Pradhan Mantri Shram Yogi Maan-Dhan (PMSYM) is the brand new Pension scheme which was introduced within the Union Govt’s Interim Price range 2019-20. PMSYM is aimed toward Un-organized staff.

The Govt has launched this newest Assured Pension Scheme with efficient from fifteenth Feb, 2019. It has been estimated that round 10 crore un-organized staff will be benefited from this pension scheme.

The principle characteristic of PMSYM is that every subscriber of the scheme shall obtain minimal assured pension of Rs 3000/- per thirty days after attaining the age of 60 years.

Atal Pension Yojana which was launched in 2015 can also be an analogous Pension scheme. However, any Indian citizen can put money into APY. Nonetheless, sure eligibility circumstances, as beneath, have been laid out to subscribe to Pradhan Mantri Shram Yogi Maan-Dhan Pension Scheme.

Eligibility circumstances for Pradhan Mantri Shram Yogi Maan-Dhan (PMSYM)

- The unorganized staff who’re principally engaged as residence primarily based staff, road distributors, mid-day meal staff, rag pickers, home staff, rickshaw pullers, agricultural staff, development staff, beedi staff, hand-loom staff and so on., solely can subscribe to this scheme.

- The Subscriber’s earnings shouldn’t be greater than Rs 15,000 p.m.

- The entry age for PMSYM is between 18 to 40 years.

- The subscriber shouldn’t be lined underneath New Pension Scheme (NPS), Workers’ State Insurance coverage Company (ESIC) scheme or Workers’ Provident Fund Organisation (EPFO).

- He/she shouldn’t be an earnings tax payer.

- A person desirous of availing the advantages underneath the Scheme shall be required to furnish proof of possession of Aadhaar quantity or bear Aadhaar authentication. He/she also needs to have a Financial savings Financial institution Account.

Salient Options of Pradhan Mantri Shram Yogi Maan-Dhan (PMSYM) Pension Scheme

- Minimal Assured Pension: Every subscriber underneath the PM-SYM, shall obtain minimal assured pension of Rs 3000/- per thirty days after attaining the age of 60 years.

- Contribution Quantity : The quantity of contribution (deposit quantity) is age particular.

- PM-SYM is a voluntary and contributory pension scheme on a 50:50 foundation the place prescribed age-specific contribution shall be made by the beneficiary and the matching contribution by the Central Authorities as per the chart.

- For instance, if an individual enters the scheme at an age of 29 years, he’s required to contribute Rs 100/ – per thirty days until the age of 60 years. An equal quantity of Rs 100/- will probably be contributed by the Central Authorities.

- Household Pension : Throughout the receipt of pension, if the subscriber dies, the partner of the beneficiary shall be entitled to obtain 50% of the pension acquired by the beneficiary as household pension. Household pension is relevant solely to partner.

- If a beneficiary has given common contribution and died resulting from any trigger (earlier than age of 60 years), his/her partner will probably be entitled to affix and proceed the scheme subsequently by fee of standard contribution or exit the scheme as per provisions of exit and withdrawal.

PMSYM – Premium Quantity Chart

The best way to Enroll for Pradhan Mantri Shram Yogi Maan-Dhan (PMSYM) Scheme?

