NPS is a retirement product. Particularly focused to build up funds for retirement.

Right here is how NPS may help you accumulate funds for retirement.

- You accumulate cash till you retire.

- You withdraw from the corpus after you retire.

- You may make investments your cash in a diversified portfolio of fairness and debt.

- You may withdraw a portion lumpsum and use the remainder the acquisition an annuity plan. The annuity plan can give you an revenue stream throughout retirement.

However you are able to do all of the above (and extra) with mutual funds too, proper?

- You may spend money on MFs if you are working.

- You can begin withdrawing from MFs when you retire.

- You may take publicity to totally different belongings by means of mutual funds too.

- And no person stops you from shopping for an annuity plan utilizing your MF portfolio everytime you need.

Each NPS and mutual funds are market-linked merchandise. Your cash is managed by skilled cash managers and your returns will depend upon the efficiency of your funds.

In that case, which is a greater car to build up your retirement corpus? NPS or mutual funds?

On this submit, allow us to examine NPS and mutual funds on numerous facets and take into account numerous nuances of those investments.

Be aware: NPS and mutual funds are NOT solely investments for retirement. There are various others too and such investments could be a part of your retirement portfolio too. Nonetheless, on this submit, we restrict the evaluation to NPS and mutual funds.

#1 NPS vs Mutual funds: Sort of funding

Each are market linked investments.

No assure of returns.

With NPS, you possibly can cut up your cash throughout Fairness Fund (E), Authorities bonds (G), and Company Bonds (C). There’s Asset Class A too, the place you get publicity to different belongings like REITs, INVITs, AIFs, and so forth.

You may choose Lively alternative, the place you determine the allocation to numerous asset lessons or funds (E,C,G A). Most fairness allocation could be 75%. Most allocation to A could be 5%.

OR

You may go for Auto-choice. Select from 3 life cycle funds (Aggressive, Average, Conservative). Within the lifecycle funds, the allocation to E, C, and G funds is pre-defined as per a matrix, and the chance within the portfolio (publicity to E) goes down with age. Portfolio rebalancing additionally occurs mechanically within the auto-choice lifecycle funds.

With mutual funds, there isn’t a dearth of alternative. You may have a number of kinds of fairness and debt funds. You may make investments even in gold, silver, and even overseas equities. You may determine asset allocation and select funds freely.

#2 NPS vs Mutual Funds: Exit Guidelines

NPS is kind of strict right here. Anticipated too from a retirement product.

In NPS, you can’t exit earlier than attaining the age of 60. Therefore, your cash is just about locked in till the age of 60.

Level to Be aware: There is no such thing as a requirement that you should exit NPS once you flip 60. The NPS guidelines can help you defer the exit from NPS till the age of 75.

On the time of exit, you possibly can withdraw as much as 60% of the gathered corpus as lumpsum. You could make the most of the remaining 40% to buy an annuity plan. Nonetheless, if you want, you possibly can even make the most of the whole quantity to buy an annuity plan. 0-60% lumpsum withdrawal. 40-100% annuity buy.

Sure, you possibly can exit NPS prematurely too when you full 10 years. Nonetheless, for pre-mature exit, you should use 80% of the gathered corpus to buy an annuity plan. Solely 20% could be taken out lumpsum. NPS additionally permits partial withdrawals in sure conditions.

With mutual funds, there isn’t a restriction on exit from any scheme. You may promote everytime you need. The one exception is ELSS the place your funding is locked in for 3 years from the date of funding.

In case of NPS, annuity buy will occur with pre-tax cash.

You should purchase annuity plans utilizing your MF proceeds too. Nonetheless, please perceive, in case of mutual funds, annuity buy will occur with post-tax cash. You’ll promote your mutual funds to purchase an annuity plan and sale of MFs will lead to capital positive factors legal responsibility.

#3 NPS vs Mutual Funds: Tax-Remedy on Funding

Personal Contribution to NPS account

If you’re submitting ITR below Outdated tax regime, you’ll get tax profit below Part 80CCD(1B) for as much as Rs 50,000 per monetary 12 months for funding in Tier-1 NPS. This tax profit is on the market over and above tax advantage of Rs 1.5 lacs below Part 80C.

Profit below Part 80CCD(1B) not obtainable below New Tax Regime.

Employer contribution to NPS account

That is relevant to solely salaried workers. And even there, not all employers provide this. Nonetheless, in case your employer presents NPS, it can save you some severe tax in case your employer presents to contribute to your NPS account.

