Are you questioning if ProjectionLab is the most effective instrument that can assist you plan for retirement and your different monetary targets? This ProjectionLab Overview will break down what you could know. On the subject of managing my cash, I really like utilizing instruments that assist me really feel in management. I’ve tried many apps through the years,…

Are you questioning if ProjectionLab is the most effective instrument that can assist you plan for retirement and your different monetary targets? This ProjectionLab Overview will break down what you could know.

On the subject of managing my cash, I really like utilizing instruments that assist me really feel in management. I’ve tried many apps through the years, however generally you need one thing that goes deeper than a funds tracker. That’s why I made a decision to check out ProjectionLab.

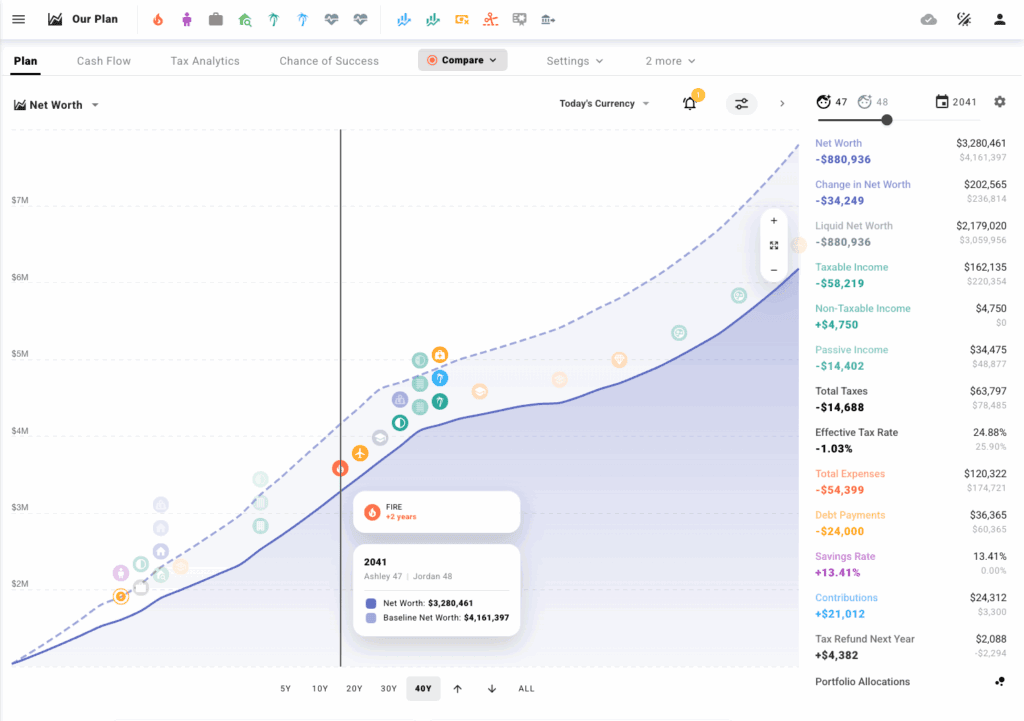

ProjectionLab is a robust instrument that permits you to map out your monetary future – all the best way from this 12 months to the subsequent 50+ years. If you happen to prefer to plan for retirement, large purchases, or simply wish to see “what-if” situations, you would possibly love this instrument too.

As somebody who’s excited by planning for retirement (and early retirement or FI aka monetary independence), I actually loved utilizing ProjectionLab and enjoying round with the completely different options and seeing my retirement plan all specified by entrance of me.

You possibly can attempt ProjectionLab without spending a dime by clicking right here.

ProjectionLab Overview

On this ProjectionLab evaluation, I’m going to stroll you thru what it’s, the way it works, who it’s for, and the way a lot it prices.

What’s ProjectionLab?

ProjectionLab is a monetary planning instrument and calculator. It’s not a every day funds app – it’s designed for big-picture planning, like planning for early retirement.

ProjectionLab will help you:

- See your retirement plan’s likelihood of success.

