will produce winners and losers, however a slowing economic system will negatively influence most companies.

Determine #6: Company Well being

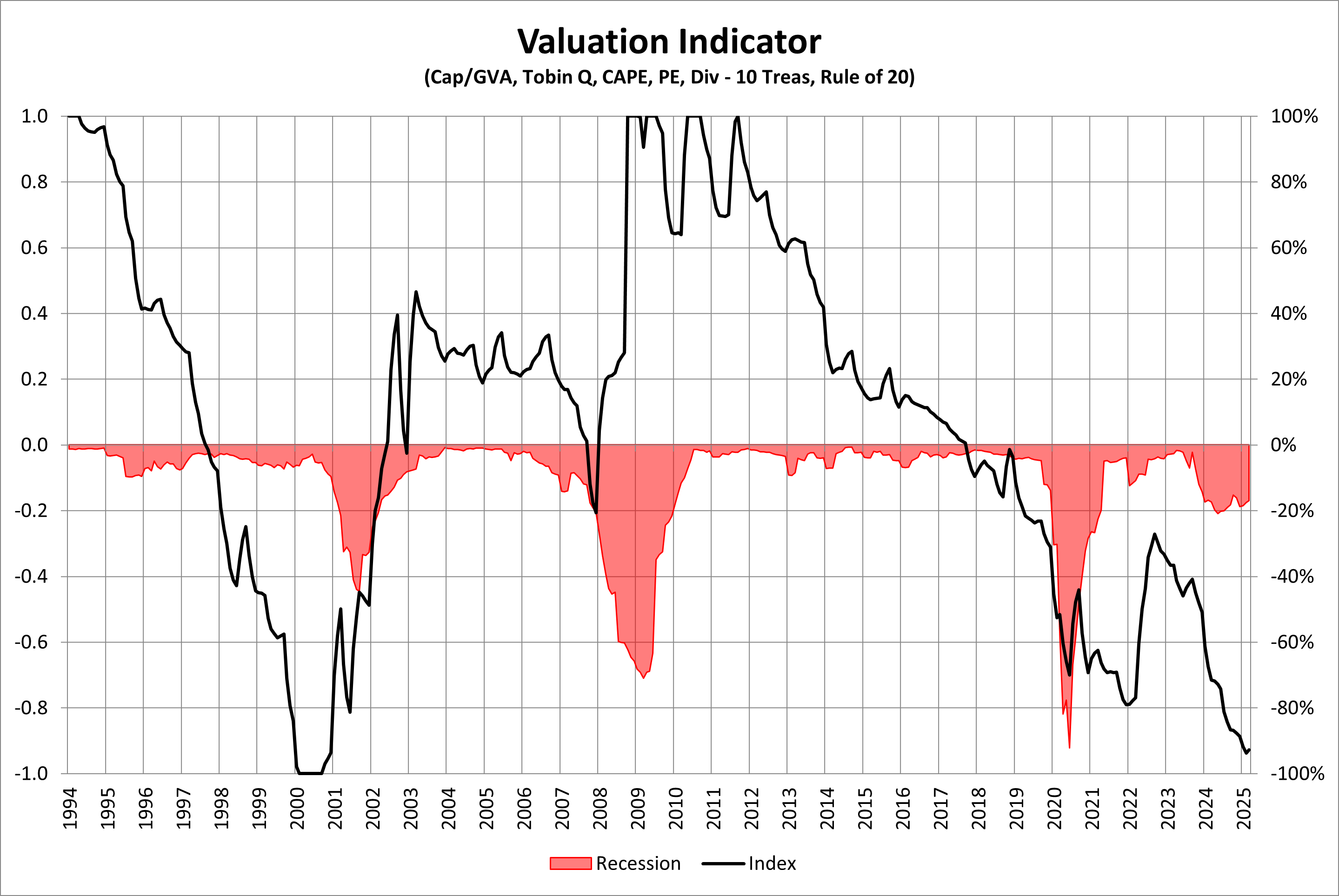

In Determine #7, I composite a half dozen measures of valuation to conclude that previous to the market correction, equities rivaled the Know-how Bubble for prime valuations. They’re nonetheless extremely valued regardless of the present market correction.

Determine #7: Fairness Valuation

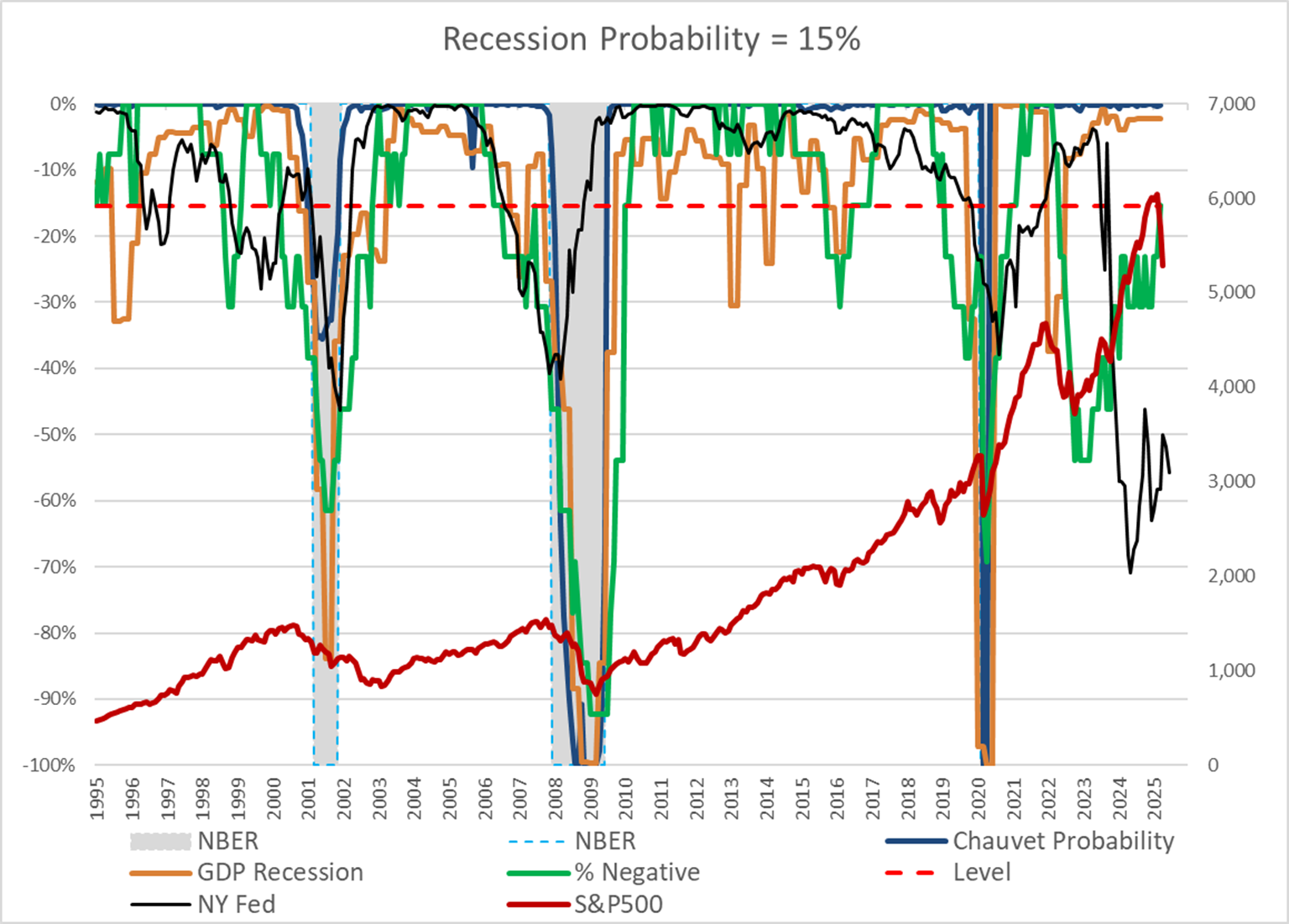

Determine #8 exhibits my Recession Indicator. I constructed it to provide advance warning of recessions. The likelihood of a recession (inexperienced line) has been falling steadily since 2022. The New York Federal Reserve recession likelihood based mostly on the yield curve (black line) stays above 50%. Knowledge impacted by tariffs and uncertainty will trickle in over the course of the 12 months, and I count on the recession likelihood to rise considerably.

Determine #8: Recession Indicator

Closing

The Funding Mannequin is an efficient guideline for the way I need to make investments; nevertheless, there have been a whole lot of improvements in funds, the web, and instruments. I exploit Monetary Advisors at Constancy and Vanguard to handle over half of my funding, which is generally within the average to greater danger accounts. I handle principally the extra conservative accounts for earnings. My general portfolio has related allocations to the forms of funds within the Funding Mannequin, however not the identical funds.

I see similarities to the stagflation of the Seventies as a result of tariffs improve inflation and the uncertainties related to provide chain disruptions. I imagine that much less authorities spending and fewer rules will return us nearer to post-World Battle II inventory market conduct, with extra frequent and hopefully much less extreme recessions. The 1995-2013 funding atmosphere might be extra consultant of the following decade than the 2014-2025 interval.

Excessive valuations are nonetheless a headwind for home fairness returns. Worldwide buyers have pulled cash from US markets, conserving yields excessive on US 10-year Treasuries. The rising nationwide debt will are likely to hold rates of interest greater for longer. Credit score spreads on high-yield bonds are rising. Uncertainty is in-built till July 8th when the ninety-day pause on tariffs ends, or is prolonged, or commerce offers are reached, or recent calls for are added, or…

Following the Mannequin Portfolio, I intend to extend allocations to short-term investment-grade and inflation-protected bond funds over the course of the 12 months. As for the uncertainty within the markets, my Funding Buckets for the Quick- and Intermediate-term are strong with little volatility. I made main changes previous to inauguration day and have made just a few modifications resulting from tariffs or volatility. I’ll use volatility-adjusted momentum to regulate allocations for the remainder of the 12 months with a give attention to guaranteeing the soundness of withdrawals. I stay danger off.