When the chief of the world’s largest cash supervisor speaks, folks are likely to hear. It’s best to, too. In his 2020 letter to CEOs, BlackRock Chairman and CEO Larry Fink acknowledged that “we’re on the sting of a elementary reshaping of finance” attributable to local weather change. Fink, a fiduciary and steward of $7 trillion in belongings, feels that local weather danger is funding danger. Within the close to future, he says, there will likely be a profound reassessment of danger and asset values that can trigger a momentous reallocation of capital.

To account for this shift, BlackRock has determined to make sustainability the cornerstone of its funding course of, as Fink believes sustainable investing would be the strongest basis for shopper portfolios transferring ahead. That’s a robust assertion from a person whose main duty is to deploy capital in the very best curiosity of traders and shareholders.

Fink’s letter is a sport changer within the sustainability story. It’s now not about environmentalism; it’s about investing and a fiduciary obligation.

Simply Take a look at the Information

No matter the place you sit within the debate on the causes of local weather change, there’s one factor everybody ought to agree on: local weather change is occurring, and it’s going to have an effect on the funding of capital within the years forward.

On this context, the 2 main dangers to think about are excessive climate occasions (e.g., catastrophic hurricanes, fires, and floods) and rising world temperatures. Prior to now 40 years, the frequency of worldwide excessive climate occasions has elevated at a fast tempo (see chart under). Why? Common world temperatures have elevated 1.1 % (Celsius) since 1880, in keeping with McKinsey & Firm.

When common temperatures rise, the severity and frequency of acute and persistent hazards may even enhance, creating situations that will likely be felt bodily and monetarily. These situations embody results on infrastructure providers, actual property, and meals manufacturing, with apparent knock-on monetary results. It’s cheap to imagine that insurers, municipalities, and monetary intermediaries might want to view danger evaluation by a special lens transferring ahead—one which some traders haven’t but thought of.

Fink sheds gentle on this concept by asking readers the next:

“Will cities, for instance, have the ability to afford their infrastructure wants as local weather danger reshapes the marketplace for municipal bonds? What’s going to occur to the 30-year mortgage—a key constructing block of finance—if lenders can’t estimate the affect of local weather danger over such an extended timeline, and if there is no such thing as a viable marketplace for flood or hearth insurance coverage in impacted areas?”

Conventional valuation fashions based mostly off historic norms fall quick on this regard. Analysts and traders might want to think about extra, forward-thinking metrics past what’s extracted from revenue statements and stability sheets within the “new regular.” Qualitative parts just like the viability and sustainability of a agency’s operations, provide chain, and clients will play a bigger half as the results of local weather change take maintain in ever-increasing methods. Some traders are already beginning to see issues from this new perspective, as evidenced by latest flows.

The Tide Is Shifting

BlackRock’s announcement reset the deck in favor of a sustainable method, which comes at a time when the demand for sustainable funding options is stronger than ever.

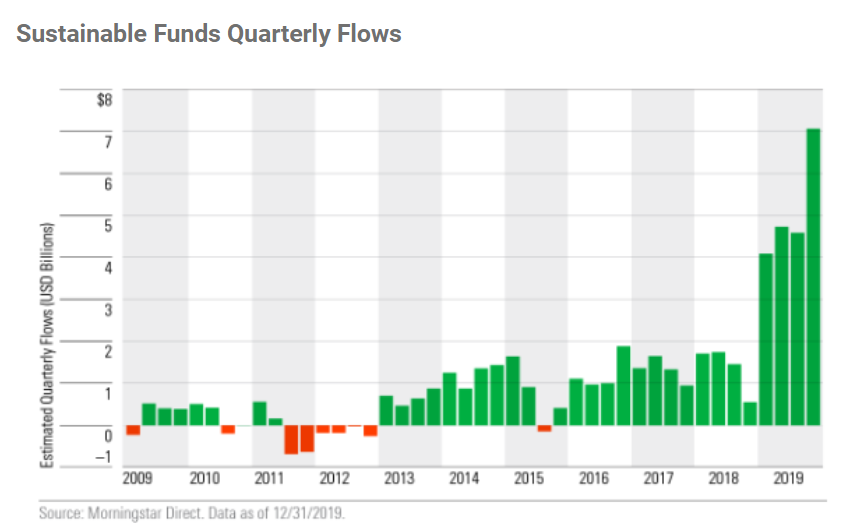

Morningstar lately launched its year-end move report. In it, Morningstar famous that U.S. traders poured $20.6 billion into sustainable funds in 2019, almost 4 occasions the earlier annual document in 2018 (see chart under). On a extra granular stage, a latest BlackRock ESG fund is nearing $2 billion in belongings—and it’s lower than a yr outdated!