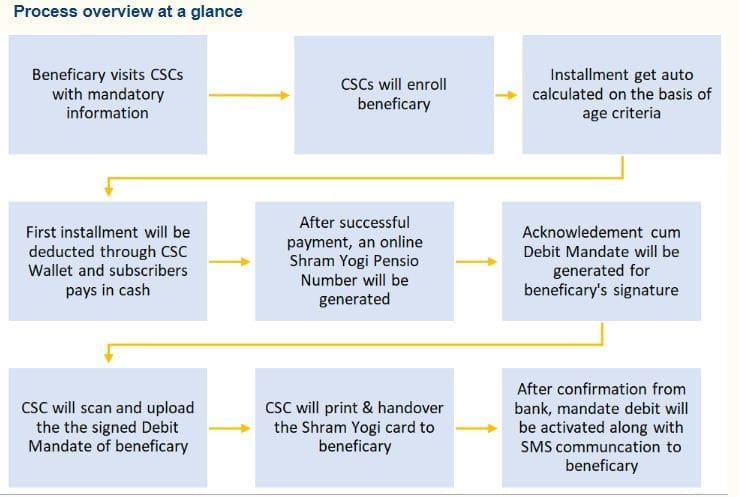

The subscriber will probably be required to have a cell phone, financial savings checking account and Aadhaar quantity. The eligible subscriber could go to the closest CSCs and get enrolled for PM-SYM utilizing Aadhaar quantity and financial savings checking account/ Jan-Dhan account quantity on self-certification foundation.

Enrollment companies : The enrolment will probably be carried out by all of the Group Service Facilities (CSCs). The unorganised staff could go to their nearest CSCs together with their Aadhar Card and Financial savings Checking account passbook/Jandhan account and get registered themselves for the Scheme. Contribution quantity for the primary month shall be paid in money for which they are going to be supplied with a receipt.

Facilitation Centres: All of the department workplaces of LIC, the workplaces of ESIC/EPFO and all Labour workplaces of Central and State Governments facilitate the unorganised staff concerning the Scheme, its advantages and the process to be adopted, at their respective facilities.

PMSYM – Exit and Withdrawal Guidelines

Contemplating the hardships and erratic nature of employability of those staff, the exit provisions of scheme have been stored versatile. Exit provisions are as underneath:

- In case subscriber exits the scheme inside a interval of lower than 10 years, the beneficiary’s share of contribution solely will probably be returned to him with financial savings financial institution rate of interest.

- If subscriber exits after a interval of 10 years or extra however earlier than superannuation age i.e. 60 years of age, the beneficiary’s share of contribution together with amassed curiosity as truly earned by fund or on the financial savings financial institution rate of interest whichever is greater.

- If a beneficiary has given common contributions and died resulting from any trigger, his/ her partner will probably be entitled to proceed the scheme subsequently by fee of standard contribution or exit by receiving the beneficiary’s contribution together with amassed curiosity as truly earned by fund or on the financial savings financial institution rate of interest whichever is greater.

- If a beneficiary has given common contributions and grow to be completely disabled resulting from any trigger earlier than the superannuation age, i.e. 60 years, and unable to proceed to contribute underneath the scheme, his/ her partner will probably be entitled to proceed the scheme subsequently by fee of standard contribution or exit the scheme by receiving the beneficiary’s contribution with curiosity as truly earned by fund or on the financial savings financial institution rate of interest whichever is greater.

- After the demise of subscriber in addition to his/her partner, your complete corpus will probably be credited again to the fund.

- Every other exit provision, as could also be determined by the Authorities on recommendation of NSSB.

My Opinion

The pension quantity underneath PMSYM scheme is a assured one. This will likely sound enticing, however from returns viewpoint and contemplating the speed of inflation in India, the month-to-month pension quantity of Rs 3,000 after a few years from now, will not be actually enough throughout the Pensioner’s retirement age.

Nonetheless, in India, as of now, we shouldn’t have any Social Safety System. So, this scheme can profit, particularly the low earnings group and people who’re working within the unorganized sectors.

When you’ve got enough monetary assets, it’s not that troublesome to create a monetary plan. You possibly can plan nicely and lead a very good life.

However, it is extremely powerful for low earnings households like your home helpers, car-driver or unorganized staff, with restricted monetary assets, to plan nicely and lead a very good life.

Whether it is attainable, kindly do help/encourage them to subscribe to those sort of Govt Schemes. If required, you might also counsel beneath Insurance coverage schemes to them.

Proceed studying :

(Supply & References : PIB & LIC) (Publish first printed on : 19-February-2019)