In Aug 2024, we revealed a reader story a couple of younger earner’s journey to 1 crore and plans to construct additional wealth: Crossing the Million Mark: Our Journey to the First Crore. That is an replace.

About this collection: I’m grateful to readers for sharing intimate particulars about their monetary lives, which advantages us all. A number of the earlier editions are linked on the backside of this text. You can even entry the complete reader story archive.

Opinions expressed in reader tales don’t essentially signify the views of freefincal or its editors. We should respect a number of options to the cash administration puzzle and empathise with numerous views. Articles are sometimes not checked for grammar except essential to convey the fitting that means and protect the tone and feelings of the writers.

If you want to contribute to the DIY group on this method, ship your audits to freefincal AT Gmail dot com. They are often revealed anonymously in case you so need.

Please observe: We welcome such articles from younger earners who’ve simply began investing. See, for instance, this piece by a 29-year-old: How I monitor monetary targets with out worrying about returns. We have now additionally began a brand new “mutual fund success tales” collection. That is the primary version: How mutual funds helped me attain monetary independence. Now, over to the reader.

First, some background. I come from a Defence background the place, to be candid, we regularly confronted monetary constraints as a consequence of familial obligations that my father, because the eldest little one, needed to handle. My publicity to investing started throughout my faculty years. In distinction, my spouse hails from a well-established IT background with publicity to investing since childhood. We each accomplished our B.Tech. levels, with me graduating in 2018 and my spouse in 2019. My dad and mom stretched their sources, even taking a mortgage, to safe my admission to a Tier-1 Non-public School in Chennai, whereas my spouse opted for a daily faculty in Hyderabad.

Each of us began our careers with the identical firm on the age of twenty-two. We obtained married throughout the COVID-19 pandemic, managing to maintain bills underneath 10 lakhs. Starting within the IT sector with entry-level salaries, we understood the challenges of being on the backside of the pay scale. Regardless of this, we stayed with our first firm longer than anticipated earlier than realising our potential for development and deciding to maneuver on to positions with greater incomes potential.

- The previous 12 months was difficult, each personally and within the markets.

- Two main life occasions occurred: I left my job at PwC after a 12 months as a consequence of burnout, and we sadly skilled a miscarriage after three months.

- FY25 turned a 12 months of studying and adapting — the markets examined our persistence, and private occasions influenced our monetary selections.

- Our complete pre-tax family lively earnings for FY25 was ₹50 lakh. We additionally acquired about ₹30,000 in dividends from our holding firms.

- There was a one-time windfall of ₹25 lakh from a household actual property sale.

- The % development in comparison with final 12 months is skewed as a consequence of this windfall. Excluding it, the precise earnings development involves round 67%, i.e., ₹50.3 lakh.

| Earnings Supply | FY24 | FY25 | % Change |

|---|---|---|---|

| Wage | ₹30L | ₹50L | 66% |

| Dividends | ₹20k | ₹30k | 50% |

| Rental Earnings | ₹0 | ₹0 | 0% |

| Aspect Hustle | ₹0 | ₹0 | 0% |

| Windfall Earnings | ₹0 | ₹25L | NA |

| Whole | ₹30.2L | ₹75.3L | 150% |

Expense Abstract

- Our complete annual bills had been round ₹24.30 Lakhs.

- Journey continues to be our greatest discretionary expense. Over the previous 12 months, we took journeys to Singapore, Bali, Meghalaya (with household), Goa, and Andaman (with household). In FY26, we’ve already accomplished a week-long workation in Kerala, with upcoming journeys deliberate to Goa and Japan.

