I’ve been enthusiastic about the state of passive investing because the message “simply purchase the S&P 500” grew to become the predominant narrative in recent times. This thought was first posed to me by our former GIC chief and Presidential candidate Ng Kok Music just a few years in the past, and I haven’t been in a position to shrug it off since.

In my latest journey to Omaha for the 2025 Berkshire Hathaway AGM, I had the fortune to satisfy with many clever traders and thought leaders as we talked about shares and the rising theme of passive traders who merely purchase index funds each month with out pondering. Is that this “purchase and overlook” technique sufficient? How do these form the markets, and are they inflicting an even bigger valuation hole for firms who aren’t within the giant market indices (but)? May the brand new 10X technique be to seek out worthwhile small-cap firms which are quickly rising and spend money on them earlier than they get included within the indices?

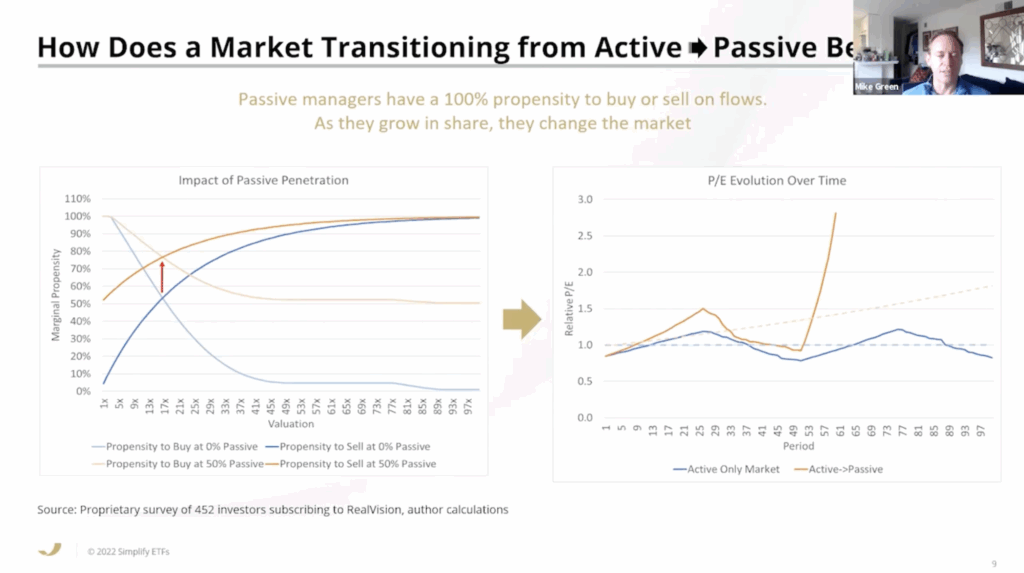

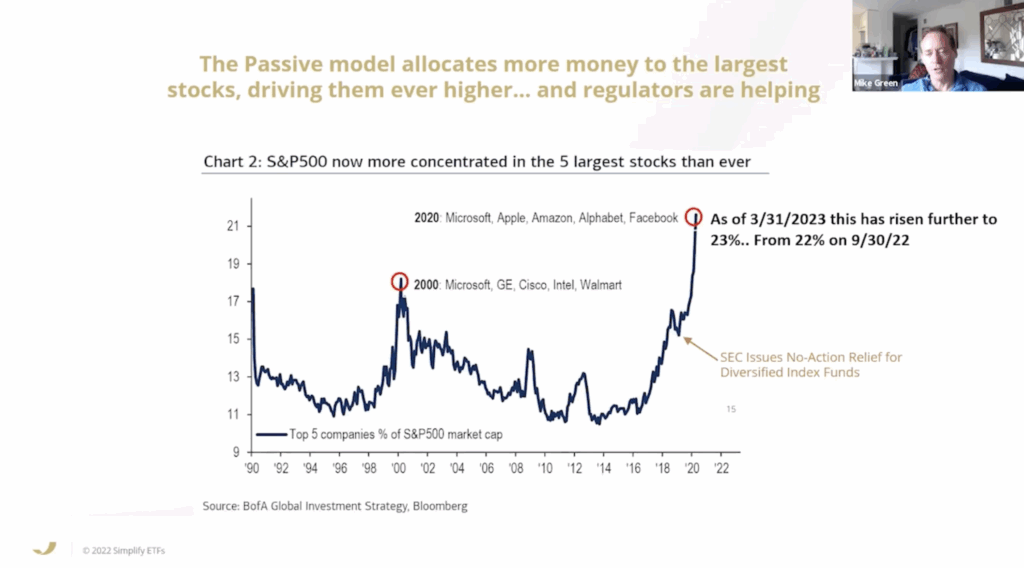

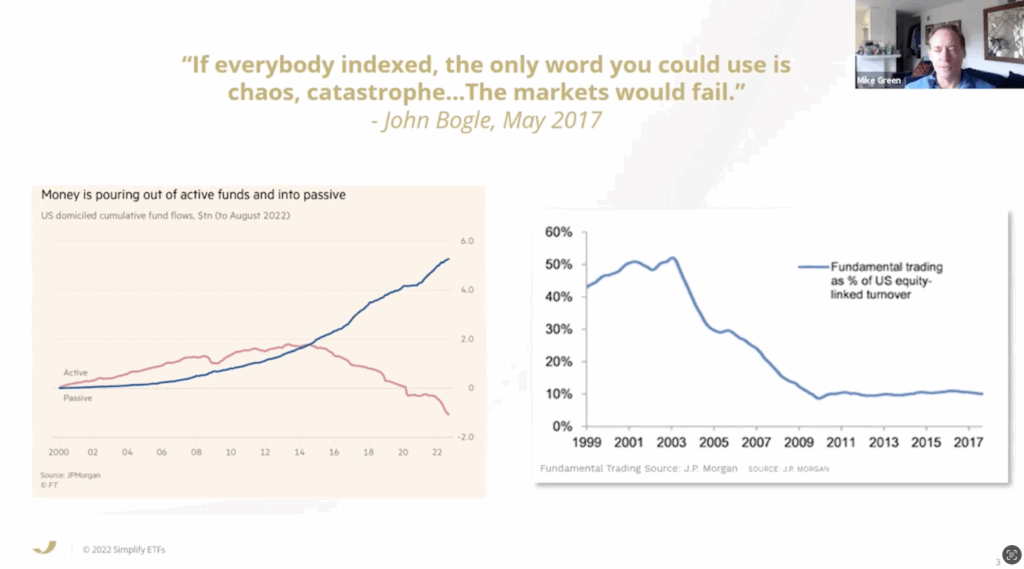

I spoke with Michael Inexperienced, chief strategist of Simplify Asset Administration on the VALUExBRK convention the day earlier than, who calls passive index investing “The Biggest Story Ever Bought”. He argues that passive is not passive and is as a substitute the best con ever pulled on traders. The beneath slides are snippets I’ve lower from an earlier model of his presentation, which will be discovered right here.

The argument that the rise of passive investing not solely distorts the markets, however will result in chaos isn’t precisely new, however we lastly have extra statistics to again this speculation up. Curiously, this sentiment was additionally echoed by Warren Buffett in an earlier 1982 letter to shareholders the place he expressed issues concerning the detachment from underlying enterprise valuations that the rise of index funds may convey.

Howard Marks additionally wrote a memo on this earlier this yr, and I quote some noteworthy sections from it that acquired me pondering:

“The best bubbles often originate in reference to improvements, principally technological or monetary, they usually initially have an effect on a small group of shares. However typically they prolong to entire markets, because the fervor for a bubble group spreads to all the pieces.

In an identical vein, heated shopping for spurred by the statement that shares had by no means carried out poorly for a protracted interval brought on inventory costs to rise to a degree from which they have been destined to do exactly that.

The S&P 500 declined in 2000, 2001, and 2002 for the primary three-year decline since 1939, throughout the Nice Despair. As a consequence of this poor efficiency, traders abandoned shares en masse, inflicting the S&P 500 to have a cumulative return of zero for the greater than eleven years from the bubble peak in mid-2000 till December 2011.

