Every month, I replace my rating system for the thousand or so funds that I observe utilizing the MFO Premium fund screener and Lipper world dataset. I then examine the funds that I personal to the trending funds to see if I need to make any adjustments. I comply with a diversified conventional portfolio strategy with over half managed by Constancy and Vanguard. On this article, I have a look at the Lipper Classes and highest ranked funds for bonds, combined belongings, and equities.

Bond Funds

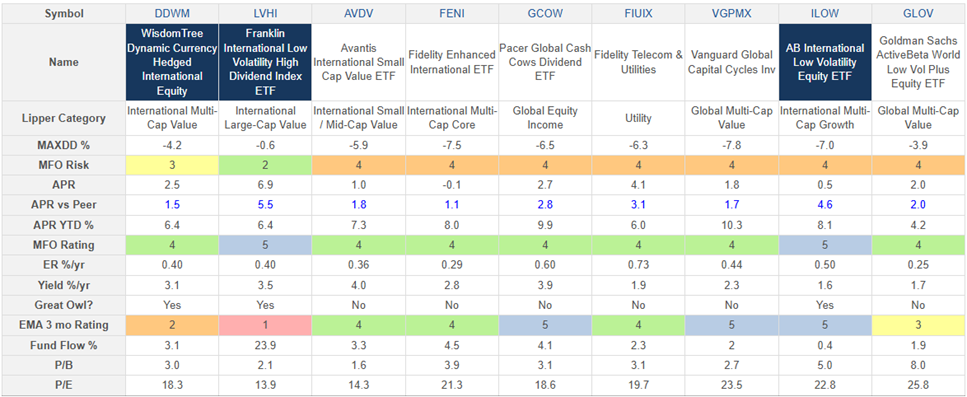

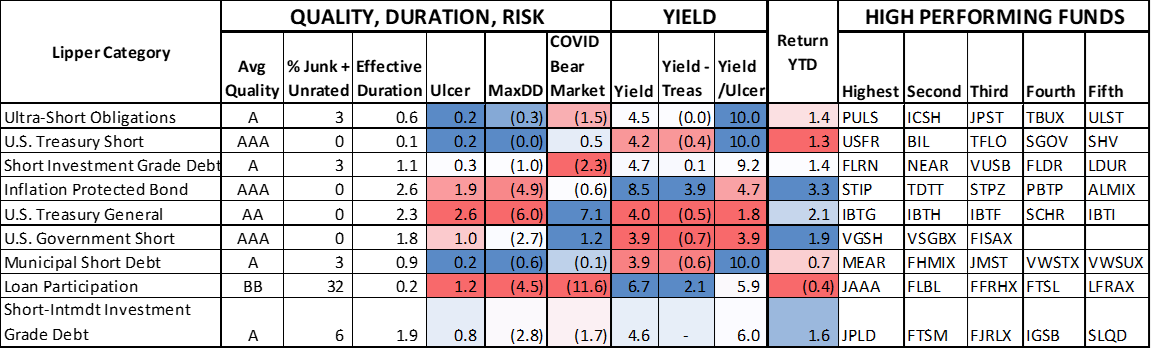

Bond funds are ranked based mostly upon 1) three-year risk-adjusted returns (Martin Ratio), 2) short-term returns and momentum, 2) danger (drawdowns and Ulcer Index), 3) bond high quality, and 4) yields, amongst different metrics. The funds in Desk #1 are ordered from the best ranked Lipper Class to the bottom, together with the 5 highest ranked funds. Over half of the investments in bonds that I handle are in bond ladders. I’m glad with the efficiency of my funds; nonetheless, high-yield funds which might be meant for revenue have had barely damaging returns year-to-date. Over the course of the following few months, I’ll consider buying and selling Constancy Capital & Revenue (FAGIX) for a short-term or inflation-protected bond fund.