- As a part of household help, we contribute month-to-month to my dad and mom, despite the fact that they’re financially impartial and nonetheless working. Their investments have largely been in debt devices, making them comparatively unfamiliar with equities. To assist them steadily construct consolation with fairness publicity, we’ve opened a mutual fund account of their identify, which I fund not directly. This can enable them to diversify their portfolio as they strategy retirement in FY29.

| Expense Class | Quantity (₹) | % of Whole |

|---|---|---|

| Family | 6 Lakhs | 24.9% |

| Journey | 12 Lakhs | 50% |

| Healthcare | 30,000 | 0.2% |

| Schooling | Nil | Nil |

| Miscellaneous | 6 Lakhs | 24.9% |

| Whole | 24.30 Lakhs | 100% |

- Financial savings fee = (Earnings – Bills) / Earnings = (75.3L – 24.30L ) / 75.3L = 63%

*The calculation is once more skewed by the windfall acquired throughout the 12 months. After excluding it, the financial savings fee stands at 50%, which aligns with our annual goal.

Funding Efficiency

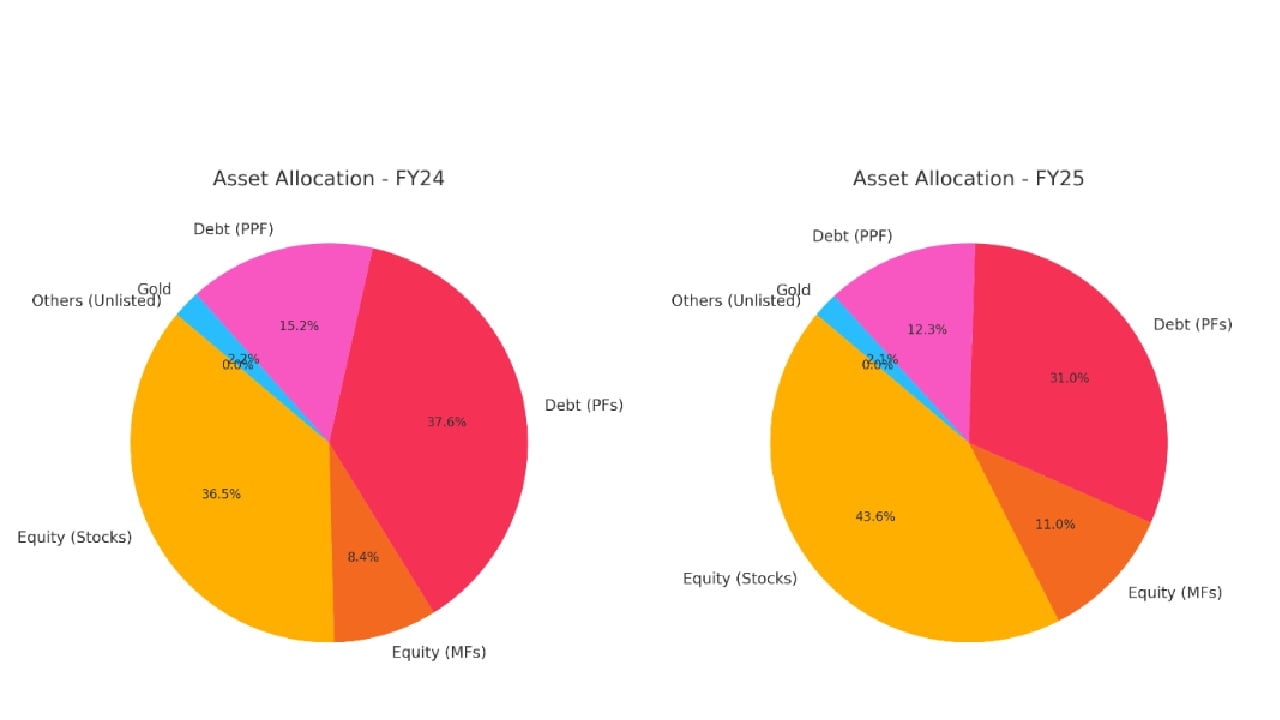

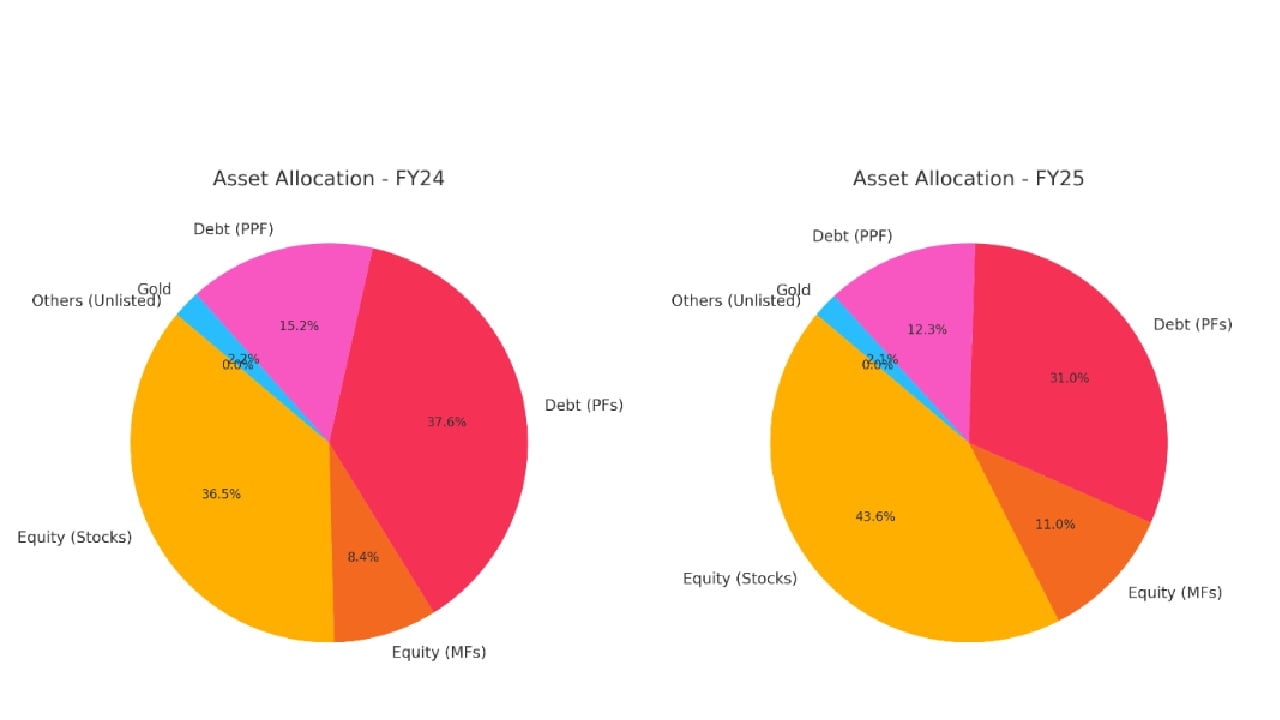

- We monitor our total portfolio throughout 4 relations — myself, my spouse, and my dad and mom — overlaying Fairness, Debt, Gold, and Different investments.

- We exclude actual property from our funding calculations as it’s primarily for self-use, has irregular valuations, and lacks liquidity. Actual property will solely be factored in if and when an precise sale happens and proceeds are realized.

- We monitor each absolute returns and share development, whereas additionally evaluating our portfolio efficiency towards benchmarks resembling Nifty, Sensex, and related mutual fund indices.

