One of the crucial essential issues to know once you apply for a bank card is which credit score bureau the financial institution makes use of to tug your credit score report.

Your credit score report is an in depth file of your credit score historical past that may decide whether or not or not you might be accepted for a brand new line of credit score, reminiscent of a bank card.

Within the U.S., there are three main credit score bureaus — also referred to as credit score reporting businesses — that banks and bank card firms pays to entry your credit score report: Equifax, Experian and TransUnion.

Associated: Easy methods to verify your credit score rating totally free

The credit score reporting company (CRA) utilized by a card issuer to see your credit score report can decide whether or not your software is accepted or denied, particularly once you apply for varied playing cards in a brief time frame. If a number of card issuers pull from the identical credit score reporting company, it may have an effect on your probabilities of being accepted.

Nevertheless, if card issuers go to completely different credit score bureaus to purchase your experiences, one issuer won’t see that you just’re making use of for a brand new account elsewhere. In consequence, your probabilities of being accepted for a number of playing cards ought to enhance.

A number of credit score purposes might cut back your rating, so it is essential to know what you are stepping into earlier than you determine to use for a number of playing cards without delay.

Earlier than you apply for a brand new line of credit score

Understanding the place your credit score stands earlier than making use of for any sort of latest credit score is important. Make sure that to verify your credit score rating and experiences earlier than you fill out a brand new software.

Test your credit score report

Your credit score report is a file of your credit score exercise, together with your fee historical past, excellent money owed and credit score inquiries. Understanding your credit score well being provides you a greater concept of how your software might look to potential bank card issuers. Fortuitously, checking your three credit score experiences is straightforward.

Each day Publication

Reward your inbox with the TPG Each day publication

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

You’ll be able to request a free report from Equifax, TransUnion and Experian as soon as each 12 months on-line at AnnualCreditReport.com.

Associated: Easy methods to right errors in your credit score report

Test your credit score rating

Whereas your credit score report paints an in depth image of your credit score historical past, it doesn’t usually embrace your present credit score rating, so you will need to verify that too.

Checking your credit score rating, nonetheless, could be a bit extra complicated. As a substitute of simply three scores — one for every of your credit score experiences — there are tons of of commercially accessible credit score scores, and a few lenders even use their very own customized fashions. This implies there are millions of potential credit score rating variations.

The 2 most generally used credit score rating fashions within the U.S. are FICO and VantageScore. VantageScore, created by the three main credit score bureaus, has been gaining in reputation since its launch in 2006.

Nevertheless, FICO stays the business commonplace, with 90% of lenders counting on it for credit score choices. Many banks supply free FICO scores to cardholders as a useful perk.

What’s a FICO rating?

Your FICO rating is a quantity between 300 and 850 based mostly on the data in your credit score report.

