When Dick and Mac McDonald opened the primary McDonald’s the thought was to convey quick, low-cost meals to busy individuals within the suburbs of Chicago.

The primary hamburger again in 1948 value simply 15 cents.

That’s my son’s favourite burger (ketchup solely, no onions or pickles) so I do know it now prices $1.89 at my native McDonald’s.1 Meaning we’re near a 12x value improve previously 77 years or so.

That feels like rather a lot. It’s an enormous motive for this sentiment:

You recognize once I was a child…

Nonetheless, it’s not that egregious while you have a look at the inflation figures. That 12x value improve from 15 cents to almost $2 equates to an annual inflation price of three.3%. The precise inflation price over that time period was 3.4% per 12 months.

Over lengthy intervals of time, even small share good points can snowball. It’s one of many causes your finest good friend when investing is a very long time horizon. Individuals have a tough time wrapping their heads round compounding over the long-run in relation to costs, investments and incomes.

As an example, the median revenue for people in 1948 when a McDonald’s hamburger value 15 cents was simply $1,000 a 12 months. Costs imply nothing with out a denominator for some perspective.

Incomes change over time due to inflation, progress and progress.

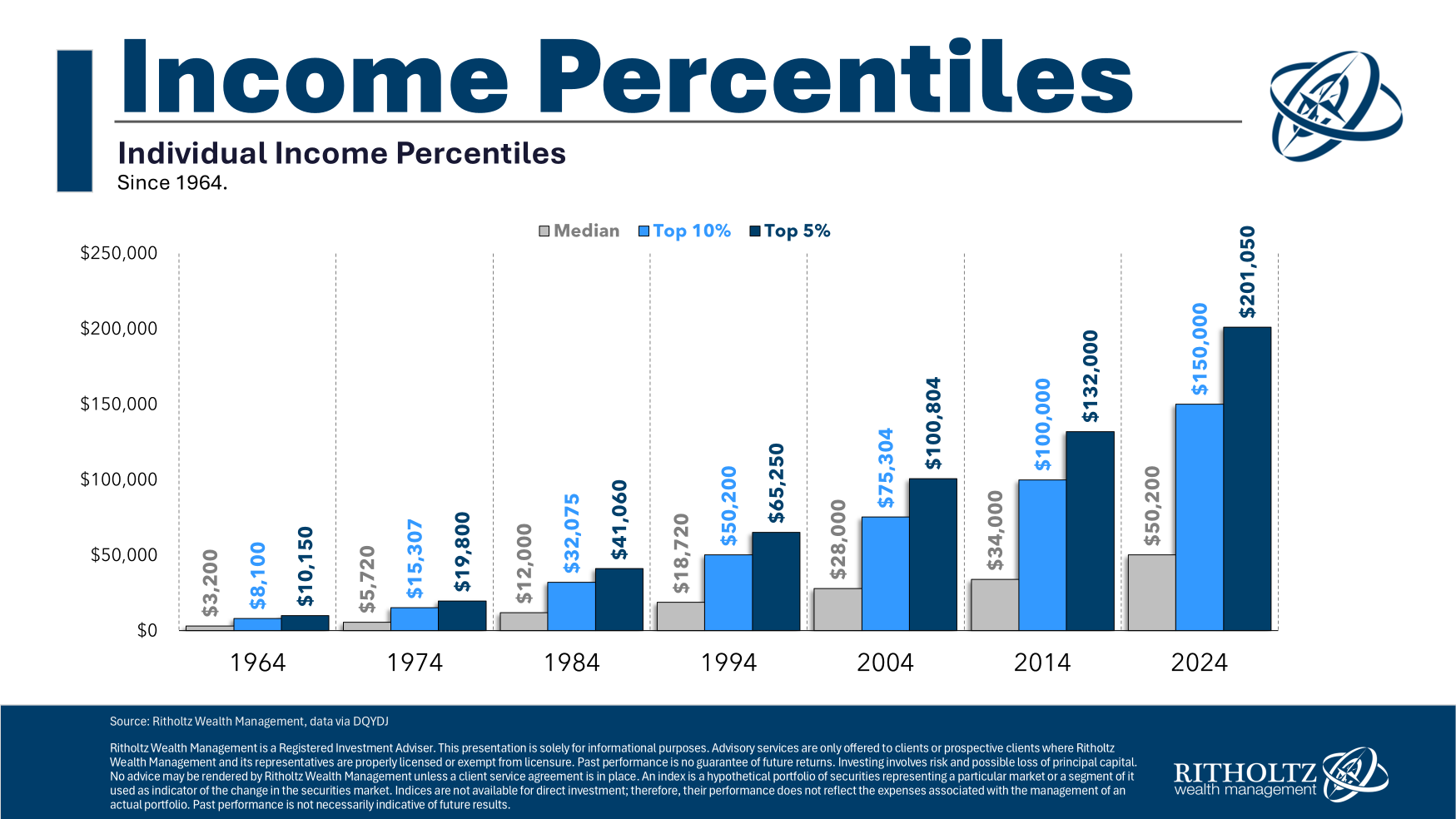

Have a look at the adjustments to particular person revenue thresholds over time2 for the median, high 10% and high 5%:

It’s a gentle march up and to the appropriate. It’s additionally onerous to consider how low absolutely the revenue ranges have been again within the day.

Evaluating present costs to previous value ranges can harm your mind since you anchor to these earlier numbers. That is very true with housing prices this decade.

Lance Lambert not too long ago interviewed a mortgage dealer about how month-to-month funds have advanced within the Washington DC space for homebuyers at completely different ranges given the immense rise in housing costs and mortgage charges:

My common first-time homebuyer now says $3,500 is comfy, in comparison with the $2,000 to $2,500 vary beforehand. These searching for a household home now say $6,500 to $7,500; beforehand, $4,500 was the first goal. I’m additionally seeing extra individuals extra comfy with $8,000 to $10,000 mortgage funds than ever. Truthfully, for the primary 20 years of my profession, I don’t consider I ever had a mortgage fee provided over $10,000, and now I’ve a couple of of these every quarter.