- Map out your revenue, bills, financial savings, and investments for the long run.

- Plan for giant life adjustments like early retirement, a sabbatical, shopping for a home, or transferring.

- Run “what-if” situations to see how completely different decisions have an effect on your cash.

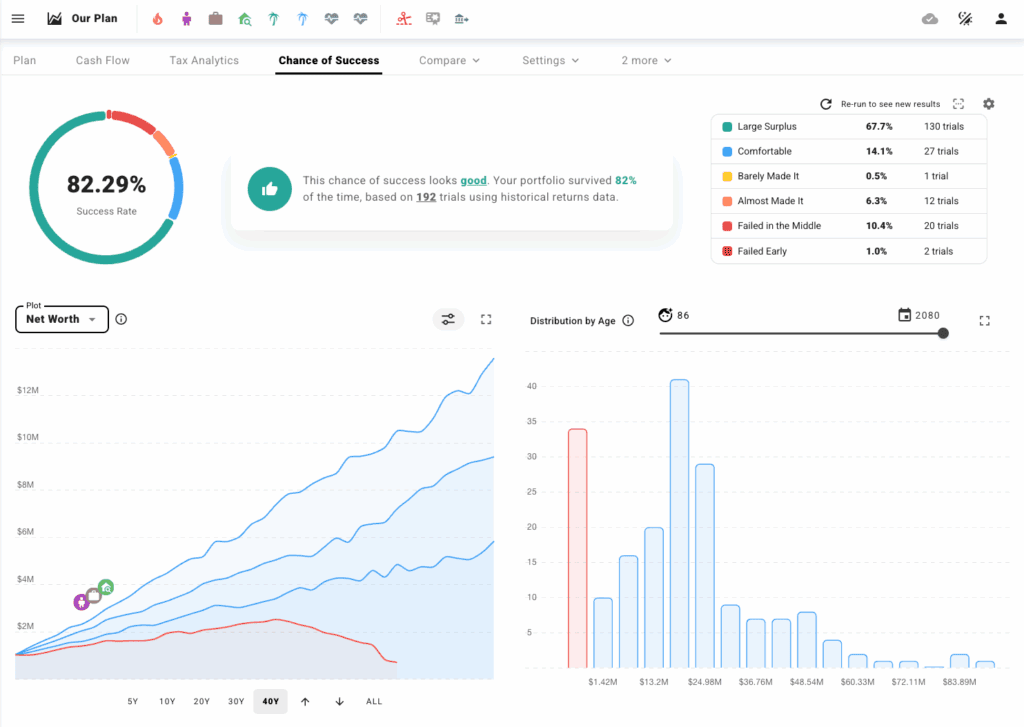

- Use Monte Carlo simulations to check best- and worst-case outcomes.

