As nonprofits search new and sustainable methods to develop donor help, employer-backed giving packages current a robust alternative. Nonetheless, understanding the distinction between office giving vs. payroll giving is vital to benefiting from these channels.

Whereas the phrases are sometimes used interchangeably, they check with distinct fashions of worker giving, every with its personal advantages and logistics. On this publish, we’ll break down what units office giving other than payroll giving and the way your group can successfully have interaction with every to develop your donor base and deepen company partnerships.

Particularly, we’ll cowl:

By understanding the nuances between these two giving fashions, your group can higher place itself to attach with engaged donors and align with corporations that worth social impression. Whether or not you’re simply beginning to discover employer-backed giving or seeking to improve your current efforts, this information will equip you with the insights and methods wanted to succeed.

What’s payroll giving?

Payroll giving is a type of charitable donation wherein workers contribute to nonprofits immediately from their paychecks, usually on a recurring, pre-tax foundation. This methodology permits donors to contribute common donations with minimal effort, making it some of the handy methods to help a trigger over time.

In a payroll giving program, workers select a nonprofit they’d prefer to help and specify a donation quantity to be routinely deducted from their wage every pay interval. These deductions are then processed by the employer or a third-party platform after which disbursed to the nonprofit.

For nonprofits, payroll giving can set up a gradual and predictable income stream whereas additionally deepening long-term donor relationships. Though particular person contributions could also be modest, their consistency and potential for development—particularly when supported by employer matching packages—can add up considerably over time.

What’s office giving?

