A reader asks:

My spouse and I plan on promoting our home as soon as my youngest graduates highschool in 2.5 years. My spouse is pushing for us to promote it this Spring of 2025 as an alternative of ready till Spring of 2027 as a result of she believes dwelling costs shall be down significantly in 2027 as a result of Trump’s insurance policies and inflation. I attempted to channel my inner-Ben and let her know that there isn’t any strategy to predict these items, however she is urgent me laborious. Any strategies on the right way to handle somebody who thinks they know dwelling costs shall be decrease in 2027 than in 2025?

I’m undecided how I really feel about being utilized in a marital disagreement however I like the subject right here.1

Ben’s widespread sense rule of thumb #347 is don’t combine politics together with your portfolio. Have all of the political beliefs you need however predicting how anyone political social gathering or particular person politician will affect the market is a idiot’s errand. Traders are virtually at all times fallacious about these predictions.

Vibes should not actionable for investing functions.

I’m additionally not an enormous fan of timing the housing market.

Again in April 2021, I obtained a query from a home-owner in Seattle who was questioning about taking some money off the desk:

The housing market continues to be loopy, my neighbor simply bought his home for $1M+, based mostly on what the true property apps say I might promote this identical home lower than 3 years after I purchased it and, after prices and paying the mortgage, stroll away with about $500k. I do know it isn’t some huge cash & I’m not planning to promote as a result of that is my main residence but it surely made me suppose: there must be a degree the place it makes mathematical sense to promote a home and simply begin renting. What are your ideas?

The housing market did appear loopy again then. Mortgage charges have been at 3%. There have been bidding wars everywhere in the nation. Costs have been going bananas.

And guess what?

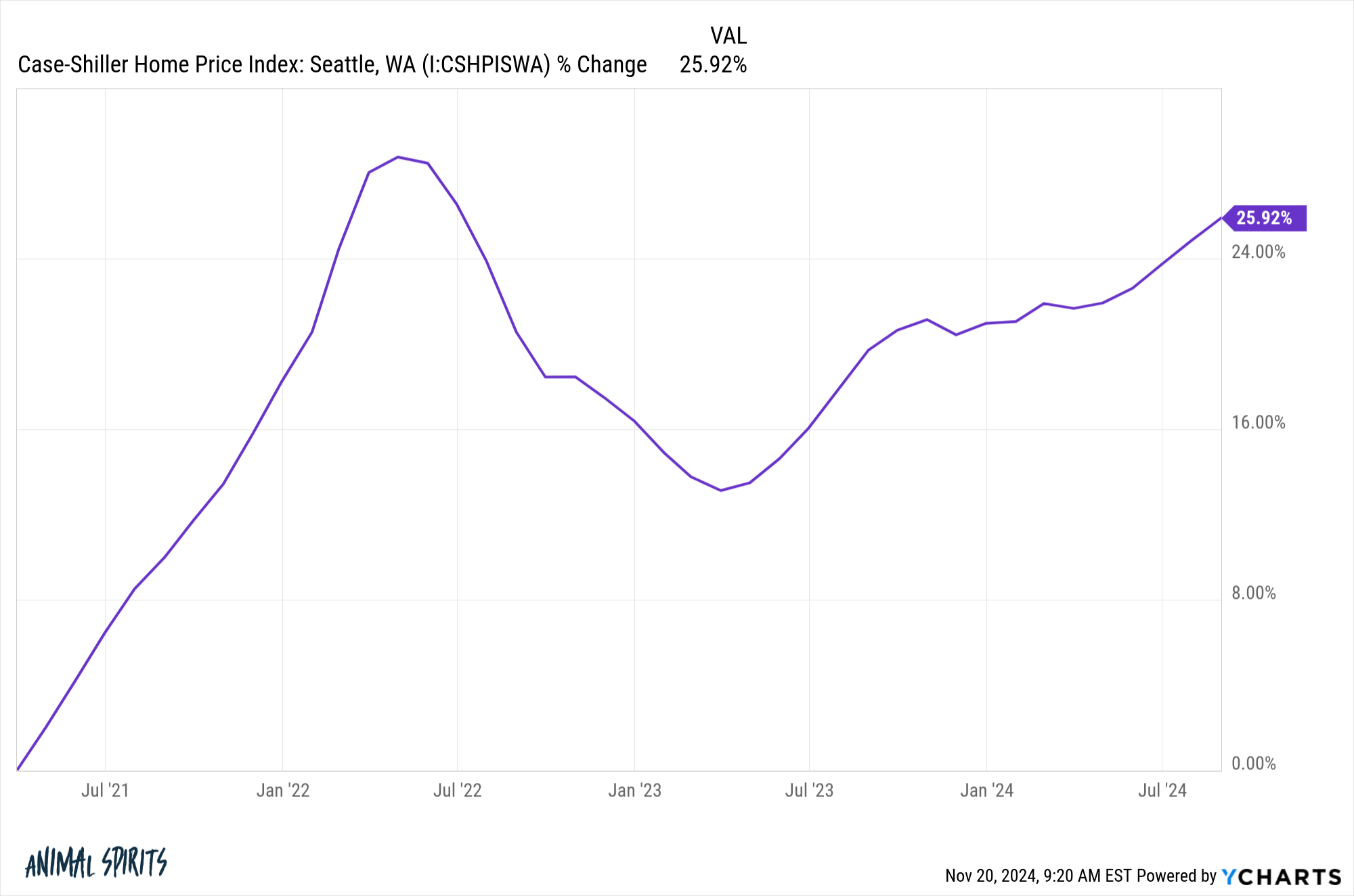

Issues acquired even crazier. Take a look at housing costs in Seattle since then:

They’re up virtually 30%, regardless of a short pullback.

Taking cash off the desk would have meant leaving cash on the desk.

Clearly, nobody occasions these transactions completely. Plus, a home isn’t meant to be traded like a inventory. You’re not supposed to leap out and in of it or timing the market.

Should you can afford to service the debt and the ancillary prices of dwelling possession, you should purchase if that’s what you need to do.

If you should promote your property, you need to achieve this in a timeframe that fits your wants and psyche.

I particularly hate the concept of making an attempt to time the housing market utilizing macro variables. Mortgage charges first hit 6% someday within the fall of 2022. How many individuals have been ready for them to fall ever since? And so they’ve truly gone greater, but costs by no means got here down!

Possibly Trump is dangerous for the housing market, possibly not. Let’s say his insurance policies do trigger inflation to come back roaring again. Inflation is often good for housing costs. Housing was the perfect asset class within the Seventies, outperforming shares, bonds and money. Housing was a beautiful hedge towards excessive inflation in 2022.

So desirous about it from that perspective doesn’t make a whole lot of sense.

However possibly your spouse merely desires some peace of thoughts. She is aware of it’s a must to promote in a couple of years. Ready round with that hanging over your head will be anxious. Shopping for a brand new home whereas promoting an present property could be a difficult scenario from a timing perspective.

When my spouse and I have been constructing our lake home we already owned one other property in the identical growth. We knew we needed to promote the primary dwelling in some unspecified time in the future to assist with the down fee on the brand new place.

This was again in the summertime of 2022 when mortgage charges have been simply beginning to rise. We noticed them go from 3% to five% in a rush and we have been nervous about how it could affect potential homebuyers. So we put the home available on the market a full yr earlier than the brand new home was completed.

Possibly we missed out on additional upside however we didn’t care as a result of locking within the sale forward of time fully took that fear off our plates.

A house is already probably the most emotional monetary asset in existence so I don’t like introducing politics into the equation. That superchargers the feelings even additional, turning it right into a 3x leveraged ETF-like scenario.

Nevertheless, I do suppose it’s price discussing the professionals and cons of promoting now versus ready from a stress administration perspective.

It’s laborious to place a worth on peace of thoughts.

Barry Ritholtz joined me on Ask the Compound this week to debate this query:

We additionally answered questions on when it’s time to fireplace your monetary advisor, the affect of the presidential election on the markets and economic system, investing a pile of money throughout a bull market and the perfect hedge for China invading Taiwan.

Additional Studying:

The Drawback With Timing the Housing Market

1Who am I kidding? I find it irresistible!