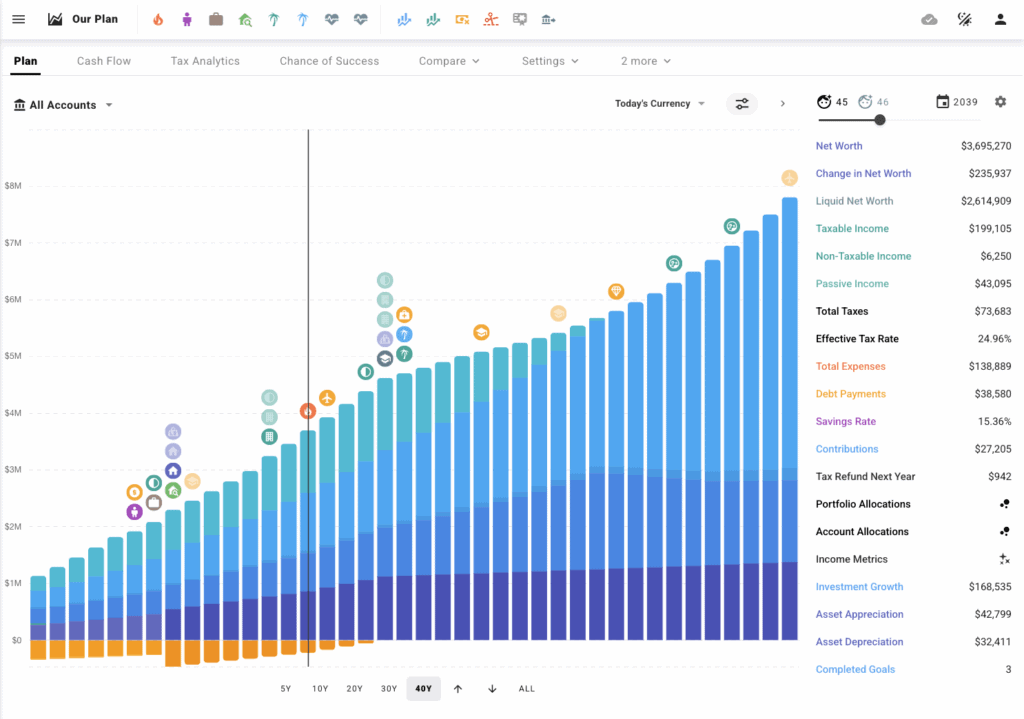

- Observe your future money circulate and web price in easy-to-read charts.

- Stress-test your monetary plan so you are feeling extra ready and assured.

- Do all of it whereas maintaining your knowledge personal as a result of there is no such thing as a pressured account linking.

What makes ProjectionLab stand out is that it’s privacy-first. You don’t should hyperlink your monetary accounts in case you don’t wish to. As an alternative, you enter your revenue, bills, money owed, belongings, and targets manually. It’s unbiased and run by a small crew, which implies they don’t promote your knowledge.

How ProjectionLab works

Establishing your plan can take a while at first, but it surely’s price it, and I discovered it fairly simple to do. Right here’s what you do:

- Join a free ProjectionLab account by clicking right here.

- Add all of your revenue streams, similar to your wage, aspect hustles, rental revenue, and anything.

- Enter your bills, money owed, pupil loans, and financial savings targets.

- Construct situations on your monetary targets like shopping for a house, retiring early, or taking a 12 months off.

- Use their Monte Carlo simulations to run hundreds of attainable outcomes, so that you see what would possibly occur in good years and dangerous.

- See how taxes would possibly have an effect on your plan with their tax analytics.

All the pieces is specified by easy-to-read charts, graphs, and cash-flow fashions. You possibly can tweak your assumptions anytime.

Under is their Getting Began video, and I discovered this actually useful:

ProjectionLab Options I Like

Considered one of my favourite issues about ProjectionLab is what number of superior instruments it provides you – multi function place. Right here’s a more in-depth have a look at a few of the major options and why I feel they stand out.