Employer contribution to your NPS, EPF, and superannuation account is exempt from tax upto Rs 7.5 lacs every year. For NPS, this tax exemption has an extra cap. Such a contribution should not exceed 10% of fundamental wage. The cap will increase to 14% for state and central Authorities workers.

On this submit, at any time when I confer with NPS, I imply Tier-1 NPS. There’s NPS-Tier 2 as properly and you will get tax-benefit for funding in Tier-2 NPS topic to circumstances. Nonetheless, I’ve not thought of Tier-2 NPS right here as a result of it’s not a pure retirement product. Moreover, I’m referring to All Residents Mannequin or Company NPS mannequin.

In case of mutual funds, there isn’t a tax profit on funding, aside from ELSS. Funding in ELSS qualifies for tax profit below Part 80C of the Revenue Tax Act.

#4 NPS vs Mutual Funds: Tax Remedy on Exit

NPS: On the time of exit, any lumpsum withdrawal (as much as 60% of the gathered corpus) is exempt from revenue tax.

Remaining quantity (40%) have to be used to buy an annuity plan. Whereas this quantity used to buy annuity plan shouldn’t be taxed, the payout from an annuity plan is added to your revenue and taxed at your slab charge.

Mutual fund taxation is dependent upon the kind of mutual fund and the underlying home fairness publicity.

#5 NPS vs Mutual Funds: NPS permits tax-free rebalancing

NPS wins this contest simply. Tax-free rebalancing is the most important optimistic of NPS.

In NPS, taxes come into image solely on the time of exit from NPS. Not earlier than that. Therefore, your cash can compound unhindered by the friction of taxes.

Switching cash between several types of funds and even switching to a unique pension fund supervisor doesn’t lead to any capital positive factors. Therefore, no capital positive factors taxes.

This makes portfolio rebalancing tremendous tax-efficient.

So, allow us to say your NPS portfolio is 50 lacs. Lively-choice NPS.

Rs 30 lacs in E and a cumulative 20 lacs in E and G.

Your goal allocation is 50:50 Fairness: debt however it has gone to 60:40 fairness: debt due to the inventory market run-up. You may merely tweak your allocation to E:C: G barely (to say 51:25:24) and the portfolio will rebalance to your goal degree (fairly near that). You’ll not need to pay any taxes throughout rebalancing in NPS.

In Auto-choice NPS, rebalancing occurs mechanically in your birthday. In Lively alternative, you should do that manually.

That is necessary contemplating the taxation of mutual fund investments has develop into more and more hostile over the previous decade.

2015: Lengthy-term holding interval for debt funds was elevated from 1 12 months to three years. Not as a lot of an issue.

2018: Lengthy-term capital positive factors tax introduced in for fairness funds. Any LTCG on sale of shares/fairness MF greater than Rs 1 lac in a monetary 12 months taxed at 10%.

2023: Idea of long-term capital positive factors faraway from debt funds. For debt MF items purchased after March 31, 2023, all capital positive factors arising out of sale of such items shall be thought of quick time period positive factors and be taxed at revenue tax slab charge (marginal tax charge). That is the most important downside.

Clearly, if you happen to should rebalance a portfolio of mutual funds, there will likely be leakage within the type of taxes. It will hinder compounding. Furthermore, it’s not nearly rebalancing. You’ll have invested in a mutual fund that you don’t like as a lot anymore. In absence of taxes, you’ll merely swap to the mutual fund that you just like extra. Nonetheless, taxes make this whole train troublesome.

For rebalancing, there’s a small workaround that you need to use in some instances. As a substitute of shuffling previous investments, tweak the incremental allocation. As an example, allow us to say your goal fairness: debt allocation is 50:50. Due to the current market fall, the asset allocation is now 45:55 fairness: debt. You may route all incremental cashflows to fairness funds till the asset allocation shifts again to focus on allocation. Since you aren’t promoting something there isn’t a downside of taxes. Personally, I discover this a lot method a bit cumbersome and troublesome to execute. This method will anyhow not work for larger portfolios.

#6 NPS vs Mutual Funds: Early retirement is usually a downside

What if you happen to determine to retire on the age of 55 and never 60?

NPS is inflexible. Retirement means 60 and above.

Therefore, if you happen to go for an early retirement and most of your retirement cash is in NPS, you’ve got an issue.

In case you exit on the age of 55, then you should use 80% of the gathered corpus in the direction of buy of an annuity plan.

Be aware that NPS account doesn’t need to closed once you cease working. You may proceed the account even past your retirement. Therefore, even if you happen to have been to retire at 55, you possibly can proceed and even contribute to your NPS account till the age of 60,70, or 75.

