RSU or Restricted Inventory Items are shares of the corporate given to staff freed from value however with some restrictions. What are RSUs? Why are RSUs given? What’s the vesting date? When are RSU taxed? Is there a capital acquire on promoting RSU? What’s the capital acquire from promoting RSU? We will reply these questions by speaking in regards to the RSU of an American MNC.

Overview of RSU, Tax, and ITR

RSU or Restricted Inventory Items are shares of the corporate given to worker freed from value however with some restrictions(because the title suggests)

- On Granting of RSU no tax implication. It’s only a promise by the employer

- On the vesting day, the given share of RSUs are transferred to worker’s buying and selling account.

- Worker has to pay tax primarily based on his revenue slab.

- the worth of shares is taken into account as Perquiste in India and seems in Kind 16. The market worth of the shares vested (variety of shares vested x Honest Market value X Conversion from Greenback to Indian Rupee) is added to the worker’s taxable revenue as perquisites. The worth at which Inventory is given to you is named because the Honest Market Worth

- Tax is likely to be deducted within the different nation.

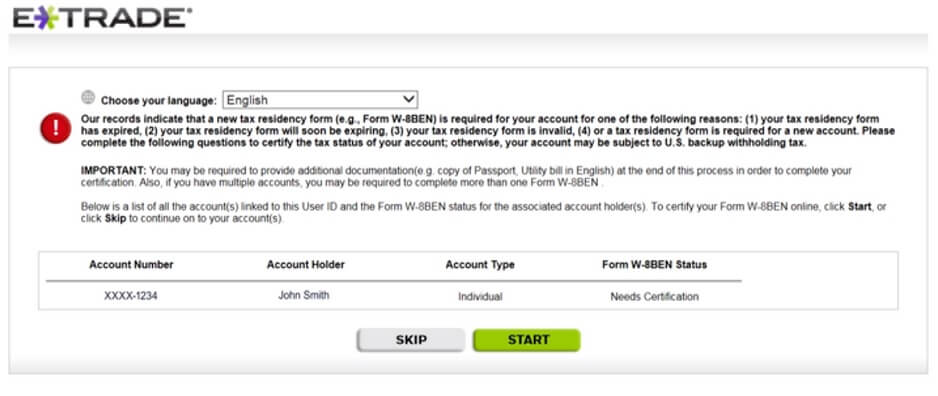

- US MNCs with staff in India typically submit W-8BEN to US brokers to keep away from any withholding associated to US taxes.

- Indian corporations deduct % of shares as tax.

- There may be no double taxation as tax is paid from the sale of shares.

- One must declare shares obtained as RSU as Capital Asset in Schedule FA(International Belongings) of ITR2, ITR3, ITR4.

- ITR1 does NOT have the schedule for International Belongings. So in the event you RSU, ESPP in MNC you can’t file ITR1.

- You must fill in details about all of the RSUs you might have as of the monetary 12 months of the MNC

- You must present revenue you derived from it(Dividend, Capital Features).

- If tax for RSU has been deducted by promoting of shares, Variety of shares talked about needs to be after the deduction. So if 100 shares acquired vested and 30 shares have been deducted then it’s essential present solely 70 shares in International Belongings.

- One can solely promote the RSUs which can be vested. On the sale of the vested shares, the revenue earned is a capital acquire and is subsequently taxable in India.

- For RSUs, the distinction between the vesting value or the Honest Market Worth and the sale value is the as capital acquire

- For RSUs, the acquisition date is the vesting date.

- Because the RSUs of the MNCs are usually not listed on the Indian inventory alternate and no STT(Safety Transaction Tax) is paid so the definition of a long run and short-term capital positive factors is totally different from the shares listed on Indian inventory alternate like BSE and NSE.

- Quick-term capital property – when offered inside 24 months of holding them. Quick-term positive factors are taxed at worker’s revenue tax slab charges

- Lengthy-term capital property – when offered after 24 months of holding them. Lengthy-term positive factors are taxed at 12.5% (earlier than Lengthy-term positive factors are taxed at 20% with indexation earlier than Price range 2024)

- This capital acquire should be declared in Schedule CG of ITR2 ITR3, ITR4 for tax functions.

- Advance Tax needs to be paid for revenue/capital acquire of greater than 10,000 Rs.

The reporting can be as beneath for international shares on

- Schedule CG for Capital acquire on Sale of Shares

- Schedule OS for Dividend revenue

- Schedule FSI and Schedule TR for claiming the international tax credit score in case of double taxation reduction

- Schedule FA: Particulars of holding of international shares/securities

RSU or Restricted Inventory Items

RSU or Restricted Inventory Items are shares of the corporate given to worker freed from value however with some restrictions(because the title suggests). The restriction is that although an worker is granted RSUs on a particular day (comparable to when he joins an organization or will get a promotion) he will get possession of the shares over a time period. It’s an incentive to the worker to remain within the firm and to revenue from the expansion of the corporate. When the shares are awarded to the worker in line with the schedule, it’s thought-about as perquisite revenue and added to common revenue. When one sells the RSUs one capital acquire comes into play and one might must pay tax relying on the interval of holding of RSU. Phrases related to RSU.

- Grant date: The date on which the shares are allotted

- Vesting date: the date on which the shares get transferred to the worker.

Say if one is granted 100 RSUs to be vested over 3 years within the ratio 34%/33%/33% on 23 Nov 2023. Then 34 RSUs (34%) will vest on 23 Nov 2024 and 33 every (33%) on 23 Nov 2025 and 23 Nov 2026 respectively. If you happen to go away the corporate on 1 December 2025, then it is possible for you to to promote solely 34 shares and the remaining 66 shares will return to the corporate. If you happen to stick round for an additional month, then it is possible for you to to promote 67 shares (34 + 33) as one other 33 shares will vest on 23 Nov 2025.

So if one is granted 100 RSUs to be vested over 4 years within the ratio 25%/25%/25%/25% on 16 Dec 2023. Then 25% of RSUs i.e 25 shares of the corporate will vest on 16 Dec 2024, on 16 Dec 2025, 16 Dec 2026 and 16 Dec 2027 respectively. (If the vesting day is vacation then the shares vest on subsequent working day)

The opposite type of incentives provided by the businesses are ESPP and ESOP.

Our article What are Worker Inventory Choices (ESOP) explains ESOP intimately.

Our article Worker Inventory Buy Plan or ESPP explains ESPP intimately.

Tax when RSUs are Granted

On Granting of RSU no tax implication. It’s only a promise by the employer.

Tax when RSUs are Vested

Vesting date is the date on which the predefined share of shares get transferred to the worker in line with the predefined schedule. Say one is granted 100 RSUs to be vested over 4 years within the ratio 25%/25%/25%/25% on 16 Dec 2023. Then 25% of RSUs i.e 25 shares of the corporate will vest on 16 Dec 2024. On the vesting day, the given share of RSUs are transferred to worker’s buying and selling account, for instance, eTrade or Charles Schwab account for an American MNC. On Vesting, one has to handle following issues

- one has to pay tax primarily based on revenue slab.

- the worth of shares is taken into account as revenue in India.