1. A free choice to get began

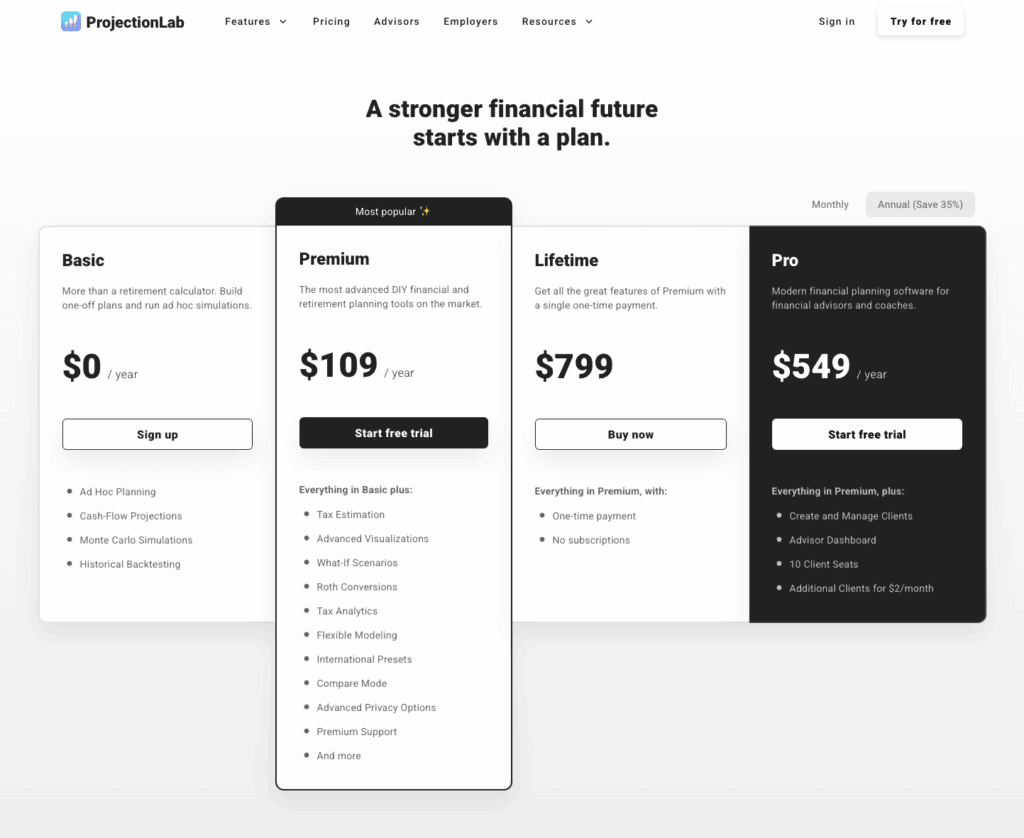

One factor I actually like about ProjectionLab is that they really have a primary free model. It’s not only a teaser – you possibly can construct one-off plans, check your concepts with Monte Carlo simulations, run cash-flow projections, and even do historic backtesting with out paying something upfront.

In fact, if you wish to save and revisit your plans later, or unlock extra superior instruments like detailed tax analytics and customized situations, you’ll want the Premium plan. However I feel it’s nice that they allow you to attempt the primary options for $0 per 12 months to see in case you prefer it first.

This makes it really feel much less intimidating to get began – you possibly can mess around, study the way it works, and resolve later if you wish to improve.

2. Monte Carlo simulations

That is most likely ProjectionLab’s hottest function. If you happen to’ve ever anxious about what occurs when the inventory market goes up and down, this instrument is for you.

Monte Carlo simulations run hundreds of attainable situations on your retirement plan. You possibly can see best-case, worst-case, and common outcomes – all specified by easy-to-read charts.

Personally, I like that it helps me really feel ready for various market situations as a substitute of simply hoping for the most effective. It’s a easy technique to stress-test your plan with no need a level in statistics.

Word: Individuals generally take “likelihood of success” too actually and assume they should hit 100%. However an 85% success charge doesn’t imply there’s a 15% likelihood of failure. It simply implies that in 15% of situations, you would possibly have to be versatile … spend a bit much less, earn some part-time revenue, or alter your plan for a short while. That flexibility is usually what makes a plan not fail.

