by Hope

We have now now made it previous the second contingency interval. The inspection has been reviewed and accepted. The appraisal is completed. The time limit is simply a few weeks away. I’m positive you all know that I’ve been taking part in with the numbers for months now.

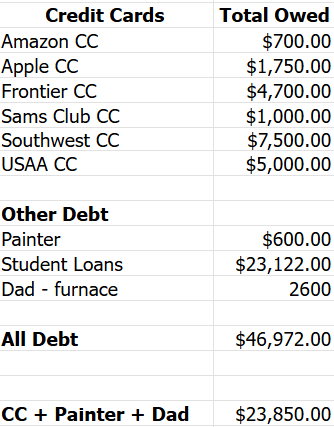

However I nonetheless don’t know the way a lot I’ll truly take away from the home sale. Nonetheless, I’ve obtained a stable plan for the place the cash will go. Clearly, the home will probably be paid off. The overall for that pay out will probably be round $127,000.

First, the painter will probably be paid the remaining $600 I owe him.

Second, I’ll repay my dad for the mortgage from January, 2024 for the brand new furnace.

Third, I’ll repay ALL of my bank cards. All besides three of them will probably be closed. Eliminating the temptation. I will probably be leaving my Apple CC, Sam’s Membership CC, and USAA CC open. They’re already locked (and maxed out so the lock doesn’t actually do something.)

Between, these three objects, $23.850 will probably be spent.

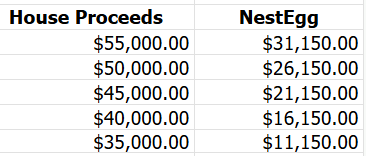

Based mostly on my guestimates, that may then depart me with a nest egg of…

I don’t plan to hurry to repay my pupil loans. At this level, they are going to be my solely debt, and I’m snug with simply beginning to make common month-to-month funds.

I’ve a number of different issues I’d love to do, however I believe the very best factor can be to:

- Put a minimum of $7500 in an EF. That may be primarily 3 months of dwelling bills ought to one thing occur to me/my work.

- Pay my automotive insurance coverage by this 6 month interval. My auto insurance coverage is my highest month-to-month invoice. And whereas there isn’t any curiosity to make month-to-month funds, I’d prefer it to be paid. Then I can “pay myself” month-to-month so when it renews in September, I pays it unexpectedly. That is only a peace of thoughts factor vs a monetary factor.

- The rest will probably be used to jumpstart my Transfer fund in a excessive yield financial savings account.

I’m actually open to suggestions.

Hope is a resourceful and solutions-driven enterprise supervisor who has spent almost twenty years serving to shoppers streamline their operations and develop their companies by challenge administration, digital advertising and marketing, and tech experience. Not too long ago transitioning from her position as a single mother of 5 foster/adoptive kids to an empty nester, Hope is navigating the emotional and sensible challenges of redefining her life whereas sustaining her dedication to regain monetary management and remove debt.

Residing in a comfortable small city in northeast Georgia together with her three canines, Hope cherishes the serenity of the mountains over the bustle of the seaside. Although her youngsters are actually discovering their footing on this planet—pursuing schooling, careers, and independence—she stays deeply dedicated to supporting them on this subsequent chapter, at the same time as she faces the bittersweet tug of letting go.

Since becoming a member of the Running a blog Away Debt neighborhood in 2015, Hope has candidly shared her journey of economic ups and downs. Now, with a renewed focus and a transparent path forward, she’s able to sort out her funds with the identical ardour and perseverance that she’s dropped at her life and profession. By way of her writing, she continues to encourage others to confront their very own monetary challenges and try for a brighter future.