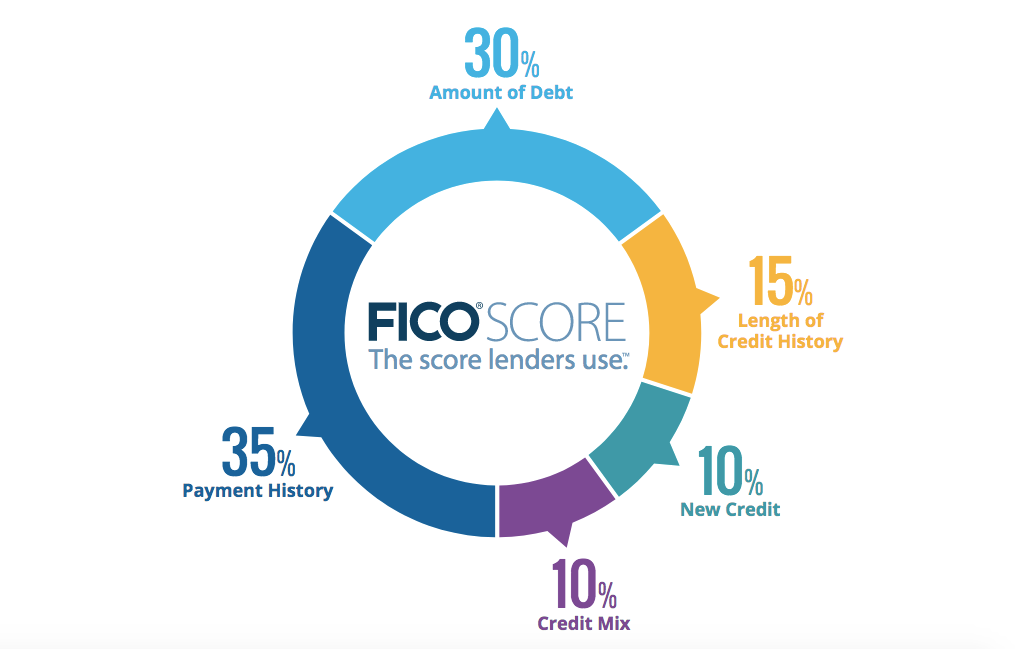

FICO scores are calculated utilizing many various items of credit score knowledge in your credit score report. This knowledge is grouped into 5 classes: fee historical past (35%), quantities owed (30%), size of credit score historical past (15%), new credit score (10%) and credit score combine (10%).

Lenders use this rating to evaluate your creditworthiness — the upper your rating, the higher your probabilities of getting accepted for bank cards and different loans.

In accordance with FICO, a “good” credit score rating falls between 670 and 739, whereas a rating of 740-799 is taken into account “excellent” and 800+ is taken into account “distinctive.” Nevertheless, chasing an ideal 850 rating is not obligatory. Usually, bank card issuers do not differentiate a lot between scores above 720, so a robust rating on this vary is often sufficient to safe one of the best presents.

Which credit score bureaus do banks verify — and why does it matter?

If you apply for a bank card, the issuer contacts a credit score bureau (or a number of) to buy a duplicate of your credit score report. Included in your report are the 5 classes talked about above.

Associated: What is an efficient credit score rating?

You may discover one credit score report class, which counts for 10% of your rating, known as “new credit score.” When you have too many credit score purposes opened inside a brief time frame, it could have an effect on your credit score rating negatively.

Think about the next state of affairs: You have stuffed out a number of purposes for brand new credit score (assume loans or bank cards) within the final 12 months. These purposes present up in your credit score experiences as “exhausting inquiries” and will doubtlessly harm your credit score rating.

You then determine to apply for an additional new bank card. Along with your rating doubtlessly taking successful, you would possibly expertise one other highway block.

The financial institution processing your software is perhaps involved about why you are making use of for a lot new credit score in a brief time frame. In consequence, there’s an opportunity you would be turned down for a bank card even when your credit score rating is in fine condition.

Understanding which credit score reporting company card issuers use to tug experiences would possibly enable you keep away from this downside. With this data in hand, you’ll be able to time your purposes (or bundle them, because the case could also be) in such a method that you just enhance your approval odds for the bank cards you need.

Associated: 5 issues to verify earlier than making use of on your subsequent bank card

Many bank card firms are likely to depend on one bureau once they course of bank card purposes. The credit score bureau they use to purchase experiences, nonetheless, might differ relying on the state you reside in and the precise bank card you need.

Listed below are the credit score bureaus generally utilized by three widespread issuers:

- Citi makes use of all three credit score bureaus, however normally pulls credit score experiences from Equifax or Experian.

- American Specific makes use of all three credit score bureaus however primarily pulls experiences from Experian, although typically Equifax or TransUnion as nicely.

- Chase makes use of all three credit score bureaus however favors Experian, but can also purchase Equifax or TransUnion experiences.

Nevertheless, take into account that you’ll be able to by no means know for positive which credit score bureau a bank card firm will use.

Backside line

Your credit score report is a key a part of your monetary profile that may have a notable influence in your creditworthiness. By understanding which credit score reporting company banks use to evaluation your credit score, you might be able to enhance approval odds on your subsequent bank card software.

Associated: 4 widespread credit score rating myths