A reader asks:

I personal 76 single-family homes, the property administration firm working these and a small actual property brokerage. I really like actual property. However how is that this sustainable? Are wages growing sufficient to take care of the rise in housing costs? If not, how are individuals going to ever afford shopping for a home? What’s going to trigger costs to fall? We nonetheless have provide points, mortgages are legit and really regulated, so what the hell goes to occur? Are there different intervals in time we are able to research to see what occurred?

76 homes!

I’d say that’s an empire. This query is a superb reminder that even consultants within the housing trade don’t actually know what’s going to occur subsequent with costs.

If you happen to had advised me 3-4 years in the past that we might have 7% mortgage charges for an prolonged time frame following a 50% rise in nationwide dwelling costs I’d have assumed costs would get dinged. That hasn’t occurred, clearly.

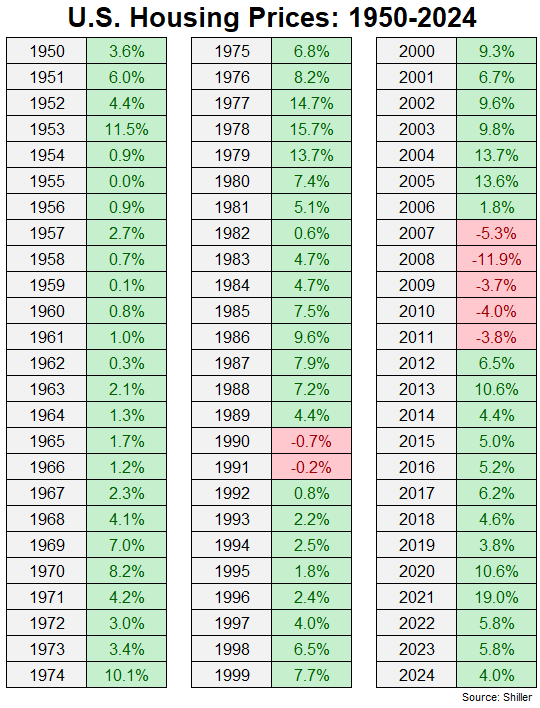

There may be one necessary truth to notice when attempting to determine when housing costs will fall — it doesn’t occur fairly often. These are nationwide housing worth returns by yr going again to 1950:

There have been simply 7 down years on this 75 yr interval.1 It’s additionally necessary to acknowledge the one two intervals when housing costs fell each got here throughout a monetary disaster — the financial savings and mortgage disaster and the Nice Monetary Disaster — that was closely influenced by the finance sector and poor pending requirements.

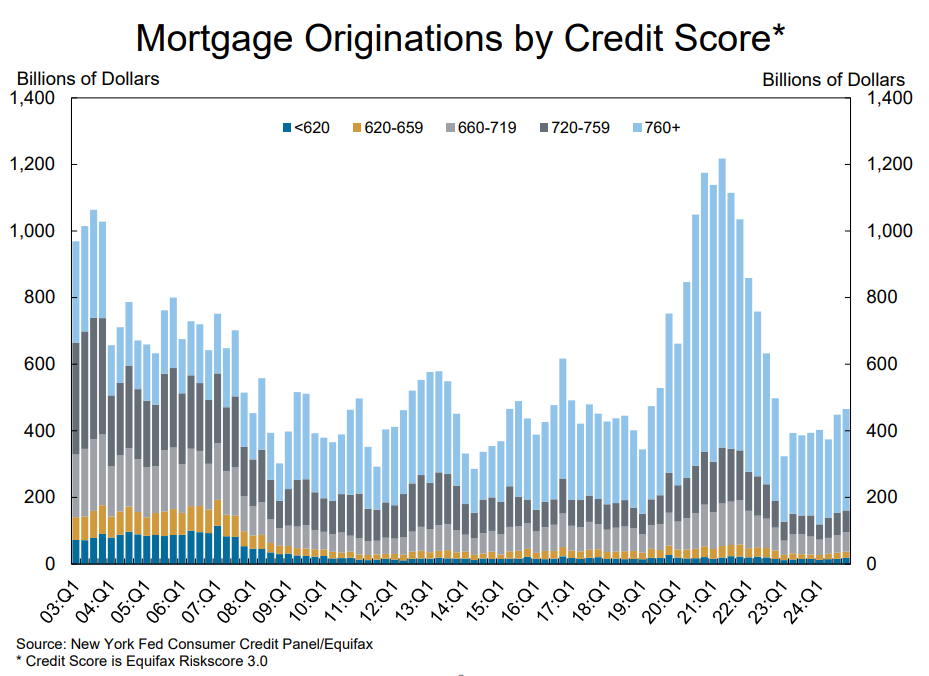

That’s merely not the case right this moment:

On the peak of the housing bubble in 2006, 25% of all mortgages have been going to households with credit score scores of 760 or larger. However the identical quantity was going to subprime debtors with credit score scores of lower than 660.

