Right here’s a loopy stat from Bloomberg:

Half of American households account for 97.5% of the wealth on this nation.

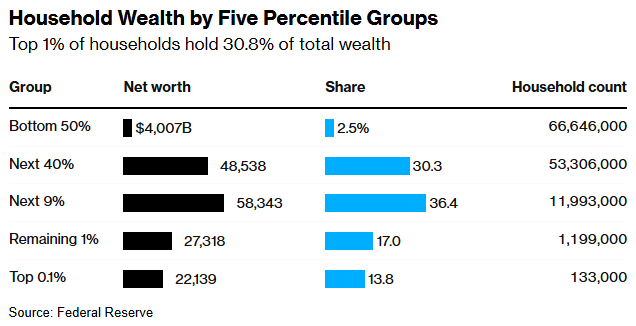

That is the breakdown from Federal Reserve information:

On the one hand these numbers — 2.5% of wealth — appear nearly inconceivable for the underside 50%.

Alternatively, that is an enchancment from the final decade.

It was a lot worse popping out of the Nice Monetary Disaster. In 2011, the highest 50% managed 99.6% of the wealth, whereas the underside 50% accounted for simply 0.4%.1

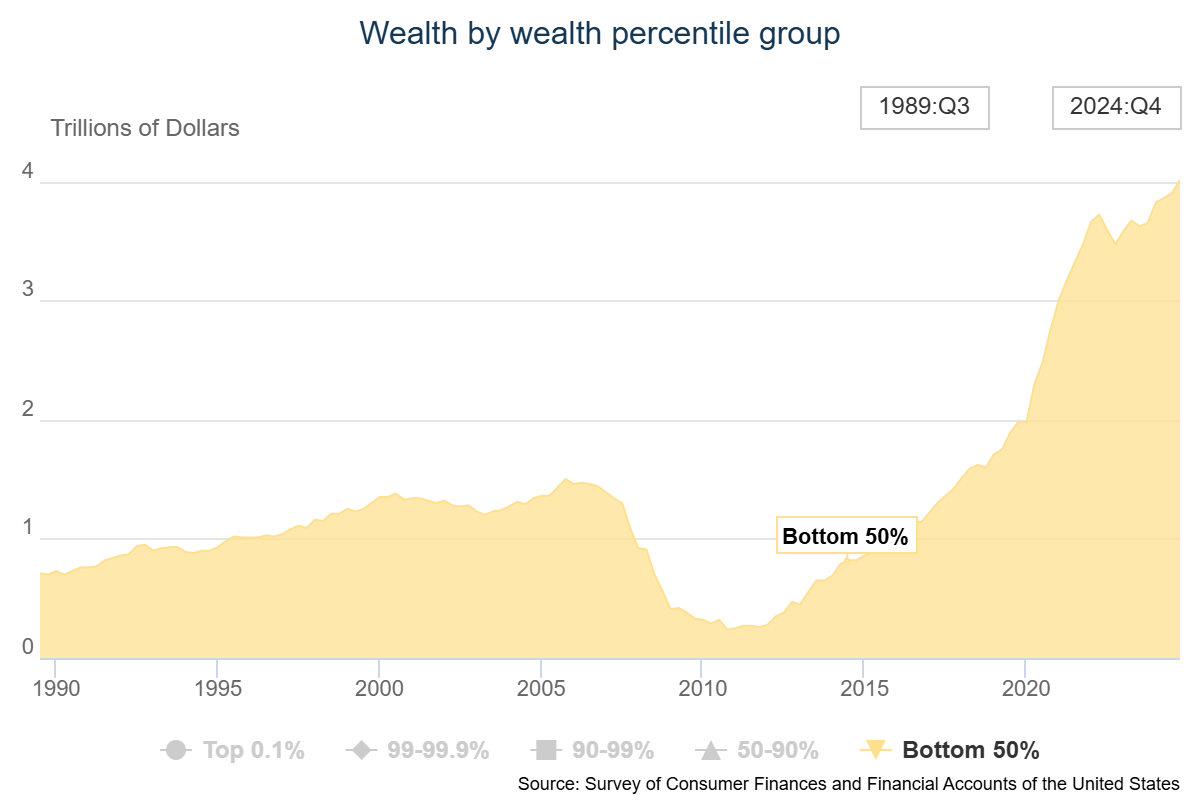

The pandemic noticed a large improve within the wealth of the underside 50%:

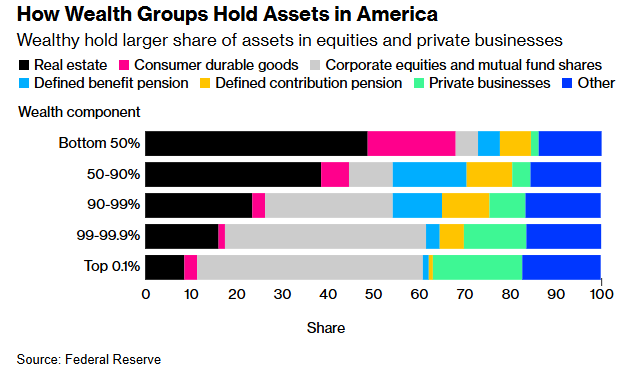

Rising dwelling values have helped since housing makes up nearly all of monetary property for the underside 50%:

Roughly half of all wealth for the underside 50% resides of their dwelling whereas simply 5% is in shares. These numbers for the highest 10% are 19% and 36%, respectively.

Family funds are in a wierd place. The wealthy are getting richer, however everybody else is getting richer, too, simply at a slower tempo usually.

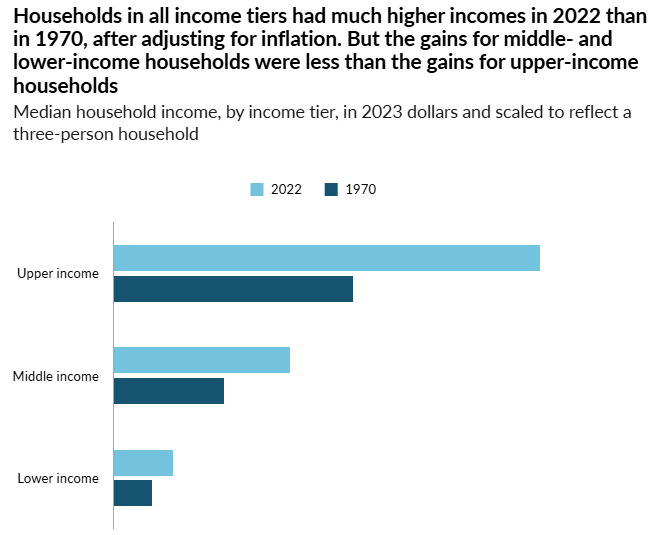

Pew Analysis exhibits higher earnings households have seen their incomes develop a lot sooner than center and decrease earnings households since 1970:

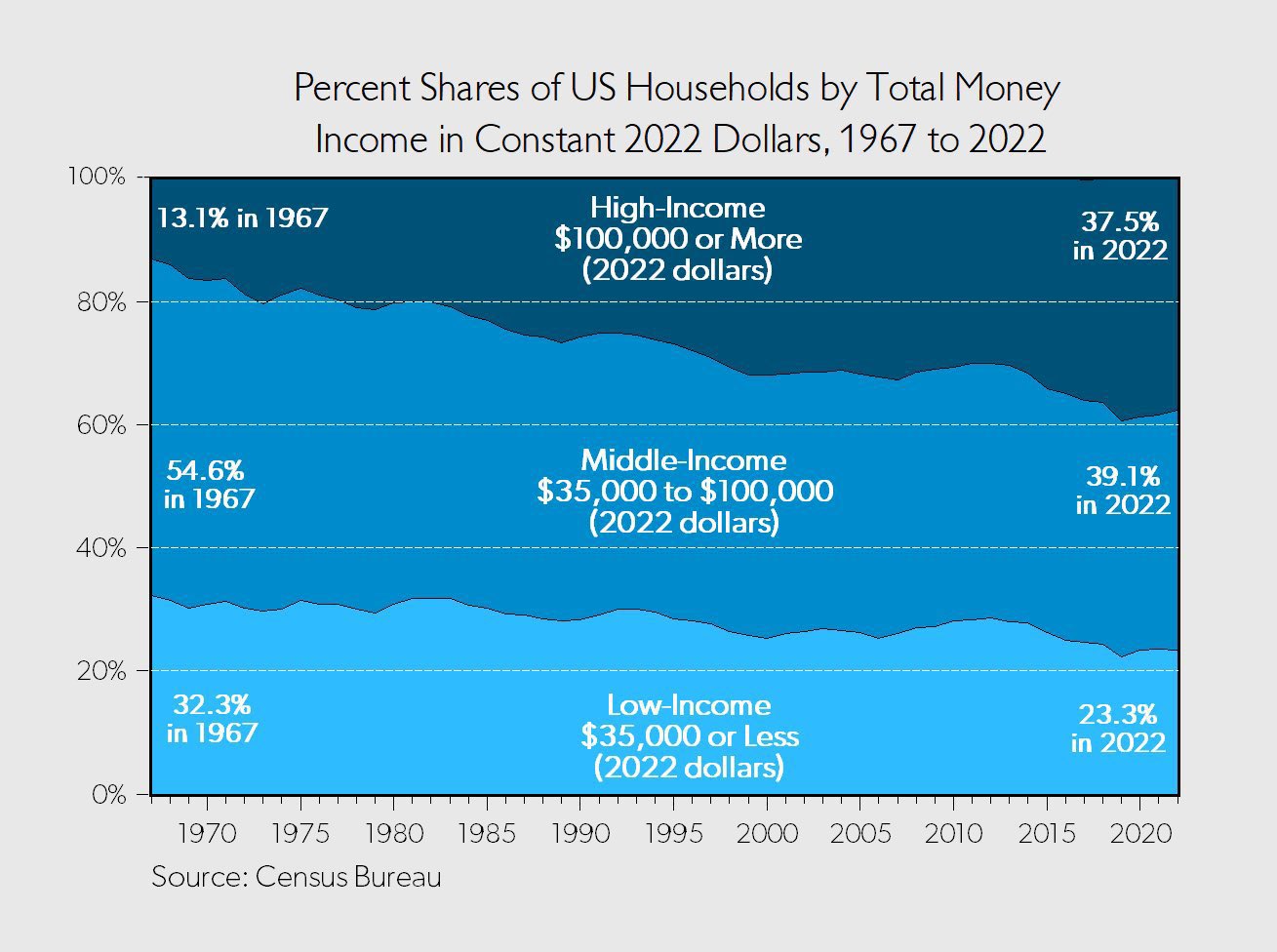

Take a look at this chart from Chris Freiman on the shrinking center class:

The center class is shrinking as a result of extra individuals are shifting into the higher class.2 It is a good factor but it surely doesn’t make the individuals on the skin trying in really feel any higher about their station in life.

You will need to acknowledge that the individuals who make up these completely different earnings and wealth buckets are continually altering over time.

I wrote about this in Don’t Fall For It:

Analysis exhibits over 50% of Individuals will discover themselves within the prime 10% of earners for no less than one yr of their lives. Greater than 11% will discover themselves within the prime 1% of income-earners sooner or later. And near 99% of those that make it into the highest 1% of earners will discover themselves on the skin trying in inside a decade.

An identical dynamic is at play with regards to internet price. It’s not static.

I used to be within the backside 50% for years after I graduated faculty. I had pupil loans and a automobile mortgage. I didn’t make a lot, so I didn’t save a lot. My internet price was destructive till my late 20s.

I don’t know what the proper stage of family wealth distribution ought to appear to be. I sympathize with the concept that our system ought to reward risk-taking however we also needs to attempt to raise up as many individuals as attainable.

I’m undecided there’s a stability that might ever make everybody completely satisfied.

The vital factor is to get to a spot the place you’re pleased with what you’ve.

Simpler mentioned than executed.

Additional Studying:

The Wealth Impact

1The best share for the underside 50% was 4% of whole wealth within the Nineties.

2I do know some individuals will quibble along with his definitions of higher, center and decrease class however the level is these numbers are inflation-adjusted over time.

This content material, which incorporates security-related opinions and/or data, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There will be no ensures or assurances that the views expressed right here will likely be relevant for any specific details or circumstances, and shouldn’t be relied upon in any method. You need to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital property, or efficiency information, are for illustrative functions solely and don’t represent an funding suggestion or provide to supply funding advisory providers. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding resolution. Previous efficiency will not be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from numerous entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or indicate endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the chance of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.