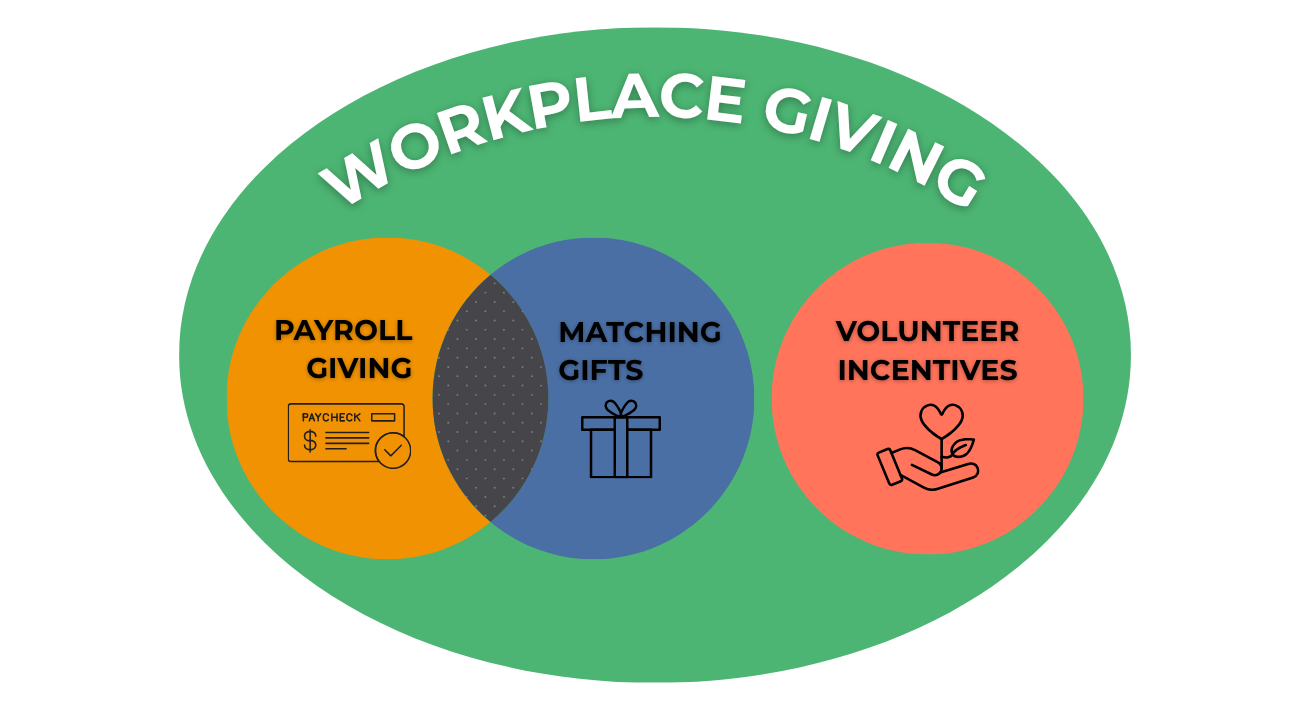

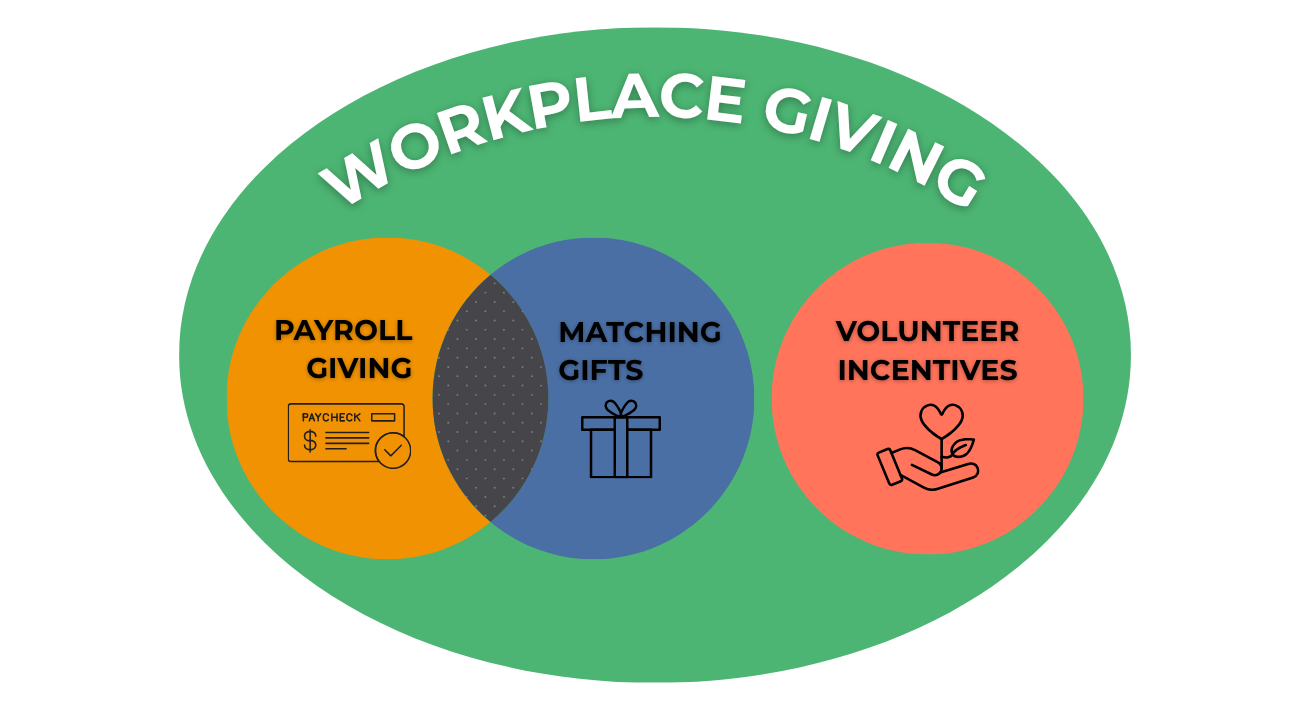

Office giving, however, is a broader time period that refers to any program or initiative that allows workers to help charitable causes by their employer. Not like payroll giving, which focuses particularly on paycheck deductions, office giving encompasses a variety of giving alternatives—each monetary and non-financial—which might be facilitated by the office.

These packages can embody:

- Payroll giving/deductions

- Employer donation matching

- Volunteer grants or paid Volunteer Time Off

- Firm-sponsored fundraising campaigns

- Inside charity drives or giving days

The purpose of office giving is to create a tradition of generosity inside an organization and make it simpler for workers to contribute to causes they care about. For nonprofits, partaking in office giving means extra than simply receiving donations—it’s about being half of a bigger ecosystem of social duty the place corporations and workers collaborate to drive impression.

By taking part in office giving packages, nonprofits can faucet into new donor networks, profit from company visibility, and entry extra help, akin to occasion sponsorships or in-kind donations. These packages not solely assist elevate funds but additionally strengthen neighborhood ties and enhance consciousness of your mission.

How do office and payroll giving relate?

Office giving and payroll giving are intently linked—a lot in order that they’re usually talked about in the identical breath. That’s as a result of payroll giving is definitely one part of the broader office giving panorama. In different phrases, all payroll giving is office giving, however not all office giving is payroll giving.

Whereas payroll giving refers particularly to donations made immediately from an worker’s paycheck, office giving encompasses payroll giving and different types of help, together with employer donation matching, fundraising campaigns, and volunteer incentives.