In the present day, 65% of mortgages go to debtors with 760 or higher credit score scores whereas subprime debtors make up lower than 8% of the entire. Debtors are in fine condition.

Wanting a monetary disaster, what might trigger costs to fall?

Housing provide wants to extend. There are usually two methods this may occur:

(1) Construct extra properties.

(2) Make housing costs too unaffordable.

The second possibility appears extra lifelike within the quick run. The truth is, it’s already occurring in some locations.

Bear in mind, housing is native. Nationwide housing costs replicate that common of tens of millions of various neighborhoods and communities.

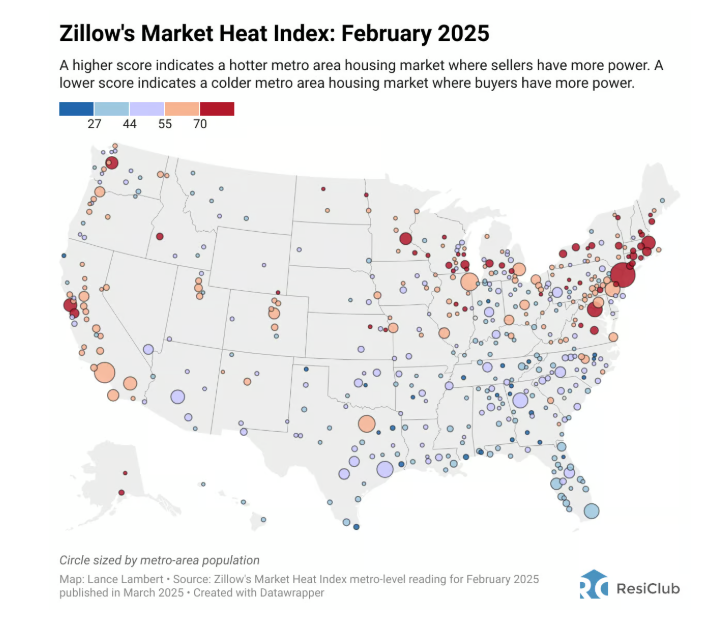

Right here’s an excellent chart from Lance Lambert that exhibits the present mixture of purchaser’s and vendor’s markets throughout the nation:

It nonetheless appears like a vendor’s market within the Northeast, Midwest, and West Coast. It’s turning right into a purchaser’s market within the Southeast and Southwest.

That’s an excellent factor for potential homebuyers. The issue is the areas the place provide is growing can be the place many of the large good points got here in the course of the pandemic housing growth.

Let’s use Miami for example.

Invoice McBride famous in a latest replace that Miami now has an unsold stock of greater than 12 months of housing provide in comparison with the nationwide common of three-and-a-half months. This can be a good factor for homebuyers in Southeast Florida.

