For those who’re a private finance fanatic with youngsters, you’ve most likely puzzled: at what family revenue degree will schools cease providing scholarships and grants (i.e., free cash) to assist your youngster attend? What’s that revenue cutoff?

On condition that the price of school is already outrageous — and certain solely getting worse — it is a legitimate and essential query. The most important joke of all? At this price, you’ll should be a millionaire simply to afford 4 years at a personal college, with the overall value approaching $1 million!

Because of an evaluation by Bloomberg in an article titled High Faculties Are Too Pricey Even for Dad and mom Making $300,000, we now have a tough reply. The analysis, performed by Ann Choi, Francesca Maglione, Paulina Cachero, and Raeedah Wahid, highlights how America’s “center class” is more and more being squeezed out of elite school affordability, with little recourse however to decide out.

As a father or mother of two, neither of whom I imagine have a snowball’s likelihood in hell of getting right into a top-50 college, I’ve already mentally ready for the extra sensible route: public college or neighborhood school for the primary two years. Nevertheless, Bloomberg’s article factors out that even public universities won’t essentially be less expensive, relying in your family revenue.

Let’s discover this important and engaging matter.

Family Revenue Restrict for Receiving Free Cash from Faculties

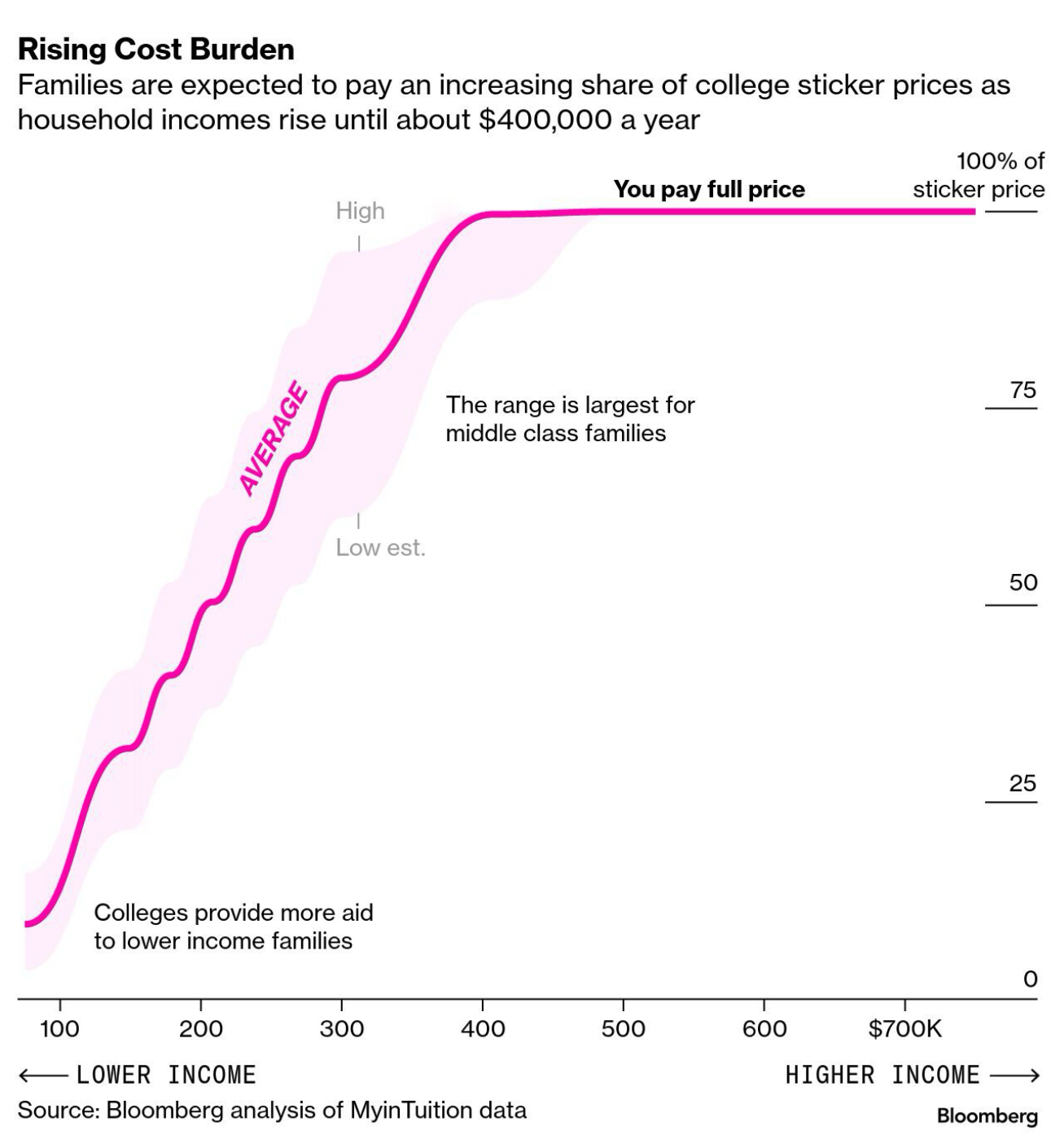

In response to Bloomberg’s evaluation, as soon as a family’s revenue reaches $400,000, households ought to now not count on to obtain any scholarships or grants. In different phrases, households incomes $400,000 or extra are usually anticipated to pay the full sticker worth. Roughly 50% of households at these elite non-public universities are already doing so.

I feel it’s nice that non-public schools are attempting to make larger schooling extra inexpensive for extra households. Attending to pay half worth in case your family makes round $225,000 a yr isn’t a foul deal. In any case, $225,000 offers a comfy middle-class way of life for a household of 4 residing in a non-coastal metropolis.

Sadly, schools do not appear to take note of the cost-of-living variations households face throughout the nation. Incomes $225,000 in San Francisco or New York Metropolis offers a considerably decrease high quality of life than incomes the identical quantity in Des Moines. If schools may take that subsequent step and think about a cost-of-living adjustment (COLA), that will be pretty.

From the article:

At USC, households that make round $180,000 are anticipated to pay wherever from 22% to 33% of their revenue in direction of tuition, or roughly $50,000 on common — the biggest monetary burden out of the colleges in Bloomberg’s evaluation, every of which makes use of the MyinTuition calculator.

A household with the identical monetary profile is predicted to contribute 13%, or $24,000, in direction of the annual tuition at MIT.

At Williams School, a pupil with $300,000 of household revenue can be requested to pay from $43,000 to $73,000 a yr towards the roughly $92,000 sticker worth. The identical pupil qualifies for little to no reduction at Harvard, the place tuition is round $87,000 a yr, based on the evaluation.

Because of the Bloomberg article, hopefully it’s now clear to everybody that incomes $300,000 a yr is taken into account a middle-class revenue in lots of components of the nation. I used to be raked over the coals within the feedback part of my article, regardless of having a transparent and reasonable family funds. However people are lastly coming round!

It’s Not as Easy as Incomes Much less Than $400,000 to Get Free Cash for School

At first look, staying beneath $400,000 in family revenue sounds simple. In any case, $400,000 places you within the prime 3% of revenue earners in America, that means about 97% of households earn much less. Yay — most of us ought to get free cash for school, proper? Mistaken.

What the Bloomberg article overlooks is the influence of property. Within the private finance world, web price issues greater than lively revenue. Someday you would be incomes a excessive wage, and the subsequent you would be out of a job. Nevertheless, when you construct a big sufficient web price, you’ll be able to generate sufficient passive funding revenue to stay freely eternally.

Maybe Bloomberg’s slender concentrate on revenue alone displays broader societal tendencies. In any case, the common financial savings price in America hovers round simply 5%. Our society prioritizes aggressive consumerism over disciplined saving and investing. In response to the newest Survey of Shopper Funds, the median web price in America is barely about $192,000.

Bloomberg could also be assuming that the standard American household doesn’t construct a rental property portfolio, doesn’t open a custodial funding account (UTMA), and doesn’t save in a 529 school financial savings plan — and so they is perhaps proper!

Living proof: I just lately spoke to a buddy who manages cash professionally and has an MBA from Harvard. He has two youngsters, ages 5 and eight and he had no thought what a 529 plan even was!

Your Property Matter When Making use of For Monetary Help For School

When filling out the FAFSA (Free Software for Federal Pupil Help), the property that depend towards a household (i.e., are thought of out there to assist pay for school and might scale back monetary help eligibility) usually embrace:

Property that FAFSA Counts:

- Money, financial savings, and checking account balances

- Investments, together with:

- Shares

- Bonds

- Mutual funds

- Certificates of deposit (CDs)

- Cryptocurrency

- Actual property (however not the household’s main residence — see extra under)

- School financial savings accounts, like 529 plans (if owned by the father or mother or pupil)

- Belief funds

- UGMA/UTMA accounts (student-owned accounts)

- Companies and farms (provided that they’ve 100+ full-time workers or are funding companies)

Property that FAFSA Does Not Rely:

- Major residence (household residence fairness is excluded so purchase the nicest home you’ll be able to afford)

- Retirement accounts, resembling:

- 401(okay)s

- IRAs (conventional and Roth)

- Pensions

- Annuities

- Life insurance coverage insurance policies

- Private possessions (like automobiles, furnishings, jewellery)

Further Notes:

- Mother or father property are assessed at a a lot decrease price than pupil property.

- About 5.64% of father or mother property are thought of out there for school prices.

- About 20% of pupil property are counted, which is way harsher.

- 529 plans owned by mother and father are handled as a father or mother asset (higher).

- 529s owned by grandparents (beneath the outdated FAFSA guidelines) may mess issues up when distributions occur, however beginning with the 2024-2025 FAFSA, these distributions are now not reported as untaxed pupil revenue.

The Extra Property You Have, the Much less Free Cash You Get for School

In case your family of 4 earns $80,000 a yr however has a $5 million taxable brokerage account, $200,000 in money, a $2 million rental property portfolio, and $300,000 in every kid’s 529 plan, you are unlikely to get any free cash for school.

Don’t even trouble making an attempt to manipulate your revenue decrease. Hand over! Your years of diligent saving and investing have earned you the “privilege” of paying full sticker worth. You’ll be able to’t conceal your property to make your self look poorer — and if a faculty finds out you tried, your youngster’s admission supply may get rescinded.

Essentially the most sum of money you and your kids can outdoors of tax-advantage retirement accounts is about $300,000 per youngster to obtain school scholarships. So should you’ve been interested by shopping for that midlife disaster automotive or a large costly residence you don’t want, doing so could assist win you free cash. Keep in mind, you’ll be able to personal a $10 million mansion and drive a Lamborghini and FASFA gained’t depend the property of their calculations.

Sadly, all elite non-public universities transcend the FAFSA and require the CSS Profile to judge whether or not your family qualifies for need-based monetary help. The CSS Profile is way more thorough as a result of it distributes cash from the universities’ personal funds, not from the federal authorities. With the CSS profile, your mansion most likely counts towards you.

In case you are revenue poor and asset wealthy, you lose in terms of getting free monetary help for school.

What About Going to Public School to Save Cash?

As a graduate of The School of William & Mary, a public faculty in Virginia, I’ve lengthy been a robust advocate for attending public school to economize. After I went, my mother and father paid simply $2,800 a yr in tuition, whereas non-public universities had been charging round $20,000.

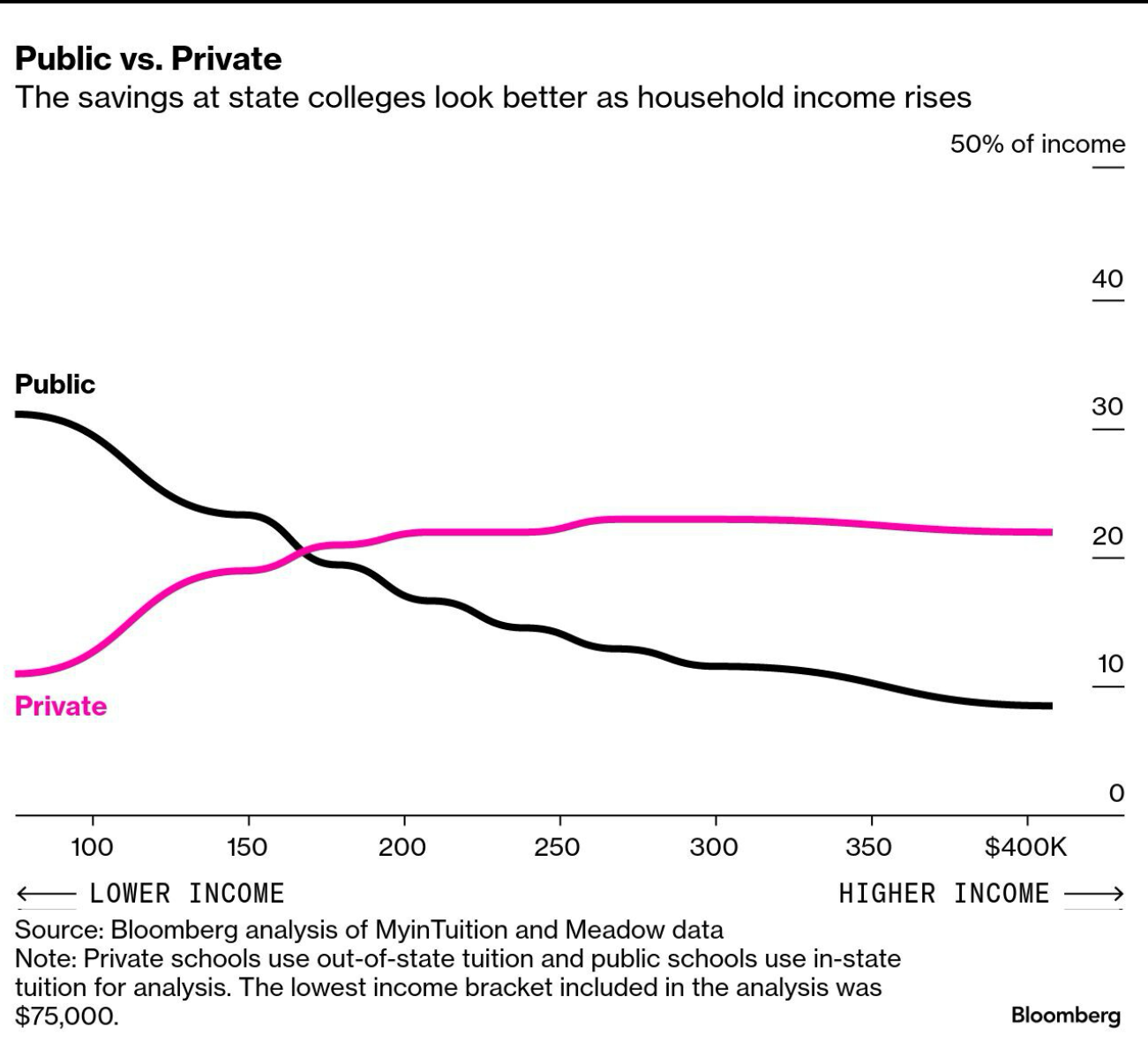

Nevertheless, attending a public school to economize over a personal one might not be as easy right now. In response to Bloomberg’s evaluation, as soon as your family revenue exceeds roughly $170,000, it may truly be cheaper to ship your youngster to a personal college.

The rationale? Personal schools typically have extra sources and are extra prepared to supply monetary help, whereas public schools count on households to contribute extra as soon as they cross sure revenue thresholds.

Personally, I feel what is going to possible occur for my youngsters is that they’ll both attend a public school or go to a tier 2 or 3 non-public school with “advantage help.” I put “advantage help” in quotes as a result of many schools at the moment are giving out cash beneath the guise of advantage to make households really feel good and incentivize enrollment.

Don’t Be Center Class When Making use of for School Grants and Scholarships

Hopefully, it’s clear from this evaluation that when making use of for school, you both need to be poor or a multi-millionaire.

For those who’re poor, you’ll possible get important free cash for school, which is incredible. Please take full benefit. A school schooling continues to be among the finest methods to interrupt out of the poverty cycle.

For those who’re a multi-millionaire, you most likely gained’t qualify for need-based grants or scholarships. However the sting of paying full worth gained’t really feel as painful since you’ll have sufficient property saved up, and probably a excessive revenue as effectively. For those who’re fortunate, your youngster would possibly even obtain need-blind advantage help, which is basically a reduction to encourage them to enroll.

Sadly, should you’re a millionaire with a web price beneath ~$5 million, paying $100,000+ per yr for 4 years for only one youngster will nonetheless harm. Ideally, you’d need a web price of at the very least 25X for the associated fee to now not really feel painful.

In different phrases, if you wish to ship your child to NYU or USC for $400,000 complete, you’d want at the very least a $10 million web price to really feel financially comfy doing so. How loopy is that? Fairly quickly, going to a personal school will solely be a luxurious for the very wealthy or the extraordinarily gifted.

The center-class family incomes between $150,000 to $400,000 a yr will really feel essentially the most ache when paying for school. Except you’re a legacy pupil, athlete, or a part of a particular curiosity group, affording school comfortably will possible be robust. And you may’t depend these benefits as they are not in your management.

Readers, what are your plans to make school extra inexpensive? Why do you assume Bloomberg and others not think about property when doing their evaluation? Are we actually only a nation of spenders who do not save and make investments aggressively for the longer term?

Change into a Millionaire to Afford a Million-Greenback School Diploma

It’s ironic that households now must develop into millionaires as a result of the overall value of faculty is heading towards 1,000,000 {dollars} all-in. However the math would not lie. You’ll be able to both take issues into your individual arms by constructing critical wealth, or pray for the kindness of others on this brutally aggressive world. I select the previous.

If you wish to have a neater time paying for school, choose up a replica of my new e-book, Millionaire Milestones: Easy Steps to Seven Figures. It will be a crying disgrace in your youngster to get into their dream faculty however not be capable of attend since you weren’t rich sufficient. The more cash you will have, the extra choices — and freedom — you and your kids can have.

For those who love private finance, be part of 60,000+ others and join my free weekly publication. Since 2009, my objective is to assist readers obtain monetary freedom sooner so we will do extra of what we wish.