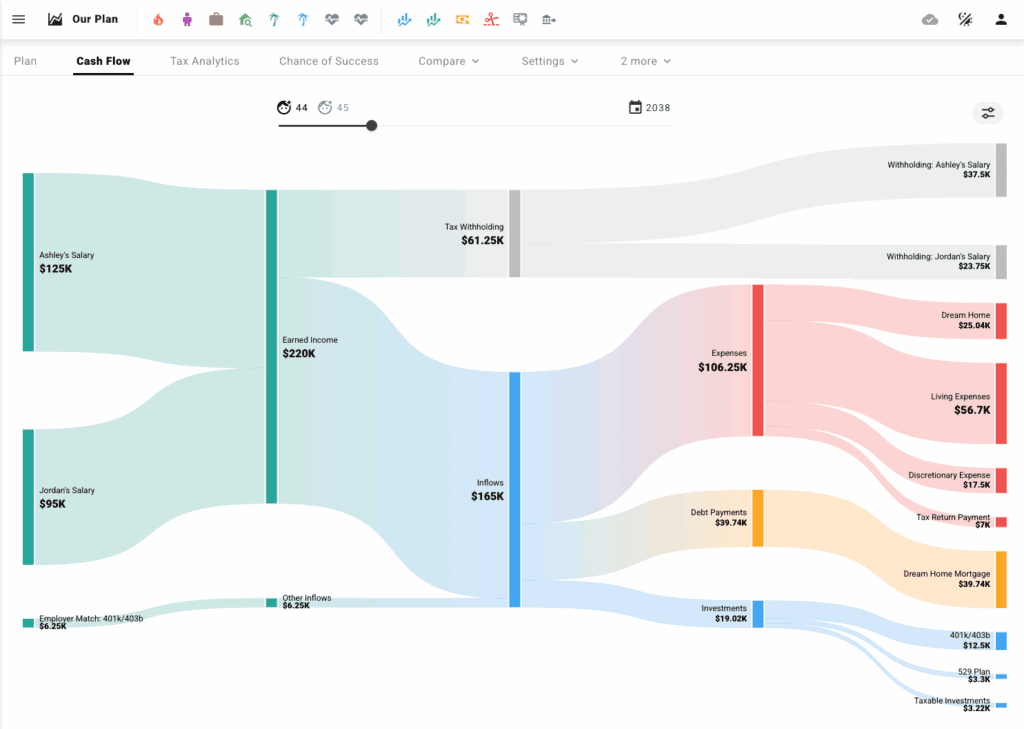

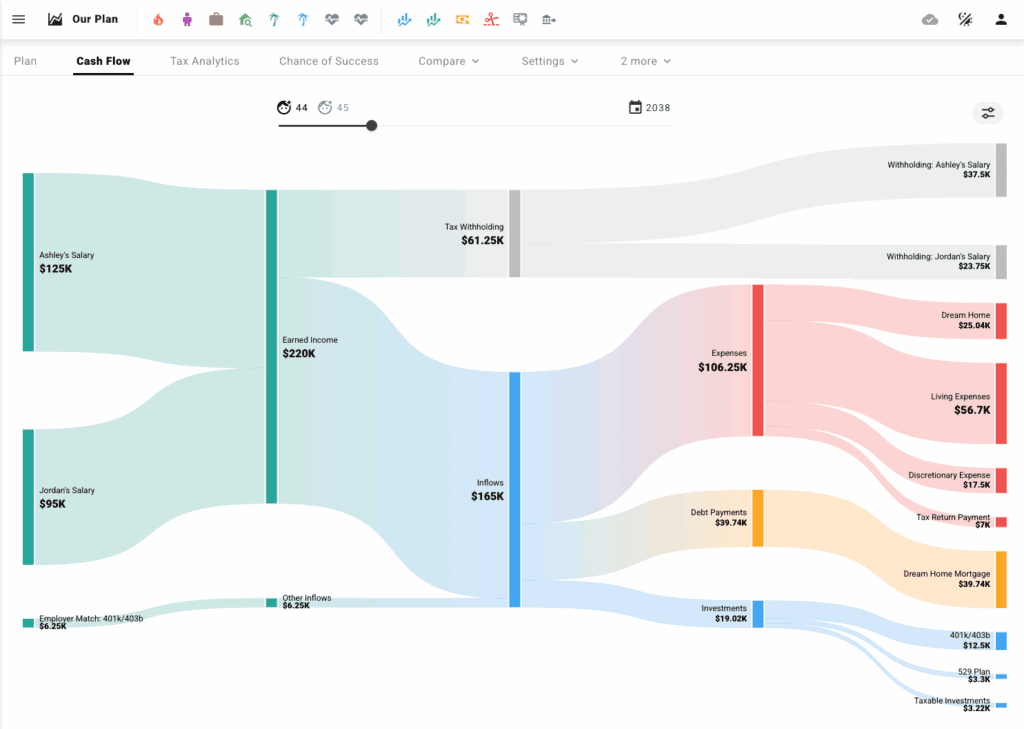

3. Money circulate modeling

Most budgeting instruments solely present you what you’re spending every month, however ProjectionLab goes manner deeper. You possibly can add your completely different revenue streams (like a day job, aspect hustles, or rental properties) and see precisely the place that cash goes over time.

