I’ve been writing currently about how buyers have continued to purchase the dip anytime the inventory market falters (see right here and right here).1

We preserve hitting report after report for investor inflows. That is from Bloomberg:

Retail merchants went on a report dip shopping for spree Monday, reversing a 1% decline within the S&P 500 Index triggered by the US credit score downgrade from Moody’s Scores late final week.

Particular person buyers bought a web $4.1 billion in US shares by 12:30 p.m. in New York, the biggest stage ever for that point of day — and broke the $4 billion threshold by midday for the primary time ever, in line with information compiled by JPMorgan Chase & Co. quantitative and by-product strategist Emma Wu.

A 1% down day and we see large shopping for?!

There may be additionally a ton of cash going into S&P 500 index funds:

The place is all of this cash coming from?

Let’s check out the most probably suspects.

Bonds. The best way I see it, fastened revenue serves 4 functions for buyers:

1. Volatility discount.

2. Common revenue.

3. Spending energy when shares are down.

4. Dry powder when shares are down.

My thesis is that buyers used their fastened revenue for choice #4 throughout the downturn in April.

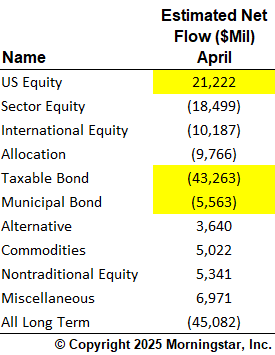

Morningstar’s Jeffrey Ptak was form sufficient to run some fund circulation information for me for the month of April:

Lo and behold, buyers offered out of bonds and acquired shares. Not all that cash went into inventory funds, however a lot of it did.

Bonds offered a few of the dry powder as buyers rebalanced into the ache.