Tax on RSU

Corporations are obligated to deduct taxes for RSUs vested. The most typical methodology of deducting tax is share withholding, the place the corporate withholds sufficient shares to cowl the tax legal responsibility and deposits internet shares to your brokerage account. This feature is named as Promote to cowl. Some corporations allow different strategies, comparable to money or sell-to-cover transactions, that are defined beneath. Completely different strategies could also be supported by buying and selling corporations like Schwab or eTrade, however solely the strategies approved by your organization can be accessible to you.

The assorted choices to deduct tax on broking web site the place the RSUs are held are as follows:

- A sell-to-cover That is the default choice the place TDS (as per your revenue slab) share of the vested shares are offered instantly and the quantity is paid to the federal government as tax. The remaining 70% of the vested shares stay in your account and you’ll promote them later everytime you need. Actully tax deducted is as per the revenue slab however as in a lot of the corporations, the RSUs are provided above a sure stage the place revenue is available in 30% revenue slab.

- A same-day sale: All of the vested RSUs are offered instantly. Proportion of the sale proceeds are deducted and paid as tax to the federal government and the remainder of cash will get wired to your account. You don’t any shares after this.

- A money train permits you to pay the tax and no shares are offered. The cash to pay should be accessible in your brokerage account.

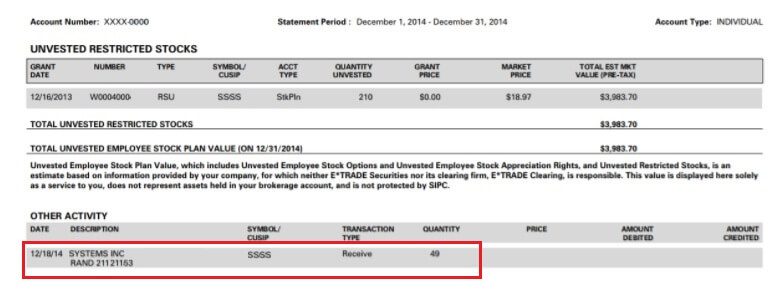

The default choice is Promote to Cowl therefore If 70 RSUs are vested then you definately would get solely 49 shares in your account resulting from taxation. 30% of 70 = 21 which is taken as tax. So no of shares within the account turns into 70-21=49.

RSUs as Perquisite Earnings in India

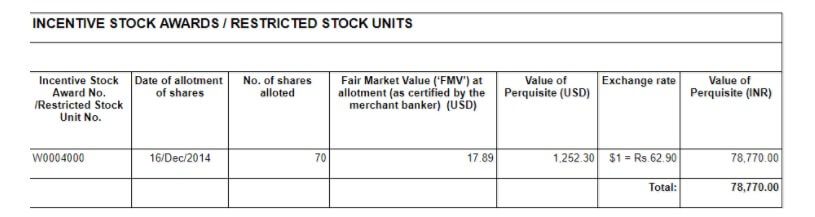

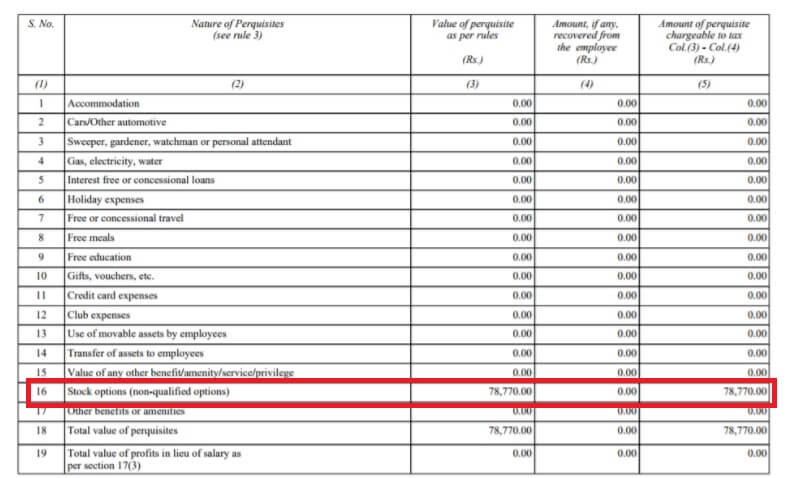

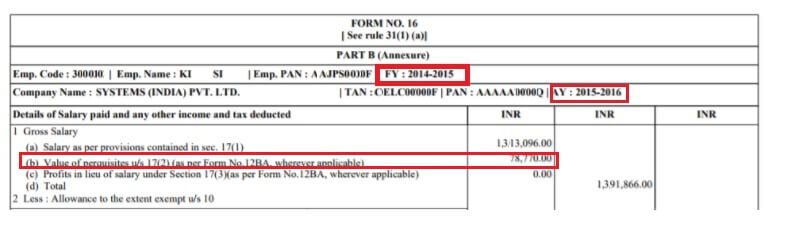

For RSUs, the acquisition value or buy value is zero and so your entire market worth of vested shares is handled as revenue in India as a perquisite. The market worth of the shares vested (variety of shares vested x Honest Market value X Conversion from Greenback to Indian Rupee) is added to the worker’s taxable revenue as perquisites. The worth at which Inventory is given to you is named because the Honest Market Worth. All of the shares which can be vested are used to calculate the Perquiste Earnings which incorporates the shares which have been offered for tax. if 70 RSUs are vested then you definately would get solely 49 shares in your account resulting from taxation however all of the 70 shares can be used to calculate the perquiste revenue.

It’s declared in his Kind 12BA for the 12 months and is accessible in your Kind 16, as proven within the photos beneath. The Indian firm provides it to worker’s Earnings and fees Tax accordingly.

Our article Understanding Kind 12BA give particulars of Perquisites given to an worker intimately.

Our article Understanding Kind 16: Tax on revenue explains the Kind 16. Earnings Tax Kind 16 is a certificates from the employer which certifies that TDS has been deducted from worker’s wage by the employe

Are RSU’s Taxed Twice?