You may as well mannequin issues like paying off debt, saving for giant purchases, or taking a 12 months off work. I really like how visible that is – you possibly can see dips, peaks, and the way your money circulate adjustments as your life adjustments.

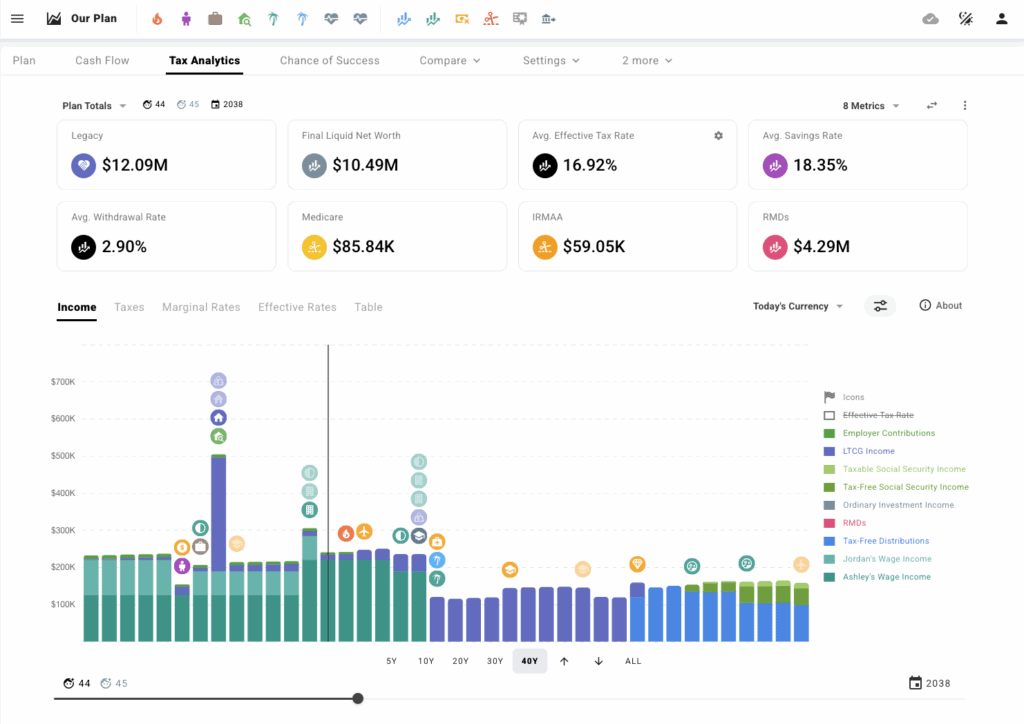

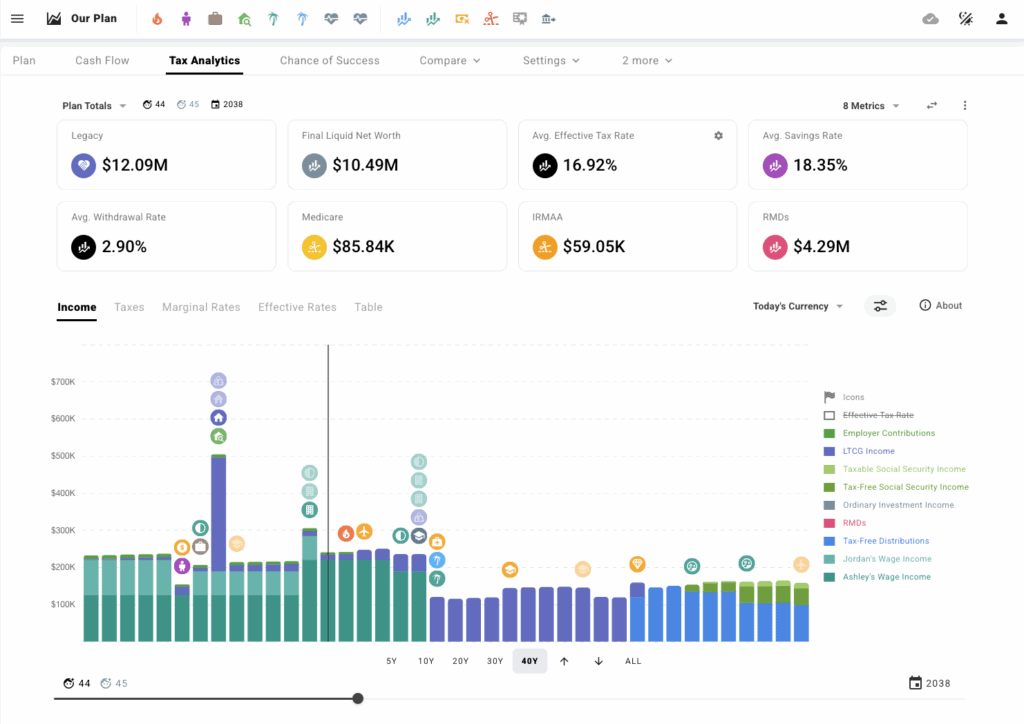

4. Tax analytics

Taxes are one of many largest issues that may make or break a monetary plan. ProjectionLab’s tax analytics instrument allows you to see how taxes will have an effect on your plan now and sooner or later.

It adjusts for issues like submitting standing, completely different tax brackets, or dwelling in several states. You may as well experiment with superior methods like Roth conversions.

I feel this instrument is nice as a result of it may well show you how to to:

- See how a lot you’ll really hold after taxes, not simply your gross revenue.

- Perceive how completely different revenue sorts (like dividends, rental revenue, or aspect hustles) are taxed.

- Mannequin what occurs to your taxes in case you transfer to a different state or nation (similar to to see how a higher-tax state impacts your monetary freedom and monetary targets).

- Examine how completely different submitting statuses (single, married submitting collectively, and many others.) affect your plan.

- For early retirement or FIRE (Monetary Independence, Retire Early) plans, see how pulling cash from taxable vs. tax-advantaged accounts impacts your complete tax invoice.

- Take a look at completely different tax methods and optimize your future taxes. Many ProjectionLab clients are in a position to save greater than $10,000 in taxes over their lifetime because of ProjectionLab.

And extra!

5. Web price projections

With ProjectionLab, you possibly can calculate and monitor your web price. You possibly can see your belongings, liabilities, and web price multi function place, which is basically useful.

And, in case you’ve ever questioned what your web price would possibly seem like in 5, 10, and even 30 years, this function is basically motivating.

ProjectionLab lays it out in clear charts so you possibly can see while you would possibly hit large milestones – like paying off your mortgage or reaching your FIRE quantity. You possibly can mess around with spending much less or incomes extra to see how these adjustments have an effect on your future web price, too.

6. Privateness and safety

This isn’t precisely a “instrument,” but it surely’s one of many major causes I wished to attempt ProjectionLab. There’s no pressured account linking – you resolve what to share. All the pieces you enter stays safe with native encryption.

Since they’re self-funded, they’re not getting cash by promoting your knowledge or exhibiting you advertisements. I do know that that is one thing that stops many individuals lately from utilizing an internet retirement planning instrument, and I felt that ProjectionLab was very protected to make use of.

Who Is ProjectionLab For?

ProjectionLab is greatest for individuals who need extra management over their monetary future. It’s nice for:

- DIY planners who prefer to run situations and perceive how monetary choices affect their monetary future (similar to with shopping for vs. renting a house, beginning a household, and many others.)