With mutual funds, you’ll NOT face this downside. You may take out your cash everytime you need. Withdrawals are usually not linked to your age.

On a aspect be aware, whereas NPS might path MFs in flexibility, it’s far forward of different pension merchandise.

I’m evaluating NPS to pension merchandise from life insurance coverage corporations in India. Life insurance coverage corporations have launched pension merchandise in each linked and non-linked variants.

In NPS, your investments wouldn’t have to be systematic. You may even make large lumpsum investments. No limits. With different pension merchandise, you should pay a specific amount of premium yearly. Topping up shouldn’t be simple.

Proceeds from ULIPs (with annual premium > 2.5 lacs) and Conventional plans (with annual premium > 5 lacs) at the moment are taxable. No such downside with NPS.

In NPS, you possibly can withdraw 60% of gathered corpus tax-free. In pension plans from insurance coverage corporations, you possibly can withdraw only one/3rd of accumulate corpus tax-free.

#7 NPS vs Mutual Funds: NPS has lesser alternative

You may spend money on only one fairness fund below NPS. Likewise for C and G funds.

Whereas your Fairness(E), Authorities bonds (G), and Company Bonds (C) could be from totally different pension fund managers, you continue to have simply 1 fairness fund in your NPS portfolio. 1 actively managed fairness fund. I might count on these fairness funds from NPS to have a large-cap tilt.

Every Pension fund supervisor (PFM) presents 1 E, 1 G, and 1 C fund. You may spend money on only one E, G, and C funds. From the identical or totally different PFMs. You can’t spend money on 2 fairness funds. Or fairness funds from 2 pension fund managers.

Mutual funds provide a a lot wider number of selections. You may have massive cap, midcap, and small cap funds. Each energetic and passive. Flexicap, Issue, Sectoral, Thematic. Overseas fairness. You title it and you’ve got it.

In terms of investments, much less alternative shouldn’t be essentially unhealthy. Nonetheless, most buyers wouldn’t wish to preserve all their fairness cash in a single actively managed fund, as is the case in NPS.

#8 NPS vs Mutual Funds: Returns

I don’t wish to examine returns. Just because NPS funds have a lot lesser restrictions on the place they’ll make investments. What ought to be the true benchmark for an NPS Fairness fund? Nifty 50, Nifty 100, Nifty 500? Which fairness mutual funds ought to I examine the efficiency with?

You may test the returns of assorted NPS schemes right here.

#9 NPS vs Mutual Funds: Prices

NPS is the bottom value funding product. The Funding administration charge is lower than 10 bps.

Mutual funds bills are a lot increased. Will depend on a number of elements. Common or Direct. Fairness or Debt. Lively or Passive.

#10 NPS vs Mutual Funds: Is obligatory annuity buy an issue?

With an annuity plan, you pay a lump sum to the insurance coverage firm. And the insurance coverage firm ensures you an revenue stream for all times.

Obligatory annuity buy has been highlighted a serious downside of NPS.

Nonetheless, I don’t see obligatory annuity buy as an issue. Any good retirement product ought to have the ability to divert an allocation in the direction of annuity buy. Nonetheless, you should purchase the best variant on the proper age.

Sure, if you’re sensible with cash, you possibly can handle with out an annuity plan. Nonetheless, most buyers would wrestle to generate common cashflows throughout retirement from a market linked portfolio. If payouts from an annuity plan can cowl a portion of your bills, I don’t see a lot downside there.

Even if you’re sensible, you should take into account following factors.

- With annuity plans, you possibly can lock-in rate of interest for all times. No different product can do that. Sure, there are long run Authorities Bonds with maturity of as much as 40 years. Nonetheless not for all times. Solely annuity merchandise can. What if

- Covers longevity danger. The revenue will proceed for all times. Even when the quantity is small, you’ll by no means run out of cash. Should buy variants the place your partner will obtain cash after you. These are sensible life conditions that must be offered for. Not everybody within the household can handle withdrawals from a diversified portfolio.

- By staggering annuity purchases can improve revenue and scale back danger within the portfolio. By making certain a fundamental degree of revenue, you possibly can take increased danger (commensurate along with your danger profile) along with your remaining investments and probably earn higher returns.

