I like Jesse Livermore quotes as a result of they’re usually multi-faceted.

That is one in every of my favorites:

One other lesson I discovered early is that there’s nothing new in Wall Avenue. There can’t be as a result of hypothesis is as previous because the hills. No matter occurs within the inventory market right now has occurred earlier than and can occur once more.

I agree with this sentiment. Human nature is the one fixed throughout all market cycles. Even AI received’t change that.

I additionally know the inventory market construction is consistently altering and by no means the identical.

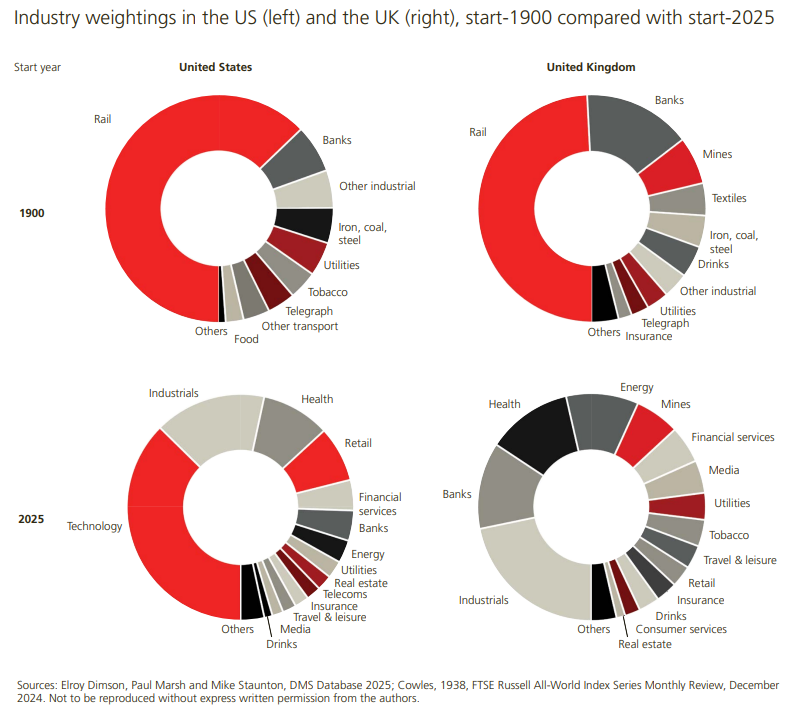

Right here’s one in every of my favourite annual charts from the UBS World Funding Return Yearbook:

I nonetheless keep in mind studying The Clever Investor for the primary time and questioning why Benjamin Graham saved writing about railroad shares. Nicely, it was written within the Forties and Graham grew up when railroad shares dominated the day.

That’s not the case anymore. Tech shares rule the day in America. Within the UK, it’s extra unfold out.

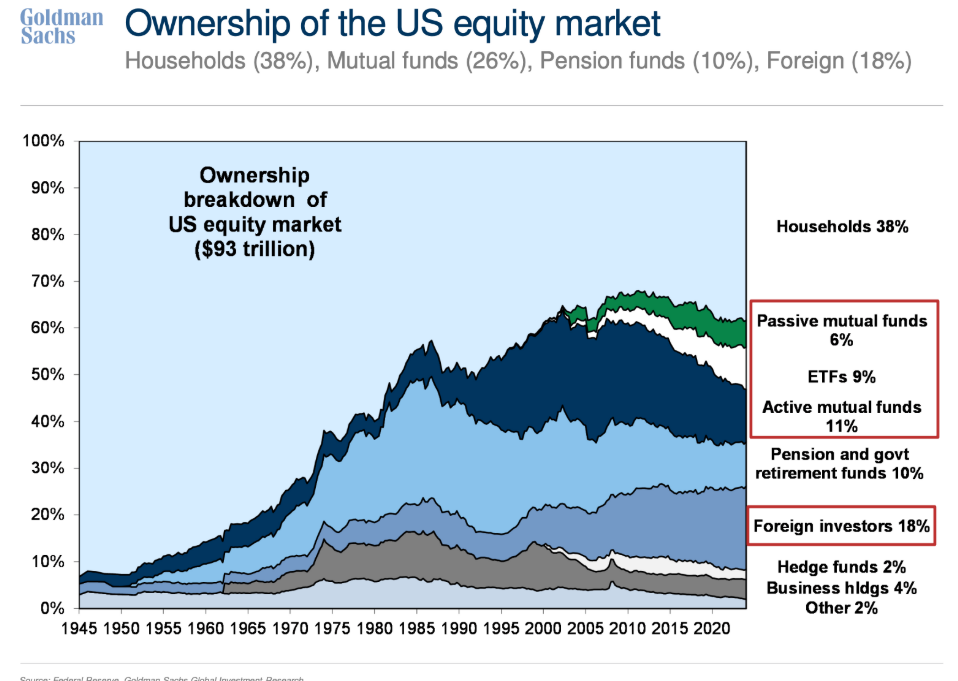

Possession of the inventory market is at all times altering too. This Goldman Sachs chart is one other private favourite:

Inventory market possession was once closely concentrated within the arms of households. That’s not the case anymore.