- The FIRE group (Monetary Independence, Retire Early)

- Individuals with a number of revenue streams, properties, or advanced funds

- Anybody who values privateness and doesn’t need their knowledge offered

If you happen to solely need a every day funds app, this most likely isn’t for you – however in case you love “what-if” planning, you’ll take pleasure in it. ProjectionLab is a superb addition to any budgeting app, and many individuals use YNAB or Monarch Cash together with ProjectionLab.

Execs and Cons of ProjectionLab

Right here’s what I feel are the professionals and cons of ProjectionLab:

Execs:

- Extremely customizable

- It’s an inexpensive different to conventional monetary planning companies

- Nice privateness – no pressured account linking

- Superior situations and practical simulations

- Stunning, clear visuals

Cons:

- Guide setup takes time (this isn’t actually a con as a result of it’s price it so as to get a whole monetary image)

How A lot Does ProjectionLab Price?

ProjectionLab has a primary choice that’s free, in addition to paid choices.

You possibly can select month-to-month or annual plans relying on what options you need. The Premium plan is $109 per 12 months in case you pay yearly, which works out to about $9 monthly. The Premium model additionally has a 7-day money-back assure if you wish to try it out first.

In addition they have a ProjectionLab Lifetime plan, which is $799 as a one-time fee to get ProjectionLab perpetually with no different month-to-month or annual value.

Incessantly Requested Questions

Under are solutions to frequent questions on ProjectionLab.

Is ProjectionLab price it?

If you happen to love enjoying with numbers, testing “what-if” situations, or planning for early retirement, ProjectionLab is unquestionably price attempting. It’s a singular instrument that helps you are feeling extra assured concerning the future, and it doesn’t promote your knowledge. I like to recommend it for anybody who desires greater than only a easy funds app. It’s particularly helpful in case you have a number of properties, rental revenue, or plan to retire early.

Is ProjectionLab free?

There’s a free ProjectionLab model, in addition to paid variations. It relies on what you’re in search of. If you wish to save your knowledge, then that may be a premium function.

Is ProjectionLab simple to make use of?

Sure, however count on to spend a while setting it up. When you do, the charts and simulations are very user-friendly (they’ve useful YouTube movies, an amazing Discord group, and an amazing buyer help crew).

Is ProjectionLab protected?

Sure, they don’t drive you to hyperlink your financial institution accounts, they usually use encryption to maintain your knowledge safe.

ProjectionLab Overview – Abstract

I hope you loved my ProjectionLab Overview.

Planning your monetary future can really feel overwhelming, however instruments like ProjectionLab make it simpler to see the large image.

If you happen to’re the type of one that desires greater than only a budgeting app – somebody who desires to actually see how their cash choices would possibly play out over the subsequent 5, 10, and even 50 years – then ProjectionLab could possibly be an amazing match for you. I like that this instrument goes past the fundamentals and offers you a versatile, visible technique to map out your monetary future.

It’s highly effective sufficient for individuals who have advanced conditions, like a number of revenue streams, rental properties, seasonal dwelling, or early retirement plans. I particularly admire which you can run practical Monte Carlo simulations, monitor your web price over time, and see precisely how your money circulate adjustments with completely different life decisions.

I additionally like which you can begin with a primary free model to check issues out, and improve solely if you wish to save your plans or unlock superior options like detailed tax analytics and customized situations.

Total, ProjectionLab is a great selection if you wish to really feel extra assured about your future, whether or not which means retiring early, shopping for a trip dwelling, or simply being ready for all times’s “what-ifs.” It’s a instrument I see myself utilizing at any time when I wish to check out an enormous thought and really feel reassured that my plan really is sensible.

If you happen to’re curious, you possibly can construct a plan without spending a dime and see in case you prefer it. I’d love to listen to what you suppose, too – let me know in case you attempt ProjectionLab and the way it works on your life!

You possibly can attempt ProjectionLab without spending a dime by clicking right here.

Have you ever tried ProjectionLab? Do you want planning your monetary future with a instrument like this, or do you like sticking to spreadsheets or working with a monetary planner?

Word: To guard my privateness, the pictures on this ProjectionLab Overview will not be of my private funds – they had been offered by ProjectionLab.

Advisable studying: