A practice courting again to the times of FundAlarm was to yearly share our portfolios, and reflections on them, with you. My portfolio, indolent in design and execution, makes for fearfully boring studying. That’s its major attraction.

This isn’t a “right here’s what it’s best to personal” train, a lot much less an “envy me!” one. As a substitute, it’s a “right here’s how I feel. Maybe it is going to assist you do likewise?” train.

My portfolio and my life

By design, my portfolio is supposed to be largely ignored for all intervals as a result of, on the entire, I’ve significantly better methods to spend my time, power, and a spotlight. For individuals who haven’t learn my earlier discussions, right here’s the quick model:

Shares are nice for the long run (suppose: time horizon for 10+ years) however don’t present ample reward within the quick time period (suppose: time horizon of 3-5 years) to justify dominating your non-retirement portfolio.

An asset allocation that’s round 50% shares and 50% revenue provides you fewer and shallower drawdowns whereas nonetheless returning round 6% a yr with some consistency. That’s enticing to me.

“Beating the market” is totally irrelevant to me as an investor and utterly poisonous as a purpose for anybody else. You win if and provided that the sum of your assets exceeds the sum of your wants. In case you “beat the market” 5 years working and the sum of your assets is lower than the sum of your wants, you’ve misplaced. In case you get overwhelmed by the market 5 years working and the sum of your assets is larger than the sum of your wants, you’ve received.

That is perhaps the only most essential perspective you’ll be able to take away this month. Investing is about having cheap safety in help of a fairly wealthy life. Not yachts. Not followers. Not bragging rights. Life.

“Profitable” requires having a smart plan enacted with good funding choices and funded with some self-discipline. It’s that straightforward.

My portfolio is constructed to permit me to win. It isn’t constructed to impress anybody.

My asset allocation selections

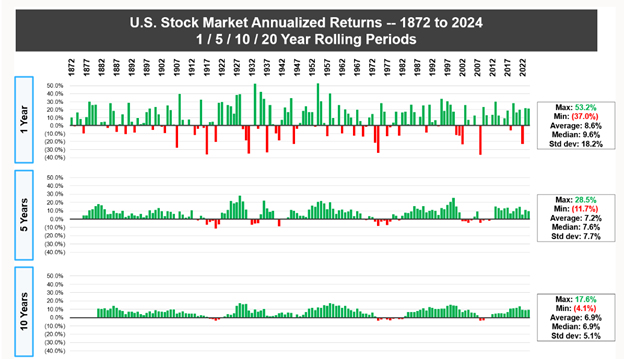

Shares are rewarding in the long term, gut-wrenching within the quick run, and often depressing disappointments within the medium run. The “depressing – medium” sentence interprets to this: it’s painfully widespread for the inventory market to go 5 – 10 years and not using a achieve. A Canadian monetary training website, A Measure of a Plan, supplied this 150-year chart of US market efficiency.

So, on a rolling foundation, there seem to have been 14 decade-long intervals and two dozen five-year intervals during which buyers made no cash. On the entire, I would like regular positive factors to mixing spectacular positive factors, sickening losses, and years of futility. That led me to an unconventional asset allocation: 50%.

“50% what?” you ask. 50% every little thing. My portfolio targets 50% fairness and 50% not, which interprets to 50% progress and 50% stability. My fairness portfolio targets 50% US and 50% not. My stability portfolio targets 50% bonds and 50% not.

That’s primarily based on lots of analysis from T. Rowe Value on the return/volatility tradeoff as portfolios improve their publicity to shares. Brief model: you pay a really excessive value within the short- to medium-term for a potential achieve of two or three p.c in returns. A 50% portfolio affords the prospects of returns of 6-7% on common with a small fraction of the market’s draw back. That works for me.

My year-end 2024 allocation

| Home fairness | Shut sufficient | Conventional bonds | Nailed it |

| Goal 25% | 2024: 23% | Goal: 25% | 2024: 25% |

| Additionally managed a 50% large-cap / 50% small to mid-cap weight. | Shocking sources: Palm Valley Capital is 30% short-term bonds | ||

| Worldwide fairness | Obese | Money / market-neutral / liquid | Shut sufficient |

| Goal 25% | 2024: 31% | Goal: 25% | 2022: 22% |

| This has been a fairly long-lasting chubby. The typical US investor has 15% of their equities in worldwide shares whereas I’m concentrating on 50% and sitting at 60%. | Fairly lots of my managers have discovered cause to carry lots of money of late. FPA, Leuthold, and Palm Valley all sit at or above 20%. | ||

Right here’s what that appears like when it comes to efficiency and volatility.

| Annual return | Max Loss | Customary Deviation | Sharpe Ratio | Ulcer Index | |

| 2024 | 6.7 | -2.0 | 5.3 | 0.32 | 0.9 |

| Three yr | 2.7 | -16.2 | 9.4 | -0.14 | 6.9 |

| 5 yr | 7.1 | -17.6 | 11.1 | 0.42 | 6.6 |

The three-year efficiency appears to be like unhealthy as a result of it consists of 2022 when the inventory market dropped 23% and the bond market fell 13%. The Indolent Portfolio did higher than both in 2022 and about 4% higher than a hypothetical portfolio with the identical weightings. And that’s been true most years: 1-2% higher than a peer-weighted portfolio, 6-9% returns, volatility in examine.