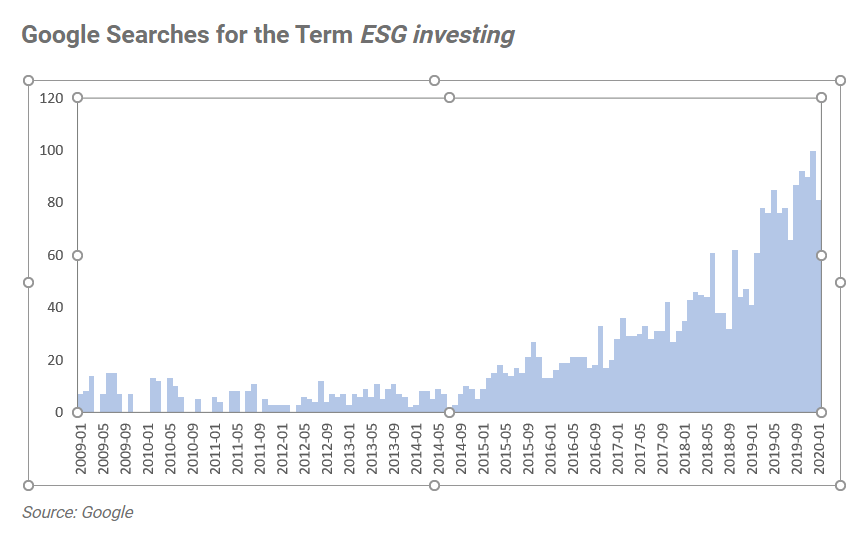

Additional affirmation of the curiosity within the area is obtainable by analytics in Google Traits, a platform that enables customers to realize perception into how explicit search phrases are trending. The variety of searches for the time period ESG investing has exploded over the previous few years, as evidenced by the chart under. People and traders are taking notice, and the trade is, too. As the actual implications of local weather change proceed to unfold, it’s cheap to imagine that these latest tendencies will solely proceed.

The Sustainability Premium

The shifting tide in belongings goes to have actual ramifications for the way corporations function and report within the years forward. As traders more and more scrutinize agency conduct from an ESG perspective, {dollars} will inevitably gravitate towards firms with sustainability on the core and excessive rankings. In reality, there could come a time once we hear the time period ESG premium, the place traders could be keen to pay the next value for top-ranked ESG firms in contrast with in any other case lower-ranked names in the identical trade (all else being equal).

This shift additionally helps clarify the latest development with S&P 500 firms. In line with the Governance & Accountability Institute, roughly 85 % of firms within the index now produce a sustainability report, up from lower than 20 % in 2011. Sustainability has overwhelmingly grow to be the norm in a really quick interval.

What Are Commonwealth’s Plans?

On the investing facet, there’s not a lot for us to do. Our Most popular Portfolio Providers® Choose SRI fashions had been incepted a decade in the past, and we’ve devoted a superb quantity of effort over that interval getting the sustainability phrase out. We’ve hosted shows at our annual Nationwide Convention, revealed articles, and proceed to teach our advisors and purchasers. The SRI fashions lately surpassed $200 million in belongings (as of December 31, 2019) on account of blossoming shopper curiosity in sustainability.

Along with the SRI mutual fund fashions, Commonwealth launched its ESG All-Cap SMA in 2019, which appears to be garnering numerous curiosity on account of rising ESG reputation. So, from an funding perspective, we’re positioned accordingly and have been for years.

On a firm-wide foundation, there’s extra to return from Commonwealth and ESG, which I will likely be writing about because the yr progresses. I’ve additionally been tasked with serving to Joni Youngwirth, our managing principal emeritus, to interrupt floor on an inner ESG initiative, one thing that I’m each honored to be part of and desperate to see come to fruition. We’re very a lot within the early levels, although good issues to return. Keep tuned!

Editor’s Word: The authentic model of this text appeared on the Impartial

Market Observer.