I’ve seen all kinds of estimates for the approaching wealth switch from child boomers to the following technology.

$16 trillion. $84 trillion. $124 trillion.

I suppose these numbers depend on a bevy of assumptions which is why they’re everywhere in the map.

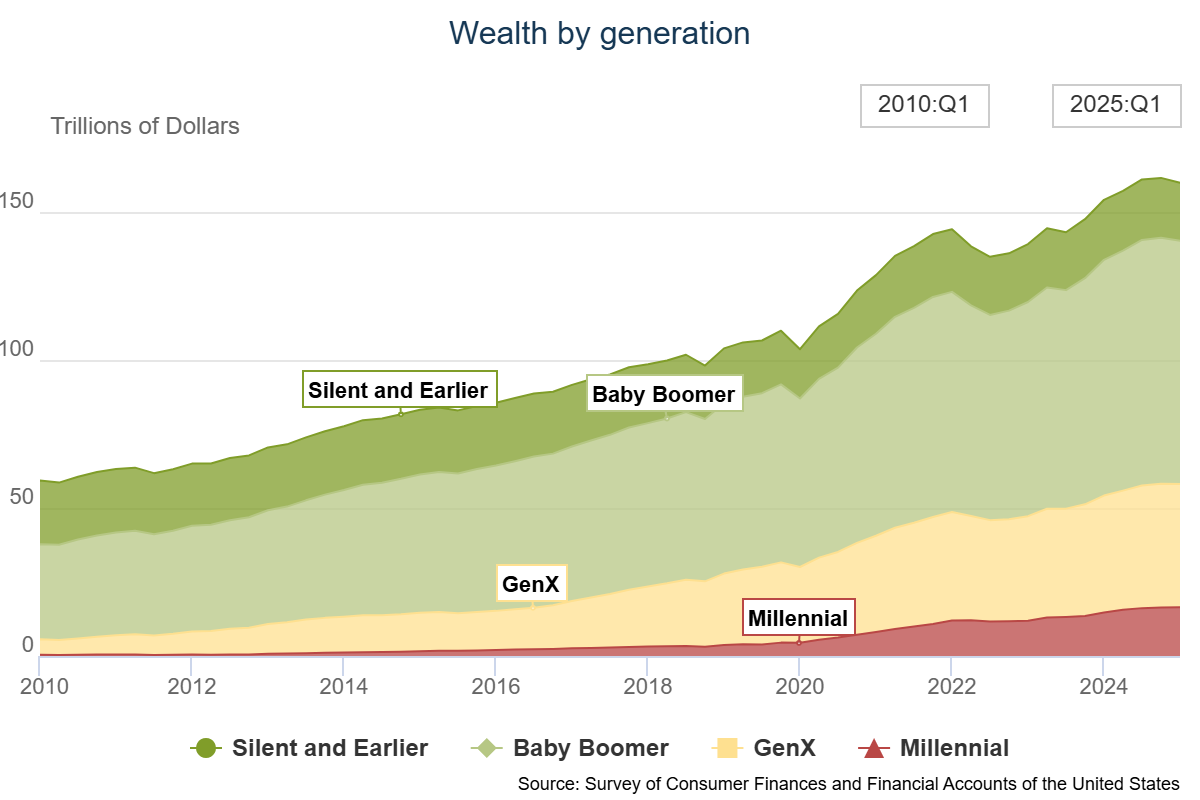

Regardless of the precise quantity is sooner or later, proper now the child boomer technology is price greater than $82 trillion:

A few of that cash shall be spent however a lot of will probably be handed down.

There are quite a few speaking factors about The Nice Wealth Switch.

How will it affect the housing market? Will child boomers give away a few of their cash to the youthful technology now? What does it imply for the inventory market? What are the tax implications? How will it form wealth inequality?

Right here’s the one a part of this dialog we’re not likely concerning — The Nice Wealth Switch requires that the child boomer technology dies off. Demise and taxes, proper?

These are individuals’s dad and mom, grandparents, aunts, uncles and buddies.

When that cash passes it’s not only a line merchandise on a spreadsheet. There’s an emotional element to it as nicely. The cash, homes and different objects that get handed down can have that means concerned.

Prior to now month Ozzy Osbourne and Hulk Hogan handed away. They have been each of their 70s.

It’s morbid to consider however with 70+ million child boomers there are going to be quite a lot of deaths within the years forward of individuals you recognize personally or know of in another capability. The median age of child boomers is round 70 years previous.1

I’ve been fascinated about demise lots this 12 months after my brother Jon handed away. It pressured my household to have plenty of troublesome and uncomfortable conversations.

Plenty of households are going to be pressured into related talks within the years forward.

Monetary advisors usually play a task within the cash facet of the equation when somebody dies as nicely.

There’s a ton of paperwork and selections that should be made. That course of turns into far more difficult if issues aren’t specified by advance.

I’ve heard horror tales of monetary advisors attempting to reap the benefits of individuals after a member of the family handed away. I’ve additionally seen firsthand how useful an excellent monetary advisor could be to somebody who’s coping with the lack of a liked one by making monetary selections and duties simpler.

That requires having some uncomfortable conversations so everybody’s on the identical web page.

Carl Richards has at all times been one among my favourite voices in the case of simplifying the monetary planning course of. He’s additionally a grasp at getting individuals to speak in regards to the essential stuff.

I wasn’t planning on getting too deep into the subject of demise and cash however Carl acquired me to open up.

We talked about the way to have uncomfortable conversations along with your monetary advisor or family members too:

We additionally touched on the largest worries monetary advisors have proper now, the shrinking habits hole, creating genuine content material, the way to spend your cash appropriately, Carl’s greatest cash mistake and extra.

Subscribe right here so that you by no means miss an episode.

In case you’re an advisor, subscribe to our publication at The Unlock the place we’re speaking about all issues wealth administration.

Additional viewing:

Give your youngsters the cash now!

1The infant boomer technology is often outlined as being born between 1946 and 1964.

This content material, which comprises security-related opinions and/or data, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There could be no ensures or assurances that the views expressed right here shall be relevant for any specific information or circumstances, and shouldn’t be relied upon in any method. You need to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital property, or efficiency information, are for illustrative functions solely and don’t represent an funding suggestion or provide to offer funding advisory providers. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency will not be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from varied entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or indicate endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.