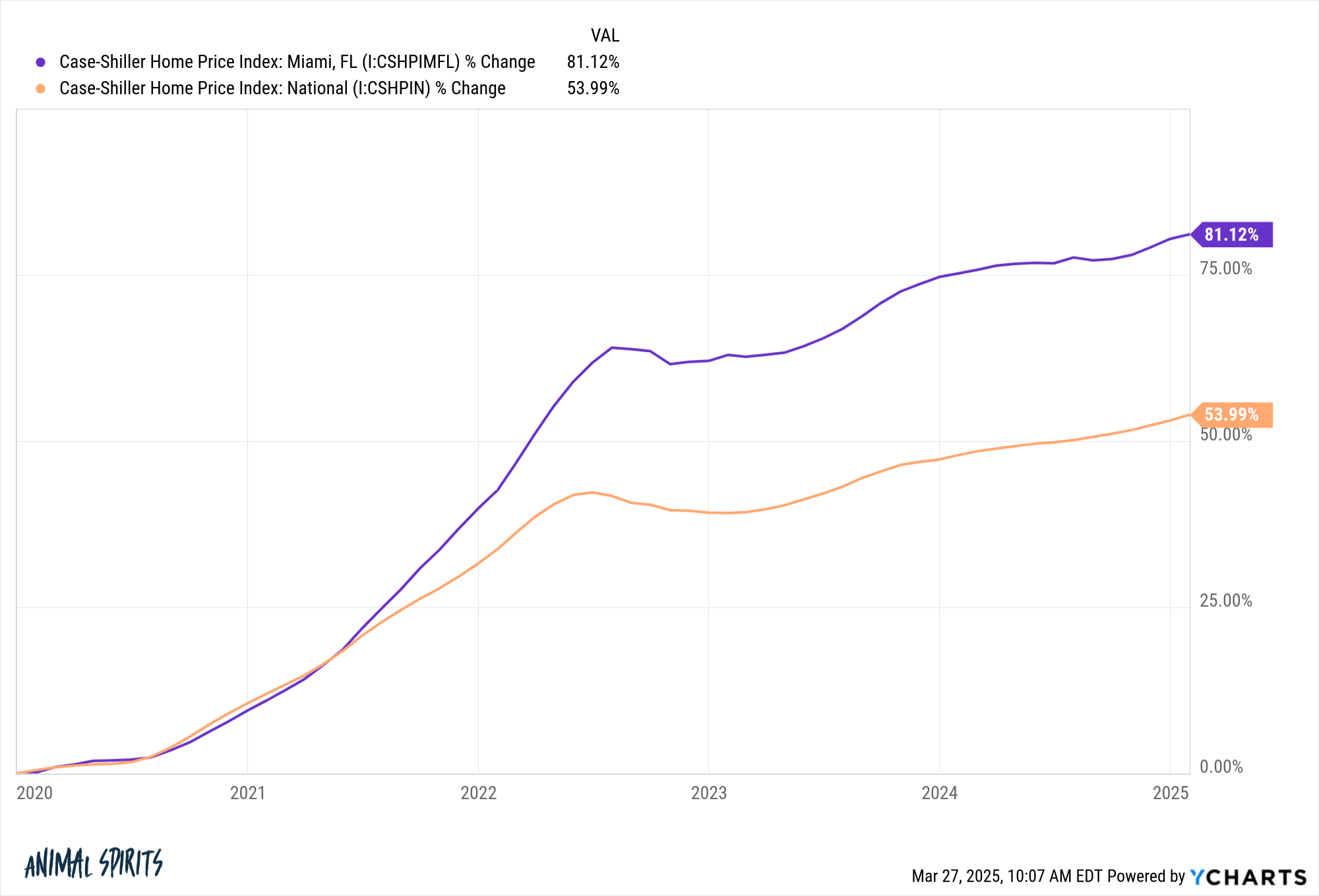

The issue is housing costs in Miami have far outpaced the nationwide averages for the reason that begin of this decade:

Plus, one of many huge causes provide has swelled is as a result of insurance coverage prices have risen significantly lately.2

The next provide of properties give patrons negotiating energy however that doesn’t essentially imply it’s tremendous reasonably priced to purchase there, even when costs come again to earth a bit.

I’m not saying housing costs can’t go down. They will and can in some places greater than others.

However don’t count on it to occur fairly often. Housing costs on this nation are extraordinarily secure over the long term.

Until we lastly determine to construct extra housing, a sustained interval of falling costs appears unlikely as a result of we have now an enormous demographic of younger individuals seeking to purchase.

One of the best-case state of affairs might be stagnating housing costs for just a few years so incomes can play catch-up to assist with affordability. Falling mortgage charges might assist too however I’m satisfied that may also enhance demand.

Perhaps I’m unsuitable. Perhaps housing costs will fall 10% throughout the board, mortgage charges will drop and housing provide will magically enhance.

However I wouldn’t guess on that consequence.

Josh Brown joined me on Ask the Compound this week to debate this query:

We additionally answered questions in regards to the distinction between a portfolio and a plan, private finance recommendation for somebody who misplaced their job, when to go from DIY to an advisor and get out of your illiquid investments.

Additional Studying:

Timing the Housing Market: When Ought to You Promote?

1The S&P 500 has skilled 16 down years in that very same time-frame however way more corrections alongside the way in which.

2A couple of years in the past that rental collapsed in Miami so new guidelines went into impact that require a much bigger upkeep fund for every constructing.