At a latest investor day presentation, KKR CEO Scott Nuttall talked in regards to the big potential for personal investments in retirement plans like 401ks and targetdate funds:

Apollo’s Marc Rowan made the same pronouncement on the corporate’s newest earnings name:

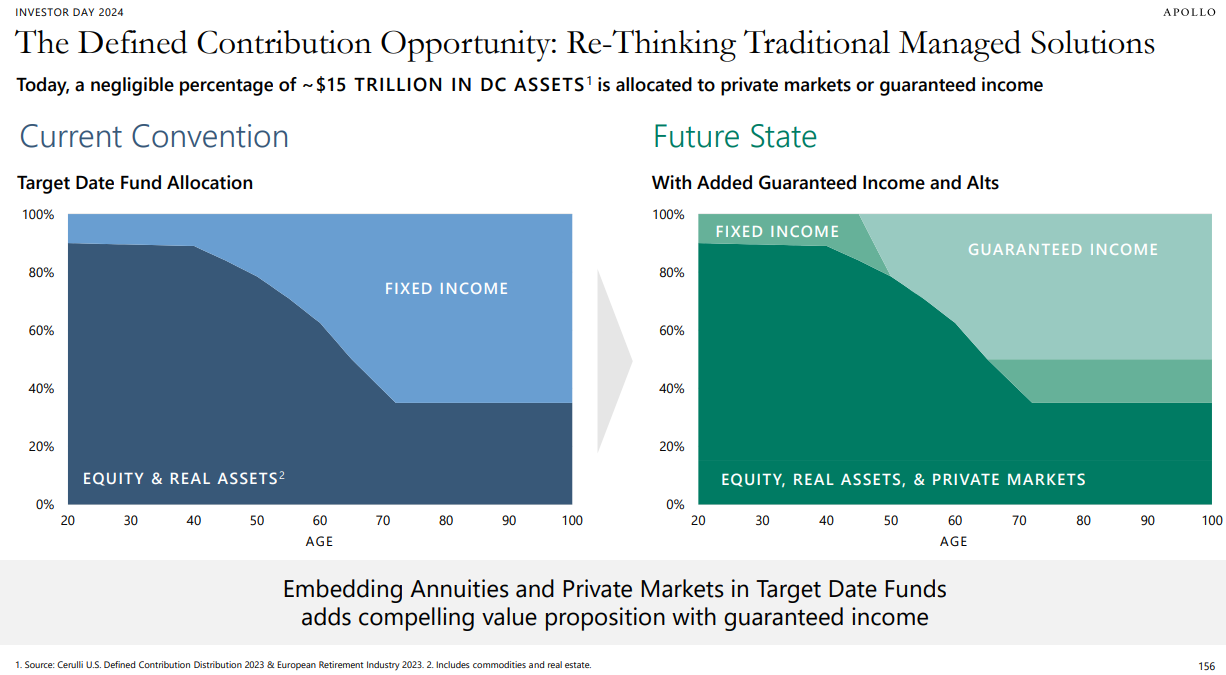

There’s something like $15 trillion within the outlined contribution retirement plan area. Apollo envisions a situation the place targetdate funds embrace methods like non-public credit score and personal fairness:

I do know this makes some folks nervous.

On the one hand, retirement plans would appear to make a whole lot of sense for these fund buildings. Your time horizon in a 401k plan is mostly lengthy, measured in many years typically. Plus, you don’t want short-term liquidity in a retirement plan the place your cash is actually locked up already. So the illiquidity piece shouldn’t matter as a lot.

However, I do fear in regards to the complexity of those merchandise.

Do 401k traders have the monetary acumen to grasp all these merchandise? Do they know what the charges are? Do they grasp the illiquidity concerned? Do they get how usually the costs are marked to market?

I’ve some considerations.

No matter these considerations, it seems like that is coming.

Bloomberg had an extended profile final month on the push from non-public funding managers into the wealth administration channel:

Lower than per week earlier than President Donald Trump’s second inauguration, greater than 30 cash managers gathered on Zoom to strategize about methods to pull America’s retirement savers into investments far past shares and bonds.