It isn’t an either-or determination

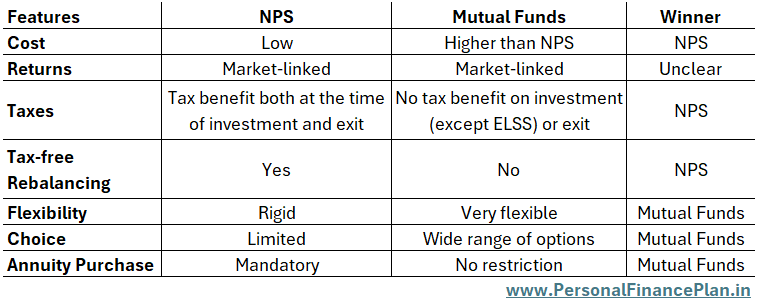

A fast comparability on all of the facets we mentioned above.

- Value: NPS wins right here.

- Returns: Each are market-linked. I want NOT to match returns.

- Taxes: NPS wins right here, each in tax profit on funding and tax therapy on the time of exit.

- Flexibility: Mutual funds win right here. No lock-ins. Simple withdrawals. Exit not linked to age. NPS is inflexible.

- Alternative: Mutual funds are a transparent winner. Far higher alternative of funds in comparison with NPS.

- Obligatory Annuity Buy: NPS has this restriction. Mutual funds don’t. I don’t see obligatory annuity buy as an issue. With mutual funds too, you should purchase an annuity plan.

Be aware: In case of NPS, annuity buy will occur with pre-tax cash. In case of mutual funds, annuity buy will occur with post-tax cash.

So, which is a greater funding car for retirement financial savings? MFs or NPS?

I don’t assume we’ve got an goal winner right here. NPS fares higher on value, taxes, and a crucial space of portfolio administration, portfolio rebalancing. MF is an outright winner in flexibility and selection of funds. Therefore, the reply is dependent upon your necessities and preferences.

Furthermore, it’s not an either-or determination. You need to use each.

When you find yourself planning for retirement, you wouldn’t have to maintain all of your retirement cash in a single car. You need to use a number of automobiles for a similar purpose.

Therefore, you possibly can spend money on each mutual funds and NPS to your retirement.

If the inflexible exit guidelines or the dearth of alternative of funds in NPS worries you, you possibly can make investments extra in mutual funds.

If tax-free rebalancing is a excessive precedence, you possibly can allocate a sizeable quantity in NPS.

Sure, you possibly can produce other merchandise too in your portfolio comparable to EPF, PPF, Gold, bonds and so forth). For this submit, I’m limiting dialogue to MFs and NPS.

An instance of how one can profit from tax-free rebalancing function of NPS.

Allow us to say, to your retirement portfolio, you’ve got Rs 40 lacs in NPS and Rs 40 lacs in mutual funds.

NPS: E: 24 lacs, G: 8 lacs C: 8 lacs

Mutual funds: Fairness Funds: 28 lacs, debt funds: 12 lacs

Whole fairness allocation = 24 + 28 = Rs 52 lacs, which is 65% allocation to equities.

However you needed 60:40.

In case you promote fairness funds and purchase debt funds, you’ll have to pay tax.

However, if you happen to may shift Rs 4 lacs from NPS-Fairness (E) fund to G and C funds, we are able to go to again to 60:40 goal allocation with out paying any taxes. And you are able to do that by merely altering asset allocation in NPS to 50:25:25 (E:G:C).

Personally, I want to have the majority of the cash in mutual funds. Better alternative of funds. Availability of passive investments. Higher disclosures than NPS funds. Extra targeted regulator (SEBI vs. PFRDA). On the identical time, having a good allocation to NPS wouldn’t hurt due to the tax-free rebalancing function. In reality, the allocation to NPS can turn out to be useful since you should purchase an annuity plan from pre-tax cash after you retire.

What do YOU want to your retirement financial savings: NPS or Mutual funds?

Picture Credit score: Unsplash

Disclaimer: Registration granted by SEBI, membership of BASL, and certification from NISM on no account assure efficiency of the middleman or present any assurance of returns to buyers. Funding in securities market is topic to market dangers. Learn all of the associated paperwork rigorously earlier than investing.

This submit is for training objective alone and is NOT funding recommendation. This isn’t a suggestion to take a position or NOT spend money on any product. The securities, devices, or indices quoted are for illustration solely and are usually not recommendatory. My views could also be biased, and I could select to not give attention to facets that you just take into account necessary. Your monetary targets could also be totally different. You’ll have a unique danger profile. You might be in a unique life stage than I’m in. Therefore, you should NOT base your funding choices primarily based on my writings. There is no such thing as a one-size-fits-all resolution in investments. What could also be a great funding for sure buyers might NOT be good for others. And vice versa. Due to this fact, learn and perceive the product phrases and circumstances and take into account your danger profile, necessities, and suitability earlier than investing in any funding product or following an funding method.