Desk #1: High Ranked Lipper Bond Classes and Highest Ranked Funds – Three 12 months Metrics

Supply: Writer Utilizing MFO Premium fund screener and Lipper world dataset with YTD Returns from Morningstar as of April twenty second

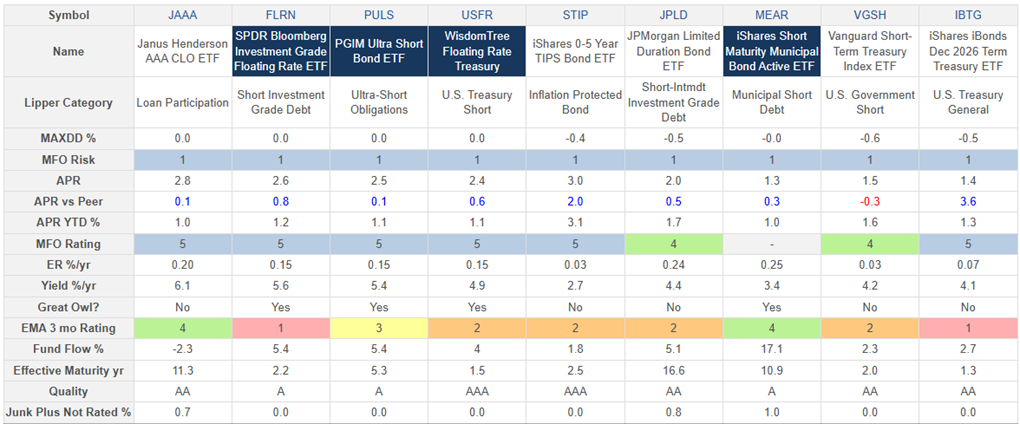

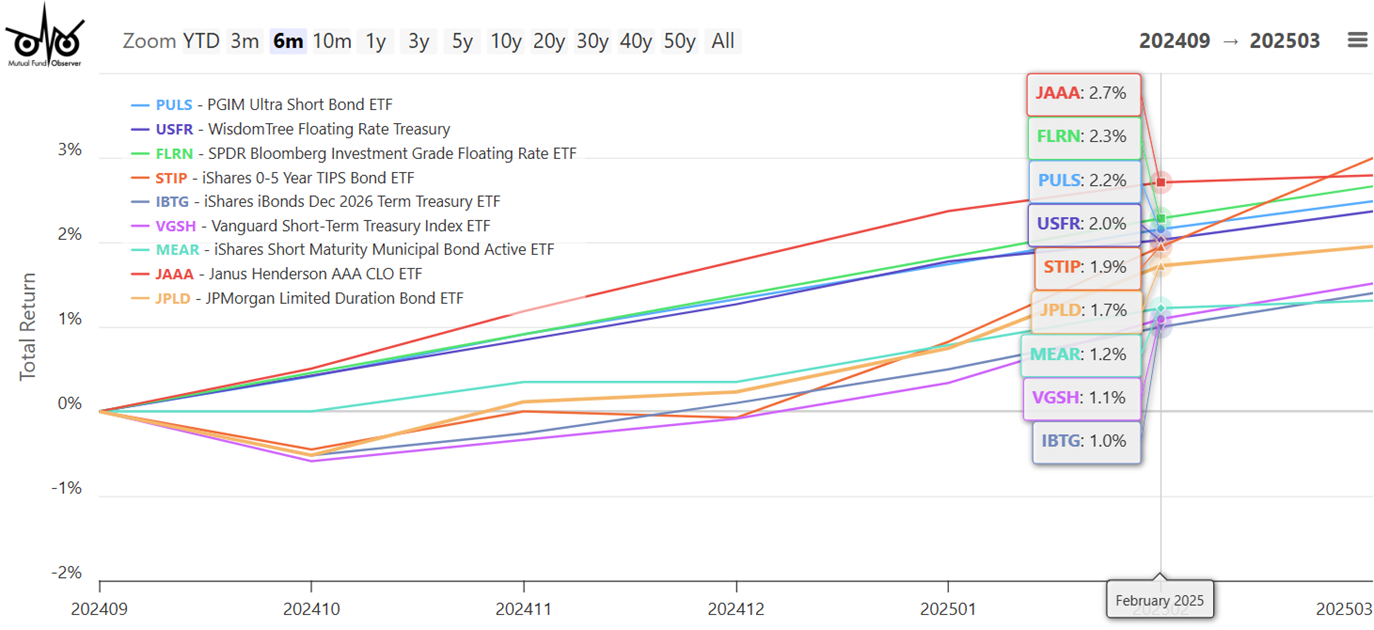

In Desk #2, I show a snapshot of the highest-ranked fund in every of the above 9 Lipper Classes. Word that IBTG within the U.S. Treasury Basic Class is the iShares iBond Dec 2026 Time period Treasury ETF, which is a fund designed for bond ladders. I wrote about these funds in “ETF Bond Ladders” final month. Determine #1 exhibits the overall return of those funds since Inauguration Day.

Desk #2: Highest-Ranked Bond Funds – Metrics For Six Months

Determine #1: Whole Return of Highest-Ranked Bond Funds Since Inauguration Day

Combined Asset Funds

Combined-asset funds are ranked based mostly upon 1) three-year risk-adjusted returns (Martin Ratio), 2) short-term returns and momentum, 3) danger (drawdowns and Ulcer