For nonprofits, understanding this relationship is important. By recognizing payroll giving as a gateway to broader office engagement, organizations can put it to use as a basis for extra significant partnerships. For instance, if a donor begins with payroll deductions, your nonprofit could later be eligible for employer matching funds or featured in a company-wide giving marketing campaign. These connections assist construct long-term donor loyalty whereas increasing your attain inside supportive corporations.

How do office and payroll giving differ?

Whereas office giving and payroll giving are intently associated, the 2 program sorts differ in scope, construction, and suppleness. Consequently, every provides a novel set of benefits for nonprofits and donors alike.

Right here’s what you must know concerning the packages’ variations:

1. Scope:

Payroll giving is a particular sort of office giving that includes common, automated donations taken immediately from an worker’s paycheck. In distinction, office giving encompasses a broader umbrella that features payroll giving, in addition to packages akin to donation matching, charity drives, fundraising occasions, volunteer grants, and extra.

2. Donation Methodology:

Payroll giving is facilitated by payroll methods, with donations deducted pre- or post-tax (relying on the placement or employer setup). Office giving, however, can contain numerous types of giving—monetary or time-based—that will not be tied to payroll, akin to taking part in a company-wide giving day or logging volunteer hours to earn grant {dollars}.

3. Donor Engagement:

Payroll giving is usually a passive, set-it-and-forget-it methodology. As soon as an worker indicators up, donations happen routinely frequently. Office giving, however, provides extra energetic engagement alternatives, akin to workforce fundraising challenges or company-hosted volunteer occasions, creating extra touchpoints for deeper donor interplay.

4. Employer Involvement:

Employers usually play a bigger position in broader office giving packages, providing highly effective incentives akin to donation matching or volunteer time without work. Payroll giving could or could not embody employer matching and infrequently capabilities extra independently from wider office tradition initiatives.

Understanding these variations will help nonprofits tailor their outreach and messaging. Whereas payroll giving offers regular, recurring income, broader office giving packages open the door to deeper engagement and extra company help. Each are useful, and when used collectively, they will considerably amplify mission impression.

Methods for benefiting from every

To completely faucet into the potential of payroll and office giving, nonprofits want extra than simply enrollment—they want a strategic method. Listed here are some key methods to maximise visibility, engagement, and long-term impression by these useful channels:

Get Listed on Office Giving Platforms

Many employers use third-party platforms to handle their giving packages. Guarantee your nonprofit is registered on these platforms in order that workers can simply discover and help you thru payroll giving and different office initiatives.

Excited by a step-by-step breakdown of how your group can register with main platforms (together with direct hyperlinks to functions)? Take a look at this information to get began.