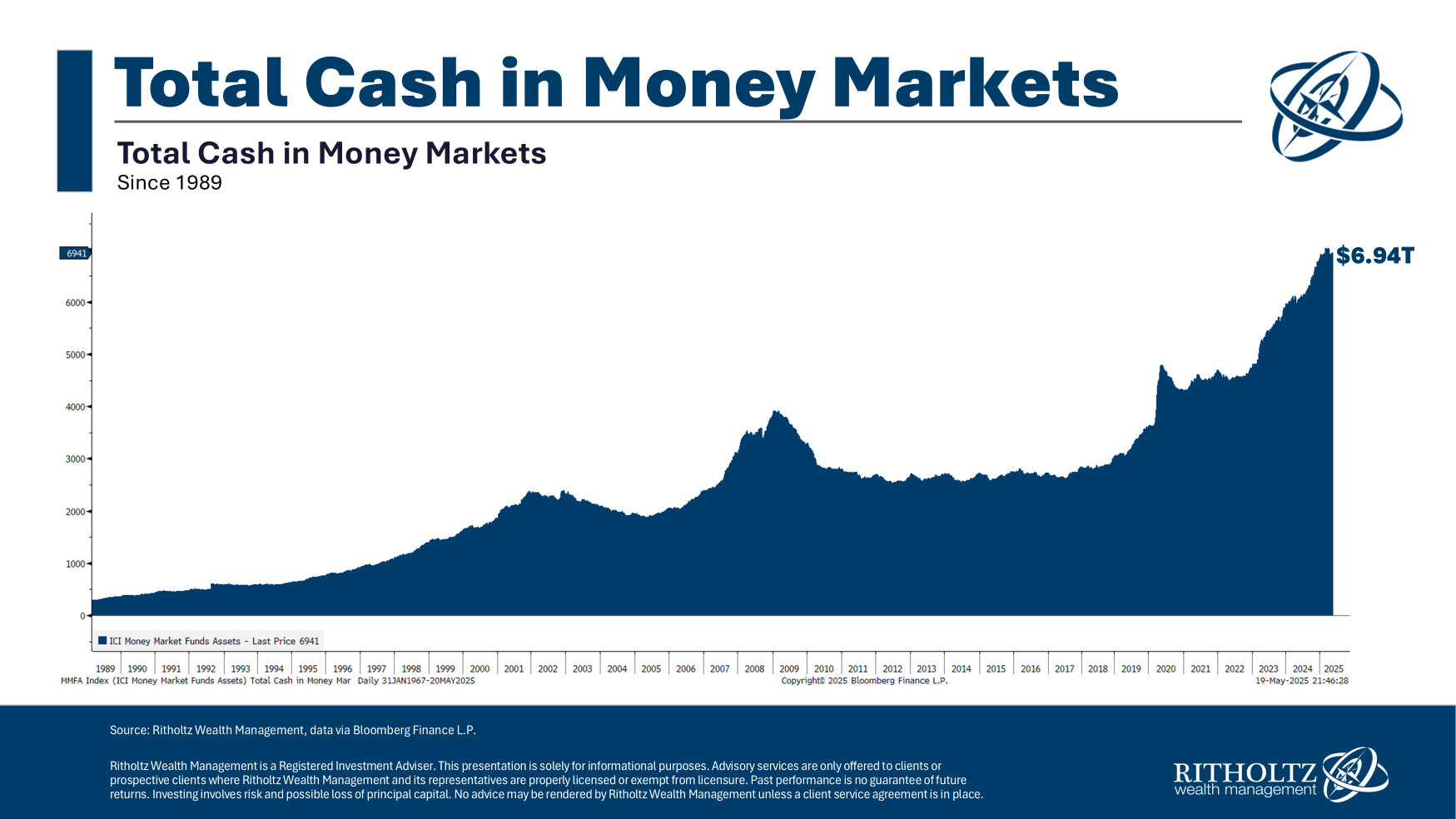

Cash markets. There may be nonetheless A LOT of cash sitting in cash market funds:

We’re nonetheless near $7 trillion even after the Fed lower charges 75 foundation factors.

Is there cash popping out of those funds throughout a downturn?

Let’s have a look:

Some huge cash got here out in April. A few of that was seemingly used to pay taxes.2 There’s a seasonality element to those issues as you’ll be able to see shares dipped final yr on the similar time.

However I’m certain a few of this cash poured into the inventory market.

That’s what money on the sidelines is for.

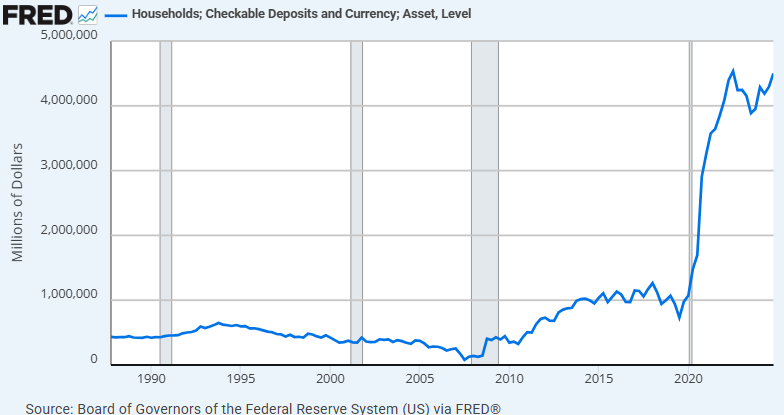

Money. There may be nonetheless some huge cash sitting in checking/financial savings accounts at banks:

This information is up to date quarterly so we gained’t know for a few months nevertheless it wouldn’t shock me if some buyers put some money to work throughout the transient bear market.

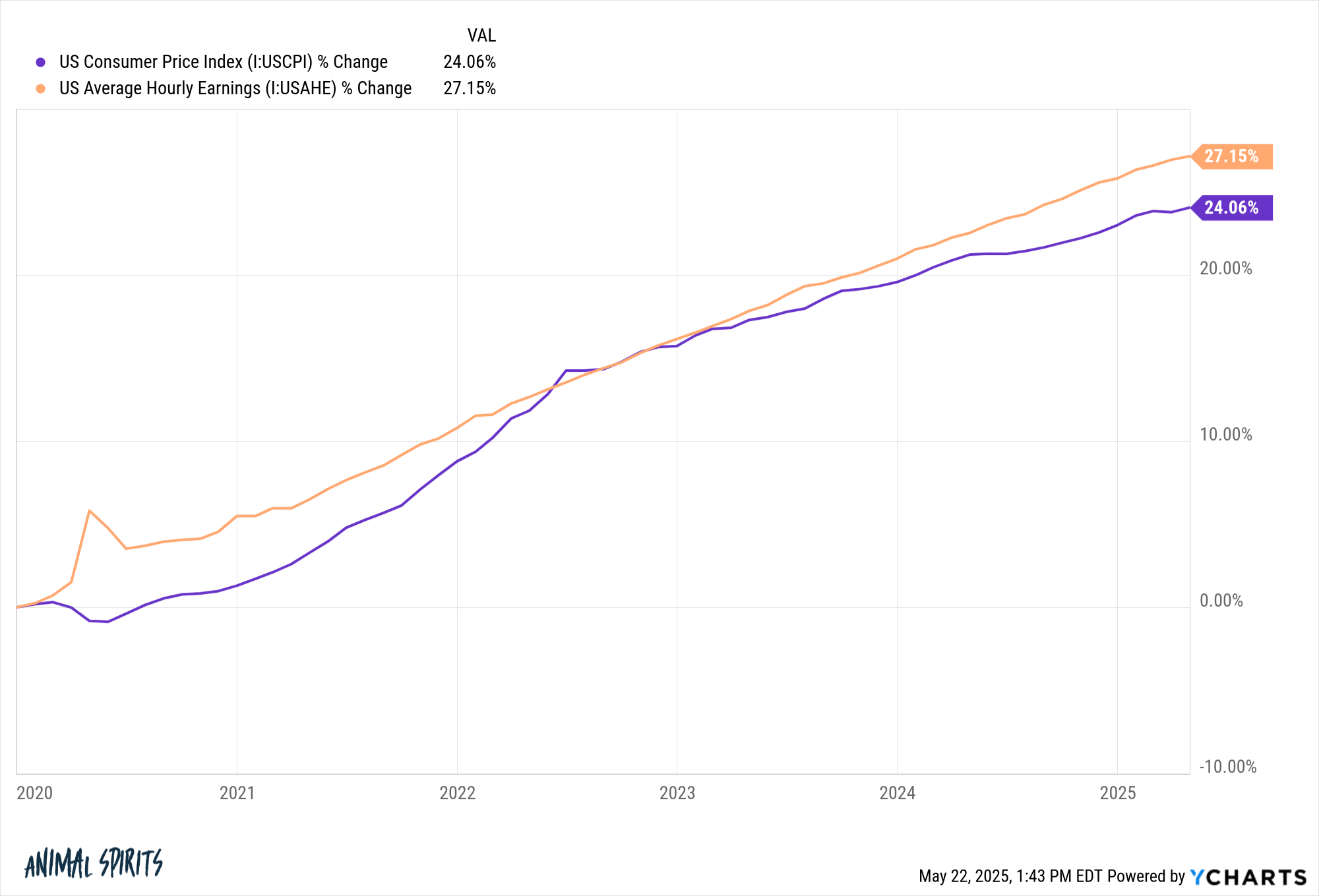

Wages. The cumulative improve in costs within the 2020s is 24% however wages have risen greater than 27% in whole:

That’s an enormous quantity.

It means extra revenue out there to save cash. For those who save a daily proportion of your revenue and your revenue goes up 30%, that’s much more cash to avoid wasting and make investments on a nominal foundation.

That’s another excuse we preserve seeing report inflows.

Add all of it up and that’s the place the cash is coming from.

Will it final?

I don’t know.

For now, threat urge for food is such that buyers are keen to purchase when shares are down.

Michael and I talked about retail buyers, investor schooling, the place the entire cash is coming from and extra on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

The Dumb Cash Isn’t So Dumb Anymore

Now right here’s what I’ve been studying currently:

Books:

1I’m sufficiently old to recollect when folks had been frightened about extra financial savings being depleted from the pandemic.

2As somebody who plans quite a bit for this stuff I can’t think about having to promote shares to pay my tax invoice.

This content material, which accommodates security-related opinions and/or info, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There may be no ensures or assurances that the views expressed right here can be relevant for any specific info or circumstances, and shouldn’t be relied upon in any method. It is best to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital property, or efficiency information, are for illustrative functions solely and don’t represent an funding advice or provide to supply funding advisory companies. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding resolution. Previous efficiency just isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from numerous entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or suggest endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the chance of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.