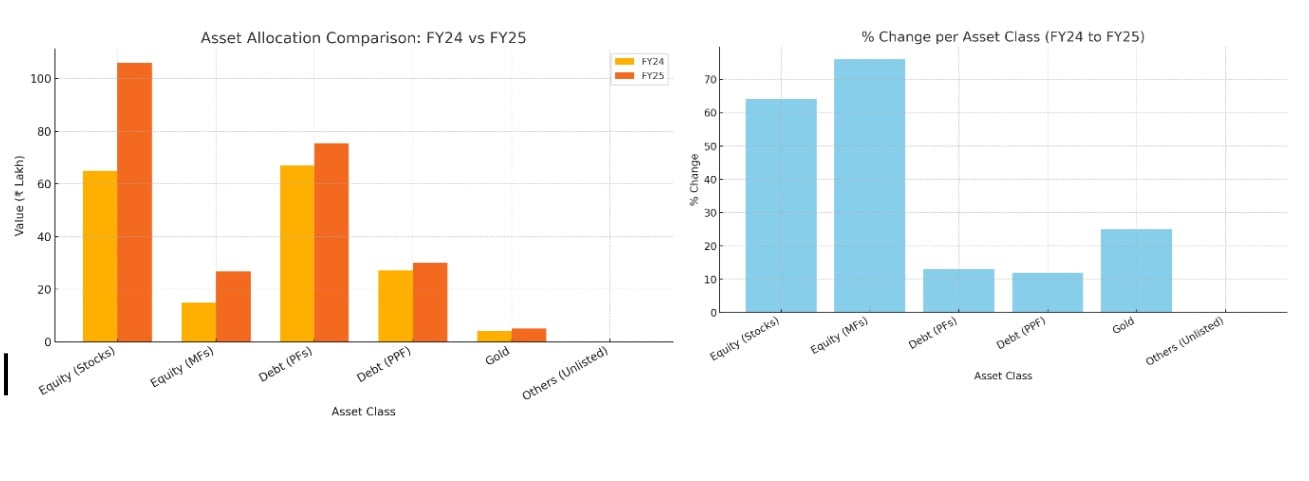

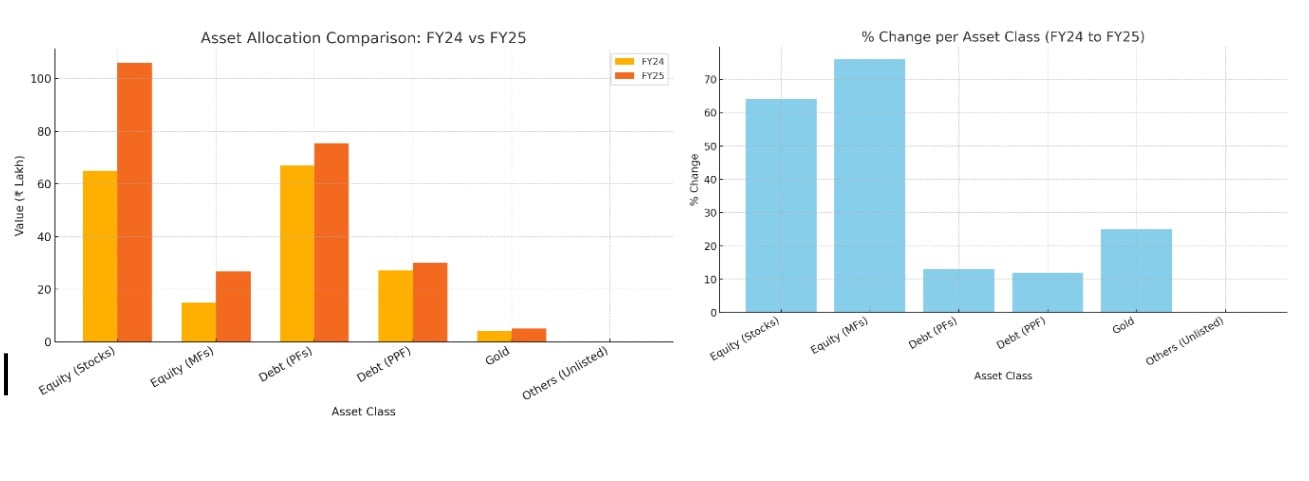

- The returns on shares and mutual funds have seen a major rise this 12 months, largely as a consequence of deploying a significant portion of the windfall instantly into the markets. As well as, a number of Systematic Withdrawal Plans (SWPs) have been initiated from a funded arbitrage account.

| Asset Class | Worth (FY24) | Worth (FY25) | % Change |

|---|---|---|---|

| Fairness ( Shares ) | 65 L | 1.06 Cr | 64% |

| Fairness ( MFs ) | 15 L | 26.70 L | 76% |

| Debt ( PFs ) | 67 L | 75.5 L | 13% |

| Debt ( PPF ) | 27 L | 30 L | 12% |

| Gold | 4 L | 5 L | 25% |

| Others (Unlisted) | Nil | Nil | Nil |

| Whole | 1.78 Cr | 2.43 Cr |

Internet Price Replace

- Opening Internet Price in Mar’2024: 1.78 Cr

- Closing Internet Price April’2025: 2.43 Cr

- 37% change YoY within the NW backed by market restoration from the sooner drop of 30% from PF-all time excessive.

