I like index funds and ETFs for his or her low-cost nature and ease of possession. Nevertheless, if you wish to construct generational wealth earlier than conventional retirement age, take into account wanting past simply index funds and index ETFs.

Since beginning Monetary Samurai in 2009, I’ve written extensively about funding methods, monetary independence, and retiring earlier to do what you need.

Primarily based on years of reader surveys and conversations, it is clear this group is without doubt one of the wealthiest on the net. A good portion of you will have already surpassed the $1 million web price mark, whereas many extra are closing in. Compared, the median family web price in America is simply about $200,000.

With this in thoughts, it’s time to acknowledge a easy reality: the richest folks on this planet don’t rely primarily on index funds and ETFs to construct their fortunes. As an alternative, many use index funds primarily to protect their wealth, not create it.

Why Index Funds Alone Aren’t Sufficient

Most of us love index funds for his or her simplicity, low charges, and historic returns. But when your objective is to attain monetary freedom earlier than the standard retirement age, or to achieve a high 1% web price, index funds alone most likely gained’t get you there earlier than age 60.

To get wealthy sooner, you want both:

- A large quantity of earnings to constantly make investments massive sums into index funds, or

- To take extra calculated dangers in different asset courses

Merely put, index fund investing is finest for capital preservation and slower, steadier development. A possible 10% annual return is unbelievable. However at that fee, your funding solely doubles each 7.2 years. Hey, I will take it, and so would lots of you. Nevertheless, it is merely not ok for the richest folks.

Your life is finite. Most of us solely begin working full time after age 18. Forty years would possibly sound like a very long time to construct wealth, however belief me—it flies by. I am 48 now, and I graduated school in 1999 at age 22. The previous 26 years have zoomed previous.

If I had solely invested in index funds, I wouldn’t have been in a position to depart the workforce for good in 2012 at age 34. Don’t neglect, there was a “misplaced decade” for each the S&P 500 and NASDAQ from 2000 to 2012. Relying solely on index funds would have delayed my monetary freedom indefinitely.

Moreover getting fortunate, the one technique to obtain monetary freedom ahead of common is to take above-average dangers by investing past index funds and ETFs. Wanting again, I want I had taken extra dangers.

The Common Wealthy Versus the Richest Wealthy

First off, if you happen to’re wealthy—or really feel wealthy—congratulations! You’re forward of not less than 90% of the world, which additionally means you’ve purchased your self extra freedom than most. Though it’s powerful, attempt to not let somebody richer than your already-rich self get you down. The hot button is appreciating what you will have.

That mentioned, it’s necessary to differentiate between two sorts of wealthy, as a result of they’re not the identical. The non-public finance group largely focuses on the primary variety—The Common Wealthy—partly as a result of it is simpler to elucidate and attain, and partly as a result of many monetary creators don’t have finance backgrounds.

In actual fact, the dearth of monetary depth within the house was one of many essential causes I launched Monetary Samurai in 2009. Again then, almost each blogger solely emphasised budgeting and saving their technique to wealth. That’s stable recommendation for most individuals, nevertheless, I needed to transcend that. You’ll be able to solely achieve this a lot saving your technique to wealth.

I needed to flee the finance business altogether and retire early. That’s after I began writing about FIRE for the trendy employee. With the web making it doable to earn and dwell in non-traditional methods, I noticed an thrilling alternative to pursue a distinct way of life.

Sarcastically, it was 2009—through the international monetary disaster—when the digital nomad development actually took off, as hundreds of thousands discovered themselves out of conventional jobs and trying to find one thing new.

Now let’s particular the 2 sorts of wealthy folks.

1. The Common Wealthy

This group contains people or households with investable belongings between $1,000,000 and $5 million. They are usually extremely educated, dual-income professionals who max out their 401(okay)s, spend money on low-cost index funds, and personal their main residence.

Most of their investments are in public markets and actual property, and so they sometimes really feel financially steady however not actually wealthy. Some would describe this because the mass prosperous class. Many began off or are HENRYs (Excessive Earners Not Wealthy But), however then usually decelerate their tempo of wealth accumulation as soon as youngsters arrive.

You would possibly consider the on a regular basis wealthy particular person as somebody with gray hair, a portly determine, and retiring across the extra conventional age of 60–65. They have a median-priced house and would possibly fly Financial system Plus if they’re feeling notably spendy. They don’t seem to be consuming at Michelin-star eating places, besides possibly for a uncommon big day, like a 30-year marriage ceremony anniversary.

The Common Wealthy know they’re wealthier than most, but they nonetheless don’t really feel wealthy. As an alternative, they really feel nearer to the center class than to the actually rich.

2. The Richest Wealthy

These are the folks with $10 million-plus in investable belongings, usually proudly owning second and third trip houses, flying first-class, and making excessive six-figure or seven-figure investments. Their youngsters largely go to non-public grade faculty, which they’ll comfortably afford with out monetary assist. In addition they freely donate vital sums of cash often.

As an alternative of investing largely in index funds to get wealthy, their cash got here from:

They could personal index funds, however it wasn’t a driver for them to get wealthy. As an alternative, index funds are a spot the place they park their cash, virtually like a money plus, till they discover a probably higher alternative.

20% plus or minus strikes within the S&P 500 do not section them because the Richest Wealthy usually expertise rather more unstable swings. In actual fact, the Richest Wealthy usually have investments go to zero as they constantly fortune hunt for the following multi-bagger funding. So usually, index funds and ETFs are a small share of their general web price (<20%).

The Richest Wealthy Have a tendency To Be Seen as Eccentric

The Richest Wealthy are sometimes considered as eccentric, agitators, or downright bizarre by most of the people. That’s as a result of they have an inclination to reject the established order and do issues their very own means. Consequently, they entice critics—generally a lot of them—merely for not following societal norms.

They refuse to spend their total careers working for another person to make that particular person wealthy or group wealthy. They don’t seem to be spending a fortune to get an MBA solely to work for another person. As an alternative, they guess closely on themselves by entrepreneurship and different investments. Index funds and ETFs? Boring. Too gradual. These people would somewhat construct one thing from scratch or swing for the fences.

Most of the Richest Wealthy additionally go all-in on optimizing their our bodies and minds. They practice exhausting, eat clear, and observe each metric they’ll—usually within the hopes of staying match sufficient to increase their grind and lifespan.

To most, they arrive throughout as quirky or intense. However from their perspective, it’s the remainder of society that’s asleep, trapped in a system they’ve managed to flee.

Actual-World Internet Price Breakdowns

Listed below are just a few anonymized examples of the Richest Wealthy:

Instance 1 – $30 Million Internet Price

- 30% possession in enterprise fairness they began

- 30% actual property

- 20% public equities (65% particular person shares, 35% S&P 500 index funds)

- 15% enterprise capital funds

- 5% muni, Treasury bonds, money

Instance 2 – $300 Million Internet Price

- 40% possession in enterprise fairness they began

- 20% actual property

- 20% in different non-public firms

- 15% shares (half in index funds)

- 5% money and bonds

Instance 3 – $600 Million Internet Price

- 5% possession in a large non-public cash administration agency as certainly one of their senior execs

- 15% actual property

- 50% in different non-public firms

- 10% shares (half in index funds)

- 20% money & bonds (~$180 million at 4% yields a whopping $6.4 million risk-free a 12 months right now)

None of them received wealthy by solely investing in index funds. As an alternative, index funds are merely a low-risk asset class to them the place they’ll park cash.

Internet Price Breakdown By Ranges Of Wealth

Here is an excellent web price breakdown visualization by web price ranges. The information is from the Federal Reserve Board Of Shopper Funds, which comes out each three years.

Let’s assume the mass prosperous represented within the chart beneath is on the $1 million web price degree. Roughly 25% of the mass prosperous’s web price is of their main residence, 15% is in retirement accounts, 10% is in actual property investments, and 12% is in enterprise pursuits.

Compared, for the Richest Wealthy ($10M+), not less than 30% of their web price is in enterprise pursuits. Intuitively, we all know that entrepreneurs dominate the wealthiest folks on this planet. Due to this fact, if you wish to be actually wealthy, take extra entrepreneurial dangers and funding dangers.

Time + Better Threat Than Common = Better Than Common Wealth

Constructing significant wealth usually comes right down to how a lot threat you’re taking—and the way early you’re taking it. While you’re younger, lean into greater bets. Spend money on your self. Construct one thing. Personal one thing past simply index funds. When you lose cash, you’ve nonetheless received time to earn it again—after which some.

If I may rewind the clock, I’d’ve taken extra calculated dangers in my 20s and early 30s. Quite than enjoying it comparatively secure, I’d’ve gone greater on enterprise alternatives and leveraged extra into actual property. I additionally would’ve made bigger, concentrated bets on tech giants like Google, Apple, Tesla, and Netflix. The CEO of Netflix, Reed Hastings, spoke at my MBA commencement ceremony in 2006 when the inventory was solely $10 a share.

As well as, I’d have began Monetary Samurai in 2006, after I graduated enterprise faculty and got here up with the concept. As an alternative, I waited three years till a world monetary disaster pressured me to cease being lazy.

However actually, I used to be too hen poop to speculate greater than $25,000 in anybody identify—even after I had the capital to place $100,000 in every earlier than 2012. The scars from the dot-com bust and the international monetary disaster made me hesitant, particularly after watching so many wealthier colleagues get crushed.

Nonetheless, I nonetheless ended up saving over 50% of my earnings for 13 years and investing 90% of the cash in threat belongings, most of which was not in index funds. I’ve had some spectacular blowups, however I’ve additionally had some terrific wins that created a step perform up in wealth.

Don’t Be Too Simply Glad With What You Have

One of many keys to going from wealthy to actually wealthy is pushing past your monetary consolation zone—particularly whilst you’re nonetheless younger sufficient to bounce again from errors.

You’ve received to be a little bit greedier than the common particular person, as a result of let’s face it: no person wants tens or a whole lot of hundreds of thousands—not to mention billions—to outlive or be pleased. However if you happen to’re aiming for that subsequent degree of wealth, you are going to must need it extra and take calculated dangers others gained’t.

I used to be happy with a $3 million web price again in 2012, so I ended attempting to maximise my funding returns. Massive mistake. The financial system boomed for the following 10 years, and I missed out on higher upside.

Then in 2025, after one other short-term 20% downturn, I shifted my taxable portfolio nearer to a 60/40 asset allocation. The temptation of incomes 4%+ risk-free passive earnings was too sturdy. From a pure returns perspective, that’ll most likely grow to be one other mistake long run.

To stability issues out, I’ve deployed a dumbbell technique—anchoring with Treasury payments and bonds on one finish, whereas taking bolder swings in non-public AI firms on the opposite. And what? It feels nice. I get to sleep nicely at evening realizing I’ve received safety on the draw back, whereas nonetheless taking part within the upside if the following huge factor takes off.

Remaining Thought On Investing In Index Funds And ETFs

Index funds are nice. I personal a number of seven figures price of them. You must too. However they’re finest fitted to these on the standard retirement observe or these seeking to protect wealth.

If you wish to obtain monetary freedom sooner or be a part of the ranks of the Richest Wealthy, you’ll want to speculate past index funds. Construct one thing. Take dangers. Personal extra of your future.

That’s how the richest folks do it.

Free Monetary Evaluation Provide From Empower

You probably have over $100,000 in investable belongings—whether or not in financial savings, taxable accounts, 401(okay)s, or IRAs—you will get a free monetary check-up from an Empower monetary skilled by signing up right here. It’s a no-obligation technique to have a seasoned skilled, who builds and analyzes portfolios for a dwelling, overview your funds.

A recent set of eyes may uncover hidden charges, inefficient allocations, or alternatives to optimize—providing you with higher readability and confidence in your monetary plan. The richest folks on this planet get often monetary checkups.

The assertion is supplied to you by Monetary Samurai (“Promoter”) who has entered right into a written referral settlement with Empower Advisory Group, LLC (“EAG”). Click on right here to be taught extra.

Diversify Your Retirement Investments

Shares and bonds are traditional staples for retirement investing. Nevertheless, I additionally recommend diversifying into actual property—an funding that mixes the earnings stability of bonds with higher upside potential.

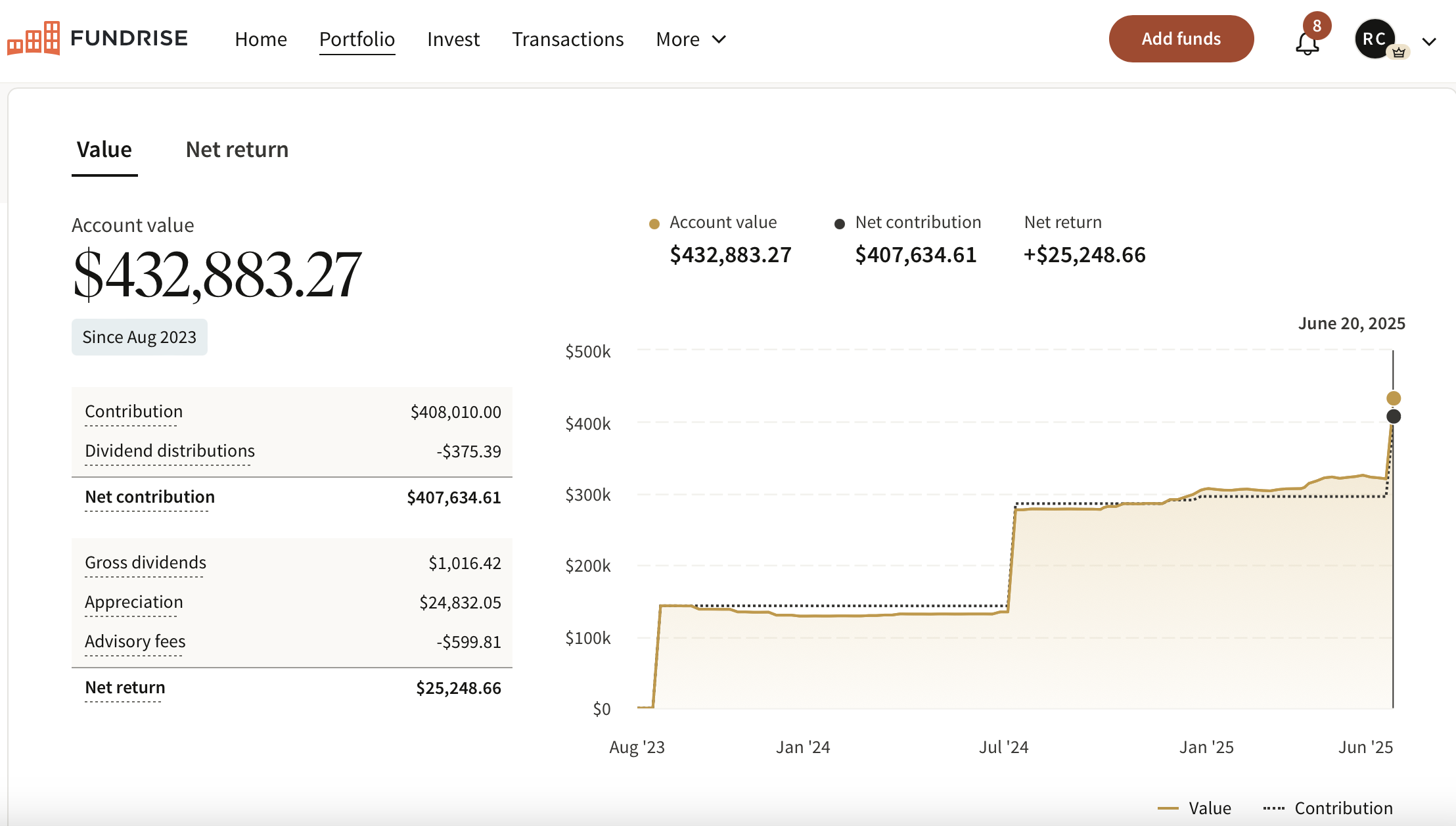

Take into account Fundrise, a platform that permits you to 100% passively spend money on residential and industrial actual property. With over $3 billion in non-public actual property belongings beneath administration, Fundrise focuses on properties within the Sunbelt area, the place valuations are decrease, and yields are usually increased. Because the Federal Reserve embarks on a multi-year rate of interest lower cycle, actual property demand is poised to develop within the coming years.

As well as, you may spend money on Fundrise Enterprise if you would like publicity to non-public AI firms like OpenAI, Anthropic, Anduril, and Databricks. AI is about to revolutionize the labor market, remove jobs, and considerably increase productiveness. We’re nonetheless within the early phases of the AI revolution, and I need to guarantee I’ve sufficient publicity—not only for myself, however for my kids’s future as nicely.

I’ve personally invested over $400,000 with Fundrise, and so they’ve been a trusted accomplice and long-time sponsor of Monetary Samurai. With a $10 funding minimal, diversifying your portfolio has by no means been simpler.

To extend your possibilities of attaining monetary independence, be a part of 60,000+ readers and subscribe to my free Monetary Samurai publication right here. Monetary Samurai started in 2009 and is the main independently-owned private finance web site right now. All the pieces is written primarily based off firsthand expertise.