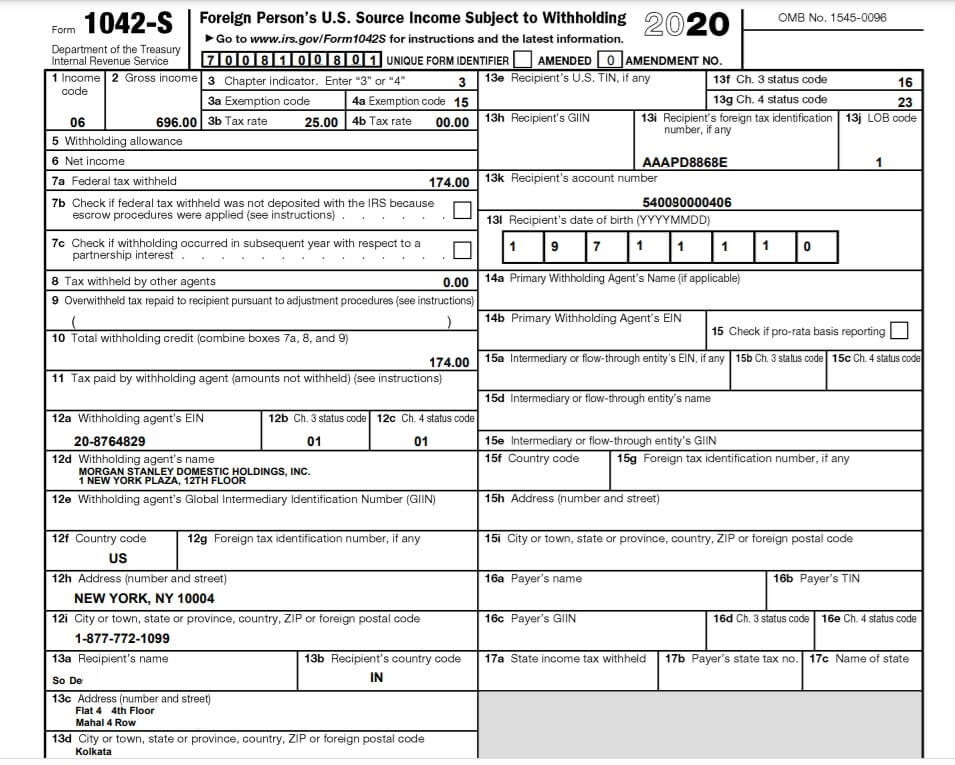

Quick Reply is RSU’s are usually not taxed twice. If they might have been taxed twice you’ll have Govt doc of the nation deducting tax saying that tax has been deducted. Like Kind 16/Kind 16A supplied by Indian Govt or Kind 1042-S supplied by US when the tax is deducted on the dividend of US compnaies.

An worker (Resident Indian) working in India in a subsidiary of a US Firm is given RSU or Restricted Inventory Items of the mum or dad firm.

When the shares are vested, some shares are withheld (Promote to cowl) to satisfy tax legal responsibility in US and after lowering these shares, the steadiness is given to the worker.

Indian firm additionally calculates prerequisite primarily based on FMV on the overall variety of shares together with withheld shares and TDS is deducted. That is mirrored in Kind 16 Half B.

So are RSUs are taxed twice. About 65.22% worth is consumed in tax.

Is double taxation achieved by the corporate is appropriate?

Can DTAA advantages be availed for a refund?

No, RSUs are usually not taxed twice is what my firm says. Simply since you are seeing that in your Kind 16 and your brokers statements, it doesn’t imply that its been deducted twice.

Within the instance above, Reader Smriti defined superbly.

100* FMV was added to your prerequisite to indicate it as part of revenue. it simply means you have been paid a 100*FMV quantity by the corporate( in type of shares).

66 shares are deposited to your brokerage account.

The remaining shares (100-66 = 34) are thought-about to be offered by the dealer in your behalf and the quantity obtained from that is paid as tax.

All these calculations are a part of your wage prerequisite and therefore, will present in your wage slip because the tax you might be paying to Govt of India.

The employer shouldn’t be deducting tax twice. it’s simply including all the small print within the payslip.

We’ve got heard that Proof is within the pudding or present me the proof. If the tax had been deducted by the international firm then they should present paperwork like Kind 16/Kind 16A in India and Kind 1042-S within the US. The Pattern Kind 1042-S from our article How are Dividends of Worldwide or International Shares taxed? Find out how to present in ITR is proven beneath.

Dividend revenue from international shares

Dividend revenue earned from international shares is taxed as per Earnings Tax slabs below the top Earnings from Different Sources.

In Schedule TR, it’s essential present a abstract of tax reduction that’s being claimed in India for taxes paid outdoors India in respect of every nation. This schedule captures a abstract of detailed info furnished in Schedule FSI.

Within the case of sure ESOPs, a person can also obtain dividend-equivalent revenue on unvested shares. These are typically taxed as a part of wage revenue.To find out one’s taxation it’s advisable to have a chat along with your Employer or colleagues.

The Double Taxation Avoidance Settlement or DTAA is a tax treaty signed between India and one other nation in order that taxpayers can keep away from paying double taxes on their revenue earned from the supply nation in addition to the residence nation. At current, India has double tax avoidance treaties with greater than 80 international locations world wide.

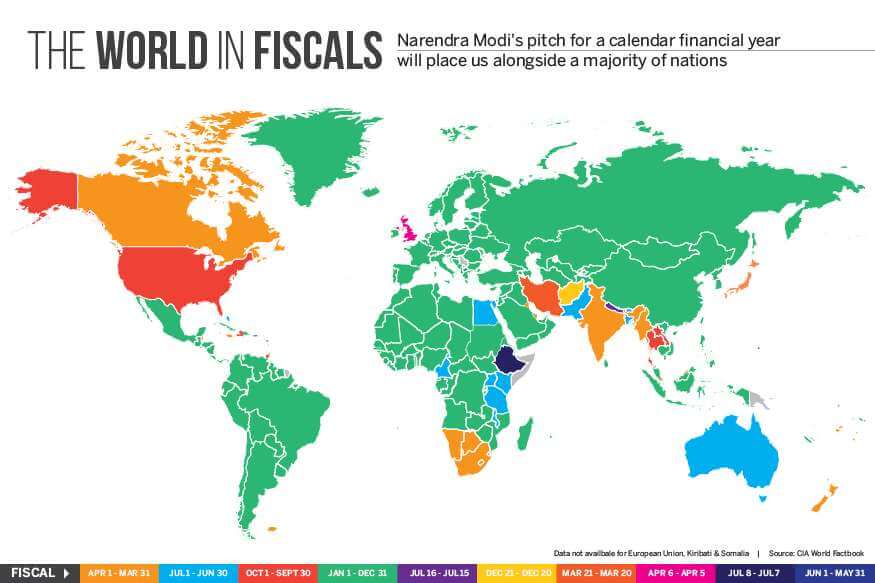

Monetary years of various international locations

“It’s hereby clarified {that a} taxpayer shall be required to reply the related query (whether or not international property are held or not) within the affirmative, provided that he has held the international property and so forth. at any time through the “earlier 12 months”(in India) as additionally at any time through the “related accounting interval”(within the international tax jurisdiction), and refill Schedule FA accordingly.”

Lets take an instance of RSUs of a MNC headquartered in USA which has monetary 12 months from 1 Jan to 31 Dec. So solely RSUs(ESPPs) acquired between 1 Jan 2022 to 31 Dec 2023 must be reported.