Key Learnings & Errors

- What labored nicely: Our fairness portfolio noticed a pointy 30% dip from its all-time excessive in October however totally recovered over the next six months.

- What didn’t work: We missed the chance so as to add to our fairness positions throughout the downturn. This was primarily due to monetary commitments in the direction of a deliberate household trip and my ongoing job transition.

- Behavioural observations: Regardless of the 30% drop, we stayed calm and targeted on analysing which shares introduced the very best alternatives so as to add as soon as funds had been out there. Diversification throughout the portfolio gave us peace of thoughts and lowered anxiousness about any single holding.

- Market takeaway: Markets reward those that keep invested and keep away from turning non permanent paper losses into everlasting ones.

Modifications in Monetary Targets

- Our Monetary Independence (FI/FU) goal is to achieve the $1 million mark, which is predicated on our present projections, ought to be achievable by FY32 — about 7 years from now.

- The objective for the upcoming 12 months is to develop our mixed internet price to ₹3.23 crore, which represents a 33% improve from the present 12 months.

Motion Plan for FY26

- We’re making higher use of bank card rewards to assist offset journey bills, particularly for flights and lodging.

- Our total asset allocation stays conservative on the household portfolio stage, with a 55:45 cut up between Fairness and Debt.

- We’ve began exploring turnaround alternatives, significantly the place firm insiders are growing their possession throughout market downturns.

- No adjustments have been made to our budgeting strategy, as issues are progressing in response to plan.

- We publish our month-to-month numbers together with any portfolio adjustments at direct fairness stage on Twitter (@FundaInvesting) usually.

Closing Ideas

- Some issues in life are merely past our management. The very best we are able to do is settle for them and hold transferring ahead. Life will all the time have its share of ups and downs, and nobody can ever say with certainty whether or not “this time it’s completely different.”.

- Thanks for studying this far. When you’ve got any questions or ideas, be happy to drop them — I’ll be completely happy to reply and focus on.

- That is for informational functions solely, not monetary recommendation.

Reader tales revealed earlier:

As common readers might know, we publish a private monetary audit every December – that is the 2024 version: Portfolio Audit 2024: The Annual Evaluation of My Purpose-Primarily based Investments. We requested common readers to share how they evaluation their investments and monitor monetary targets.

- First audit: How Suhas tracks his MF investments and opinions monetary targets.

- Second audit: How Avadhoot Joshi evaluates his funding portfolio.

- Third audit: How a single mother is on monitor to monetary freedom

- Fourth audit: How Gowtham began goal-based investing & took management of his cash

- Fifth audit: Why my monetary independence & early retirement plans had been postponed by 4 years

- Sixth audit: How Abhisek funded his marriage & is on monitor to monetary freedom.

- Seventh audit: How Rohit’s early struggles outlined his funding journey

- Eighth audit: Why my investments are nonetheless on monitor regardless of job loss and decrease earnings.

- Ninth audit: How a retirement planning calculation scared me to take motion

- Tenth audit: I made a number of funding errors however have turned my life round.

- Eleventh audit: My internet price doubled within the final monetary 12 months, due to affected person investing!

- Twelveth audit: My monetary journey: from novice to goal-based investor.

- Thirteenth audit: My journey: from a detrimental internet price to goal-based investing.

- Fourteenth audit: From Mounted Deposits to Purpose-based investing in MFs.

- Fifteenth audit: My 10-year monetary journey – errors made and classes learnt.

- Sixteenth audit (half 1): How I achieved monetary independence with out mutual funds or shares.