Index), 4) valuation, and 5) yields. Combined-asset funds are nice for a buy-and-hold technique and letting knowledgeable supervisor make the funding selections. The downside in retirement could also be that you’ve much less management over withdrawals as a result of you possibly can’t withdraw from sure classes when they’re performing properly.

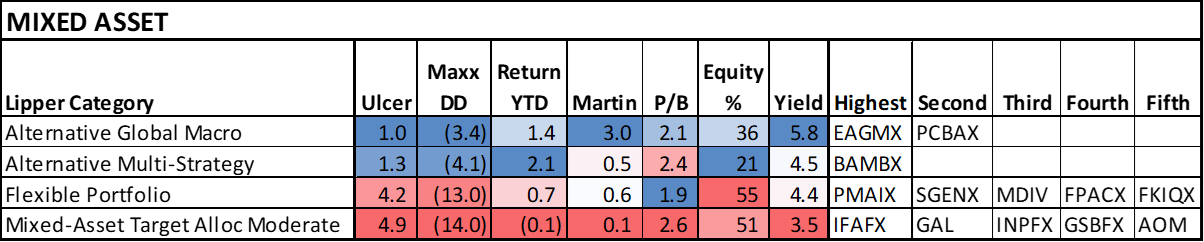

Desk #3 exhibits the Lipper Combined-Asset Classes that I rank the best, together with the 5 funds with the best rank. Different world macro and different multi-strategy are likely to have increased expense ratios. I could take into account shopping for one as a “Threat Off” diversifier. In a “Threat On” setting, I could take into account including a versatile portfolio fund in accounts that I handle.

Desk #3: High-Ranked Lipper Combined-Asset Classes and Highest Ranked Funds – Three-12 months Metrics

Supply: Writer Utilizing MFO Premium fund screener and Lipper world dataset with YTD Returns from Morningstar as of April twenty second