Monetary years for widespread international locations are given beneath

1. United States: Monetary 12 months is from January 1st to December thirty first.

2. United Kingdom: Monetary 12 months is from April sixth to April fifth.

3. Canada: Monetary 12 months is from January 1st to December thirty first.

4. Australia: Monetary 12 months is from July 1st to June thirtieth.

5. United Arab Emirates: Monetary 12 months is from January 1st to December thirty first.

For particulars checkout our article Distinction between Evaluation Yr and Monetary Yr, Earlier Yr,Fiscal Yr in World

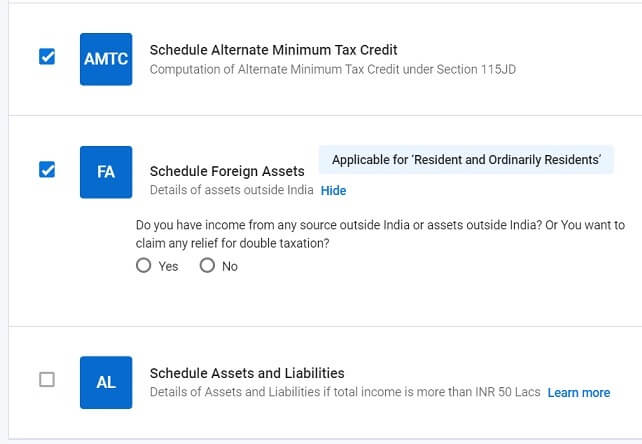

Find out how to present RSU, ESPP, and International Belongings in ITR

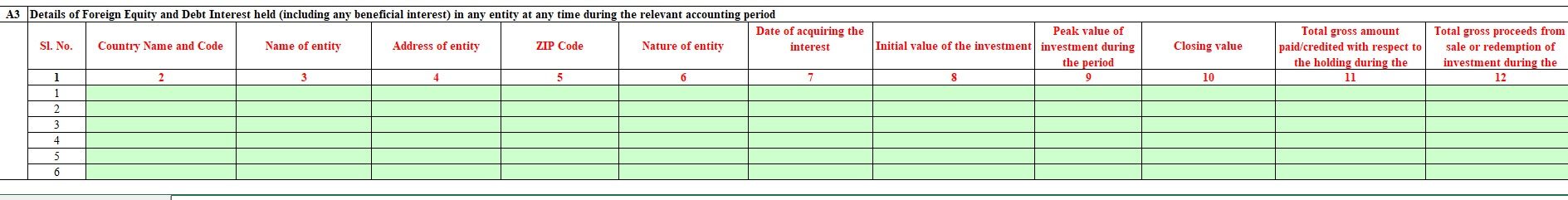

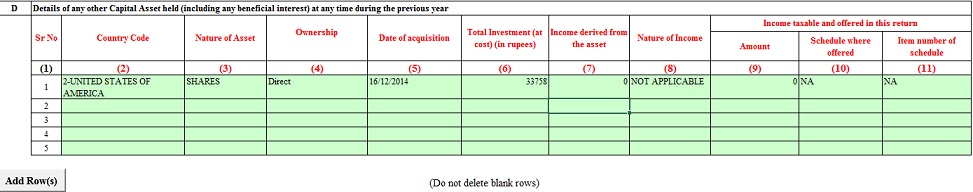

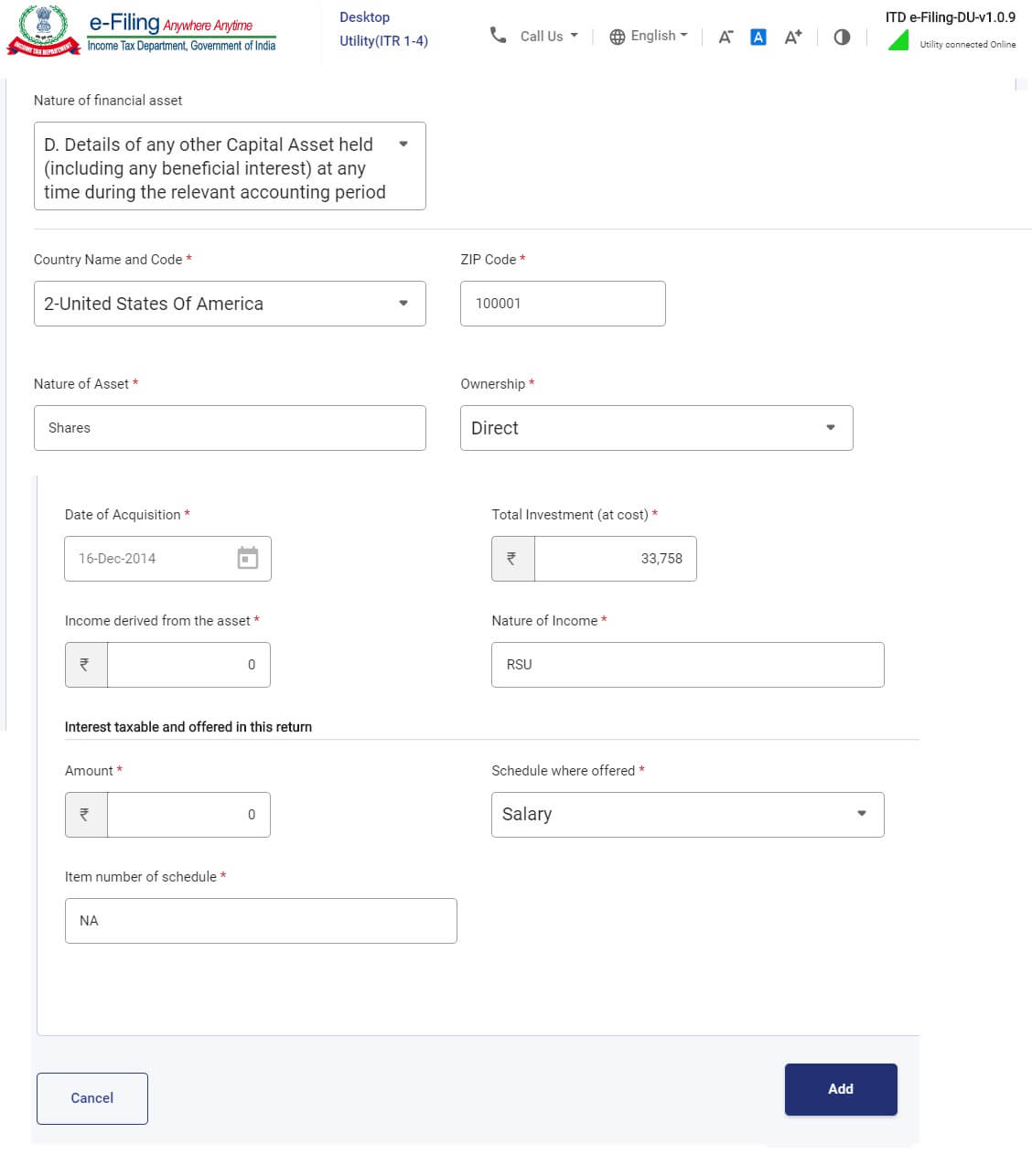

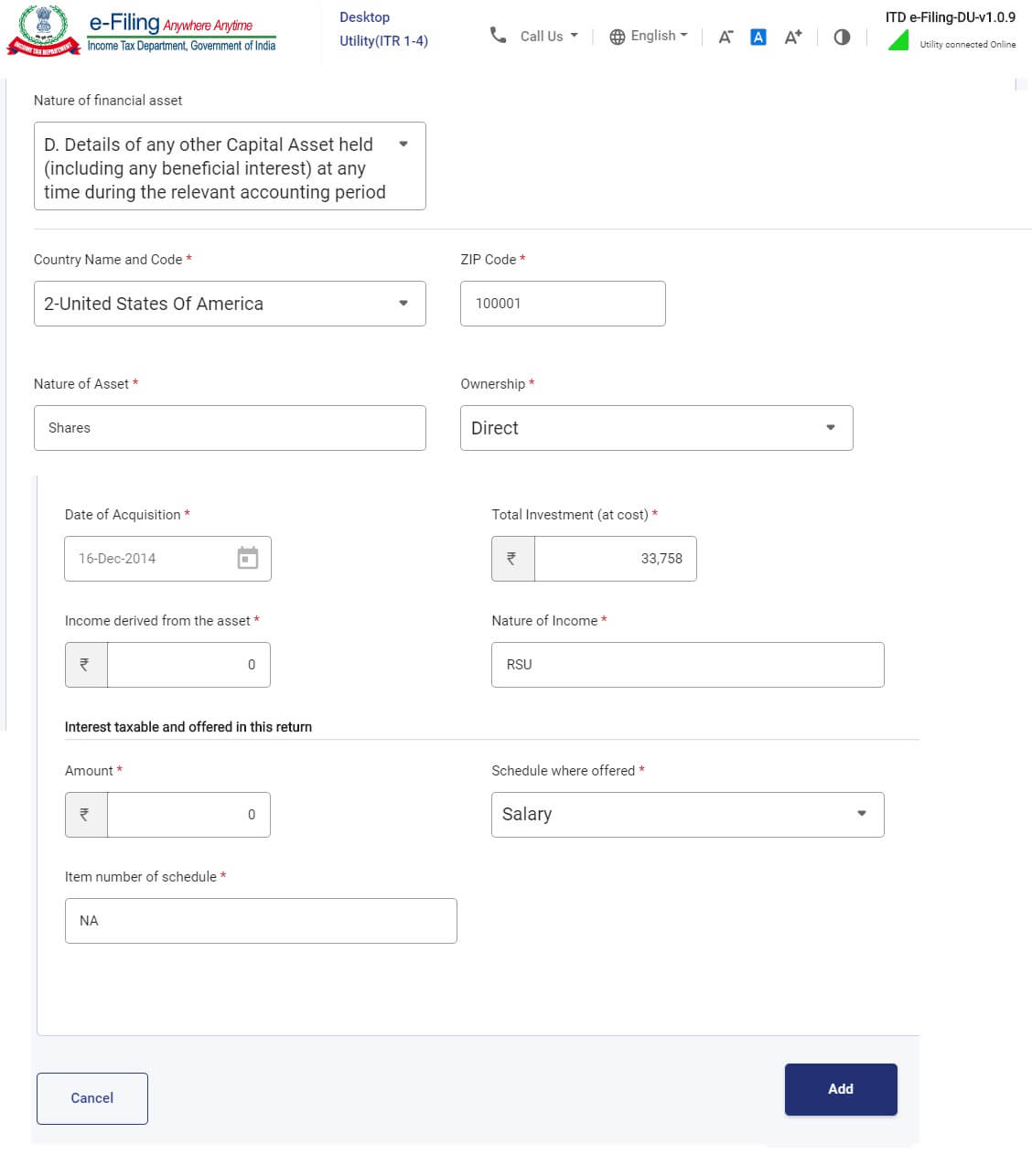

One wants to indicate shares obtained as RSU(ESPP/ESOP) as Capital Asset in Schedule FA(International Belongings) of ITR aside from ITR1 comparable to ITR2, ITR3, ITR4 as proven within the picture beneath. ITR1 does NOT have the schedule for International Belongings.

The picture beneath exhibits the case of solely when shares of an organization within the US have been allotted to the worker and the worker has not offered them until submitting of the revenue tax return. To fill this please undergo Perquisite on Inventory Choices report and the break up supplied by your employer on shares allotted to you.

If tax for RSU has been deducted by promoting of shares, the Variety of shares talked about needs to be after the deduction. So if 100 shares acquired vested and 30 shares have been deducted then it’s essential present solely 70 shares in International Belongings. Whole Funding values is the Variety of shares in your account X Honest Market Worth X US greenback inventory value.