- Sixteenth audit (half 2): Classes from my monetary independence journey and future funding plans.

- Seventeenth audit: How I plan to realize monetary independence and transfer to my native place

- Eighteenth audit: I used the present bull run to scale back my mutual funds from 14 to 4!

- Nineteenth audit: How a conservative investor created his monetary plan

- Twentieth audit: I plan to realize monetary independence by 46; that is my grasp plan

- Twenty-first audit: I’ve made many funding errors however am heading in the right direction to monetary independence by 45.

- Twenty-second audit: I felt nugatory six years in the past however have achieved monetary stability at this time

- Twenty-third audit: My monetary journey was directionless till age 40: that is how I made up for misplaced time

- Twenty-fourth audit: Why I elevated fairness MF investments by 275% and lowered PPF contributions.

- Twenty-fifth audit: How I monitor monetary targets with out worrying about returns

- Twenty-sixth audit: I’m 24 and began investing 1Y in the past, however what am I investing for?

- Twenty-seventh audit: How we plan to realize a retirement corpus 50 instances our annual bills.

- Twenty-eighth audit: I believed fairness investing was of venture, however now I purpose to carry 60% fairness for retirement

- Twenty-ninth audit: My journey: From 5 lakhs in debt to constructing a corpus price six years in retirement

- Thirtieth audit: My funding journey: From random purchases to a goal-based portfolio

- Thirty-first audit: My funding journey: from product-driven to process-driven

- Thirty-second audit: How a younger couple is making an attempt to stability travelling and investing

- Thirty-third audit: My journey: From Rs. 30 financial institution stability to monetary independence

- Thirty-fourth audit: Our journey: From scratch to a internet price of 18 instances annual bills.

- Thirty-fifth audit: From a internet price of Rs. 6000 to auto-pilot goal-based investing

- Thirty-sixth audit: How I retired from company bondage at 46, two years in the past!

- Thirty-seventh audit: How I learnt to maintain it easy and construct a internet price 19 instances my annual bills

- Thirty-eighth audit: How Abhineeth plans to realize monetary independence and construct a home.

- Thirty-ninth audit: How Sahil plans to realize monetary independence by environment friendly monitoring

- Fortieth audit: My Journey to a Ten Crore Portfolio

- Forty-first audit: Burdened with debt for a number of years, I’m now aggressively investing in fairness

- Forty-second audit: From Engineer to Librarian after Monetary Independence and Early Retirement (FIRE)

- Forty-third audit: I misplaced six months’ earnings in F&O and ditched it for systematic investing

- Forty-fourth audit: My retirement plan to deal with the cruel realities of the IT business

- Forty-fifth audit: My funding journey: errors, 10 years of MF investing and restoration

- Forty-sixth audit: My MF portfolio is price six crores regardless of a number of errors

- Forty-seventh audit: Saving, Investing, and Operating Marathons: My 25-year Journey to Monetary Independence

- Forty-eighth audit: By no means Too Late to Begin: How I Grew to become Financially Savvy at 40

- Forty-ninth audit: My Funding Journey to a internet price 29 instances my annual bills

- Fiftieth audit: How I audit my portfolio with out monitoring returns

- Fifty-first audit: Monetary Classes Discovered Throughout and After a PhD

- Fifty-second audit: Funding & Monetary journey of a 23 12 months outdated

- Fifty-third audit: The system I take advantage of to attract earnings and spend after retirement securely

- Fifty-fourth audit: From Begin-Up Worker to Millionaire: A Success Story of Resilience and Good Investing

- Fifty-fifth audit: 25-12 months-Previous Software program Engineer’s Funding Journey: From Shares to Mutual Funds and Past

- Fifty-sixth audit: Crossing the Million Mark: Our Journey to the First Crore

- Fifty-seventh audit: Navigating Market Volatility: How an IT Skilled Remodeled His Funding Strategy for Retirement

- Fifty-eighth audit: How Sahil achieved a 10X retirement corpus by environment friendly portfolio monitoring

- FIfty-ninth audit: How I achieved monetary freedom by 45 with out onsite assignments or ESOPs

- Sixtieth audit: Constructing Wealth on a Authorities Wage: Classes Discovered

- Sixty-first audit: Minimalism, Index Funds, and Staying Calm: My Investing Journey at 28

- Sixty-second audit: Constructing Wealth and Breaking Boundaries: How Swati Took Management of Her Monetary Future

- Sixty-third audit: My monetary journey: How I missed the Compounding Bus!

- Sixty-fourth audit: My MF funding journey: From thematic funds to a 3-fund portfolio

- Sixty-fifth audit: How I learnt that investing is about discovering the stability and never chasing returns

These revealed audits have had a compounding impact on readers. If you want to contribute to the DIY group on this method, ship your audits to freefincal AT Gmail. You can even publish them anonymously.

Do share this text with your folks utilizing the buttons under.

🔥Take pleasure in huge reductions on our programs, robo-advisory software and unique investor circle! 🔥& be part of our group of 7000+ customers!

Use our Robo-advisory Instrument for a start-to-finish monetary plan! ⇐ Greater than 2,500 traders and advisors use this!

Observe your mutual funds and inventory investments with this Google Sheet!

We additionally publish month-to-month fairness mutual funds, debt and hybrid mutual funds, index funds and ETF screeners and momentum, low-volatility inventory screeners.

Podcast: Let’s Get RICH With PATTU! Each single Indian CAN develop their wealth!

You may watch podcast episodes on the OfSpin Media Buddies YouTube Channel.

🔥Now Watch Let’s Get Wealthy With Pattu தமிழில் (in Tamil)! 🔥

- Do you could have a remark in regards to the above article? Attain out to us on Twitter: @freefincal or @pattufreefincal

- Have a query? Subscribe to our e-newsletter utilizing the shape under.

- Hit ‘reply’ to any electronic mail from us! We don’t provide customized funding recommendation. We will write an in depth article with out mentioning your identify you probably have a generic query.

Be a part of 32,000+ readers and get free cash administration options delivered to your inbox! Subscribe to get posts by way of electronic mail! (Hyperlink takes you to our electronic mail sign-up type)

About The Writer

Dr M. Pattabiraman(PhD) is the founder, managing editor and first creator of freefincal. He’s an affiliate professor on the Indian Institute of Know-how, Madras. He has over ten years of expertise publishing information evaluation, analysis and monetary product improvement. Join with him by way of Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You could be wealthy too with goal-based investing (CNBC TV18) for DIY traders. (2) Gamechanger for younger earners. (3) Chinchu Will get a Superpower! for youths. He has additionally written seven different free e-books on varied cash administration subjects. He’s a patron and co-founder of “Price-only India,” an organisation selling unbiased, commission-free funding recommendation.

Dr M. Pattabiraman(PhD) is the founder, managing editor and first creator of freefincal. He’s an affiliate professor on the Indian Institute of Know-how, Madras. He has over ten years of expertise publishing information evaluation, analysis and monetary product improvement. Join with him by way of Twitter(X), Linkedin, or YouTube. Pattabiraman has co-authored three print books: (1) You could be wealthy too with goal-based investing (CNBC TV18) for DIY traders. (2) Gamechanger for younger earners. (3) Chinchu Will get a Superpower! for youths. He has additionally written seven different free e-books on varied cash administration subjects. He’s a patron and co-founder of “Price-only India,” an organisation selling unbiased, commission-free funding recommendation.

Our flagship course! Be taught to handle your portfolio like a professional to realize your targets no matter market situations! ⇐ Greater than 3,000 traders and advisors are a part of our unique group! Get readability on tips on how to plan on your targets and obtain the required corpus regardless of the market situation is!! Watch the primary lecture free of charge! One-time fee! No recurring charges! Life-long entry to movies! Scale back worry, uncertainty and doubt whereas investing! Discover ways to plan on your targets earlier than and after retirement with confidence.