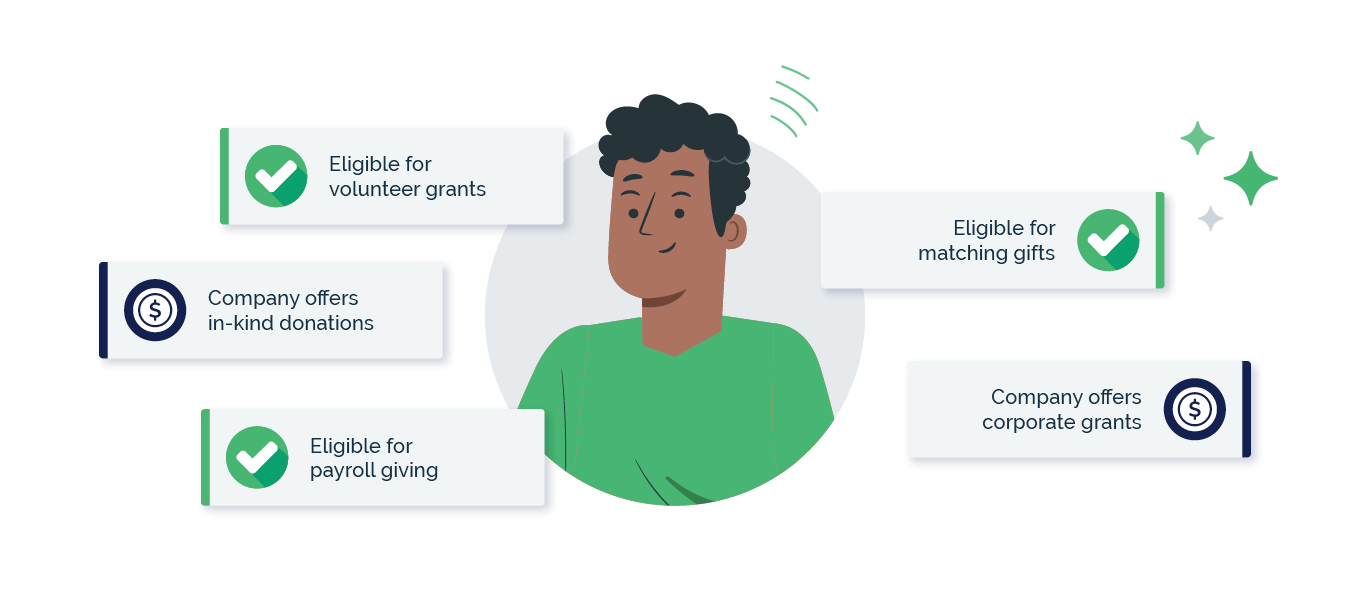

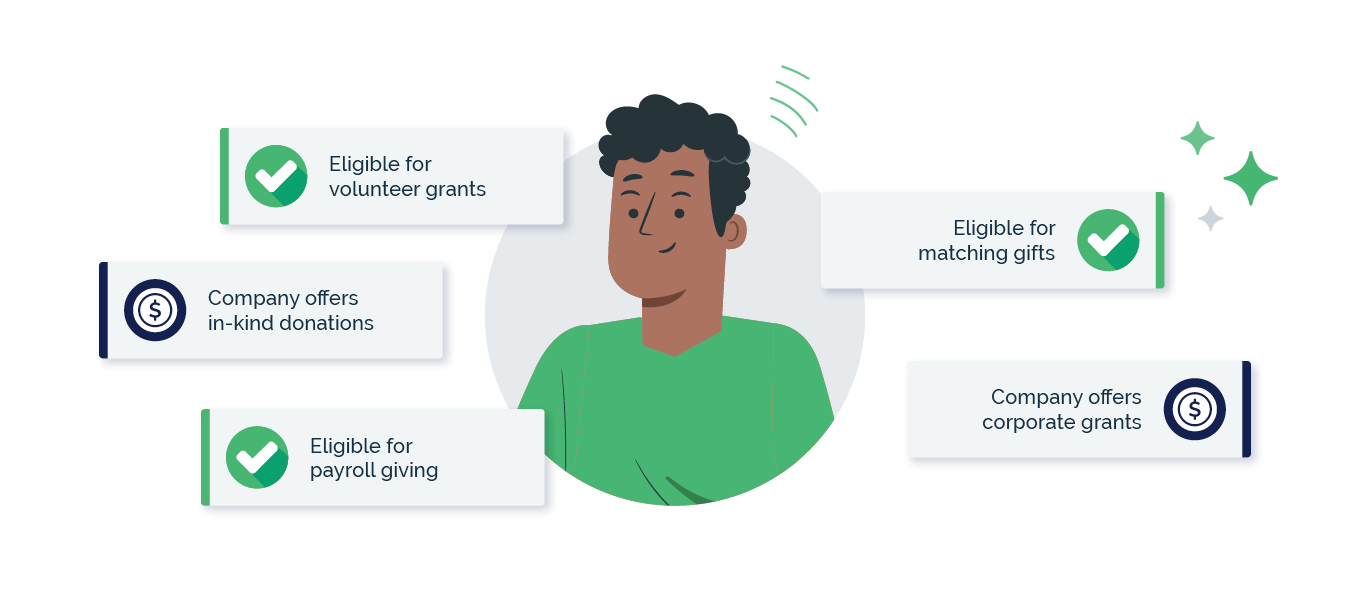

Acquire Employment Info From Supporters

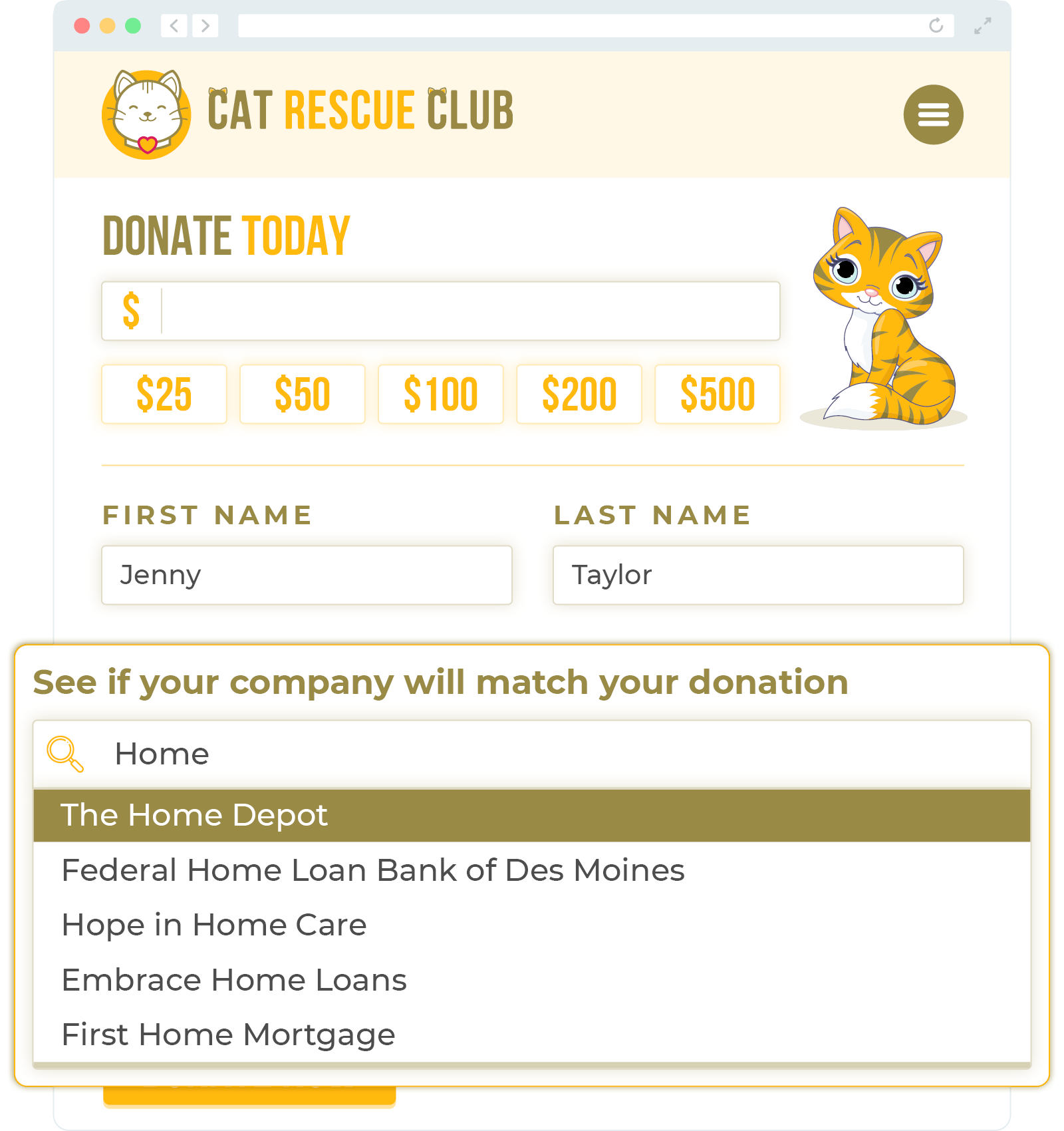

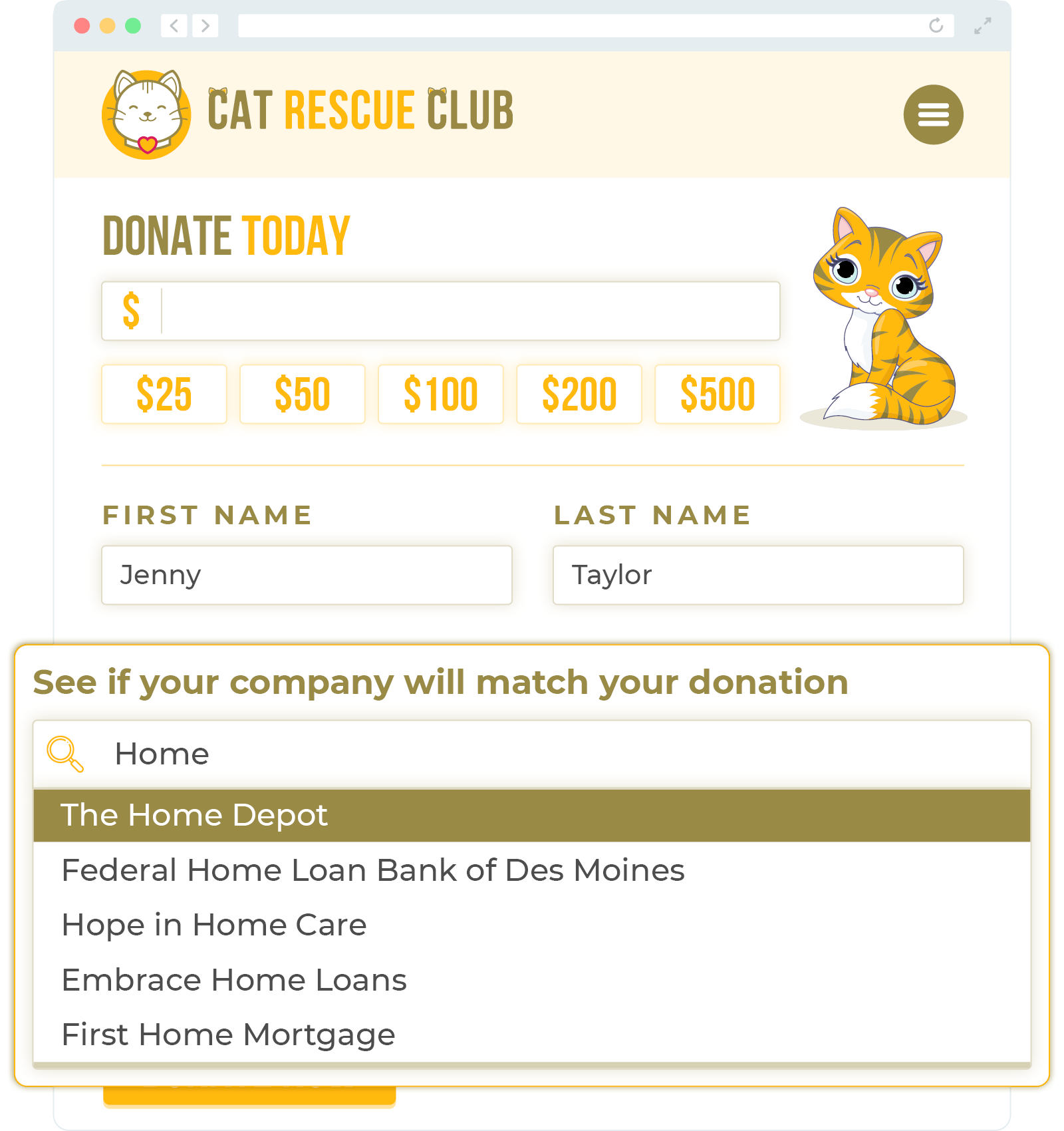

One of many easiest but strongest steps your nonprofit can take is to ask supporters the place they work. Realizing a donor’s employer opens the door to potential payroll giving, matching present alternatives, and broader office giving packages alike.

You possibly can acquire this data by donation kinds, e-newsletter sign-ups, volunteer registrations, or follow-up outreach. Even a single subject that asks, “Who’s your employer?” can present useful perception for future outreach and segmentation.

After getting this knowledge, you’ll be able to:

- Establish corporations with energetic office giving or matching present packages.

- Tailor communication to focus on related giving alternatives tied to that employer.

- Encourage donors to discover whether or not their office provides payroll giving or match choices.

- Attain out to CSR or HR contacts at these corporations to discover potential partnerships.

The extra you already know about the place your donors work, the higher positioned you’re to unlock company help, develop donor engagement, and maximize giving potential by employer-backed packages.