In case you have acquired RSU at totally different occasions and also you haven’t offered them then particulars about every allotment you had until 31 Mar of the monetary 12 months for which you might be submitting ITR needs to be put within the International Belongings desk.

For instance, your 70 RSUs acquired vested in 2020 and 70 in 2021, the details about each the allotments needs to be in International Belongings.

Schedule for International Earnings in ITR

Distinction between Schedule International Supply Earnings (FSI) and International Belongings (FA)

Is Schedule FSI required to be crammed in ITR2?

I’m resident in India. I’ve been allotted inventory choices (of my mum or dad US firm), which have been proven in my Kind 16. Do I additionally want to indicate this revenue in Schedule FSI or Schedule FA (International Belongings)? No Tax has been deducted within the US and I’m not claiming any refund.

- In Schedule International Supply Earnings (FSI), it’s essential report the small print of revenue, which is accruing or arising from any supply outdoors India. FSI schedule is necessary for residents who earned revenue from outdoors India and tax paid outdoors India and to assert the good thing about DTAA on such revenue.

Find out how to choose the Schedules?

Go to Schedule Choice

- Click on Earnings to see the Earnings from Capital Features Schedule. Choose the Schedule

- Click on Earnings to see the International Supply Earnings schedule. Choose the Schedule

- Click on Others to see the International Belongings Earnings schedule. Choose the Schedule