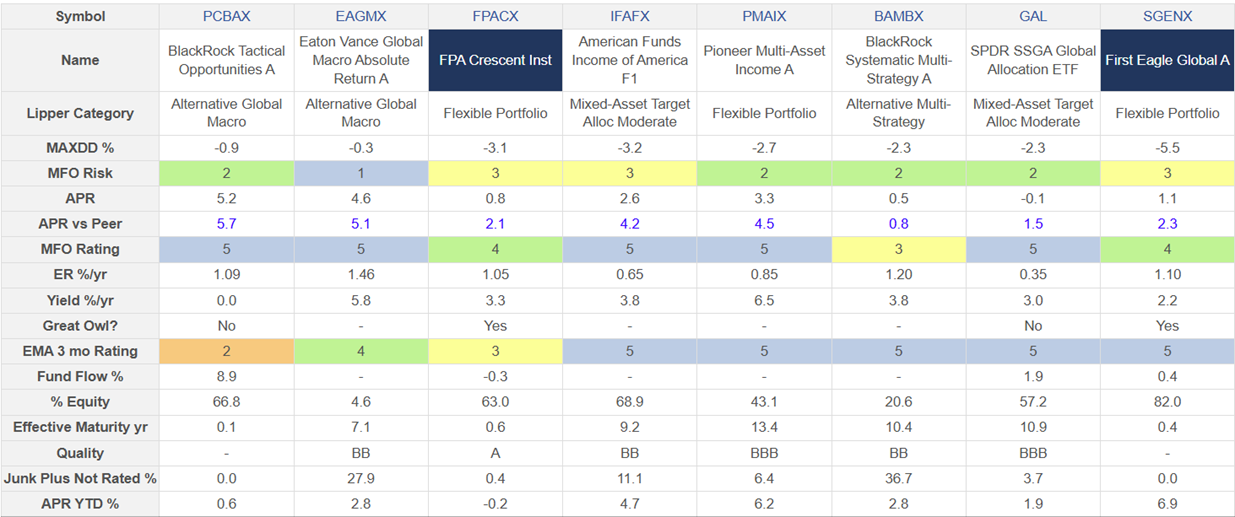

Desk #4 exhibits a snapshot of the best ranked fund in every Lipper Class, together with just a few different well-known funds.

Desk #4: Chosen Excessive-Performing Combined-Asset Funds – Metrics For Six Months

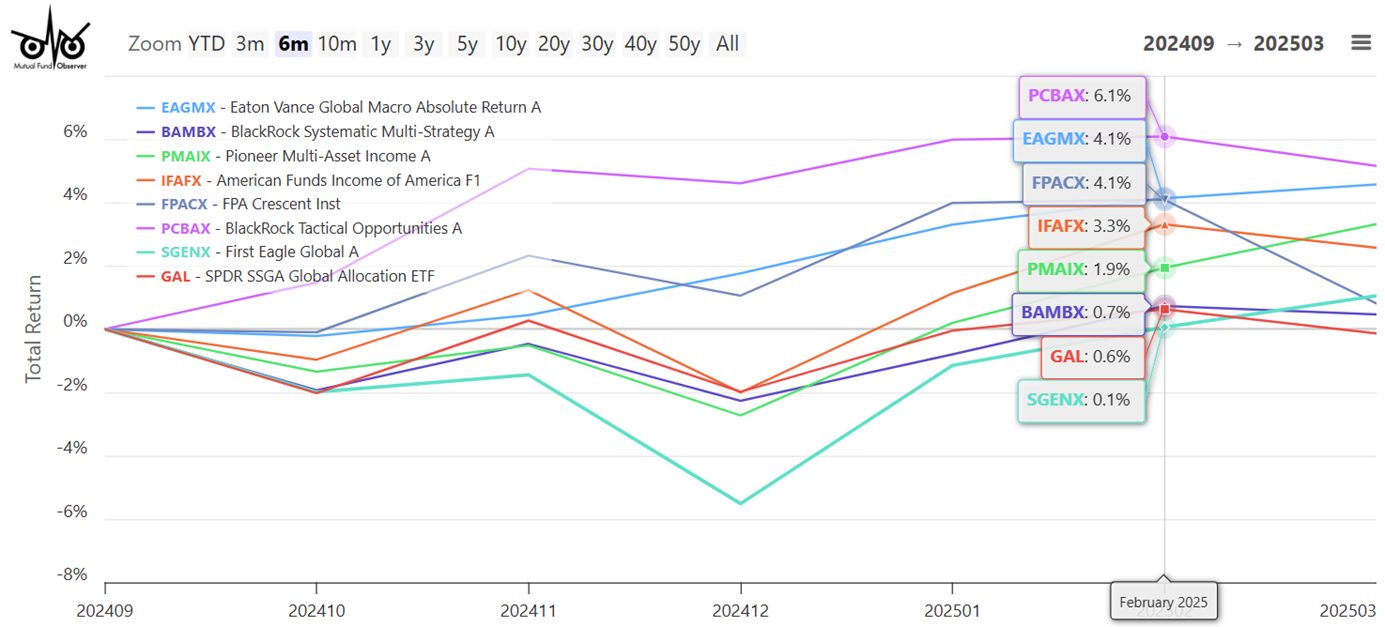

I just like the return profile of the Eaton Vance World Macro Absolute Return (EAGMX) fund as proven in Determine #2.

Determine #2: Whole Return of Chosen Excessive Performing Combined-Asset Funds Since Inauguration Day

Fairness Funds

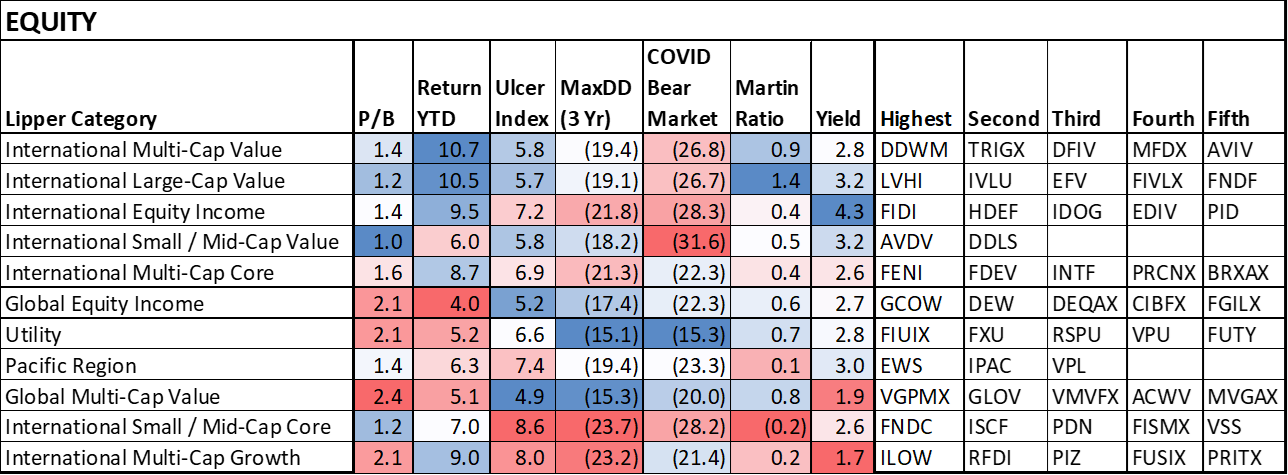

I rank fairness funds based mostly upon 1) three-year risk-adjusted returns (Martin Ratio), 2) short-term returns and momentum, 3) danger (drawdowns and Ulcer Index), and 4) valuations. Virtually all the highest ranked Lipper Fairness Classes are worldwide or world. The returns are robust for the yr in mild of the uncertainty.

Desk #5: High Ranked Lipper Fairness Classes and Highest Ranked Funds – Three 12 months Metrics

Supply: Writer Utilizing MFO Premium fund screener and Lipper world dataset with YTD Returns from Morningstar as of April twenty second

Desk #6: Chosen Excessive-Performing Fairness Funds – Metrics for Six Months

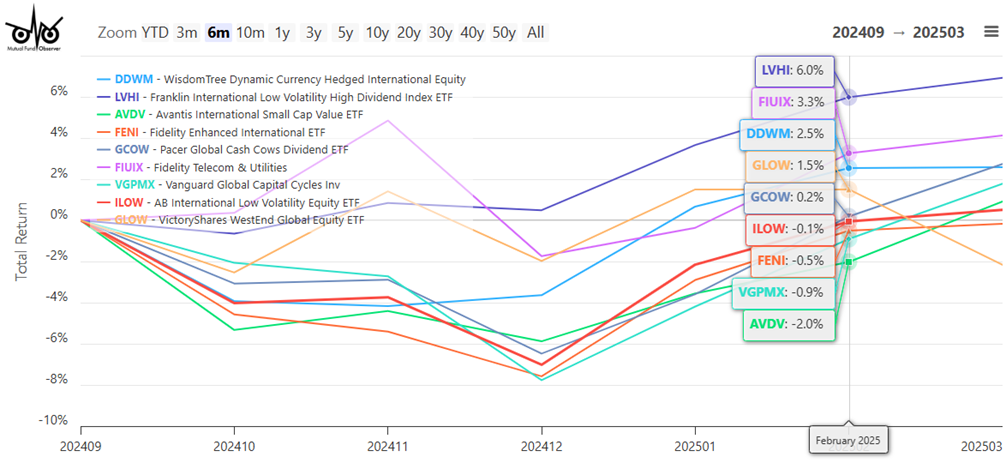

Determine #3: Whole Return of Chosen Excessive-Performing Fairness Funds Since Inauguration Day

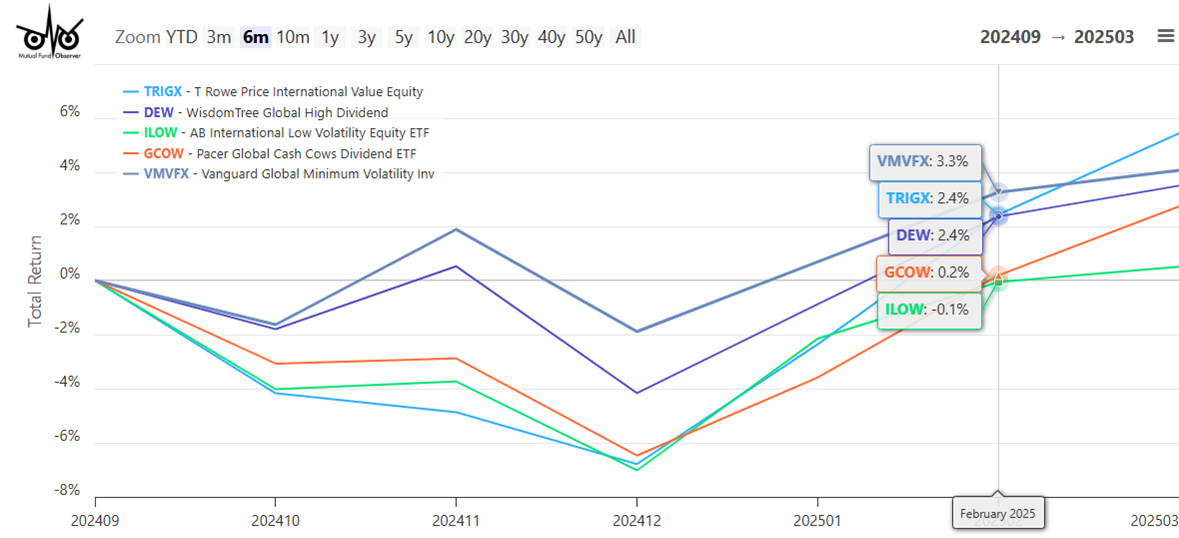

Because the mud from the commerce battle settles, I’ll in all probability be out there for a tax-efficient worldwide or world fairness fund. My quick checklist is proven in Determine #4.

Determine #4: Excessive-Performing Tax-Environment friendly Worldwide Fairness Funds

Closing

I consider that the influence of tariffs will start to point out up extra clearly in June as a result of imports affected by tariffs will attain the cabinets in Might. A recession received’t change into evident except the uncertainty spreads to enterprise investments and worldwide commerce worsens, together with shocks to produce chains. The longer the uncertainty lasts, the upper the likelihood of a recession will probably be.

Tariffs are a regressive tax on lower-income households who spend most of their revenue on primary wants. Cuts to Federal packages that assist the poor will improve the monetary stress on these households. I favor fiscal accountability and slowing the rise of the nationwide debt in a well-thought-out bipartisan method.

My rating system is at present oriented to focus on funds that can do properly in market downturns. I stay danger off and focus extra on having a dependable money circulate from fastened revenue for the following 5 to 10 years.