Promote Employer Matching

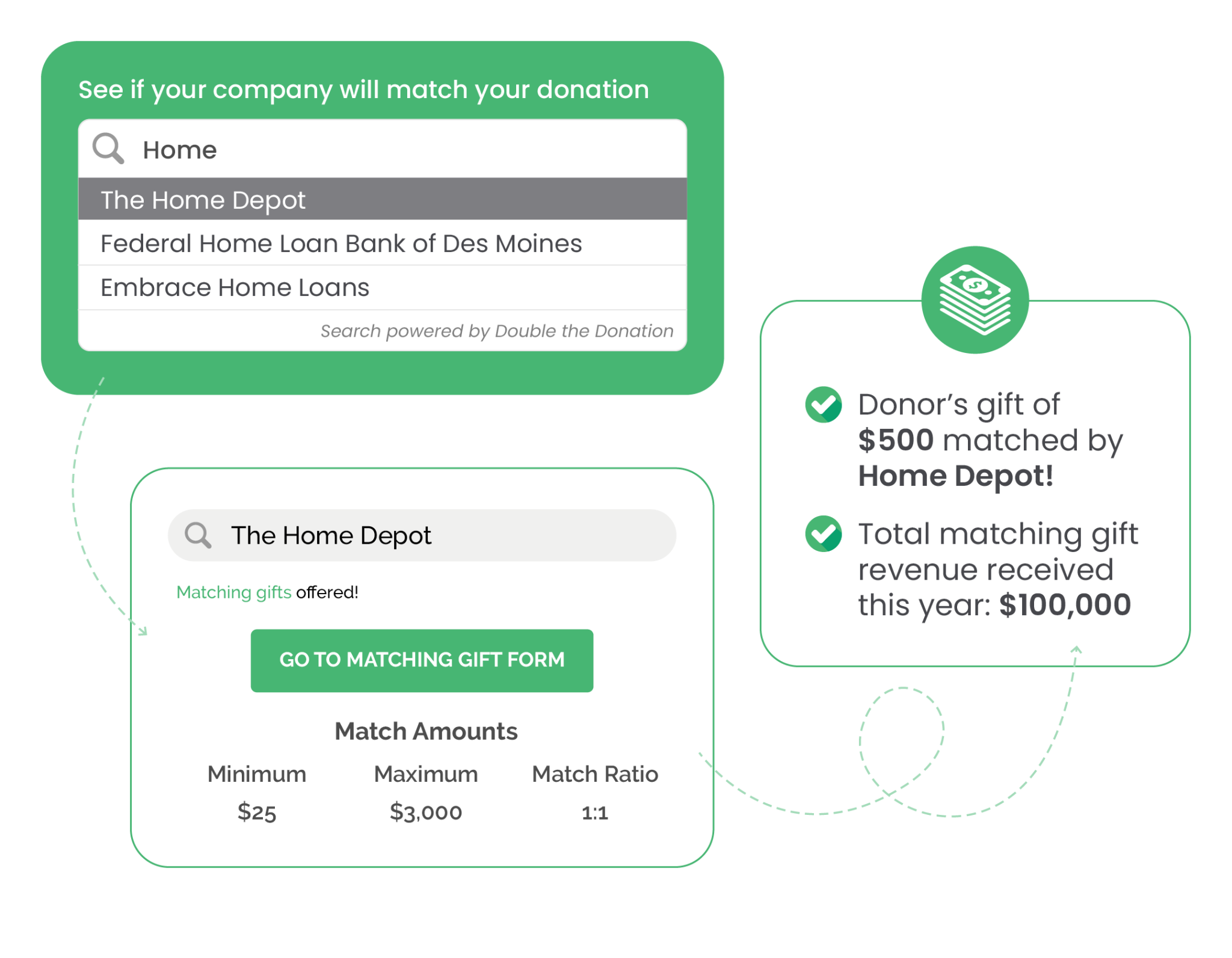

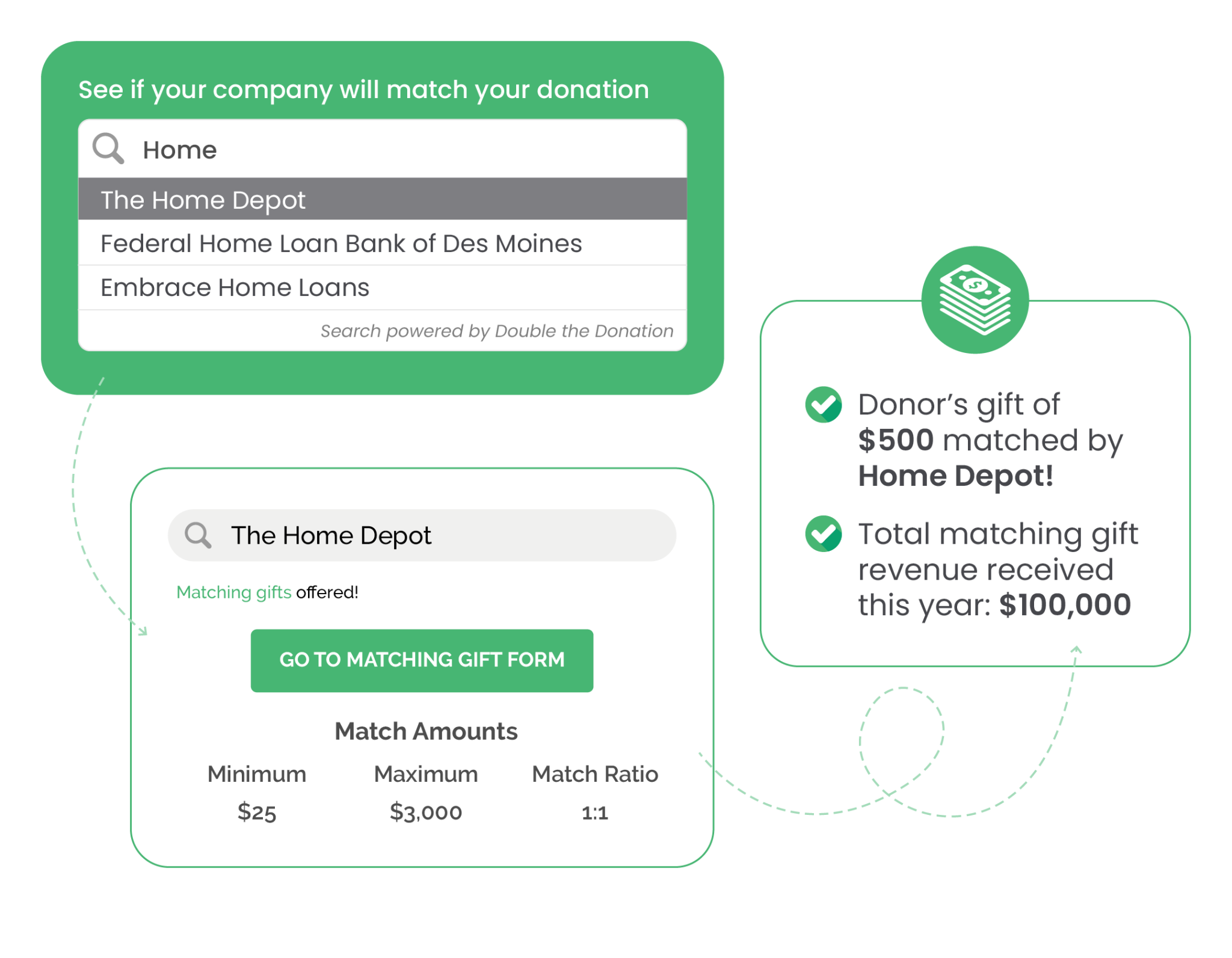

Many workers are unaware that their firm provides donation matching, usually along with different packages, akin to payroll giving. Your workforce will help bridge that hole by creating or leveraging the fitting assets—like a matching present lookup instrument, FAQs, or social media content material—to encourage donors to test if their present may be doubled.

For the most effective outcomes, spotlight this in donation kinds, affirmation emails, thank-you pages, and different related supplies.

Share Clear Impression Tales

Whether or not donors give by payroll deductions or different company-sponsored campaigns, they wish to know their contributions matter. Use newsletters, impression reviews, and social media content material to reveal how office and payroll items make a distinction.

You possibly can even tailor these tales for a company viewers when doable.

Construct Relationships with CSR Groups

Kick off your efforts by establishing partnerships with corporations’ company social duty (CSR) or HR groups. Provide to create co-branded promotional supplies, present audio system, host volunteer alternatives, or collaborate on giving campaigns.

These connections can result in deeper engagement and extra funding past payroll giving alone.

Empower Donors to Advocate Internally

Your current supporters may be your strongest advocates for brand new and improved office giving packages. When related, encourage them to appoint your group for inclusion of their employer’s giving campaigns or volunteer days or present a heat introduction to their employer.

You possibly can even present toolkits or one-pagers that they will share with HR or CSR leaders to assist make a powerful case for employee-directed philanthropy.

Observe and Acknowledge Payroll Donations

Payroll donations may be tougher to trace than direct items, however they’re no much less significant, and managing them successfully isn’t any much less essential. Subsequently, collaborate with platform suppliers to entry donor data (when accessible) and specific gratitude to contributors frequently. In spite of everything, personalised acknowledgments assist retain and develop long-term help.