Our new course! Enhance your earnings by getting individuals to pay on your expertise! ⇐ Greater than 700 salaried workers, entrepreneurs and monetary advisors are a part of our unique group! Discover ways to get individuals to pay on your expertise! Whether or not you’re a skilled or small enterprise proprietor who desires extra shoppers by way of on-line visibility or a salaried individual wanting a facet earnings or passive earnings, we’ll present you tips on how to obtain this by showcasing your expertise and constructing a group that trusts and pays you! (watch 1st lecture free of charge). One-time fee! No recurring charges! Life-long entry to movies!

Our new e book for youths: “Chinchu Will get a Superpower!” is now out there!

Most investor issues could be traced to an absence of knowledgeable decision-making. We made unhealthy selections and cash errors after we began incomes and spent years undoing these errors. Why ought to our kids undergo the identical ache? What is that this e book about? As dad and mom, what would it not be if we needed to groom one capacity in our kids that’s key not solely to cash administration and investing however to any facet of life? My reply: Sound Determination Making. So, on this e book, we meet Chinchu, who’s about to show 10. What he desires for his birthday and the way his dad and mom plan for it, in addition to educating him a number of key concepts of decision-making and cash administration, is the narrative. What readers say!

Should-read e book even for adults! That is one thing that each dad or mum ought to train their youngsters proper from their younger age. The significance of cash administration and resolution making based mostly on their desires and desires. Very properly written in easy phrases. – Arun.

Purchase the e book: Chinchu will get a superpower on your little one!

Tips on how to revenue from content material writing: Our new book is for these serious about getting facet earnings by way of content material writing. It’s out there at a 50% low cost for Rs. 500 solely!

Do you wish to test if the market is overvalued or undervalued? Use our market valuation software (it’ll work with any index!), or get the Tactical Purchase/Promote timing software!

We publish month-to-month mutual fund screeners and momentum, low-volatility inventory screeners.

About freefincal & its content material coverage. Freefincal is a Information Media Group devoted to offering authentic evaluation, reviews, opinions and insights on mutual funds, shares, investing, retirement and private finance developments. We achieve this with out battle of curiosity and bias. Comply with us on Google Information. Freefincal serves greater than three million readers a 12 months (5 million web page views) with articles based mostly solely on factual data and detailed evaluation by its authors. All statements made will likely be verified with credible and educated sources earlier than publication. Freefincal doesn’t publish paid articles, promotions, PR, satire or opinions with out information. All opinions will likely be inferences backed by verifiable, reproducible proof/information. Contact data: To get in contact, use this contact type. (Sponsored posts or paid collaborations won’t be entertained.)

Join with us on social media

Our publications

You Can Be Wealthy Too with Purpose-Primarily based Investing

Printed by CNBC TV18, this e book is supposed that will help you ask the fitting questions and search the proper solutions, and because it comes with 9 on-line calculators, you may also create customized options on your life-style! Get it now.

Printed by CNBC TV18, this e book is supposed that will help you ask the fitting questions and search the proper solutions, and because it comes with 9 on-line calculators, you may also create customized options on your life-style! Get it now.

Gamechanger: Overlook Startups, Be a part of Company & Nonetheless Reside the Wealthy Life You Need

This e book is supposed for younger earners to get their fundamentals proper from day one! It would additionally provide help to journey to unique locations at a low price! Get it or reward it to a younger earner.

This e book is supposed for younger earners to get their fundamentals proper from day one! It would additionally provide help to journey to unique locations at a low price! Get it or reward it to a younger earner.

Your Final Information to Journey

That is an in-depth dive into trip planning, discovering low-cost flights, funds lodging, what to do when travelling, and the way travelling slowly is best financially and psychologically, with hyperlinks to the net pages and hand-holding at each step. Get the pdf for Rs 300 (prompt obtain)

That is an in-depth dive into trip planning, discovering low-cost flights, funds lodging, what to do when travelling, and the way travelling slowly is best financially and psychologically, with hyperlinks to the net pages and hand-holding at each step. Get the pdf for Rs 300 (prompt obtain)