It’s no secret that banks have misplaced curiosity in mortgage lending lately.

It has grow to be very a lot dominated by nonbanks, corporations that don’t settle for buyer deposits or preserve loans on their books.

Facilitating this development has been the originate-to-distribute mannequin, the place mortgage corporations make loans solely to promote them off shortly after.

Up to now, banks would truly preserve the loans they made, however it has grow to be loads much less widespread nowadays.

This will clarify why the highest three mortgage lenders final 12 months have been all nonbanks.

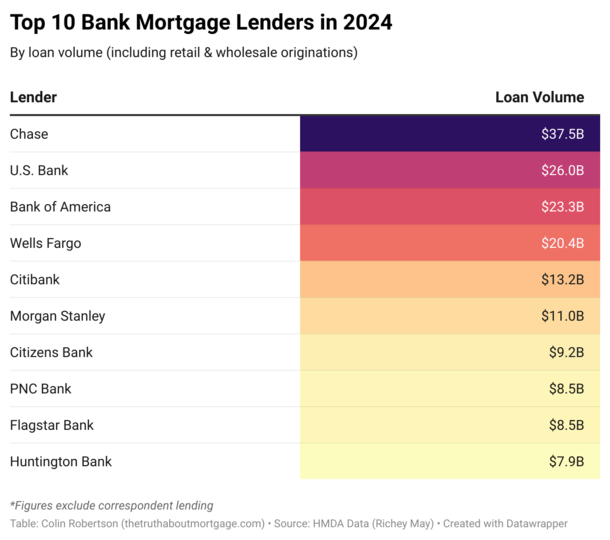

Chase Leads the Banks in Mortgage Lending Nationwide

I used to be curious to know which banks have been dominating the mortgage area, regardless of ceding a number of floor to nonbanks lately.

Simply main the pack was NYC-based Chase Financial institution with about $38 billion in lending quantity final 12 months, per HMDA knowledge.

They have been adopted by U.S. Financial institution with $26.0 billion and Financial institution of America with $23.3 billion.

Rounding out the highest 5 have been former mortgage behemoth Wells Fargo and Citibank.

Funding financial institution Morgan Stanley additionally made the checklist, as did Residents Financial institution, PNC Financial institution, Flagstar, and Huntington.

Whereas the numbers look okay, they pale compared to the nonbanks.

Prime lender United Wholesale Mortgage (UWM) funded $137.8 billion whereas Chase solely managed $37.5 billion.

Regardless of UWM working completely with mortgage brokers, they outperformed the highest financial institution by a staggering $100 billion.

The nation’s second largest lender, Rocket Mortgage, did about 2.5X the quantity of Chase too.

And even lesser-known CrossCountry Mortgage outpaced Chase by a pair billion as properly.

After all, we are able to’t blame Chase as a result of they have been nonetheless the highest financial institution mortgage lender within the nation.

The place have been all the opposite banks? The reply: additional down the checklist. Together with former #1 Wells Fargo, who barely made the top-20 with a paltry $20 billion funded.

In complete, nonbanks greater than doubled the house mortgage manufacturing of the banks final 12 months.

They funded $1.1 trillion in house loans versus simply $491 billion for the banks.

It makes me surprise what would convey the banks again to mortgage, if something.

Why Don’t Banks Need to Make Mortgages Anymore?

Earlier this 12 months, WaFd Financial institution exited mortgage solely, and their CEO mentioned one the the reason why is that mortgages have grow to be a commodity.

In different phrases, everybody simply makes the identical outdated 30-year fastened backed by Fannie Mae, Freddie Mac, or Ginnie Mae (FHA/VA loans).

You may go anyplace and get the identical product, and it’s just about all government-backed, both explicitly or implicitly within the case of Fannie/Freddie.

On the identical time, the nonbanks dump all of the loans they originate whereas the banks usually maintain onto them.

They achieve this regardless of not getting any extra enterprise from the shopper, who may also simply refinance their mortgage at any time and transfer away from the financial institution.

The WaFd CEO mainly summed it by calling it a foul enterprise, riddled with credit score threat and rate of interest threat. And since there’s no loyalty in at the moment’s world, why trouble?

Chase CEO Jamie Dimon Doesn’t Seem to Like Mortgages Both

Whereas Chase is seemingly sticking with it, their CEO Jamie Dimon just lately mentioned they most likely misplaced cash on mortgages over the previous 50 years.

He even went as far as to confer with the mortgage enterprise as a “sh*tty enterprise,” regardless of his financial institution rating #1.

Why would he really feel that approach? Nicely, apart from claims to have misplaced cash, he grumbled in regards to the many guidelines and laws tied to house mortgage lending.

Maybe that was his approach of hoping they ease up and make it simpler for the banks, who is aware of?

However Chase continues to be plugging away and main the nation in mortgage, partially due to their acquisition of First Republic after it failed in 2023.

The SF-based financial institution was a significant jumbo mortgage lender that served ultra-wealthy shoppers, so Chase has undoubtedly gained quantity from that decide up.

Nevertheless, Chase solely managed to position fourth on the checklist of high mortgage lenders final 12 months.

Whether or not they look to make up floor stays unclear. Maybe simply being a megabank will get them that stage of quantity with out an excessive amount of effort.

Talking of, Chase just lately touted discounted mortgage charges for a restricted time to drum up enterprise. So who is aware of the place they actually stand on mortgages.