These numbers sound insane while you evaluate them to month-to-month mortgage funds just some quick years in the past when costs and charges have been a lot decrease. How can anybody afford these funds?!

They clarify:

Consider, in my area, incomes have exploded increased. I can’t appear to satisfy anybody who makes lower than $130k per 12 months. Those that was once thought-about high-income ($250k to $300k) now make $450k. It’s only a completely different world now.

That is anecdotal. Washington DC is a comparatively rich metropolis. However the motive the economic system continues to chug alongside regardless of a lot increased costs is turn out to be incomes are actually a lot increased too.

In 2014, $100k put you within the high 10%. Now it takes $150k. The highest 5% went from $132k to $201k. Individuals are making far more cash now.

Costs have been far decrease again within the Sixties as a result of wages have been decrease.

Now, you might say the entire will increase over time are due to inflation. And that might get you a lot of the means there. However there was progress as properly. These are the inflation-adjusted incomes for the highest 10% in those self same years:

- 1964 – $80,516

- 1974 – $104,856

- 1984 – $98,102

- 1994 – $105,901

- 2004 – $124,756

- 2014 – $130,736

What this tells us is wages for the highest 10% have outpaced inflation over time. This can be a good factor!

It’s true for median wages as properly:

- 1964 – $31,809

- 1974 – $39,183

- 1984 – $36,702

- 1994 – $39,431

- 2004 – $46,388

- 2014 – $44,450

To be truthful, inflation-adjusted wages have elevated much more for the highest 10% than the median wage earner. But it surely’s additionally true that few employees stay in the identical revenue strata for his or her total careers. Individuals make more cash over time. Some make much less. Some see their incomes soar round from excessive to low and again once more.

What you thought was revenue previously may not get you as far sooner or later.

Good or dangerous, the goalposts are at all times transferring.

Additional Studying:

How A lot Cash is Sufficient?

1And being a private finance individual I clearly use the app to get one other 20% off the invoice each go to.

2DQYDJ is a extremely nice web site for these kinds of statistics. It’s value a bookmark.