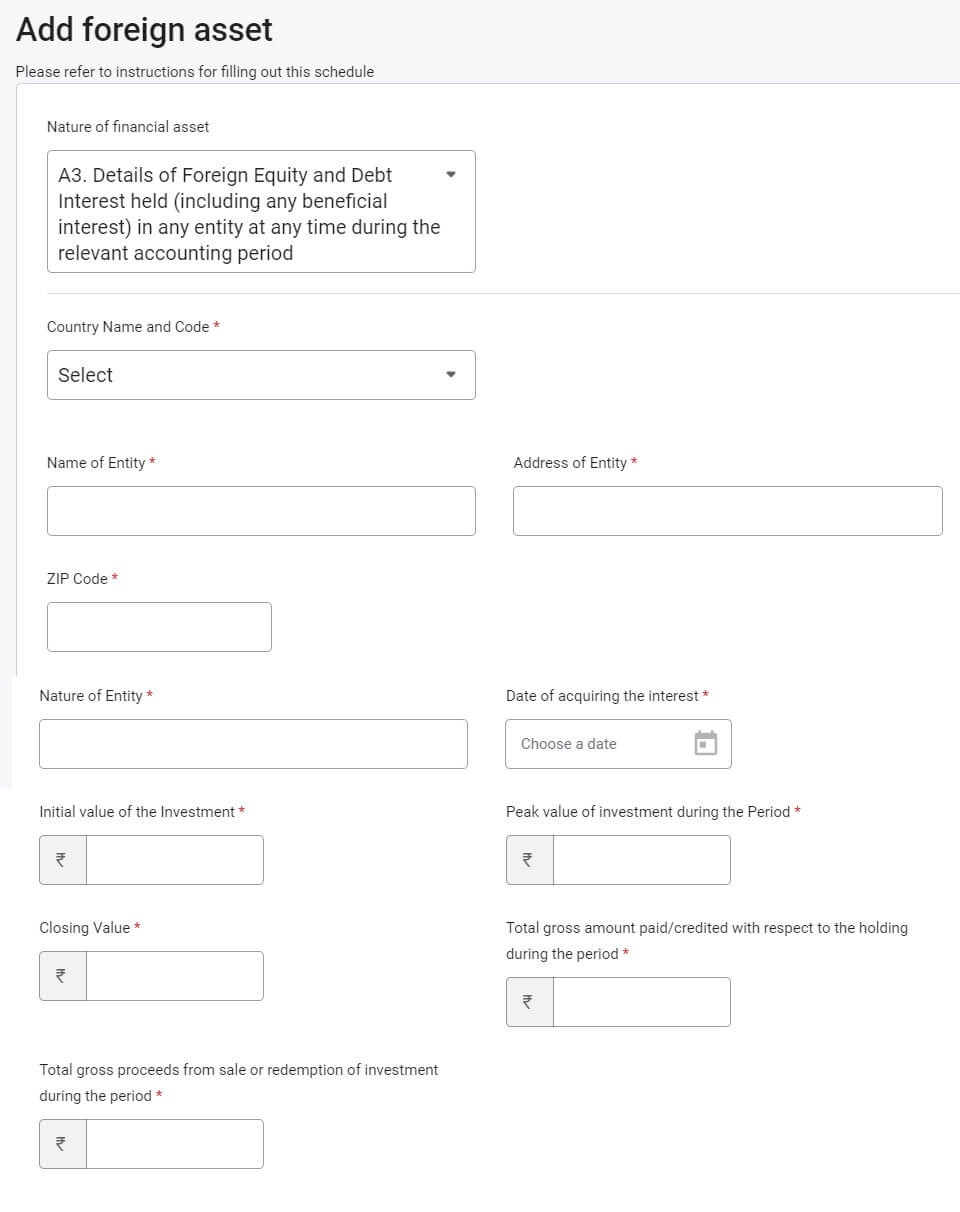

Particulars to be crammed in International Asset schedule in ITR2

Particulars to be crammed are:

- Nation Identify and code: The Nation the place the alternate on which shares are listed is traded. Ex for somebody working in Amazon or Microsoft, it could be the USA. Code is accessible within the dropdown in ITR.

- Nature of asset: Shares

- Nature of Curiosity-Direct/Useful/proprietor/Beneficiary: Direct

- Date of acquisition: Date on which shares have been allotted

- Whole Funding (at value) (in rupees): Value at which RSU/ESPP was allotted. (Please deduct the variety of shares that have been credited to your account after-tax deduction. Say you have been allotted 70 shares however due to tax solely 49 shares have been credited into your broking account). In instance 49*17.89(FMV)*62.90(USD Alternate charge)

- Earnings accrued from such :

- 0, in the event you haven’t offered the shares.

- In case you have earned a dividend then declare the dividend obtained.

- In case you have offered the shares then you need to present the revenue/loss obtained from the sale of the shares.

- Nature of Earnings: What kind of Earnings it’s. For International shares not offered it’s Earnings from Wage. For International shares offered it’s revenue from Capital Features.

Desk A3 or Desk D

You may declare it in Desk A3 or Desk D of International Belongings as proven within the photos beneath

Technically it needs to be declared in Desk A3. Further particulars required in Desk A3 are the Peak Worth of funding through the interval, Closing Worth. Closing Worth needs to be as of 31 Mar. These particulars you’ll find out of your dealer.

In desk A3, the preliminary worth of the funding, the height worth of the funding through the accounting interval, the closing worth of the funding as on the finish of the accounting interval, gross curiosity paid, the overall gross quantity paid or credited to the account through the accounting interval,and complete gross proceeds from sale or redemption of funding through the accounting interval is required to be disclosed after changing the identical into Indian forex

However because it requires extra particulars, many individuals do it in Desk D, the rationale being we’re declaring the revenue and account for it.

Desk A3 and Desk D within the outdated ITR

Desk A3 and Desk D within the outdated ITR

Our article Are ESPP, ESOP in MNC to be filed in ITR as International Belongings? discusses What are international property? The International Asset schedule in ITR2.

Tax On Sale of RSU

One can solely promote the RSUs which can be vested. On the sale of the vested shares, the revenue earned is a capital acquire and is subsequently taxable in India.

For RSUs, the distinction between the vesting value or the Honest Market Worth and the sale value is the capital positive factors.

Because the RSUs of the MNCs are usually not listed on the Indian inventory alternate and no STT(Safety Transaction Tax) is paid so the definition of a long run and short-term capital positive factors is totally different from the shares listed on Indian inventory alternate like BSE and NSE.

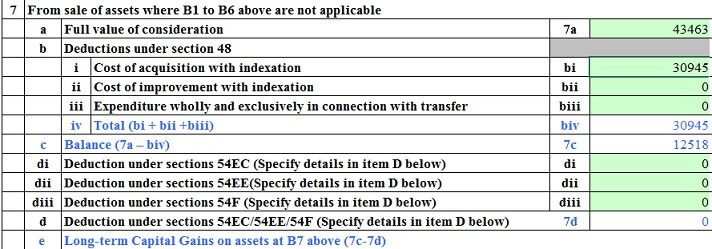

From FY 2016-17 i,e for the sale of unlisted shares on or after 1st April 2016 UNLISTED fairness shares is given beneath. This capital acquire should be declared in Schedule CG of ITR in order that tax could also be suitably charged

- short-term capital property – when offered inside 24 months of holding them. Quick-term positive factors are taxed at worker’s revenue tax slab charges

- long-term capital property – when offered after 24 months of holding them. Lengthy-term positive factors are taxed at 20% with indexation (so part 48 which makes use of Indexation applies)

The revenue tax Act in India act differentiates between the tax on capital positive factors of listed and unlisted shares.

- Listed shares are these which can be listed on Indian inventory exchanges, comparable to TCS, HDFC Financial institution, and so forth.

- Unlisted shares are these that aren’t listed on Indian exchanges, no matter whether or not they’re of Indian corporations or international corporations listed on international exchanges comparable to Google, Microsoft, Apple, and so forth.

The tax therapy on capital positive factors which can be unlisted in India or listed out of India is identical. So in the event you personal shares of an American firm, this firm shouldn’t be listed in India, therefore it’s thought-about unlisted for the aim of taxes in India.

The interval of holding begins from the vesting date as much as the date of sale

The desk beneath exhibits the instance of Quick Time period Capital Acquire and Lengthy-term Capital Acquire

| On the time of | Items | Date | FMV of share(USD) | Tax to be paid | In revenue tax return |

| Grant | 240 | 12-Dec-13 | Not Relevant | nil | Not Relevant |

| Vesting | 70 Vested

49 transferred |

12-Dec-14 | 17.89

1 USD = 62.90 Rs CII of 12 months 240 |

Tax of 30% taken by promoting 21 shares

Earnings Tax = 70 * 17.89* 62.90=78770 |

Perquiste Earnings as Earnings from Wage.

