Hey, simply again after taking the redeye house from Futureproof Colorado, and getting my toes again beneath me. However I needed to briefly talk about tomorrow’s launch of the College of Michigan (UMich) long-term inflation expectations.

You most likely know my ideas on each Inflation Expectations and Sentiment Surveys.

ICYMI, Inflation Expectations are a backwards trying train within the Recency Impact. However even worse, they usually lag precise inflation by 6-12 months. As i defined in 2023:

“Jerome Powell and the Federal Reserve spend loads of time worrying about Inflation Expectations. They shouldn’t. Usually, Sentiment Surveys are ineffective — more often than not — the exception being on uncommon events on the extremes.

They aren’t merely lagging, backward-looking indicators, however as an alternative, inform us as to what the general public was experiencing about 3-6 months in the past. Sometimes, it takes individuals a number of weeks or months to subconsciously incorporate broad, delicate adjustments into their inside psychological fashions, and longer to consciously acknowledge these nuanced shifts.”

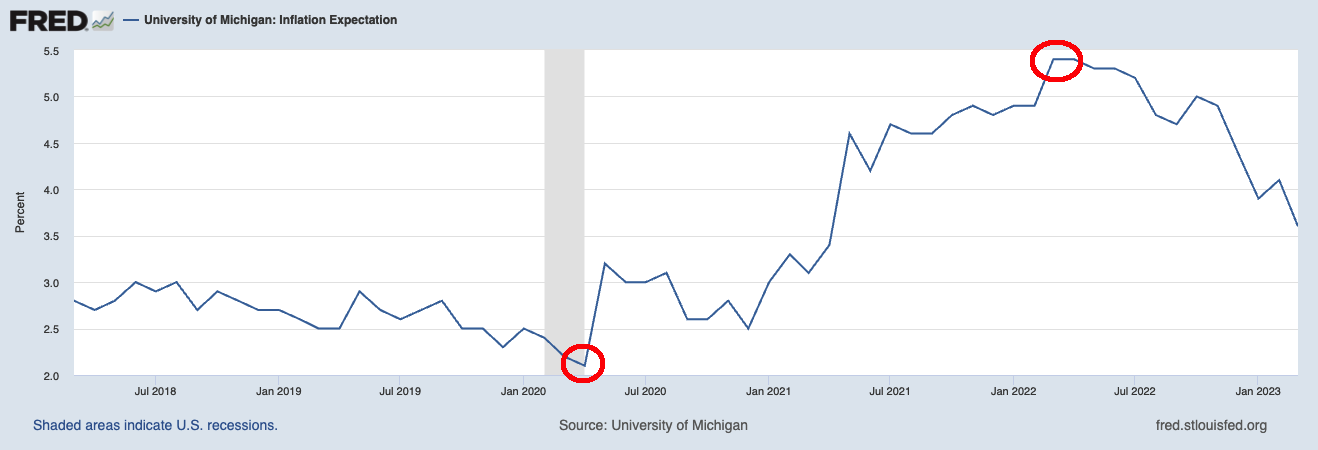

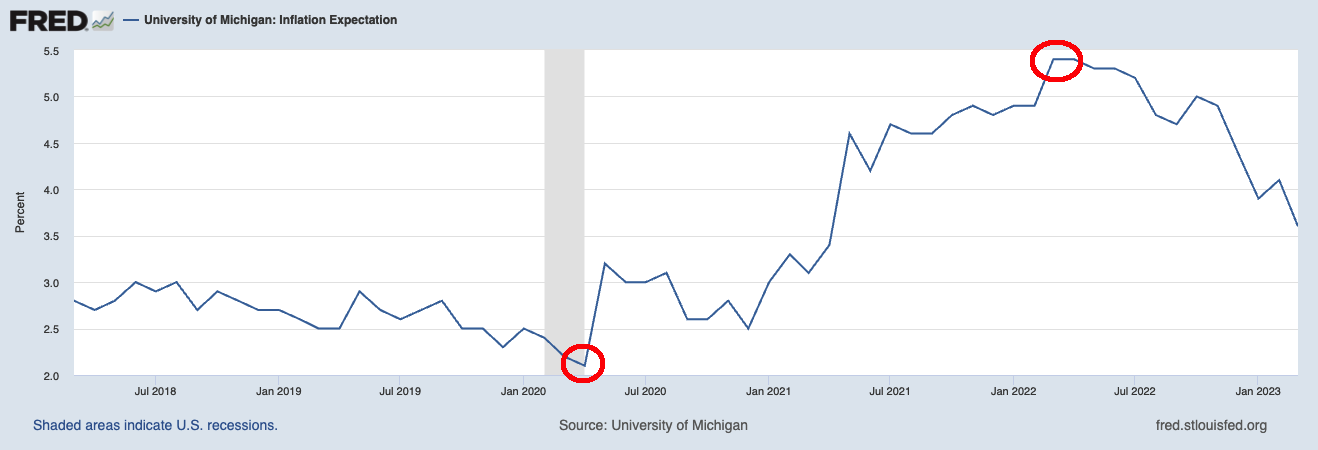

The chart provides all the story away:

Future inflation expectations have been at their aboslute nadir simply earlier than the largest inflation spike in many years occurred. And when future inflation expectations have been at their highest ranges? We have been about to begin a 12 month collapse in CPI/PCE inflation measures.

So, largely ineffective — at the least as a predictor of long term inflation charges. However they’re nice at telling you what the inflation of the previous 6 months was.

As to basic sentiment surveys, properly the chart at high displaying political bias ought to make you notice how flimsy that is as a measure. Particularly when customers say one factor, however then do the precise reverse with their cash.

The chart at high is from Financial institution of America; right here is their take:

The UMich survey reveals substantial divergence by political affiliation (Exhibit 1). Lengthy-term inflation expectations have surged amongst Democrats and Independents, to five.1% and 4.4%, respectively, in latest months. Nonetheless, expectations have cratered to 1.5% amongst Republicans. This stark divergence has led some analysts to dismiss the UMich survey, arguing that the outcomes are being pushed by political preferences reasonably than an precise evaluation of inflation dynamics.

All the above is earlier than we get to points prevalent in each mainstream and algorthmic social media.

My honest want is that economists typically, and the FOMC specifically, put much less emphasis on customers’ inflation expectations when deciding upon financial coverage.

Replace: Might 16, 2025

Barron’s: “Client sentiment hits second-lowest studying on report”

The most recent College of Michigan survey launched Friday confirmed sentiment hit its second-lowest studying on report. The index slid to a studying of fifty.8, under the 52.2 seen final month and the 53.4 anticipated by economists. The studying was simply shy of the all-time low of fifty seen in June 2022.

Beforehand:

What Else Is perhaps Driving Sentiment? (October 19, 2023)

Extra Sentiment Nonsense (July 28, 2023)

Extra Inflation Expectations Silliness (July 5, 2023)

Is Partisanship Driving Client Sentiment? (August 9, 2022)

The Bother with Client Sentiment (July 8, 2022)

Sentiment LOL (Might 17, 2022)

Sentiment versus Spending (April 18, 2022)