Households nonetheless have the very best possession proportion but it surely’s dropped from greater than 90% in 1945 to 38% now. The fund business controls greater than one-quarter of the inventory market. Overseas traders make up neatly one-fifth of the full.

Clearly, households nonetheless personal many of the shares by these different autos however there may be way more diversification within the possession construction. I believe this can be a good factor for the well being of the market.

Eggs are in a number of baskets now.

Management within the inventory market is at all times altering as nicely.

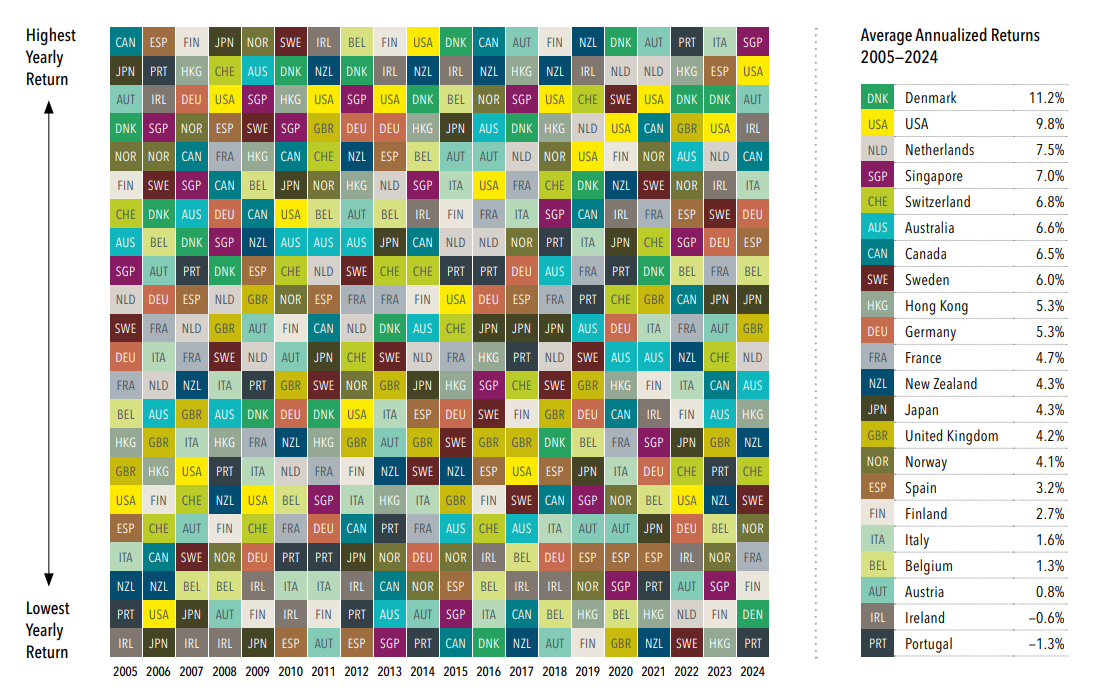

Common readers of A Wealth of Widespread Sense know I’m an enormous fan of efficiency quilts. Right here’s an ideal one from DFA that ranks nation inventory markets over the previous 20 years:

Who would have thought Denmark outperformed American shares over the previous 20 years?

However the actual takeaway right here is how the efficiency rankings are consistently altering. Are you able to think about in the event you needed to guess who the perfect or worst performer was in a given 12 months?

The worldwide inventory market is schizophrenic and I imply that as a praise.

It wouldn’t make sense if the rankings have been the identical 12 months in and 12 months out. It wouldn’t be a lot enjoyable both.

The inventory market has to alter on a regular basis.

In any other case it wouldn’t provide traders a danger premium.

Additional Studying:

Timeless Knowledge From Jesse Livermore

This content material, which incorporates security-related opinions and/or data, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There will be no ensures or assurances that the views expressed right here will probably be relevant for any explicit info or circumstances, and shouldn’t be relied upon in any method. It’s best to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital property, or efficiency information, are for illustrative functions solely and don’t represent an funding advice or provide to supply funding advisory providers. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding determination. Previous efficiency is just not indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from numerous entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or suggest endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.