My funding decisions

I personal 11 funds. Sure, I do know that’s greater than I would like. A number of the sprawl represents my curiosity in monitoring newer and progressive funds, some signify a tax entice (I’ve lots of unrealized positive factors) and a few is indolence. A fund is doing wonderful, so why hassle to alter?

Usually, my core funds are equity-oriented however the managers have the liberty (and the accountability) to take a position elsewhere when equities are usually not providing rewards that match their dangers.

Core progress funds – 2024

| Weight | APR | Max Loss | Customary Deviation | ||

| FPA Crescent | Versatile Portfolio | 22% | 14.0 | -2.0 | 6.1 |

| Palm Valley Capital | Small-Cap Development | 8% | 4.2 | -0.4 | 0.0 |

| Leuthold Core Funding | Versatile Portfolio | 6% | 7.7 | -5.0 | 10.3 |

| Brown Advisory Sustainable Development | Multi-Cap Development | 6% | 20.2 | -5.5 | 12.0 |

Leuthold and FPA are two very completely different variations of disciplined “go wherever” funds; every seeks equity-like returns with sub-market threat. Leuthold is a quant fund, and FPA’s bias is “absolute worth.” Palm Valley Capital is the fourth incarnation of Eric Cinnamond’s strict small-cap self-discipline: he loves nice shares however would relatively sit on sizzling coals than purchase shares that aren’t priced for distinctive positive factors. Masses of cash for lengthy intervals, which is irritating for some and simply wonderful for me. Brown Advisory was my alternative for one of the best sustainable fairness fund I might discover. Their consideration to high quality and valuations was unfavorable in 2024.

Core revenue / market impartial funds – 2024

| Class | Weight | Return | Max loss | |

| T Rowe Value Multi-Technique Complete Return | Different Multi-Technique | 10.0% | 5.3 | -0.7 |

| T Rowe Value Spectrum Earnings | Multi-Sector Earnings | 5.0% | 4.0 | -1.6 |

| RiverPark Strategic Earnings | Versatile Portfolio | 8.0% | 8.2 | 0.0 |

| RiverPark Brief Time period Excessive Yield | Brief Excessive Yield | 8.0% | 5.3 | 0.0 |

Multi-Technique is Value’s model of a hedge fund for the widespread investor. It’s rising on me with a low correlation to the market, and low draw back seize. Spectrum is a fund-of-income fund. And the 2 RiverPark funds are low-risk, credit-oriented investments. Brief Time period made cash in 2022 when every little thing else faltered.

That complete “worldwide chubby” factor – 2024

| Class | Weight | Return | Max loss | |

| Seafarer Abroad Worth | Worldwide Small / Mid-Cap Worth | 4.0% | -3.3 | -7.3 |

| Grandeur Peak International Micro Cap | International Small- / Mid-Cap | 14.0% | 3.2 | -6.0 |

| Seafarer Abroad Development and Earnings | Rising Markets | 9.0% | -5.4 | -9.2 |

Usually, I’ve by no means understood why shopping for shares of enormous multinational firms nominally headquartered in London would logically produce outcomes completely different from shopping for shares of enormous multinational firms nominally headquartered in Boston. In consequence, my impulse was to have a look at smaller markets and smaller corporations. In idea, that ought to work splendidly. In follow, it’s so-so.

Alternate options to my decisions

It’s not essential to personal greater than two or three funds to create an indolent portfolio. The important thing alternative is whether or not you need to construct substantial money (or cash-like securities) into the combo or persist with shares and bonds alone.

The Bogleheads endorse a three-fund portfolio which doesn’t contemplate “money” to be an funding. Their course of has two steps: (1) choose the asset allocation that’s best for you and (2) purchase three low-cost index funds that offer you publicity to the belongings you’re looking for. Their default set is:

- Vanguard Complete Inventory Market Index Fund (VTSAX)

- Vanguard Complete Worldwide Inventory Index Fund (VTIAX)

- Vanguard Complete Bond Market Fund (VBTLX)

Step One – “determine your asset allocation” – is the difficult one there. A quite simple two-fund portfolio – one versatile fund within the palms of a high tier supervisor and one incoming producing fund equally skippered – break up 50/50 might replicate my portfolio and would require negligible upkeep.

The small investor’s indolent portfolio

| Lipper Class | Weight | APR | Max Loss | |

| Portfolio | – | 100.0% | 6.8 | -2.2 |

| RiverPark Brief Time period Excessive Yield | Brief Excessive Yield | 50 | 5.3 | 0.0 |

| Leuthold Core Funding | Versatile Portfolio | 50 | 7.7 | -5.0 |

Alternately …

| Lipper Class | Weight | APR | Max Loss | ||

| Portfolio | – | 100.0% | 11.1 | -0.9 | |

| FPA Crescent | Versatile Portfolio | 50.0% | 14.0 | -2.0 | |

| RiverPark Strategic Earnings | Versatile Portfolio | 50.0% | 8.2 | 0.0 | |

Backside Line

The most effective portfolio, like one of the best water heater or greatest automobile, is the one that you just by no means want to consider. My portfolio assumes a balanced allocation with the typical fund being within the portfolio for greater than a decade. That technique doesn’t make me wealthy, it makes me glad. And that’s relatively the purpose!