Taxed as per worker’s Earnings Tax Slab Price |

| Sale of shares if unlisted | 20 | 31-Jul-15 | 20.96

1 USD = 63.60 Rs |

Quick Time period Capital Acquire= 20* ((63.60*20.96)-(62.90* 17.89))= Rs 4,155.5 | Beneath Capital Features (brief time period capital positive factors)

Taxed as per Earnings Tax slab of worker |

| Sale of shares if unlisted | 25 | 31-Jan-17 | 25.89

1USD = 67.15 CII of the 12 months 264 |

Listed bought value = 62.90 * 264/240 = 69.19

Lengthy-Time period Capital Acquire with indexation= 25*((67.15 * 25.890)-(69.19* 17.89)) = =25* (1738.5135 -1237.8091) = 25*500.7044=12517.61 Lengthy-Time period Capital Acquire tax(with indexation) = 20% of 12517.61=2503.522 |

Beneath Capital Features (long run capital positive factors)

Lengthy-Time period Capital Acquire with out indexation= 25*((67.15 * 25.890)-(62.90* 17.89)) = 15330.8125 Lengthy-Time period Capital Acquire tax(with out indexation) = 20% of 15,330.8125=3066.1625 |

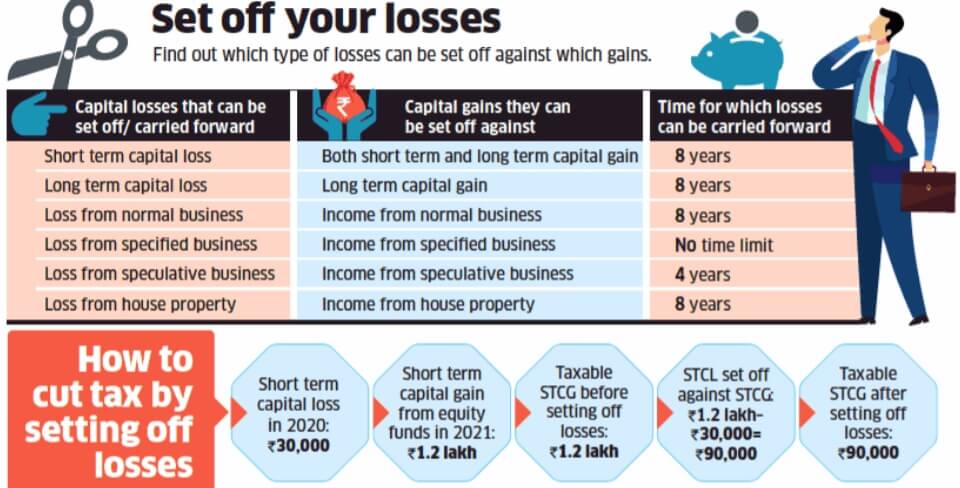

Capital Loss

What if there’s loss on promoting shares? Fortunately Earnings Tax Division provides advantage of Setting of Capital Loss.

Set-Off Losses means adjusting the loss towards the taxable revenue earned; after that, remaining the loss might be carried ahead to future years.

The taxpayer can’t carry ahead losses to future years if the revenue tax return for the 12 months by which loss is incurred shouldn’t be filed on the Earnings Tax Web site throughout the due date as per Sec 139(1).

If one has Quick time period capital loss, then it may be set off towards short-term or long-term capital acquire from any capital asset(actual property, gold, debt mutual funds).

If the loss shouldn’t be set off completely, then it may be carried ahead for a interval of 8 years and adjusted towards any short-term or long-term capital positive factors made throughout these 8 years. However provided that he has filed his revenue tax return throughout the due date.

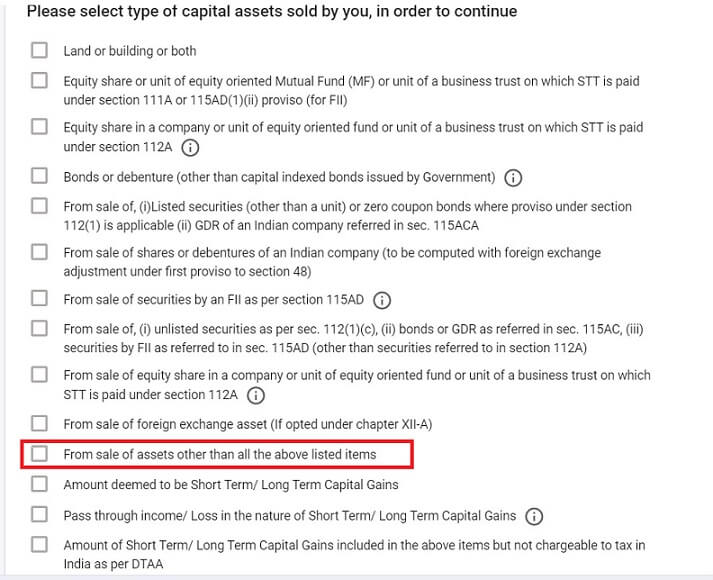

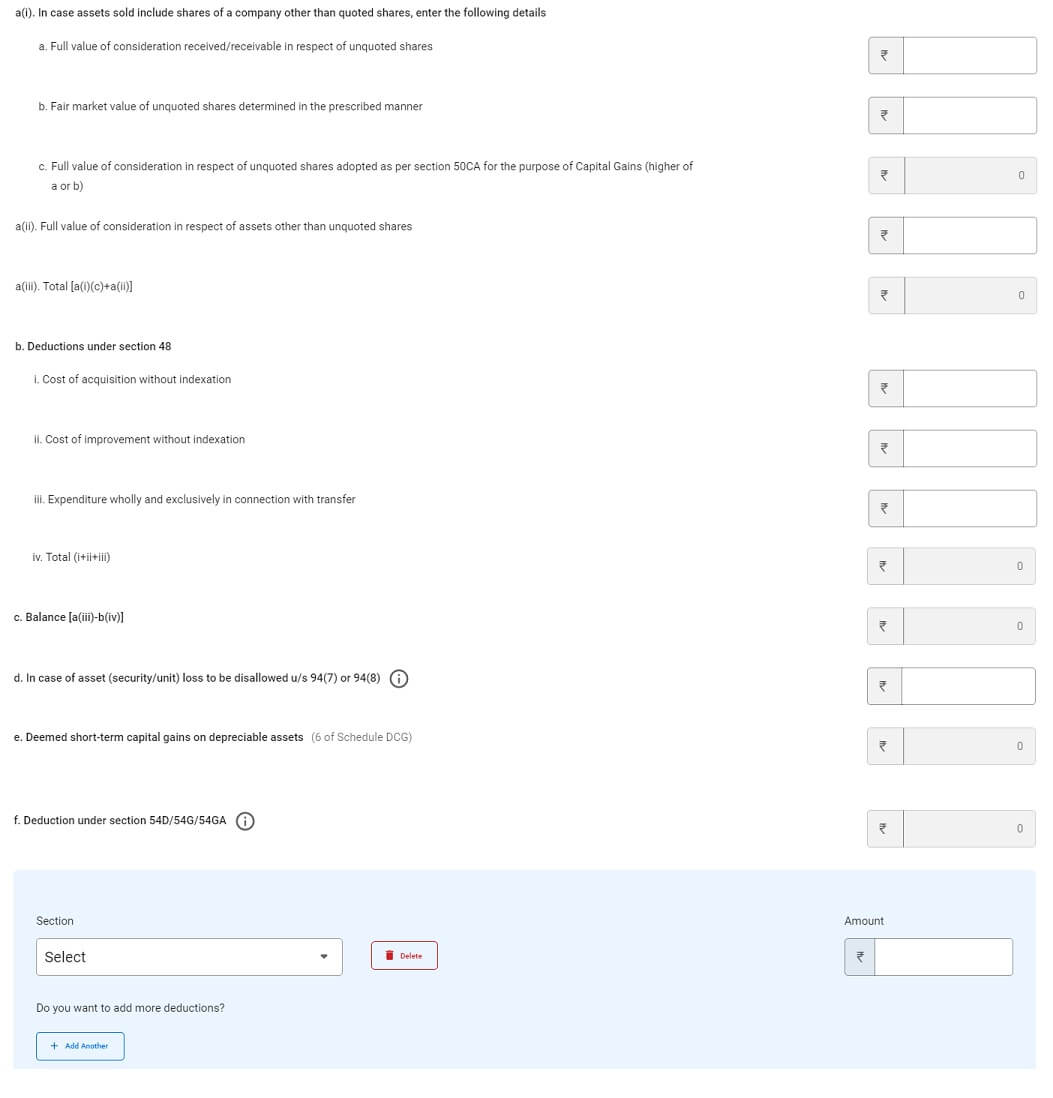

Displaying Capital Features in ITR

Half A of the Capital Features Schedule gives for computation of brief‐time period capital positive factors (STCG) from the sale of several types of capital property. Out of this, merchandise No. A3 and A4 are relevant just for non‐residents.

Half B of this Capital Features Schedule gives for the computation of lengthy‐time period capital positive factors (LTCG) from the sale of several types of capital property. Out of this, merchandise No. B5, B6, B7, and B8 are relevant just for non‐residents

Select the Schedule Capital Features

In Capital Acquire Schedule on the market of shares of MNC not listed on Indian Inventory Alternate select Sale of Belongings aside from listed. (along with every other capital acquire you’ll have)

Then Select Quick Time period Acquire/Lengthy Time period Acquire

- Quick Time period Acquire in the event you held shares for lower than 24 months

- Lengthy Time period Acquire in the event you held shares for greater than 24 months

The brand new ITR Utility exhibits the small print that should be crammed for Capital Features

Capital Features in Previous ITR

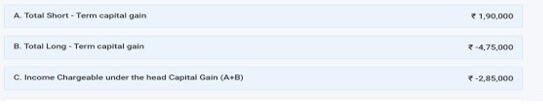

Setting of the Capital Loss

In case you have a capital loss then in abstract you’ll see the loss an instance of which is proven within the picture beneath. If there’s a Capital Loss, it could be mirrored as a adverse worth

Click on on Schedule CYLA (Present Yr Losses Changes). The small print entered in Capital Acquire Schedules will mirror in Set-Off/ Carry Ahead Schedules.

Observe: Set off & carry Ahead Schedules will fetch information from Capital acquire Schedule. The taxpayer needn’t enter the small print once more in these schedules.

Click on on Schedule CFL (Carry Ahead Losses)

The unadjusted losses of that monetary 12 months can be carried ahead.

Within the following years ITR you may modify your capital positive factors towards this loss and scale back your tax legal responsibility.

DTAA and RSU

Double taxation refers back to the scenario when a person is taxed greater than as soon as on the identical revenue, asset or monetary transaction.The Double Tax Avoidance Agreements (DTAA) is bilateral agreements entered into between two international locations, in our case, between India and one other international state. The fundamental goal is to keep away from, taxation of revenue in each the international locations (i.e. Double taxation of similar revenue) and to advertise and foster financial commerce and funding between the 2 international locations.

US MNCs with staff in India typically submit W-8BEN to US brokers to keep away from any withholding associated to US taxes. Nevertheless, the taxes and so forth are deducted for the workers in India. These are reported in perquisites kind. (as defined above). The picture beneath exhibits how one has to certify W-8BEN kind on ETrade for US. Extra particulars within the video right here.

If any tax is deducted in US then US IRS division will ship Kind much like Kind 16 to your tackle.

Advance Tax on Capital Acquire of RSU

Advance Tax guidelines require that one’s tax dues (estimated for the entire 12 months) should be paid prematurely. Advance tax is paid in installments. Whereas the employer deducts TDS when your RSUs get vested, one might must deposit advance tax if one earns capital positive factors.

Non-payment or delayed fee of advance tax leads to penal curiosity below sections 234B and 234C.

You might want to pay Advance Tax on RSUs solely once you promote the RSUs and the revenue is greater than 10,000 Rs. You might want to pay an acceptable share of it earlier than the closest due date. So in the event you offered between 16 June and 15 Sep it’s essential pay 45% earlier than 15 Sep.

| Due Date | Advance Tax Payable |

|---|---|

| On or earlier than fifteenth June | 15% of advance tax much less advance tax already paid |

| On or earlier than fifteenth September | 45% of advance tax much less advance tax already paid |

| On or earlier than fifteenth December | 75% of advance tax much less advance tax already paid |

| On or earlier than fifteenth March | 100% of advance tax much less advance tax already paid |

Nevertheless, it could be exhausting to estimate tax on capital positive factors and deposit advance tax within the first few installments if a sale happened later within the 12 months. Due to this fact when advance tax installments are being paid, no penal curiosity is charged the place installment is brief resulting from capital positive factors. Remaining installment (after the sale of shares) of advance tax each time due should embody the tax on capital positive factors.

Relying on the time length between the vesting date and the sale date, the revenue can both qualify for short-term or long-term capital positive factors tax. For RSUs, the acquisition date is the vesting date.

Our article Advance Tax:Particulars-What, How, Why is about Advance Tax for people.

Disclaimer: This info is for academic functions solely. We’ve got tried to supply the data to the most effective of our skill. However please seek the advice of your CA, tax marketing consultant. Bemoneyaware.com shouldn’t be answerable for any legal responsibility on info supplied on the positioning.

Associated Articles:

- Wage, Web Wage, Gross Wage, Price to Firm: What’s the distinction

- Wage, Allowances, Dearness Allowance, Authorities Wage, Pay Fee

- Understanding Variable Pay

- Understanding Kind 16: Half I

- How To Fill Wage Particulars in ITR2, ITR1

- HRA Exemption, Calculation, Tax, and Earnings Tax Return

- How are Dividends of Worldwide or International Shares taxed? Find out how to present in ITR

Hope this text helped in understanding What are RSUs? Why are RSUs given? What’s the vesting date? When are RSU taxed? Is there a capital acquire on promoting RSU? What’s the capital acquire from promoting RSU? Find out how to present these in ITR