Through the assembly attended by Blackstone Inc., UBS Group AG, Neuberger Berman and others, contributors assembled a manifesto articulating non-public fairness’s rightful place in 401(okay) plans, together with within the default portfolios for employees who don’t choose their very own investments.

I perceive why the business is doing this. Institutional traders are kind of tapped out.

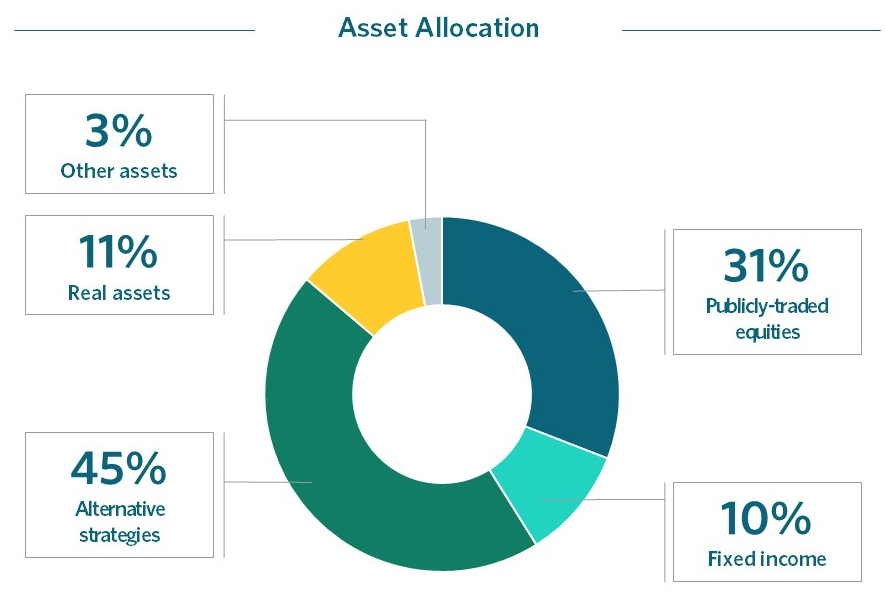

The NACUBO examine of endowment funds appears on the common asset allocation of those large traders:

Endowments, foundations and pension plans have been including to different property for years now. Positive, there’ll all the time be more cash on this area however the huge strikes are basically over.

Personal asset managers want the wealth administration channel for progress.

RIAs handle greater than $100 trillion in property. Personal funding managers are salivating on the progress potential in that area.

In his annual letter to traders, Blackrock’s Larry Fink envisions a future balanced portfolio that appears much less like 60/40 and extra like 50/30/20:

The long run normal portfolio might look extra like 50/30/20–shares, bonds, and personal property like actual property, infrastructure, and personal credit score.

There are many challenges to get from right here to there. There are new fund buildings that attempt to make entry extra seamless (interval funds, evergreen funds, and so forth.) however most traders don’t have expertise with non-public investments.

It’s a complete new world.

I’m not even positive what number of traders are clamoring for entry to non-public investments. A technique or one other, it’s coming. Monetary advisors and retirement plans will provide traders entry to extra non-public market methods within the years forward.

The tutorial part goes to be big right here. We’ll see if the business is as much as the duty. I’m skeptical however comfortable to be confirmed mistaken.

One factor I’m positive of — should you don’t perceive one thing you shouldn’t put money into it.

That goes for private and non-private market methods alike.

I had Michael Sidgmore on Ask the Compound this week to debate how non-public property will work in wealth administration:

We additionally answered questions on how non-public investments work, who ought to and shouldn’t be invested in these methods, illiquidity, non-public credit score and extra.

Additional Studying:

How Will Personal Fairness Work in 401ks?

This content material, which incorporates security-related opinions and/or data, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There will be no ensures or assurances that the views expressed right here shall be relevant for any specific information or circumstances, and shouldn’t be relied upon in any method. You need to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital property, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding suggestion or provide to supply funding advisory providers. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding resolution. Previous efficiency is just not indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from varied entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or suggest endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the danger of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.