The purpose is that when shares rise too quick – out of proportion to the expansion within the underlying firms’ earnings – they’re unlikely to maintain on appreciating. Michael Cembalest has one other chart that makes this level. It reveals that prior to 2 years in the past, there have been solely 4 instances within the historical past of the S&P 500 when it returned 20% or extra for 2 years in a row. Within the final two years, it’s occurred for the fifth time. The S&P 500 was up 26% in 2023 and 25% in 2024, for the very best two-year stretch since 1997-98. That brings us to 2025. What lies forward?”

That is an statement I’ve repeatedly expressed on my social media channels. The latest market actions are something however regular. I’m not sensible sufficient to know all of the solutions, however Howard Marks presents a clue by wanting again into historical past:

“There’s a powerful relationship between beginning valuations and subsequent annualized ten-year returns. Increased beginning valuations persistently result in decrease returns, and vice versa.

At this time’s P/E ratio is clearly effectively into the highest decile of observations. In that 27-year interval, when folks purchased the S&P at P/E ratios in step with in the present day’s a number of of twenty-two, they at all times earned ten-year returns between plus 2% and minus 2%.”

Sadly, I didn’t get an opportunity to ask Warren Buffett about this throughout the 2025 Berkshire Hathaway AGM on the microphones, so I believed I’d ask the subsequent finest individual: Markel’s CEO Tom Gayner. His monitor file is impeccable, and he’s an investor whom I drastically respect for each his monitor file and life knowledge. His response?

“It’d effectively be that this period we’ve been via (of outperformance by the S&P 500) may be very troublesome for the S&P to maintain up with.

It could look very completely different than what it has achieved within the final 5, 10 or 20 years.

I spend my time to consider every particular person enterprise and may I depend on them to relentlessly compound our capital, and I strive to consider that as independently to the S&P as I probably can.”

I typically get requested by readers whether or not merely shopping for the S&P 500 each month and doing dollar-cost averaging shall be adequate. My stance is fairly clear, and I’ll say this: it’s a must to make – and settle for – the choice for your self that can decide your future investing outcomes.

I’ve discovered these memos and insights to be helpful for me, and hope it offers you one thing to consider as making a decision on the trail you need to take together with your cash.

As an investor myself, I don’t consider that the trail to wealth lies in doing what everybody else is doing. I’ve by no means been a believer of merely shopping for the indexes – as a substitute, I desire to seek out the highest-quality firms inside it and purchase them when they’re buying and selling at undervalued costs in the marketplace.

The S&P500 might have traditionally returned 10 – 11% over the past 40 years, however previous efficiency isn’t a assure for future efficiency and there’s no telling how the long run will appear like.

I’ve little doubt that many US-listed firms will proceed to develop and dominate. I’m personally invested in a number of of them – together with Alphabet, Amazon and Palantir. However I purchased them solely at strategic timings, and never via an index fund.

One factor is for positive – my portfolio didn’t cross $1M by shopping for the index each month, and even when I may flip again time to alter my methods and purchase the S&P 500 each month as a substitute, there’s no means it might have gotten me to $1M both.

After all, simply because I could not do it with the S&P500 doesn't suggest you may't. In any case, the S&P500 returned 300% features within the final decade, so anybody who had $330k to start out with then might need yielded a very completely different end result.For the file, I began investing with $20k in 2014. It wasn't till 2017 after I hit $100k, and even when I had the foresight (and guts) to speculate all of it within the S&P500 then, my returns nonetheless would not be anyplace near $1M.

As a substitute, I desire to be considerate about what’s extra more likely to beat the markets within the long-run. I’d a lot relatively observe the playbook of legendary traders I respect – together with Buffett, Gayner and extra – and spend money on undervalued firms that can compound sooner and better than the market indexes.

Whereas I don’t know the place the S&P500 will go from right here, I shall hearken to Gayner’s recommendation and function “independently of the S&P500”.

How about you guys?

With love,

Daybreak

Finances Babe