By combining considerate outreach, robust partnerships, and clear communication, your nonprofit could make payroll and office giving a robust, dependable a part of your general fundraising technique.

Wrapping up & extra office giving assets

With regards to office giving vs. payroll giving, understanding the variations between the 2 methods is important for nonprofits in search of to domesticate sustainable donor help by employer-backed packages. Whereas payroll giving provides a dependable stream of pre-tax donations immediately from workers, office giving encompasses a broader vary of alternatives, together with company matching, fundraising occasions, and volunteer engagement.

By understanding how every of those fashions operates and the way they attraction to each workers and firms, your group can tailor outreach methods extra successfully, foster stronger partnerships with companies, and finally unlock new funding channels to help its mission.

Able to study extra about office giving and past? Take a look at these extra advisable assets:

- Prime Office Giving Corporations: Main Employers to Know. Uncover which corporations are setting the usual in worker giving packages. This useful resource highlights main employers that actively help office giving, providing inspiration and partnership alternatives in your nonprofit.

- Free Obtain: Incomes Extra Payroll Donation Income. Study actionable methods to extend payroll giving contributions. This information walks nonprofits by finest practices for partaking donors, optimizing visibility in office packages, and boosting recurring income.

- Free Obtain: Information to Creating a Office Giving Plan. Construct a transparent, efficient roadmap in your nonprofit’s office giving efforts. This complete information covers purpose setting, outreach ways, and partnership growth that can assist you launch or strengthen your giving plan.